Belleville, New Jersey

Belleville: Cherry Blossoms at Branch Brook Park

Belleville: Belleville cherry blossoms, up close

Belleville: spring in belleville

- add

your

Submit your own pictures of this place and show them to the world

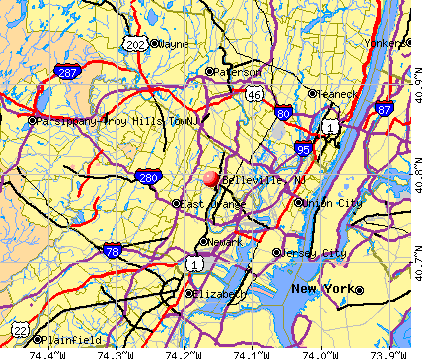

- OSM Map

- General Map

- Google Map

- MSN Map

| Males: 16,823 | |

| Females: 18,054 |

| Median resident age: | 36.2 years |

| New Jersey median age: | 36.7 years |

Zip codes: 07109.

| Belleville: | $81,054 |

| NJ: | $96,346 |

Estimated per capita income in 2022: $41,770 (it was $22,093 in 2000)

Belleville CDP income, earnings, and wages data

Estimated median house or condo value in 2022: $389,458 (it was $148,500 in 2000)

| Belleville: | $389,458 |

| NJ: | $428,900 |

Mean prices in 2022: all housing units: $574,104; detached houses: $657,086; townhouses or other attached units: $439,629; in 2-unit structures: $368,927; in 3-to-4-unit structures: $409,981; in 5-or-more-unit structures: $367,645; mobile homes: $225,735

Detailed information about poverty and poor residents in Belleville, NJ

- 20,66957.5%White alone

- 8,50723.7%Hispanic

- 4,02411.2%Asian alone

- 1,7084.8%Black alone

- 8352.3%Two or more races

- 1400.4%Other race alone

- 280.08%American Indian alone

- 170.05%Native Hawaiian and Other

Pacific Islander alone

Races in Belleville detailed stats: ancestries, foreign born residents, place of birth

According to our research of New Jersey and other state lists, there were 15 registered sex offenders living in Belleville, New Jersey as of April 26, 2024.

The ratio of all residents to sex offenders in Belleville is 2,325 to 1.

The ratio of registered sex offenders to all residents in this city is lower than the state average.

Type |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Murders (per 100,000) | 1 (3.0) | 0 (0.0) | 2 (5.5) | 0 (0.0) | 0 (0.0) | 2 (5.5) | 2 (5.5) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 1 (2.7) | 0 (0.0) | 0 (0.0) | 0 (0.0) |

| Rapes (per 100,000) | 0 (0.0) | 1 (2.8) | 3 (8.3) | 1 (2.8) | 1 (2.8) | 7 (19.3) | 3 (8.2) | 3 (8.3) | 2 (5.5) | 1 (2.8) | 9 (24.6) | 2 (5.5) | 2 (5.3) | 5 (13.4) |

| Robberies (per 100,000) | 49 (145.8) | 35 (97.4) | 60 (166.5) | 41 (113.4) | 62 (171.1) | 60 (165.4) | 57 (156.4) | 32 (88.3) | 41 (112.6) | 17 (47.1) | 24 (65.7) | 11 (30.1) | 6 (15.8) | 11 (29.5) |

| Assaults (per 100,000) | 34 (101.2) | 39 (108.6) | 50 (138.7) | 29 (80.2) | 49 (135.3) | 33 (90.9) | 33 (90.5) | 27 (74.5) | 38 (104.4) | 44 (122.0) | 44 (120.4) | 28 (76.6) | 20 (52.6) | 50 (133.9) |

| Burglaries (per 100,000) | 168 (499.9) | 159 (442.6) | 164 (455.0) | 204 (564.2) | 152 (419.6) | 131 (361.0) | 139 (381.3) | 93 (256.5) | 85 (233.5) | 87 (241.2) | 70 (191.6) | 41 (112.2) | 13 (34.2) | 39 (104.4) |

| Thefts (per 100,000) | 405 (1,205) | 466 (1,297) | 637 (1,767) | 481 (1,330) | 523 (1,444) | 533 (1,469) | 468 (1,284) | 419 (1,156) | 471 (1,294) | 414 (1,148) | 351 (960.8) | 403 (1,103) | 125 (328.5) | 524 (1,403) |

| Auto thefts (per 100,000) | 145 (431.4) | 130 (361.9) | 212 (588.1) | 175 (484.0) | 164 (452.7) | 167 (460.2) | 108 (296.3) | 88 (242.7) | 91 (249.9) | 88 (243.9) | 87 (238.2) | 78 (213.5) | 41 (107.7) | 137 (366.8) |

| Arson (per 100,000) | 7 (20.8) | 1 (2.8) | 3 (8.3) | 1 (2.8) | 3 (8.3) | 2 (5.5) | 0 (0.0) | 1 (2.8) | 0 (0.0) | 0 (0.0) | 1 (2.7) | 0 (0.0) | 0 (0.0) | 0 (0.0) |

| City-Data.com crime index | 187.6 | 165.0 | 245.0 | 183.7 | 203.9 | 215.1 | 184.3 | 131.6 | 147.1 | 123.0 | 139.9 | 97.8 | 43.6 | 139.1 |

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

Crime rate in Belleville detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 111 (106 officers - 99 male; 7 female).

| Officers per 1,000 residents here: | 2.79 |

| New Jersey average: | 5.53 |

| Belleville Commute Options to NYC (4 replies) |

| Moving back to the Belleville/Nutley area, from Arizona. (8 replies) |

| Belleville Park (0 replies) |

| Belleville: Whither Washington Avenue? (5 replies) |

| The Death of A&P and Pathmark (and the Horror that Awaits) (251 replies) |

| What are the best studio rentals around Newark Area (East Orange, Belleville, Nutley) (2 replies) |

Latest news from Belleville, NJ collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: Italian (30.9%), Irish (9.4%), German (6.9%), Polish (4.5%), United States (2.6%), English (2.2%).

Current Local Time: EST time zone

Incorporated on 04/08/1910

Elevation: 140 feet

Land area: 3.34 square miles.

Population density: 10,430 people per square mile (high).

9,638 residents are foreign born (10.5% Latin America, 9.9% Asia, 5.8% Europe).

| This place: | 26.8% |

| New Jersey: | 17.5% |

| Belleville CDP: | 3.3% ($4,960) |

| New Jersey: | 2.4% ($4,047) |

Nearest city with pop. 50,000+: East Orange, NJ (3.2 miles

, pop. 69,824).

Nearest city with pop. 200,000+: Newark, NJ (4.2 miles

, pop. 273,546).

Nearest city with pop. 1,000,000+: Manhattan, NY (10.0 miles

, pop. 1,537,195).

Nearest cities:

Latitude: 40.79 N, Longitude: 74.16 W

Daytime population change due to commuting: -7,517 (-20.9%)

Workers who live and work in this place: 2,276 (13.6%)

Area codes: 973, 862

Belleville, New Jersey accommodation & food services, waste management - Economy and Business Data

| Here: | 5.6% |

| New Jersey: | 4.5% |

- Health care (10.3%)

- Educational services (7.2%)

- Finance & insurance (6.7%)

- Professional, scientific, technical services (5.8%)

- Accommodation & food services (4.8%)

- Public administration (4.6%)

- Construction (4.5%)

- Construction (7.8%)

- Other transportation, support activities, couriers (5.4%)

- Public administration (5.4%)

- Finance & insurance (5.2%)

- Health care (5.2%)

- Professional, scientific, technical services (5.2%)

- Educational services (4.5%)

- Health care (16.0%)

- Educational services (10.1%)

- Finance & insurance (8.4%)

- Professional, scientific, technical services (6.4%)

- Accommodation & food services (5.3%)

- Personal & laundry services (4.1%)

- Public administration (3.6%)

- Other office and administrative support workers, including supervisors (5.8%)

- Secretaries and administrative assistants (4.9%)

- Material recording, scheduling, dispatching, and distributing workers (4.1%)

- Other production occupations, including supervisors (3.7%)

- Other sales and related occupations, including supervisors (3.6%)

- Other management occupations, except farmers and farm managers (3.4%)

- Driver/sales workers and truck drivers (3.2%)

- Driver/sales workers and truck drivers (5.7%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (5.1%)

- Other production occupations, including supervisors (5.1%)

- Material recording, scheduling, dispatching, and distributing workers (5.0%)

- Other sales and related occupations, including supervisors (4.7%)

- Other management occupations, except farmers and farm managers (4.1%)

- Computer specialists (4.0%)

- Secretaries and administrative assistants (10.1%)

- Other office and administrative support workers, including supervisors (8.9%)

- Registered nurses (4.7%)

- Information and record clerks, except customer service representatives (4.3%)

- Preschool, kindergarten, elementary, and middle school teachers (3.7%)

- Bookkeeping, accounting, and auditing clerks (3.2%)

- Material recording, scheduling, dispatching, and distributing workers (3.2%)

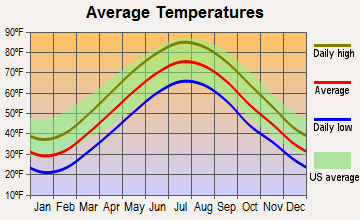

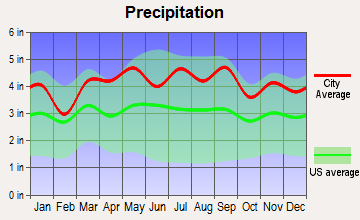

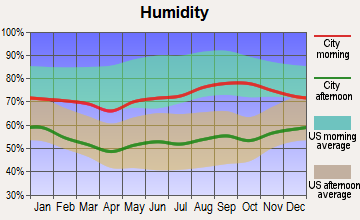

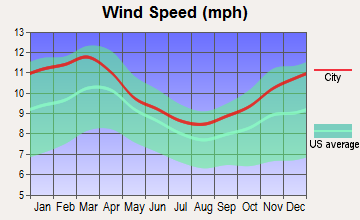

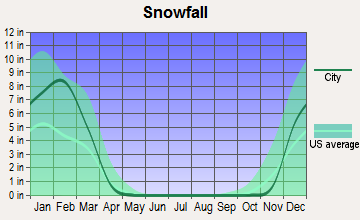

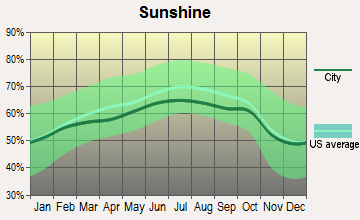

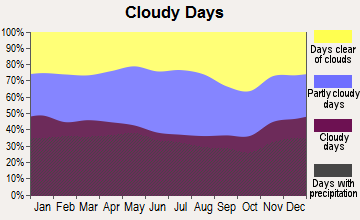

Average climate in Belleville, New Jersey

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

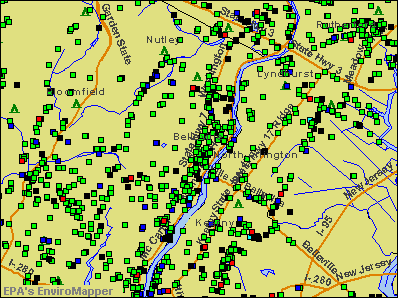

Air Quality Index (AQI) level in 2023 was 111. This is significantly worse than average.

| City: | 111 |

| U.S.: | 73 |

Carbon Monoxide (CO) [ppm] level in 2023 was 0.369. This is significantly worse than average. Closest monitor was 3.2 miles away from the city center.

| City: | 0.369 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2023 was 15.6. This is significantly worse than average. Closest monitor was 4.0 miles away from the city center.

| City: | 15.6 |

| U.S.: | 5.1 |

Sulfur Dioxide (SO2) [ppb] level in 2023 was 0.515. This is significantly better than average. Closest monitor was 3.2 miles away from the city center.

| City: | 0.515 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2023 was 29.2. This is about average. Closest monitor was 3.2 miles away from the city center.

| City: | 29.2 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2003 was 26.9. This is worse than average. Closest monitor was 5.0 miles away from the city center.

| City: | 26.9 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2023 was 9.07. This is about average. Closest monitor was 4.7 miles away from the city center.

| City: | 9.07 |

| U.S.: | 8.11 |

Lead (Pb) [µg/m3] level in 2008 was 0.0125. This is worse than average. Closest monitor was 3.7 miles away from the city center.

| City: | 0.0125 |

| U.S.: | 0.0093 |

Tornado activity:

Belleville-area historical tornado activity is near New Jersey state average. It is 36% smaller than the overall U.S. average.

On 5/28/1973, a category F3 (max. wind speeds 158-206 mph) tornado 17.7 miles away from the Belleville place center caused between $50,000 and $500,000 in damages.

On 5/28/1973, a category F3 tornado 29.5 miles away from the place center injured 12 people and caused between $50,000 and $500,000 in damages.

Earthquake activity:

Belleville-area historical earthquake activity is significantly above New Jersey state average. It is 68% smaller than the overall U.S. average.On 8/23/2011 at 17:51:04, a magnitude 5.8 (5.8 MW, Depth: 3.7 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 283.8 miles away from Belleville center

On 10/7/1983 at 10:18:46, a magnitude 5.3 (5.1 MB, 5.3 LG, 5.1 ML) earthquake occurred 218.7 miles away from the city center

On 1/16/1994 at 01:49:16, a magnitude 4.6 (4.6 MB, 4.6 LG, Depth: 3.1 mi, Class: Light, Intensity: IV - V) earthquake occurred 103.6 miles away from the city center

On 4/20/2002 at 10:50:47, a magnitude 5.3 (5.3 ML, Depth: 3.0 mi) earthquake occurred 258.3 miles away from Belleville center

On 4/20/2002 at 10:50:47, a magnitude 5.2 (5.2 MB, 4.2 MS, 5.2 MW, 5.0 MW) earthquake occurred 256.5 miles away from the city center

On 1/16/1994 at 00:42:43, a magnitude 4.2 (4.2 MB, 4.0 LG, Depth: 3.1 mi) earthquake occurred 102.2 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Essex County (30) is a lot greater than the US average (15).Major Disasters (Presidential) Declared: 19

Emergencies Declared: 10

Causes of natural disasters: Floods: 8, Hurricanes: 7, Storms: 7, Heavy Rains: 4, Snowstorms: 4, Winter Storms: 3, Blizzards: 2, Water Shortages: 2, Power Outage: 1, Tornado: 1, Tropical Storm: 1, Wind: 1, Other: 3 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers in Belleville:

- CLARA MAASS MEDICAL CENTER (Voluntary non-profit - Private, provides emergency services, ONE CLARA MAAS DRIVE)

- JERSEYCARE HOSPICE (50 NEWARK AVENUE SUITE 101)

- SEMPERCARE HOSPITAL OF BELLEVILLE (1 CLARA MAASS DRIVE)

- CLARA MAASS CONT CARE BELL (ONE CLARA MAASS DRIVE)

- ESSEX CO GERIATRIC CTR (520 BELLVILLE AVE)

- NUTLEY KIDNEY CLINIC (500 CORTLANDT STREET)

Amtrak stations near Belleville:

- 5 miles: NEWARK (RAYMOND PLAZA WEST) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, snack bar, ATM, paid short-term parking, paid long-term parking, call for car rental service, taxi stand, intercity bus service, public transit connection.

- 7 miles: NEWARK INTERNATIONAL AIRPORT (NEWARK, ) . Services: ticket office, enclosed waiting area, public restrooms, public payphones.

- 10 miles: NEW YORK (PENN STA) (NEW YORK, 7TH AVE. & W. 32ND ST.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, full-service food facilities, snack bar, vending machines, ATM, paid short-term parking, paid long-term parking, call for car rental service, taxi stand, public transit connection.

College/University in Belleville:

Colleges/universities with over 2000 students nearest to Belleville:

- New Jersey Institute of Technology (about 4 miles; Newark, NJ; Full-time enrollment: 8,212)

- Rutgers University-Newark (about 4 miles; Newark, NJ; FT enrollment: 9,869)

- University of Medicine and Dentistry of New Jersey (about 4 miles; Newark, NJ; FT enrollment: 3,210)

- Essex County College (about 4 miles; Newark, NJ; FT enrollment: 9,595)

- Montclair State University (about 5 miles; Montclair, NJ; FT enrollment: 16,277)

- Seton Hall University (about 6 miles; South Orange, NJ; FT enrollment: 7,742)

- Saint Peter's University (about 7 miles; Jersey City, NJ; FT enrollment: 2,583)

Public high school in Belleville:

- BELLEVILLE HIGH SCHOOL (Students: 1,558, Location: 100 PASSAIC AVE, Grades: 9-12)

Private high school in Belleville:

Public elementary/middle schools in Belleville:

- BELLEVILLE MIDDLE SCHOOL (Students: 682, Location: 279 WASHINGTON AVE, Grades: 6-8)

- BELLEVILLE PS3 (Location: 230 JORALEMON ST, Grades: KG-5)

- BELLEVILLE PS4 (Location: 30 MAGNOLIA ST, Grades: PK-5)

- BELLEVILLE PS5 (Location: 149 ADELAIDE ST, Grades: KG-5)

- BELLEVILLE PS7 (Location: 20 PASSAIC AVE, Grades: PK-6)

- BELLEVILLE PS8 (Location: 183 UNION AVE, Grades: KG-5)

- BELLEVILLE PS9 (Location: 301 RALPH ST, Grades: KG-5)

- BELLEVILLE PS10 (Location: 527 BELLEVILLE AVE, Grades: KG-5)

Private elementary/middle school in Belleville:

User-submitted facts and corrections:

- Belleville, NJ is officially the Cherry Blossom Capital of America.

- (Add Church) River Of Life Assembly of God 174 Holmes Street, Belleville

Points of interest:

Notable locations in Belleville: Hendricks Field Golf Course (A), Belwood Park (B), Silver Lake Station (C), Cleveland Street Station (D), Care One Medical Services (E), Belleville Fire Department Station 2 (F), Belleville Fire Department Station 3 (G), Belleville Fire Department (H). Display/hide their locations on the map

Churches in Belleville include: Grace Baptist Church (A), Silver Lake Baptist Church (B), Little Zion Methodist Church (C), Belleville Reformed Curch (D), Bethany Lutheran Church (E), Christian Apostolic Church (F), Montgomery Presbyterian Church (G), Saint Peter's Roman Catholic Church (H), Fewsmith Memorial Presbyterian Church (I). Display/hide their locations on the map

Cemetery: Glendale Cemetery (1). Display/hide its location on the map

Reservoir: Hendricks Pond (A). Display/hide its location on the map

River: Second River (A). Display/hide its location on the map

Parks in Belleville include: Hendricks Field (1), Belleville Park (2). Display/hide their locations on the map

Tourist attraction: Royal Train Rides Inc (181 Heckel St).

Hotel: Belleville Washington Motel (570 Washington Avenue).

Court: Belleville Township - Municipal Court (152 Washington Avenue).

Birthplace of: George Hrab - Musician, Frank Iero - Male singer, Liam O'Brien - Voice actor, Lucien Nocelli - Musician, Scott Graham - Sportscaster, Timothy Adams (actor) - Soap opera actor, William Thomas Pecora - Petrology, Frances Goodrich - Dramatists and playwright, James Wallwork - New Jersey State Senator, Creighton Gubanich - Baseball player.

Drinking water stations with addresses in Belleville and their reported violations in the past:

BELLEVILLE WATER DEPT (Population served: 35,129, Purch surface water):Past health violations:Past monitoring violations:

- MCL, Monthly (TCR) - In AUG-2013, Contaminant: Coliform. Follow-up actions: St Public Notif requested (SEP-05-2013), St Formal NOV issued (SEP-05-2013), St Compliance achieved (SEP-30-2013), St Public Notif received (OCT-15-2013)

- MCL, Monthly (TCR) - In SEP-2011, Contaminant: Coliform. Follow-up actions: St Public Notif requested (SEP-27-2011), St Formal NOV issued (SEP-27-2011), St Public Notif received (OCT-13-2011), St Compliance achieved (OCT-27-2011)

- MCL, Average - Between JUL-2010 and SEP-2010, Contaminant: TTHM. Follow-up actions: St Public Notif requested (NOV-15-2010), St Formal NOV issued (NOV-15-2010), St Compliance achieved (NOV-18-2010), St Public Notif received (NOV-24-2010)

- MCL, Average - Between APR-2010 and JUN-2010, Contaminant: TTHM. Follow-up actions: St Public Notif requested (JUL-21-2010), St Formal NOV issued (JUL-21-2010), St Public Notif received (AUG-12-2010), St Compliance achieved (NOV-18-2010)

- MCL, Monthly (TCR) - In OCT-2007, Contaminant: Coliform. Follow-up actions: St Formal NOV issued (NOV-28-2007), St Public Notif requested (NOV-28-2007), St Public Notif received (NOV-29-2007), St Compliance achieved (NOV-30-2007)

- Monitoring of Treatment (SWTR-Filter) - In APR-2014. Follow-up actions: St Formal NOV issued (MAY-16-2014), St Compliance achieved (MAY-29-2014)

- Monitoring and Reporting (DBP) - Between OCT-2013 and DEC-2013, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Public Notif requested (FEB-11-2014), St Formal NOV issued (FEB-11-2014), St Compliance achieved (FEB-20-2014)

- Monitoring and Reporting (DBP) - Between OCT-2013 and DEC-2013, Contaminant: TTHM. Follow-up actions: St Public Notif requested (FEB-11-2014), St Formal NOV issued (FEB-11-2014), St Compliance achieved (FEB-20-2014)

- Monitoring and Reporting (DBP) - In NOV-2012, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Public Notif requested (FEB-04-2013), St Formal NOV issued (FEB-04-2013), St Compliance achieved (FEB-14-2013), St Public Notif received (AUG-09-2013)

- Monitoring and Reporting (DBP) - In NOV-2012, Contaminant: TTHM. Follow-up actions: St Public Notif requested (FEB-04-2013), St Formal NOV issued (FEB-04-2013), St Compliance achieved (FEB-14-2013), St Public Notif received (AUG-09-2013)

- One routine major monitoring violation

- One minor monitoring violation

- 4 other older monitoring violations

| This place: | 2.6 people |

| New Jersey: | 2.7 people |

| This place: | 66.2% |

| Whole state: | 70.7% |

| This place: | 5.5% |

| Whole state: | 4.9% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.2% of all households

- Gay men: 0.3% of all households

| This place: | 8.2% |

| Whole state: | 8.5% |

| This place: | 4.5% |

| Whole state: | 4.2% |

People in group quarters in Belleville in 2000:

- 172 people in nursing homes

- 13 people in religious group quarters

- 8 people in other noninstitutional group quarters

- 5 people in homes for the mentally retarded

- 2 people in homes for the mentally ill

Banks with branches in Belleville (2011 data):

- Valley National Bank: Aitken Branch, Tri-City Branch, Peoples Branch. Info updated 2012/01/10: Bank assets: $14,186.7 mil, Deposits: $9,715.7 mil, headquarters in Wayne, NJ, positive income, Commercial Lending Specialization, 219 total offices, Holding Company: Valley National Bancorp

- Bank of America, National Association: Belleville Branch at 321 Franklin Avenue, branch established on 1948/11/01; Belleville Branch at 144 Washington Avenue, branch established on 1951/04/02. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- Capital One, National Association: Belleville Shopping Center Branch at 402 Main Street, branch established on 1985/10/07. Info updated 2011/07/01: Bank assets: $133,477.8 mil, Deposits: $97,063.7 mil, headquarters in Mclean, VA, positive income, 984 total offices, Holding Company: Capital One Financial Corporation

- JPMorgan Chase Bank, National Association: Bloomfield - Franklin Street Branch at 181 Franklin Street, branch established on 2003/05/05. Info updated 2011/11/10: Bank assets: $1,811,678.0 mil, Deposits: $1,190,738.0 mil, headquarters in Columbus, OH, positive income, International Specialization, 5577 total offices, Holding Company: Jpmorgan Chase & Co.

- The Provident Bank: Belleville Branch at 208-218 Washington Avenue, branch established on 1976/12/18. Info updated 2010/07/27: Bank assets: $7,097.5 mil, Deposits: $5,186.9 mil, headquarters in Jersey City, NJ, positive income, Commercial Lending Specialization, 83 total offices, Holding Company: Provident Financial Services, Inc.

- Sovereign Bank, National Association: 463 Washington Ave Branch at 463 Washington Ave, branch established on 1942/05/01. Info updated 2012/01/31: Bank assets: $78,146.9 mil, Deposits: $48,042.9 mil, headquarters in Wilmington, DE, positive income, Commercial Lending Specialization, 718 total offices, Holding Company: Banco Santander, S.A.

For population 15 years and over in Belleville:

- Never married: 32.0%

- Now married: 49.3%

- Separated: 2.7%

- Widowed: 7.8%

- Divorced: 8.2%

For population 25 years and over in Belleville:

- High school or higher: 78.2%

- Bachelor's degree or higher: 21.7%

- Graduate or professional degree: 5.9%

- Unemployed: 6.6%

- Mean travel time to work (commute): 27.5 minutes

| Here: | 12.7 |

| New Jersey average: | 13.1 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Belleville, NJ (based on Essex County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 261,966 | 65 |

| Other | 61,850 | 81 |

| Mainline Protestant | 41,339 | 171 |

| Black Protestant | 38,687 | 88 |

| Evangelical Protestant | 34,666 | 191 |

| Orthodox | 6,188 | 12 |

| None | 339,273 | - |

Food Environment Statistics:

| Essex County: | 3.95 / 10,000 pop. |

| New Jersey: | 2.90 / 10,000 pop. |

| Here: | 1.54 / 10,000 pop. |

| New Jersey: | 1.76 / 10,000 pop. |

| Essex County: | 0.39 / 10,000 pop. |

| State: | 0.81 / 10,000 pop. |

| Essex County: | 6.00 / 10,000 pop. |

| State: | 7.15 / 10,000 pop. |

| This county: | 9.4% |

| New Jersey: | 8.3% |

| This county: | 25.3% |

| State: | 23.3% |

| Here: | 16.5% |

| New Jersey: | 18.0% |

6.52% of this county's 2021 resident taxpayers lived in other counties in 2020 ($103,528 average adjusted gross income)

| Here: | 6.52% |

| New Jersey average: | 6.70% |

0.01% of residents moved from foreign countries ($16 average AGI)

Essex County: 0.01% New Jersey average: 0.01%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Hudson County, NJ | |

| from Union County, NJ | |

| from Kings County, NY |

7.76% of this county's 2020 resident taxpayers moved to other counties in 2021 ($101,736 average adjusted gross income)

| Here: | 7.76% |

| New Jersey average: | 7.02% |

0.02% of residents moved to foreign countries ($107 average AGI)

Essex County: 0.02% New Jersey average: 0.02%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Union County, NJ | |

| to Morris County, NJ | |

| to Hudson County, NJ |

| Businesses in Belleville, NJ | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| AutoZone | 1 | MasterBrand Cabinets | 4 | |

| Avenue | 1 | McDonald's | 2 | |

| Blockbuster | 1 | Pathmark | 1 | |

| Brunswick Bowling & Billiards | 1 | Payless | 1 | |

| CVS | 1 | Pizza Hut | 1 | |

| Decora Cabinetry | 2 | RadioShack | 1 | |

| DressBarn | 1 | Sears | 1 | |

| Dunkin Donuts | 2 | Subway | 1 | |

| FedEx | 2 | Taco Bell | 1 | |

| Food Basics | 1 | U-Haul | 3 | |

| GNC | 1 | UPS | 3 | |

| H&R Block | 1 | Walgreens | 2 | |

| KFC | 1 | Wendy's | 1 | |

| Kmart | 1 | |||

Strongest AM radio stations in Belleville:

- WINS (1010 AM; 50 kW; NEW YORK, NY; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WOR (710 AM; 50 kW; NEW YORK, NY; Owner: BUCKLEY BROADCASTING CORPORATION)

- WMCA (570 AM; 50 kW; NEW YORK, NY; Owner: SALEM MEDIA OF NEW YORK, LLC)

- WLIB (1190 AM; 30 kW; NEW YORK, NY; Owner: ICBC BROADCAST HOLDINGS-NY, INC.)

- WEPN (1050 AM; 50 kW; NEW YORK, NY; Owner: NEW YORK AM RADIO, LLC)

- WADO (1280 AM; 50 kW; NEW YORK, NY; Owner: WADO-AM LICENSE CORP.)

- WABC (770 AM; 50 kW; NEW YORK, NY; Owner: WABC-AM RADIO, INC.)

- WBBR (1130 AM; 50 kW; NEW YORK, NY; Owner: BLOOMBERG COMMUNICATIONS INC.)

- WNYC (820 AM; 10 kW; NEW YORK, NY; Owner: WNYC RADIO)

- WWRL (1600 AM; 25 kW; NEW YORK, NY; Owner: ACCESS.1 COMMUNICATIONS CORP.-NY)

- WPAT (930 AM; 5 kW; PATERSON, NJ; Owner: WPAT, INC)

- WWRU (1660 AM; 10 kW; JERSEY CITY, NJ; Owner: RADIO UNICA OF NEW YORK LICENSE CORP.)

- WFAN (660 AM; 50 kW; NEW YORK, NY; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

Strongest FM radio stations in Belleville:

- WNEW (102.7 FM; NEW YORK, NY; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WRKS (98.7 FM; NEW YORK, NY; Owner: EMMIS RADIO LICENSE CORP OF NEW YORK)

- WMSC (90.3 FM; UPPER MONTCLAIR, NJ; Owner: MONTCLAIR STATE UNIVERSITY)

- WNYC-FM (93.9 FM; NEW YORK, NY; Owner: WNYC RADIO)

- WPAT-FM (93.1 FM; PATERSON, NJ; Owner: WPAT LICENSING, INC.)

- WKTU (103.5 FM; LAKE SUCCESS, NY; Owner: AMFM RADIO LICENSES, LLC)

- WQCD (101.9 FM; NEW YORK, NY; Owner: EMMIS RADIO LICENSE CORPORATION)

- WBGO (88.3 FM; NEWARK, NJ; Owner: NEWARK PUBLIC RADIO INC.)

- WFME (94.7 FM; NEWARK, NJ; Owner: FAMILY STATIONS, INC.)

- WAXQ (104.3 FM; NEW YORK, NY; Owner: AMFM NEW YORK LICENSES, LLC)

- WHTZ (100.3 FM; NEWARK, NJ; Owner: AMFM RADIO LICENSES, L.L.C.)

- WWPR-FM (105.1 FM; NEW YORK, NY; Owner: AMFM RADIO LICENSES, L.L.C.)

- WCBS-FM (101.1 FM; NEW YORK, NY; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WCAA (105.9 FM; NEWARK, NJ; Owner: WADO-AM LICENSE CORP. ("WADO"))

- WBAI (99.5 FM; NEW YORK, NY; Owner: PACIFICA FOUNDATION, INC.)

- WBLS (107.5 FM; NEW YORK, NY; Owner: ICBC BROADCAST HOLDINGS-NY, INC.)

- WLTW (106.7 FM; NEW YORK, NY; Owner: AMFM NEW YORK LICENSES, LLC)

- WQXR-FM (96.3 FM; NEW YORK, NY; Owner: THE NEW YORK TIMES ELECTRONIC MEDIA COMPANY)

- WSKQ-FM (97.9 FM; NEW YORK, NY; Owner: WSKQ LICENSING, INC.)

- WXRK (92.3 FM; NEW YORK, NY; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

TV broadcast stations around Belleville:

- WPXO-LP (Channel 34; EAST ORANGE, NJ; Owner: PAXSON COMMUNICATIONS LPTV, INC.)

- WNYW (Channel 5; NEW YORK, NY; Owner: FOX TELEVISION STATIONS, INC.)

- WCBS-TV (Channel 2; NEW YORK, NY; Owner: CBS BROADCASTING INC.)

- WABC-TV (Channel 7; NEW YORK, NY; Owner: AMERICAN BROADCASTING COMPANIES, INC)

- WPIX (Channel 11; NEW YORK, NY; Owner: WPIX, INC.)

- WWOR-TV (Channel 9; SECAUCUS, NJ; Owner: FOX TELEVISION STATIONS, INC.)

- WPXN-TV (Channel 31; NEW YORK, NY; Owner: PAXSON COMMUNICATIONS LICENSE COMPANY, LLC)

- WNJU (Channel 47; LINDEN, NJ; Owner: WNJU LICENSE CORPORATION)

- WNBC (Channel 4; NEW YORK, NY; Owner: NATIONAL BROADCASTING COMPANY, INC.)

- WNET (Channel 13; NEWARK, NJ; Owner: EDUCATIONAL BROADCASTING CORPORATION)

- WXTV (Channel 41; PATERSON, NJ; Owner: WXTV LICENSE PARTNERSHIP, G.P.)

- WFUT (Channel 68; NEWARK, NJ; Owner: UNIVISION NEW YORK LLC)

- WNYE-TV (Channel 25; NEW YORK, NY; Owner: NEW YORK CITY BOARD OF EDUCATION)

- WKOB-LP (Channel 53; NEW YORK, NY; Owner: WKOB COMMUNICATIONS, INC.)

- WEBR-CA (Channel 17; MANHATTAN, NY; Owner: K LICENSEE INC.)

- WRNN-LP (Channel 57; NYACK, NY; Owner: LP NYACK LIMITED PARTNERSHIP)

- WXNY-LP (Channel 32; NEW YORK, NY; Owner: ISLAND BROADCASTING COMPANY)

- WNXY-LP (Channel 26; NEW YORK, NY; Owner: ISLAND BROADCASTING COMPANY)

- W60AI (Channel 60; NEW YORK, NY; Owner: VENTANA TELEVISION, INC.)

- W33BS (Channel 33; DARIEN, CT; Owner: CT&T BROADCASTING, INC.)

- WNYN-LP (Channel 39; NEW YORK, NY; Owner: ISLAND BROADCASTING COMPANY)

- WNYX-LP (Channel 35; NEW YORK, NY; Owner: ISLAND BROADCASTING COMPANY)

- W68DN (Channel 68; CHERRY HILL, ETC., NJ; Owner: MARCIA COHEN)

- WFME-TV (Channel 66; WEST MILFORD, NJ; Owner: FAMILY STATIONS, INC.)

- WLBX-LP (Channel 22; CRANFORD, NJ; Owner: RENARD COMMUNICATIONS CORP.)

- National Bridge Inventory (NBI) Statistics

- 12Number of bridges

- 72ft / 21.7mTotal length

- $2,107,000Total costs

- 277,364Total average daily traffic

- 12,477Total average daily truck traffic

- New bridges - historical statistics

- 1Before 1900

- 11910-1919

- 21930-1939

- 11940-1949

- 61950-1959

- 11960-1969

FCC Registered Antenna Towers:

36 (See the full list of FCC Registered Antenna Towers in Belleville)FCC Registered Broadcast Land Mobile Towers:

16 (See the full list of FCC Registered Broadcast Land Mobile Towers in Belleville, NJ)FCC Registered Microwave Towers:

4- CLARA MAASS HOSPITAL, 1 Vlara Maass Drive (Lat: 40.786667 Lon: -74.175556), Type: Mast, Structure height: 23.8 m, Overall height: 29.8 m, Call Sign: WQDI976,

Assigned Frequencies: 21575.0 MHz, 21925.0 MHz, Grant Date: 07/14/2015, Expiration Date: 09/08/2025, Certifier: Stephen A Megna Lt., Registrant: City Of - Police Department Newark, 311-317 Washington St., Newark, Nj, NJ 07102, Phone: (973) 733-6000, Fax: (973) 424-4218

- NJ-NNJ5483A, 681 Main Street (306739) (Lat: 40.803972 Lon: -74.143639), Type: Tower, Structure height: 53 m, Overall height: 53.9 m, Call Sign: WQLT350,

Assigned Frequencies: 22275.0 MHz, Grant Date: 07/07/2020, Expiration Date: 04/20/2030, Cancellation Date: 04/05/2022, Certifier: Nadja S Sodos-Wallace, Registrant: T-Mobile Usa, Inc., 12920 Se 38th Street, Bellevue, WA 98006, Phone: (425) 383-8401, Fax: (425) 383-4840, Email:

- NJ-NNJ5476A, 86 Lavergne Ave (Lat: 40.793611 Lon: -74.175944), Type: Tower, Structure height: 48 m, Overall height: 52.4 m, Call Sign: WQLT389,

Assigned Frequencies: 19575.0 MHz, 19675.0 MHz, 23025.0 MHz, 23175.0 MHz, Grant Date: 07/07/2020, Expiration Date: 04/20/2030, Cancellation Date: 09/13/2021, Certifier: Nadja S Sodos-Wallace, Registrant: T-Mobile Usa, Inc., 12920 Se 38th Street, Bellevue, WA 98006, Phone: (425) 383-8402, Fax: (425) 383-4840, Email:

- BELLEVILLE, 125 Franklin Street (Lat: 40.781639 Lon: -74.182944), Type: Mtower, Structure height: 39.9 m, Overall height: 40.8 m, Call Sign: WQRK236,

Assigned Frequencies: 22170.0 MHz, Grant Date: 06/03/2013, Expiration Date: 06/03/2023, Cancellation Date: 11/03/2014, Certifier: John Monday, Registrant: At&t Mobility LLC, 2200 N Greenville Ave., 1w, Richardson, TX 75082, Phone: (972) 234-7003, Fax: (972) 301-6893, Email:

FCC Registered Maritime Coast & Aviation Ground Towers:

2- Rt Us 7 Passaic River Bridge (Lat: 40.787056 Lon: -74.147361), Type: Building, Overall height: 4 m, Call Sign: WHD786,

Assigned Frequencies: 156.450 MHz, 156.650 MHz, 156.800 MHz, Grant Date: 09/24/1996, Expiration Date: 10/30/2001, Cancellation Date: 03/31/2002, Registrant: State Of New Jersey, 1035 Parkway Ave Cn613, Trenton, NJ 08625

- Rt 7 Us 7 Passaic River Bridge Control House (Lat: 40.786417 Lon: -74.147528), Type: Bridg, Structure height: 4.5 m, Overall height: 12.3 m, Call Sign: WQYG675,

Assigned Frequencies: 156.450 MHz, 156.650 MHz, 156.800 MHz, Grant Date: 09/21/2016, Expiration Date: 10/01/2025, Certifier: Edward T Runco Sr, Registrant: New Jersey Dept Of Transportation, 1035 Parkway Ave, Trenton, NJ 08625, Phone: (609) 530-2699, Fax: (609) 530-2202, Email:

FCC Registered Amateur Radio Licenses:

80 (See the full list of FCC Registered Amateur Radio Licenses in Belleville)FAA Registered Aircraft:

5- Aircraft: ECLIPSE AVIATION CORP EA500 (Category: Land, Engines: 2, Seats: 6, Weight: Up to 12,499 Pounds), Engine: P&W CANADA PW610F-A (950 Pounds of Thrust) (Turbo-fan)

N-Number: 124KK, N124KK, N-124KK, Serial Number: 000034, Year manufactured: 2007, Airworthiness Date: 07/19/2007, Certificate Issue Date: 01/08/2016

Registrant (LLC): Aether Aviation LLC, 137 1/2 Washington Ave Ste 312, Belleville, NJ 07109 - Aircraft: CESSNA 182Q (Category: Land, Seats: 4, Weight: Up to 12,499 Pounds, Speed: 112 mph), Engine: CONT MOTOR O-470 SERIES (230 HP) (Reciprocating)

N-Number: 252GS, N252GS, N-252GS, Serial Number: 18265179, Year manufactured: 1976, Airworthiness Date: 11/02/1976, Certificate Issue Date: 01/17/2020

Registrant (LLC): Aether Aviation LLC, 137 1/2 Washington Ave Ste 312, Belleville, NJ 07109 - Aircraft: WILLIAM O GOLPE UL-1 (Category: Land, Weight: Up to 12,499 Pounds), Engine: 2 Cycle

N-Number: 7793, N7793, N-7793, Serial Number: M2899, Certificate Issue Date: 08/04/2017

Registrant (Individual): William O Golpe, 23 Lavergne St, Belleville, NJ 07109 - Aircraft: CESSNA 172D (Category: Land, Seats: 4, Weight: Up to 12,499 Pounds, Speed: 105 mph), Engine: CONT MOTOR 0-300 SER (145 HP) (Reciprocating)

N-Number: 123SZ, N123SZ, N-123SZ, Serial Number: 17250216, Airworthiness Date: 01/22/2003, Certificate Issue Date: 06/06/2014

Registrant (Individual): Patrick D Walker, 40 Cuozzo St, Belleville, NJ 07109

Deregistered: Cancel Date: 03/20/2018 - Aircraft: PIPER PA-23-250 (Category: Land, Engines: 2, Seats: 6, Weight: Up to 12,499 Pounds, Speed: 150 mph), Engine: LYCOMING TI0-540 SER (310 HP) (Reciprocating)

N-Number: 6029Y, N6029Y, N-6029Y, Serial Number: 27-3214, Year manufactured: 1966, Airworthiness Date: 04/06/1966, Certificate Issue Date: 02/16/2001

Registrant (Individual): Patrick Walker, 40 Cuozzo St, Belleville, NJ 07109

Deregistered: Cancel Date: 03/14/2018

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 8 full tracts) | ||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 118 | $240,729 | 62 | $214,855 | 497 | $231,811 | 21 | $92,619 | 3 | $713,333 | 24 | $153,708 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 14 | $255,071 | 9 | $208,556 | 79 | $239,101 | 6 | $69,333 | 0 | $0 | 3 | $229,667 |

| APPLICATIONS DENIED | 30 | $254,867 | 35 | $193,400 | 300 | $245,207 | 52 | $80,942 | 3 | $1,131,667 | 20 | $175,950 |

| APPLICATIONS WITHDRAWN | 19 | $251,158 | 12 | $221,083 | 173 | $253,249 | 1 | $30,000 | 2 | $1,650,000 | 12 | $210,500 |

| FILES CLOSED FOR INCOMPLETENESS | 16 | $240,875 | 6 | $200,833 | 60 | $259,767 | 4 | $166,750 | 1 | $500,000 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 0140.00 , 0141.00, 0142.00, 0143.00, 0144.00, 0145.00, 0146.00, 0147.00

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 8 full tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 14 | $241,929 | 11 | $276,455 | 0 | $0 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 10 | $247,500 | 3 | $346,000 | 0 | $0 |

| APPLICATIONS DENIED | 4 | $214,500 | 7 | $243,000 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 1 | $180,000 | 3 | $291,667 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 2 | $295,000 | 1 | $129,000 | 1 | $360,000 |

Detailed PMIC statistics for the following Tracts: 0140.00 , 0141.00, 0142.00, 0143.00, 0144.00, 0145.00, 0146.00, 0147.00

2003 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Belleville, NJ

- 90654.4%Structure Fires

- 48128.9%Outside Fires

- 26015.6%Mobile Property/Vehicle Fires

- 181.1%Other

According to the data from the years 2003 - 2018 the average number of fire incidents per year is 104. The highest number of fires - 164 took place in 2006, and the least - 51 in 2003. The data has an increasing trend.

According to the data from the years 2003 - 2018 the average number of fire incidents per year is 104. The highest number of fires - 164 took place in 2006, and the least - 51 in 2003. The data has an increasing trend. When looking into fire subcategories, the most incidents belonged to: Structure Fires (54.4%), and Outside Fires (28.9%).

When looking into fire subcategories, the most incidents belonged to: Structure Fires (54.4%), and Outside Fires (28.9%).

- 71.3%Utility gas

- 22.2%Fuel oil, kerosene, etc.

- 4.9%Electricity

- 1.2%Bottled, tank, or LP gas

- 0.2%No fuel used

- 0.1%Coal or coke

- 65.4%Utility gas

- 21.8%Fuel oil, kerosene, etc.

- 8.3%Electricity

- 2.9%Bottled, tank, or LP gas

- 1.0%No fuel used

- 0.3%Other fuel

- 0.2%Wood

- 0.1%Coal or coke

Belleville compared to New Jersey state average:

- Unemployed percentage below state average.

- Black race population percentage below state average.

- Median age below state average.

- Renting percentage significantly below state average.

- Length of stay since moving in significantly above state average.

- Number of rooms per house significantly below state average.

- House age significantly below state average.

- Institutionalized population percentage significantly above state average.

Belleville on our top lists:

- #19 on the list of "Top 101 cities with largest percentage of males in occupations: motor vehicle operators except bus and truck drivers (population 5,000+)"

- #19 on the list of "Top 101 cities with largest percentage of males in industries: u. s. postal service (population 5,000+)"

- #24 on the list of "Top 101 cities with largest percentage of males in industries: other transportation, and support activities, and couriers (population 5,000+)"

- #31 on the list of "Top 101 cities with largest percentage of males in industries: clothing and accessories, including shoe, stores (population 5,000+)"

- #41 on the list of "Top 101 cities with largest percentage of males in occupations: other transportation workers (population 5,000+)"

- #43 on the list of "Top 101 cities with largest percentage of females in occupations: personal appearance workers (population 5,000+)"

- #47 on the list of "Top 101 cities with the most residents born in Ecuador (population 500+)"

- #51 on the list of "Top 101 cities with largest percentage of females in industries: personal and laundry services (population 5,000+)"

- #54 on the list of "Top 101 cities with largest percentage of females in occupations: secretaries and administrative assistants (population 5,000+)"

- #56 on the list of "Top 101 cities with largest percentage of females in industries: chemicals (population 5,000+)"

- #71 on the list of "Top 101 cities with largest percentage of males in occupations: personal appearance workers (population 5,000+)"

- #79 on the list of "Top 101 cities with largest percentage of males in occupations: supervisors of transportation and material moving workers (population 5,000+)"

- #81 on the list of "Top 101 cities with largest percentage of males in industries: jewelry, luggage, and leather goods stores (population 5,000+)"

- #83 on the list of "Top 101 cities with largest percentage of males in industries: sewing, needlework, and piece goods stores (population 5,000+)"

- #85 on the list of "Top 101 cities with largest percentage of males in industries: pharmacies and drug stores (population 5,000+)"

- #89 on the list of "Top 101 cities with largest percentage of females in industries: drugs, sundries, and chemical and allied products merchant wholesalers (population 5,000+)"

- #90 on the list of "Top 101 cities with largest percentage of males in industries: personal and laundry services (population 5,000+)"

- #99 on the list of "Top 101 cities with largest percentage of females in industries: u. s. postal service (population 5,000+)"

- #100 on the list of "Top 101 cities with largest percentage of females in industries: metals and minerals, except petroleum, merchant wholesalers (population 5,000+)"

- #7 on the list of "Top 101 counties with the highest Nitrogen Dioxide air pollution readings in 2012 (ppm)"

- #9 on the list of "Top 101 counties with the lowest percentage of residents that keep firearms around their homes"

- #19 on the list of "Top 101 counties with the most Black Protestant adherents"

- #20 on the list of "Top 101 counties with highest percentage of residents voting for Obama (Democrat) in the 2012 Presidential Election (pop. 50,000+)"

- #23 on the list of "Top 101 counties with the most Black Protestant congregations (pop. 50,000+)"

|

|

Total of 62 patent applications in 2008-2024.