Daytona Beach, Florida

Daytona Beach: Sunrise on Christmas day 2005

Daytona Beach: breathtaking view!

Daytona Beach: Welcone To Daytona

Daytona Beach: INTERCOASTAL COLORS

Daytona Beach: Sunglow Pier

Daytona Beach: a view from our room

Daytona Beach: International Speedway In Daytona Florida

Daytona Beach: Daytona Beach

Daytona Beach

Daytona Beach: Snapped this photo in April 2008

Daytona Beach: Band Shell on Daytona Beach

- see

68

more - add

your

Submit your own pictures of this city and show them to the world

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +21.6%

| Males: 39,560 | |

| Females: 38,398 |

| Median resident age: | 40.8 years |

| Florida median age: | 42.7 years |

Zip codes: 32114, 32117, 32118, 32119, 32124, 32129.

Daytona Beach Zip Code Map| Daytona Beach: | $51,881 |

| FL: | $69,303 |

Estimated per capita income in 2022: $29,676 (it was $17,530 in 2000)

Daytona Beach city income, earnings, and wages data

Estimated median house or condo value in 2022: $258,500 (it was $74,700 in 2000)

| Daytona Beach: | $258,500 |

| FL: | $354,100 |

Mean prices in 2022: all housing units: $299,076; detached houses: $313,131; townhouses or other attached units: $296,504; in 2-unit structures: $571,056; in 3-to-4-unit structures: $206,621; in 5-or-more-unit structures: $361,277; mobile homes: $77,025

Median gross rent in 2022: $1,211.

(15.1% for White Non-Hispanic residents, 26.0% for Black residents, 24.9% for Hispanic or Latino residents, 28.0% for American Indian residents, 34.2% for other race residents, 22.6% for two or more races residents)

Detailed information about poverty and poor residents in Daytona Beach, FL

- 38,12950.1%White alone

- 22,55129.7%Black alone

- 8,35311.0%Hispanic

- 3,3154.4%Two or more races

- 2,4673.2%Asian alone

- 5220.7%Other race alone

- 820.1%American Indian alone

- 190.02%Native Hawaiian and Other

Pacific Islander alone

Races in Daytona Beach detailed stats: ancestries, foreign born residents, place of birth

According to our research of Florida and other state lists, there were 265 registered sex offenders living in Daytona Beach, Florida as of May 09, 2024.

The ratio of all residents to sex offenders in Daytona Beach is 251 to 1.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is bigger than the state average.- means the value is much bigger than the state average.

Crime rate in Daytona Beach detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 275 (217 officers - 175 male; 42 female).

| Officers per 1,000 residents here: | 3.05 |

| Florida average: | 2.33 |

| Daytona Beach New Construction Condos (5 replies) |

| Moving to Daytona Beach (10 replies) |

| Why does Daytona Beach lead the nation in foreclosures? (2 replies) |

| Daytona Beach and Lattitudes (1 reply) |

| Daytona Beach real estate agent suggenstions needed.... (1 reply) |

| Looking for Indian community apartments in Daytona Beach areas (9 replies) |

Latest news from Daytona Beach, FL collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: American (6.9%), English (4.9%), Italian (4.9%), German (4.8%), Irish (3.8%), Polish (1.3%).

Current Local Time: EST time zone

Elevation: 10 feet

Land area: 58.7 square miles.

Population density: 1,329 people per square mile (low).

7,167 residents are foreign born (3.4% Latin America, 2.6% Asia, 2.2% Europe).

| This city: | 9.4% |

| Florida: | 21.1% |

Median real estate property taxes paid for housing units with mortgages in 2022: $2,072 (0.7%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $1,249 (0.7%)

Nearest city with pop. 200,000+: Jacksonville, FL (85.5 miles

, pop. 735,617).

Nearest city with pop. 1,000,000+: Philadelphia, PA (817.8 miles

, pop. 1,517,550).

Nearest cities:

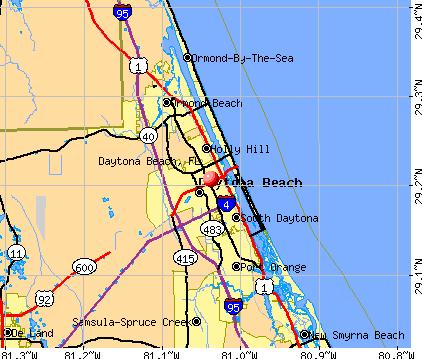

Latitude: 29.21 N, Longitude: 81.04 W

Daytime population change due to commuting: +25,365 (+32.5%)

Workers who live and work in this city: 17,778 (52.3%)

Area code: 386

Property values in Daytona Beach, FL

Daytona Beach tourist attractions:

- Daytona SeaBreeze Hotel Offers Stunning Ocean Views

- Daytona International Speedway: The Most Famous Track for NASCAR Races

- Marine Science Center near Daytona Beach a Small but Intriguing Attraction

- Museum of Arts and Sciences in Daytona Beach an Impressive Offering

- Indigo Lakes Golf Club

- MOAS - Museum of Arts and Sciences

- Beach Street

- Halifax Historical Museum

- Jackie Robinson Ballpark and Statue

- Lighthouse Point Park

- Mary Bethune Home

- Angell & Phelps Chocolate Factory

- Boardwalk Amusement Area and Pier

- Congo River Adventure Golf Daytona

- Daytona Flea and Farmers Market

- Daytona Lagoon

- Ocean Center

- Ponce Inlet

- Riverfront Marketplace

- Southeast Museum of Photography

- Tuscawilla Park

- Ponce de Leon Inlet Lighthouse and Museum a Florida Landmark

- The Beach at Daytona Beach is World-Renowned

- The Daytona 500 Experience is the Ideal Attraction for NASCAR Fans

- Volusia Mall - Daytona Beach, Florida - A Health Conscious Mall With Plenty of Retail Variety

- Wyndham Ocean Walk Hotel an Upscale Daytona Beach Favorite

Daytona Beach, Florida accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 1248 buildings, average cost: $321,900

- 2021: 1225 buildings, average cost: $270,000

- 2020: 760 buildings, average cost: $317,600

- 2019: 152 buildings, average cost: $231,400

- 2018: 141 buildings, average cost: $266,200

- 2017: 124 buildings, average cost: $266,100

- 2016: 139 buildings, average cost: $266,400

- 2015: 141 buildings, average cost: $261,400

- 2014: 130 buildings, average cost: $263,300

- 2013: 127 buildings, average cost: $254,900

- 2012: 106 buildings, average cost: $313,700

- 2011: 131 buildings, average cost: $180,000

- 2010: 130 buildings, average cost: $236,900

- 2009: 81 buildings, average cost: $302,200

- 2008: 141 buildings, average cost: $219,200

- 2007: 252 buildings, average cost: $226,900

- 2006: 363 buildings, average cost: $229,600

- 2005: 321 buildings, average cost: $211,600

- 2004: 175 buildings, average cost: $193,300

- 2003: 85 buildings, average cost: $142,700

- 2002: 93 buildings, average cost: $129,300

- 2001: 93 buildings, average cost: $167,200

- 2000: 84 buildings, average cost: $157,300

- 1999: 115 buildings, average cost: $121,900

- 1998: 99 buildings, average cost: $115,200

- 1997: 66 buildings, average cost: $111,100

| Here: | 4.1% |

| Florida: | 2.9% |

Population change in the 1990s: +666 (+1.0%).

- Accommodation & food services (15.4%)

- Educational services (11.1%)

- Health care (10.4%)

- Construction (6.3%)

- Administrative & support & waste management services (5.4%)

- Public administration (3.9%)

- Professional, scientific, technical services (3.7%)

- Accommodation & food services (15.6%)

- Educational services (10.6%)

- Construction (10.5%)

- Administrative & support & waste management services (6.1%)

- Health care (4.0%)

- Public administration (3.8%)

- Arts, entertainment, recreation (3.4%)

- Health care (17.7%)

- Accommodation & food services (15.1%)

- Educational services (11.6%)

- Administrative & support & waste management services (4.7%)

- Professional, scientific, technical services (4.3%)

- Public administration (4.1%)

- Finance & insurance (3.4%)

- Building and grounds cleaning and maintenance occupations (5.8%)

- Other sales and related occupations, including supervisors (4.5%)

- Other management occupations, except farmers and farm managers (4.0%)

- Retail sales workers, except cashiers (3.8%)

- Cooks and food preparation workers (3.2%)

- Information and record clerks, except customer service representatives (3.1%)

- Cashiers (3.1%)

- Building and grounds cleaning and maintenance occupations (6.0%)

- Other management occupations, except farmers and farm managers (5.2%)

- Cooks and food preparation workers (4.8%)

- Driver/sales workers and truck drivers (4.5%)

- Other sales and related occupations, including supervisors (4.3%)

- Retail sales workers, except cashiers (4.1%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (3.6%)

- Building and grounds cleaning and maintenance occupations (5.6%)

- Cashiers (5.2%)

- Secretaries and administrative assistants (5.2%)

- Other office and administrative support workers, including supervisors (5.0%)

- Information and record clerks, except customer service representatives (4.9%)

- Other sales and related occupations, including supervisors (4.8%)

- Waiters and waitresses (4.1%)

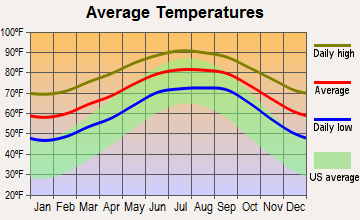

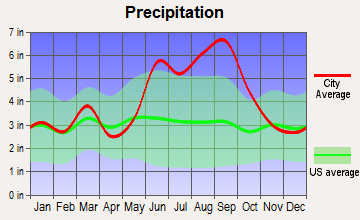

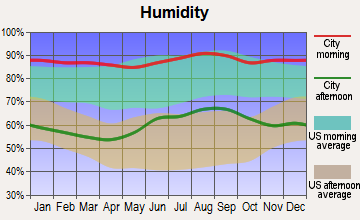

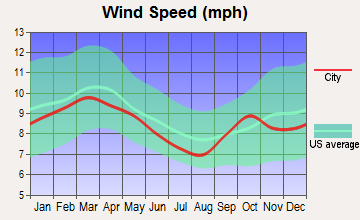

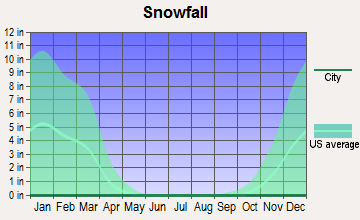

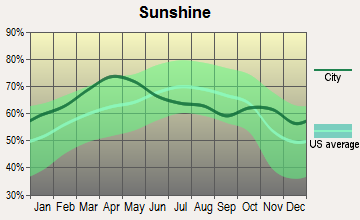

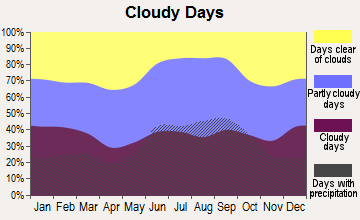

Average climate in Daytona Beach, Florida

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

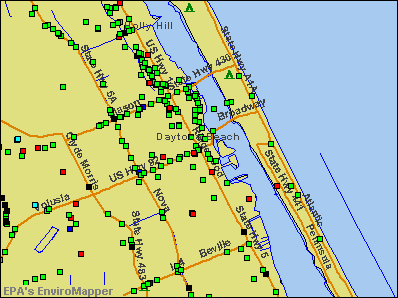

Air Quality Index (AQI) level in 2022 was 52.0. This is better than average.

| City: | 52.0 |

| U.S.: | 72.6 |

Ozone [ppb] level in 2022 was 24.8. This is better than average. Closest monitor was 7.3 miles away from the city center.

| City: | 24.8 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 19.2. This is about average. Closest monitor was 0.9 miles away from the city center.

| City: | 19.2 |

| U.S.: | 19.2 |

Tornado activity:

Daytona Beach-area historical tornado activity is near Florida state average. It is 3% greater than the overall U.S. average.

On 11/1/1997, a category F3 (max. wind speeds 158-206 mph) tornado 14.5 miles away from the Daytona Beach city center injured 32 people and caused $14 million in damages.

On 2/22/1998, a category F3 tornado 29.0 miles away from the city center killed 13 people and injured 36 people and caused $31 million in damages.

Earthquake activity:

Daytona Beach-area historical earthquake activity is significantly above Florida state average. It is 87% smaller than the overall U.S. average.On 9/10/2006 at 14:56:08, a magnitude 5.9 (5.9 MB, 5.5 MS, 5.8 MW, Class: Moderate, Intensity: VI - VII) earthquake occurred 398.7 miles away from the city center

On 11/22/1974 at 05:25:55, a magnitude 4.7 (4.7 MB, Class: Light, Intensity: IV - V) earthquake occurred 260.8 miles away from Daytona Beach center

On 9/4/2016 at 18:29:29, a magnitude 3.8 (3.8 ML, Class: Light, Intensity: II - III) earthquake occurred 108.9 miles away from Daytona Beach center

On 9/21/2016 at 16:30:52, a magnitude 3.8 (3.8 ML) earthquake occurred 110.0 miles away from Daytona Beach center

On 6/23/2016 at 17:20:29, a magnitude 3.8 (3.8 ML) earthquake occurred 110.0 miles away from the city center

On 6/10/2016 at 17:10:48, a magnitude 3.7 (3.7 MB) earthquake occurred 101.6 miles away from the city center

Magnitude types: body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Volusia County (27) is a lot greater than the US average (15).Major Disasters (Presidential) Declared: 17

Emergencies Declared: 5

Causes of natural disasters: Hurricanes: 13, Tornadoes: 7, Floods: 6, Storms: 5, Tropical Storms: 4, Fires: 3, Winds: 2, Freeze: 1, Heavy Rain: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: CONSOLIDATED TOMOKA LAND CO (REAL ESTATE), INTERNATIONAL SPEEDWAY CORP (SERVICES-RACING, INCLUDING TRACK OPERATION).

Hospitals in Daytona Beach:

- ATLANTIC MEDICAL CENTER (provides emergency services, 400 NORTH CLYDE MORRIS BOULEVARD)

- FLORIDA HOSPITAL MEMORIAL MEDICAL CENTER (Voluntary non-profit - Church, 301 MEMORIAL MEDICAL PARKWAY)

- FLORIDA MENTOR (1725 5TH STREET)

- FREDERICK AVENUE GROUP HOME (325 FREDERICK AVENUE)

- HALIFAX HEALTH MEDICAL CENTER (Government - Hospital District or Authority, provides emergency services, 303 N CLYDE MORRIS BLVD)

- HALIFAX PSYCHIATRIC CENTER NORTH (841 JIMMY ANN DR)

- ODYSSEY HEALTHCARE (149 S RIDGEWOOD AVENUE STE 600)

Nursing Homes in Daytona Beach:

- CARLTON SHORES HEALTH AND REHABILITATION CENTER (1350 S NOVA RD)

- CHATEAU VIVON NURSING CENTER (1350 NOVA RD)

- DAYTONA BEACH HEALTH AND REHABILITATION CENTER (1055 3RD STREET)

- DAYTONA MANOR NH (650 REED CANAL ROAD)

- GOOD SAMARITAN SOCIETY-DAYTONA (325 S SEGRAVE STREET)

- HEALTH CENTER OF DAYTONA BEACH, THE (550 NATIONAL HEALTHCARE DRIVE)

- HOLIDAY CARE CENTER (1031 SOUTH BEACH STREET)

- INDIGO MANOR (595 N WILLIAMSON BLVD)

- MANOR ON THE GREEN (324 WILDER BLVD)

- SANDALWOOD NURSING CENTER (1001 S BEACH STREET)

- TERRACE OF DAYTONA BEACH, LLC (1704 HUNTINGTON VILLAGE CIRCLE)

Dialysis Facilities in Daytona Beach:

- DAYTONA BEACH DIALYSIS (578 HEALTH BLVD)

- DAYTONA SOUTH DIALYSIS (1801 S NOVA RD #306)

- DIALYSIS CARE CENTER OF DAYTONA (720 CLYDE MORRIS BLVD)

Home Health Centers in Daytona Beach:

Airports and heliports located in Daytona Beach:

- Daytona Beach International Airport (DAB) (Runways: 3, Commercial Ops: 4,706, Air Taxi Ops: 8,649, Itinerant Ops: 195,894, Local Ops: 81,790, Military Ops: 1,058)

- Spruce Creek Airport (7FL6) (Runways: 1, Itinerant Ops: 5,000, Local Ops: 20,000)

- Florida Hospital Heliport (4FL6)

- Halifax Hospital Medical Center Heliport (29FL)

- Smokey's Heliport (FL44)

Colleges/Universities in Daytona Beach:

- Daytona State College (Full-time enrollment: 11,389; Location: 1200 W. International Speedway Blvd.; Public; Website: www.DaytonaState.edu)

- Embry-Riddle Aeronautical University-Worldwide (Full-time enrollment: 9,244; Location: 600 S. Clyde Morris Blvd.; Private, not-for-profit; Website: www.erau.edu; Offers Doctor's degree)

- Embry-Riddle Aeronautical University-Daytona Beach (Full-time enrollment: 4,932; Location: 600 S Clyde Morris Blvd; Private, not-for-profit; Website: www.erau.edu; Offers Doctor's degree)

- Bethune-Cookman University (Full-time enrollment: 3,733; Location: 640 Dr Mary McLeod Bethune Blvd; Private, not-for-profit; Website: www.cookman.edu; Offers Master's degree)

Other colleges/universities with over 2000 students near Daytona Beach:

- Wyotech-Daytona (about 12 miles; Ormond Beach, FL; Full-time enrollment: 2,295)

- Stetson University (about 20 miles; DeLand, FL; FT enrollment: 2,956)

- Seminole State College of Florida (about 36 miles; Sanford, FL; FT enrollment: 14,124)

- University of Central Florida (about 44 miles; Orlando, FL; FT enrollment: 51,457)

- Florida Technical College (about 45 miles; Orlando, FL; FT enrollment: 4,907)

- Full Sail University (about 46 miles; Winter Park, FL; FT enrollment: 31,435)

- Rollins College (about 47 miles; Winter Park, FL; FT enrollment: 3,085)

Biggest public high schools in Daytona Beach:

- MAINLAND HIGH SCHOOL (Students: 919, Location: 1255 W INTERNATIONAL SPEEDWAY, Grades: 9-12)

- SEABREEZE HIGH SCHOOL (Students: 878, Location: 2700 N OLEANDER AVE, Grades: 9-12)

- RICHARD MILBURN ACADEMY (Students: 89, Location: 1031 MASON AVE, Grades: 9-12, Charter school)

- VOLUSIA REGIONAL JUVENILE DETENTION CENTER (Location: 3840 OLD DELAND RD, Grades: 6-12)

- RIVERVIEW LEARNING CENTER (Location: 801 N WILD OLIVE AVE, Grades: 6-12)

- STEWART TREATMENT CENTER (Location: 3875 TIGER BAY RD, Grades: 6-12)

- HALIFAX BEHAVIORAL SERVICES (Location: 841 JIMMY ANN DR, Grades: PK-12)

- G4S YOUTH SERVICES INC. (Location: 1386 INDIAN LAKE RD, Grades: 6-12)

- THE CHILES ACADEMY (Location: 868 GEORGE W ENGRAM BLVD, Grades: PK-12, Charter school)

- DEPT. OF CORRECTIONS EDUCATIONAL PROGRAM (Location: 1300 RED JOHN DR, Grades: 8-12)

Private high schools in Daytona Beach:

Public elementary/middle schools in Daytona Beach:

- DAVID C HINSON SR MIDDLE SCHOOL (Students: 997, Location: 1860 N CLYDE MORRIS BLVD, Grades: 6-8)

- CAMPBELL MIDDLE SCHOOL (Students: 702, Location: 625 S KEECH ST, Grades: 6-8)

- PALM TERRACE ELEMENTARY SCHOOL (Students: 384, Location: 1825 DUNN AVE, Grades: PK-5)

- CHAMPION ELEMENTARY SCHOOL (Students: 238, Location: 921 TOURNAMENT DR, Grades: PK-5)

- TURIE T. SMALL ELEMENTARY SCHOOL (Students: 195, Location: 800 SOUTH ST, Grades: PK-5)

- R. J. LONGSTREET ELEMENTARY SCHOOL (Students: 172, Location: 2745 S PENINSULA DR, Grades: PK-5)

- ORTONA ELEMENTARY SCHOOL (Students: 130, Location: 1265 N GRANDVIEW AVE, Grades: KG-5)

- WESTSIDE ELEMENTARY SCHOOL (Location: 1210 JIMMY ANN DR, Grades: PK-5)

- RICHARD MILBURN ACADEMY MIDDLE SCHOOL (Location: 1025 MASON AVE # 1031, Grades: 6-8, Charter school)

Private elementary/middle schools in Daytona Beach:

- LOURDES ACADEMY (Students: 263, Location: 1014 N HALIFAX AVE, Grades: PK-8)

- BASILICA SCHOOL OF ST PAUL (Students: 159, Location: 317 MULLALLY ST, Grades: UG-8)

- MT CALVARY ACADEMY (Students: 120, Location: 700 BELLEVUE AVE, Grades: PK-6)

- MOUNT CALVARY ACADEMY (Students: 116, Location: 700 BELLEVUE AVE, Grades: PK-6)

- LIVING FAITH ACADEMY (Students: 43, Location: 950 DERBYSHIRE RD, Grades: PK-1)

- LILIES OF THE FIELDS (Students: 39, Location: 201 SAN JUAN AVE, Grades: PK-2)

- WORD AND PRAISE CHRISTIAN LEARNING CENTER (Students: 39, Location: 955 ORANGE AVE STE 120, Grades: PK-5)

- INDIGO CHRISTIAN JR ACADEMY (Students: 38, Location: 401 N WILLIAMSON BLVD, Grades: PK-8)

- THE CHASE ACADEMY (Students: 19, Location: 910 BEVILLE RD, Grades: KG-8)

User-submitted facts and corrections:

- Church of God - Ridgewood 433 N. Ridgewood Avenue Daytona Beach, 32114

Points of interest:

Notable locations in Daytona Beach: Volusia Plaza (A), Bellair Plaza (B), Contemporary Plaza (C), Derby Plaza (D), Holly Hill Plaza (E), Volusia Centre (F), Bennett Field (G), Bellair Plaza (H), Bethune Point Water Treatment Plant (I), Jackie Robinson Ballpark (J), Seabreeze High School Football Stadium (K), Daytona International Speedway (L), Volusia County Kennel Club (M), The Royal Saint Augustine Golf and Country Club (N), Coral Isle Golf Center (O), Cooper Colony Country Club (P), Continental Country Club (Q), Daytona Beach Bethune Point Wastwater Treatment Plant (R), Old Clark Field (S), Daytona Beach Fire Department Station 1 (T). Display/hide their locations on the map

Shopping Centers: Volusia Point Shopping Center (1), Volusia Mall (2), Burgoyne Shopping Center (3), Daytona Mall (4), Halifax Shopping Center (5), Daytona Mall (6). Display/hide their locations on the map

Main business address in Daytona Beach include: CONSOLIDATED TOMOKA LAND CO (A), INTERNATIONAL SPEEDWAY CORP (B). Display/hide their locations on the map

Churches in Daytona Beach include: Word of Faith Family Church (A), Westside Baptist Church (B), Truevine Temple Ministries (C), The River Church International (D), The Church of Jesus Christ of Latter Day Saints (E), Stewart Memorial United Methodist Church (F), Soul Refreshing Church of God in Christ (G), Shiloh Missionary Baptist Church (H), School Street Church of God in Christ (I). Display/hide their locations on the map

Cemeteries: Pinewood Cemetery (1), Mount Ararat Cemetery (2), Sunset Park Cemetery (3), Daytona Memorial Park (4), Greenwood Cemetery (5). Display/hide their locations on the map

Lakes and swamps: Banks Lake (A), Bonnet Lake (B), Danny Hole (C), Stooping Saplings (D), Burnt Out Bay (E), Buck Bay (F), Bennett Swamp (G), White Strand (H). Display/hide their locations on the map

Parks in Daytona Beach include: Colin's Park (1), Bethune Point Park (2), Sunnyland Park (3), Cypress Park (4), Memorial Stadium (5), Live Oak Park (6), Mary McLeod Bethune Home (7). Display/hide their locations on the map

Tourist attractions: Howard Thurman Home (Historical Places & Services; 614 Whitehall Street) (1), Halifax Historical Society Museum (Cultural Attractions- Events- & Facilities; 252 South Beach Street) (2), A Spa by Minda at the Ocean Towers (Recreation Areas; 2800 North Atlantic Avenue Ste 102) (3), Beyer & Brown (Amusement & Theme Parks; 635 Beville Road) (4), Atlantic Race Park (Amusement & Theme Parks; 2122 South Atlantic Avenue) (5), Congo River Golf & Exploration CO (Amusement & Theme Parks; 2100 South Atlantic Avenue) (6), Brown's Billiards (Amusement & Theme Parks; 1595 North Nova Road) (7), B & B Vending Inc (Amusement & Theme Parks; 721 Orange Avenue) (8), Daytona Beach Bingo (284 North Nova Road) (9). Display/hide their approximate locations on the map

Hotels: Bayview Hotel (124 Orange Avenue) (1), Club Sea Oats (2539 South Atlantic Avenue) (2), Bamboo Beach Motel (1619 South Atlantic Avenue) (3), Buzinec August (3635 South Atlantic Avenue) (4), Beach Haven Inn (2115 S Atlantic Ave) (5), Best Western Mayan Inn Beachfr (103 South Ocean Avenue) (6), Colonial Motel (208 Ridgewood Avenue) (7), Cardinal Motel (738 North Atlantic Avenue) (8), Beaches Oceanfront Resort (1299 South Atlantic Avenue) (9). Display/hide their approximate locations on the map

Courts: Florida State - Judicial- Circuit Court Seventh Judicial- Clerk Of Circuit Court Volusia Co (251 North Ridgewood Avenue) (1), Volusia County - Below Are Listings For Departments Which May Be Dia- Clerk Of C (251 North Ridgewood Avenue) (2), Florida State - Judicial- County Court Volusia- State Attorney (251 North Ridgewood Avenue) (3), Volusia County - Below Are Listings For Departments Which May Be Dia- Court Administra (251 North Ridgewood Avenue) (4), Federal Bureau Of Investigation (444 Seabreeze Boulevard) (5). Display/hide their approximate locations on the map

Birthplace of: Kenneth C. Griffin - Billionaire, Carl M. Kuttler, Jr. - Former president, Bob Ross - Painter, Joe Arnold - College baseball coach, Brennan Curtin - 2005 NFL player (Green Bay Packers, born: Jun 30, 1980), Pete Carr - Guitarist and Record Producer, Brandon Siler - College football player, Randy Reese - College swimmer, Jeff Blake - 2005 NFL player (Chicago Bears, born: Dec 4, 1970), Rickie Weeks - 2005 Major League Baseball player (Milwaukee Brewers, born: Sep 13, 1982).

Drinking water stations with addresses in Daytona Beach and their reported violations in the past:

DAYTONA BEACH (Address: 125 BASIN STREET, SUITE 130 , Population served: 88,918, Groundwater):Past health violations:TROPICAL PALMS ESTATES (Population served: 11, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - In JAN-2014, Contaminant: Coliform. Follow-up actions: St Compliance achieved (FEB-01-2014), St Public Notif requested (FEB-14-2014), St Public Notif received (MAR-21-2014)

- MCL, Monthly (TCR) - In DEC-2005, Contaminant: Coliform. Follow-up actions: St Public Notif requested (JAN-10-2006), St Public Notif received (JAN-23-2006)

- Monitoring and Reporting (DBP) - Between JUL-2007 and SEP-2007, Contaminant: TTHM. Follow-up actions: St Violation/Reminder Notice (OCT-25-2007), St Public Notif requested (OCT-25-2007), St Compliance achieved (JAN-23-2008), St Public Notif received (JAN-25-2008)

- Monitoring and Reporting (DBP) - Between JUL-2007 and SEP-2007, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Violation/Reminder Notice (OCT-25-2007), St Public Notif requested (OCT-25-2007), St Compliance achieved (JAN-23-2008), St Public Notif received (JAN-25-2008)

Past monitoring violations:

- Monitoring and Reporting (DBP) - Between JUL-2008 and SEP-2008, Contaminant: TTHM. Follow-up actions: St Compliance achieved (SEP-16-2008), St Violation/Reminder Notice (NOV-20-2008)

- Monitoring and Reporting (DBP) - Between JUL-2008 and SEP-2008, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Compliance achieved (SEP-16-2008), St Violation/Reminder Notice (NOV-20-2008)

- One routine major monitoring violation

Drinking water stations with addresses in Daytona Beach that have no violations reported:

| This city: | 2.0 people |

| Florida: | 2.5 people |

| This city: | 46.5% |

| Whole state: | 65.2% |

| This city: | 8.6% |

| Whole state: | 7.3% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.4% of all households

- Gay men: 0.5% of all households

People in group quarters in Daytona Beach in 2010:

- 3,323 people in college/university student housing

- 1,059 people in nursing facilities/skilled-nursing facilities

- 237 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 177 people in other noninstitutional facilities

- 144 people in group homes intended for adults

- 58 people in residential treatment centers for adults

- 24 people in correctional facilities intended for juveniles

- 15 people in workers' group living quarters and job corps centers

- 11 people in residential schools for people with disabilities

People in group quarters in Daytona Beach in 2000:

- 3,187 people in college dormitories (includes college quarters off campus)

- 1,315 people in nursing homes

- 310 people in other noninstitutional group quarters

- 132 people in training schools for juvenile delinquents

- 61 people in other nonhousehold living situations

- 17 people in homes for the mentally ill

- 15 people in other types of correctional institutions

- 15 people in mental (psychiatric) hospitals or wards

- 15 people in homes or halfway houses for drug/alcohol abuse

- 10 people in other group homes

- 9 people in wards in general hospitals for patients who have no usual home elsewhere

- 6 people in schools, hospitals, or wards for the intellectually disabled

- 5 people in religious group quarters

Banks with most branches in Daytona Beach (2011 data):

- Wells Fargo Bank, National Association: Seabreeze Boulevard Branch, Beville Road Branch, Daytona Beach Shores Branch, Downtown Daytona Branch, West Daytona, International Speedway Branch. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- Fifth Third Bank: Daytona Branch, Beville Road Branch, Daytona Beach Dt Branch, Seabreeze Office Branch. Info updated 2009/10/05: Bank assets: $114,540.4 mil, Deposits: $89,689.1 mil, headquarters in Cincinnati, OH, positive income, Commercial Lending Specialization, 1378 total offices, Holding Company: Fifth Third Bancorp

- SunTrust Bank: Grandview Branch, Daytona Beach Branch, Bill France Boulevard Branch. Info updated 2010/05/27: Bank assets: $171,291.7 mil, Deposits: $129,833.2 mil, headquarters in Atlanta, GA, positive income, Commercial Lending Specialization, 1716 total offices, Holding Company: Suntrust Banks, Inc.

- Bank of America, National Association: Daytona West Branch, Daytona Beach Shores Branch, International Speedway Blvd Branch. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- TD Bank, National Association: Daytona Isb at 1060 Westinternational Speedway Blvd, branch established on 2007/03/13; Beville Nova Branch at 1590 South Nova Road, branch established on 2003/05/07. Info updated 2010/10/04: Bank assets: $188,912.6 mil, Deposits: $153,149.8 mil, headquarters in Wilmington, DE, positive income, 1314 total offices, Holding Company: Toronto-Dominion Bank, The

- Southern Commerce Bank, National Association: Daytona Beach Branch at 1101 Beville Road, branch established on 2007/10/24. Info updated 2006/11/08: Bank assets: $107.8 mil, Deposits: $90.3 mil, headquarters in Tampa, FL, negative income in the last year, Commercial Lending Specialization, 11 total offices, Holding Company: Dickinson Financial Corporation Ii

- Regions Bank: Daytona Beach Branch at 100 Corsair Drive, branch established on 1985/01/21. Info updated 2011/02/24: Bank assets: $123,368.2 mil, Deposits: $98,301.3 mil, headquarters in Birmingham, AL, positive income, Commercial Lending Specialization, 1778 total offices, Holding Company: Regions Financial Corporation

- Surety Bank: Mason-Nova Branch at 1011 Mason Avenue, branch established on 1996/03/28. Info updated 2006/11/03: Bank assets: $111.7 mil, Deposits: $99.5 mil, headquarters in Deland, FL, negative income in the last year, Commercial Lending Specialization, 2 total offices

- Branch Banking and Trust Company: Daytona Beach Branch at 1899 South Clyde Morris Boulevard, branch established on 1984/01/09. Info updated 2010/03/29: Bank assets: $168,867.6 mil, Deposits: $127,549.5 mil, headquarters in Winston Salem, NC, positive income, Commercial Lending Specialization, 1793 total offices, Holding Company: Bb&T Corporation

- 4 other banks with 4 local branches

For population 15 years and over in Daytona Beach:

- Never married: 42.7%

- Now married: 33.9%

- Separated: 1.6%

- Widowed: 5.7%

- Divorced: 16.2%

For population 25 years and over in Daytona Beach:

- High school or higher: 92.3%

- Bachelor's degree or higher: 27.0%

- Graduate or professional degree: 10.2%

- Unemployed: 10.2%

- Mean travel time to work (commute): 19.1 minutes

| Here: | 10.3 |

| Florida average: | 12.2 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Daytona Beach, FL (based on Volusia County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 78,423 | 255 |

| Catholic | 50,934 | 15 |

| Mainline Protestant | 29,546 | 77 |

| Other | 7,075 | 39 |

| Black Protestant | 5,253 | 34 |

| Orthodox | 1,206 | 5 |

| None | 322,156 | - |

Food Environment Statistics:

| Volusia County: | 1.80 / 10,000 pop. |

| State: | 2.04 / 10,000 pop. |

| This county: | 0.12 / 10,000 pop. |

| Florida: | 0.11 / 10,000 pop. |

| Volusia County: | 1.52 / 10,000 pop. |

| Florida: | 1.28 / 10,000 pop. |

| Here: | 3.60 / 10,000 pop. |

| State: | 3.04 / 10,000 pop. |

| Volusia County: | 7.50 / 10,000 pop. |

| Florida: | 7.45 / 10,000 pop. |

| This county: | 9.1% |

| State: | 9.2% |

| Volusia County: | 24.5% |

| Florida: | 23.7% |

| This county: | 14.1% |

| Florida: | 14.0% |

Health and Nutrition:

| Daytona Beach: | 51.5% |

| Florida: | 51.4% |

| Daytona Beach: | 49.5% |

| Florida: | 49.4% |

| Daytona Beach: | 28.6 |

| State: | 28.6 |

| Here: | 18.3% |

| Florida: | 19.5% |

| This city: | 11.4% |

| Florida: | 10.7% |

| Daytona Beach: | 6.8 |

| State: | 6.9 |

| This city: | 33.3% |

| Florida: | 34.7% |

| Here: | 57.3% |

| State: | 57.0% |

| Here: | 79.7% |

| Florida: | 79.2% |

More about Health and Nutrition of Daytona Beach, FL Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 229 | $1,020,250 | $53,463 | 0 | $0 |

| Parks and Recreation | 140 | $586,315 | $50,256 | 0 | $0 |

| Other and Unallocable | 105 | $537,306 | $61,406 | 0 | $0 |

| Firefighters | 96 | $537,141 | $67,143 | 0 | $0 |

| Sewerage | 74 | $334,463 | $54,237 | 0 | $0 |

| Other Government Administration | 55 | $350,283 | $76,425 | 0 | $0 |

| Water Supply | 49 | $235,343 | $57,635 | 0 | $0 |

| Police - Other | 46 | $141,223 | $36,841 | 52 | $53,785 |

| Streets and Highways | 41 | $332,661 | $97,364 | 0 | $0 |

| Financial Administration | 36 | $223,548 | $74,516 | 0 | $0 |

| Fire - Other | 17 | $109,899 | $77,576 | 0 | $0 |

| Judicial and Legal | 11 | $108,376 | $118,228 | 0 | $0 |

| Housing and Community Development (Local) | 3 | $15,540 | $62,160 | 0 | $0 |

| Totals for Government | 902 | $4,532,348 | $60,297 | 52 | $53,785 |

Daytona Beach government finances - Expenditure in 2021 (per resident):

- Construction - Sewerage: $30,659,000 ($393.28)

Regular Highways: $5,000,000 ($64.14)

- Current Operations - Police Protection: $37,557,000 ($481.76)

Water Utilities: $24,983,000 ($320.47)

Parks and Recreation: $15,541,000 ($199.35)

Natural Resources - Other: $13,942,000 ($178.84)

Local Fire Protection: $13,172,000 ($168.96)

Financial Administration: $11,636,000 ($149.26)

Solid Waste Management: $10,457,000 ($134.14)

General - Other: $9,459,000 ($121.33)

Sewerage: $7,719,000 ($99.01)

Central Staff Services: $7,669,000 ($98.37)

Regular Highways: $6,638,000 ($85.15)

Protective Inspection and Regulation - Other: $4,202,000 ($53.90)

Sea and Inland Port Facilities: $2,709,000 ($34.75)

Judicial and Legal Services: $1,724,000 ($22.11)

Public Welfare - Other: $1,615,000 ($20.72)

Housing and Community Development: $1,424,000 ($18.27)

Parking Facilities: $211,000 ($2.71)

- General - Interest on Debt: $1,870,000 ($23.99)

- Other Capital Outlay - Parks and Recreation: $1,972,000 ($25.30)

Local Fire Protection: $1,250,000 ($16.03)

General - Other: $884,000 ($11.34)

Police Protection: $764,000 ($9.80)

Public Welfare - Other: $379,000 ($4.86)

Protective Inspection and Regulation - Other: $298,000 ($3.82)

Housing and Community Development: $287,000 ($3.68)

Natural Resources - Other: $183,000 ($2.35)

Central Staff Services: $109,000 ($1.40)

- Water Utilities - Interest on Debt: $2,603,000 ($33.39)

Daytona Beach government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $32,727,000 ($419.80)

Solid Waste Management: $18,973,000 ($243.37)

Natural Resources - Other: $13,376,000 ($171.58)

Parks and Recreation: $7,955,000 ($102.04)

Other: $4,523,000 ($58.02)

Sea and Inland Port Facilities: $3,404,000 ($43.66)

Parking Facilities: $540,000 ($6.93)

- Federal Intergovernmental - Other: $4,728,000 ($60.65)

Housing and Community Development: $1,499,000 ($19.23)

- Local Intergovernmental - General Local Government Support: $3,529,000 ($45.27)

Public Welfare: $1,622,000 ($20.81)

Other: $541,000 ($6.94)

- Miscellaneous - Special Assessments: $11,774,000 ($151.03)

Interest Earnings: $2,725,000 ($34.95)

Donations From Private Sources: $1,170,000 ($15.01)

General Revenue - Other: $1,010,000 ($12.96)

Rents: $853,000 ($10.94)

Fines and Forfeits: $494,000 ($6.34)

Sale of Property: $2,000 ($0.03)

- Revenue - Water Utilities: $21,361,000 ($274.01)

- State Intergovernmental - General Local Government Support: $6,085,000 ($78.05)

Highways: $1,071,000 ($13.74)

Other: $887,000 ($11.38)

Housing and Community Development: $67,000 ($0.86)

- Tax - Property: $31,600,000 ($405.35)

Public Utilities Sales: $11,561,000 ($148.30)

Occupation and Business License - Other: $7,348,000 ($94.26)

Other License: $3,347,000 ($42.93)

Motor Fuels Sales: $1,782,000 ($22.86)

Insurance Premiums Sales: $1,059,000 ($13.58)

Daytona Beach government finances - Debt in 2021 (per resident):

- Long Term Debt - Outstanding Unspecified Public Purpose: $145,586,000 ($1867.49)

Beginning Outstanding - Unspecified Public Purpose: $142,100,000 ($1822.78)

Retired Unspecified Public Purpose: $5,376,000 ($68.96)

Issue, Unspecified Public Purpose: $354,000 ($4.54)

Daytona Beach government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $13,335,000 ($171.05)

- Other Funds - Cash and Securities: $151,175,000 ($1939.19)

- Sinking Funds - Cash and Securities: $3,359,000 ($43.09)

9.11% of this county's 2021 resident taxpayers lived in other counties in 2020 ($71,399 average adjusted gross income)

| Here: | 9.11% |

| Florida average: | 8.80% |

0.04% of residents moved from foreign countries ($209 average AGI)

Volusia County: 0.04% Florida average: 0.05%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Seminole County, FL | |

| from Orange County, FL | |

| from Flagler County, FL |

6.49% of this county's 2020 resident taxpayers moved to other counties in 2021 ($53,189 average adjusted gross income)

| Here: | 6.49% |

| Florida average: | 7.45% |

0.03% of residents moved to foreign countries ($332 average AGI)

Volusia County: 0.03% Florida average: 0.04%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Seminole County, FL | |

| to Orange County, FL | |

| to Flagler County, FL |

| Businesses in Daytona Beach, FL | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 7-Eleven | 16 | Kmart | 1 | |

| ALDO | 1 | La Quinta | 2 | |

| AT&T | 3 | Lane Bryant | 1 | |

| Abercrombie & Fitch | 1 | Lane Furniture | 1 | |

| Ace Hardware | 1 | LensCrafters | 2 | |

| Advance Auto Parts | 2 | Little Caesars Pizza | 1 | |

| Aeropostale | 1 | Macy's | 1 | |

| American Eagle Outfitters | 1 | Marriott | 2 | |

| Applebee's | 2 | Marshalls | 1 | |

| Arby's | 1 | Mazda | 1 | |

| Ashley Furniture | 1 | McDonald's | 6 | |

| AutoZone | 1 | Men's Wearhouse | 2 | |

| BMW | 1 | Motherhood Maternity | 2 | |

| Barnes & Noble | 1 | New Balance | 3 | |

| Baskin-Robbins | 1 | New York & Co | 1 | |

| Bath & Body Works | 1 | Nike | 19 | |

| Bed Bath & Beyond | 1 | Nissan | 1 | |

| Best Western | 1 | Office Depot | 1 | |

| Blockbuster | 1 | Old Navy | 1 | |

| Brookstone | 1 | Olive Garden | 1 | |

| Budget Car Rental | 2 | Outback | 1 | |

| Burger King | 4 | Outback Steakhouse | 1 | |

| CVS | 3 | Pac Sun | 1 | |

| Casual Male XL | 1 | Panera Bread | 1 | |

| Catherines | 1 | Papa John's Pizza | 1 | |

| Charlotte Russe | 1 | Payless | 2 | |

| Chevrolet | 1 | Penske | 1 | |

| Chick-Fil-A | 3 | PetSmart | 1 | |

| Chipotle | 1 | Pier 1 Imports | 1 | |

| Church's Chicken | 1 | Pizza Hut | 3 | |

| Circle K | 2 | Plato's Closet | 1 | |

| Cold Stone Creamery | 1 | Publix Super Markets | 3 | |

| Comfort Inn | 1 | Quality | 1 | |

| Comfort Suites | 1 | Quiznos | 2 | |

| Cracker Barrel | 1 | RadioShack | 1 | |

| Days Inn | 3 | Ramada | 1 | |

| Dennys | 3 | Red Lobster | 1 | |

| Discount Tire | 1 | Rooms To Go | 1 | |

| Domino's Pizza | 2 | Ruby Tuesday | 2 | |

| Dunkin Donuts | 4 | SAS Shoes | 1 | |

| Extended Stay Deluxe | 1 | Sam's Club | 1 | |

| FedEx | 19 | Sears | 2 | |

| Finish Line | 1 | Shoe Carnival | 1 | |

| Firestone Complete Auto Care | 2 | Spencer Gifts | 1 | |

| Foot Locker | 1 | Sprint Nextel | 3 | |

| Ford | 1 | Staples | 1 | |

| GNC | 3 | Starbucks | 4 | |

| GameStop | 2 | Steak 'n Shake | 1 | |

| Gymboree | 1 | Subaru | 1 | |

| H&R Block | 6 | Suburban | 1 | |

| Havertys Furniture | 1 | Super 8 | 3 | |

| Hilton | 4 | T-Mobile | 3 | |

| Hobby Lobby | 1 | T.J.Maxx | 1 | |

| Holiday Inn | 4 | Taco Bell | 3 | |

| Hollister Co. | 1 | Target | 1 | |

| Home Depot | 1 | Tire Kingdom | 1 | |

| Honda | 1 | Toyota | 1 | |

| Hot Topic | 1 | Toys"R"Us | 2 | |

| Hyundai | 1 | U-Haul | 7 | |

| IHOP | 4 | UPS | 21 | |

| JCPenney | 1 | Value City Furniture | 1 | |

| Jimmy Jazz | 1 | Vans | 5 | |

| Jimmy John's | 2 | Verizon Wireless | 1 | |

| Johnny Rockets | 1 | Victoria's Secret | 1 | |

| Jones New York | 3 | Volkswagen | 1 | |

| Journeys | 1 | Waffle House | 1 | |

| Justice | 1 | Walgreens | 7 | |

| KFC | 2 | Walmart | 2 | |

Strongest AM radio stations in Daytona Beach:

- WMFJ (1450 AM; 1 kW; DAYTONA BEACH, FL; Owner: CORNERSTONE BROADCASTING CORPORATION)

- WROD (1340 AM; 1 kW; DAYTONA BEACH, FL; Owner: GORE-OVERGAARD BROADCASTING, INC)

- WELE (1380 AM; 5 kW; ORMOND BEACH, FL; Owner: WINGS COMMUNICATIONS, INCORPORATED)

- WNDB (1150 AM; 1 kW; DAYTONA BEACH, FL; Owner: BLACK CROW RADIO, LLC)

- WPUL (1590 AM; 1 kW; SOUTH DAYTONA, FL)

- WIXC (1060 AM; 50 kW; TITUSVILLE, FL; Owner: GENESIS COMMUNICATIONS I, INC.)

- WONQ (1030 AM; 45 kW; OVIEDO, FL; Owner: FLORIDA BROADCASTERS)

- WDYZ (990 AM; 50 kW; ORLANDO, FL; Owner: ABC, INC.)

- WQTM (740 AM; 50 kW; ORLANDO, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WFLF (540 AM; 50 kW; PINE HILLS, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WYND (1310 AM; 8 kW; DELAND, FL; Owner: BUDDY TUCKER ASSOCIATION, INC.)

- WHOO (1080 AM; daytime; 35 kW; KISSIMMEE, FL; Owner: GENESIS COMMUNICATIONS I, INC.)

- WOKV (690 AM; 50 kW; JACKSONVILLE, FL; Owner: COX RADIO, INC.)

Strongest FM radio stations in Daytona Beach:

- WHOG-FM (95.7 FM; ORMOND-BY-THE-SEA, FL; Owner: BLACK CROW RADIO, LLC)

- WVYB (103.3 FM; HOLLY HILL, FL; Owner: BLACK CROW MEDIA, LLC)

- WAPN (91.5 FM; HOLLY HILL, FL; Owner: PUBLIC RADIO, INC.)

- WJHM (101.9 FM; DAYTONA BEACH, FL; Owner: INFINITY RADIO OPERATIONS INC.)

- WOCL (105.9 FM; DELAND, FL; Owner: INFINITY RADIO OPERATIONS INC.)

- WMGF (107.7 FM; MOUNT DORA, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- W247AL (97.3 FM; DAYTONA BEACH, FL; Owner: CORNERSTONE BROADCASTING CORPORATION)

- WCFB (94.5 FM; DAYTONA BEACH, FL; Owner: COX RADIO, INC.)

- WGNE-FM (99.9 FM; PALATKA, FL; Owner: RENDA BROADCASTING CORP. OF NEVADA)

- WKTO (88.7 FM; EDGEWATER, FL; Owner: MIMS COMMUNITY RADIO, INC.)

- WOMX-FM (105.1 FM; ORLANDO, FL; Owner: INFINITY RADIO OPERATIONS INC.)

- WJRR (101.1 FM; COCOA BEACH, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WSHE (100.3 FM; ORLANDO, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WTKS-FM (104.1 FM; COCOA BEACH, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WHTQ (96.5 FM; ORLANDO, FL; Owner: COX RADIO, INC.)

- WWKA (92.3 FM; ORLANDO, FL; Owner: COX RADIO, INC.)

- WJLU (89.7 FM; NEW SMYRNA BEACH, FL; Owner: CORNERSTONE BROADCASTING CORPORATION)

- WPOZ (88.3 FM; UNION PARK, FL; Owner: CENTRAL FLORIDA EDUCATIONAL FOUNDATION, INC.)

- WXXL (106.7 FM; TAVARES, FL; Owner: AMFM RADIO LICENSES, L.L.C.)

- WEAZ (88.1 FM; HOLLY HILL, FL; Owner: CENTRAL FLORIDA ED. FOUNDATION, INC.)

TV broadcast stations around Daytona Beach:

- WDYB-LP (Channel 53; DAYTONA BEACH, FL; Owner: TIGER EYE BROADCASTING CORPORATION)

- WCEU (Channel 15; NEW SMYRNA BEACH, FL; Owner: DAYTONA BEACH COMMUNITY COLLEGE)

- WESH (Channel 2; DAYTONA BEACH, FL; Owner: ORLANDO HEARST-ARGYLE TELEVISION, INC.)

- WPXB-LP (Channel 57; DAYTONA BEACH, FL; Owner: PAXSON COMMUNICATIONS LPTV, INC.)

- WXXU-LP (Channel 12; ALTAMONTE SPRINGS, FL; Owner: RAMA COMMUNICATIONS)

- WVEN-TV (Channel 26; DAYTONA BEACH, FL; Owner: ENTRAVISION HOLDINGS, LLC)

- WFTV (Channel 9; ORLANDO, FL; Owner: WFTV-TV HOLDINGS, INC.)

- WZXZ-CA (Channel 11; ORLANDO, ETC., FL; Owner: THE BOX WORLDWIDE LLC)

- WRBW (Channel 65; ORLANDO, FL; Owner: FOX TELEVISION STATIONS, INC.)

- WKMG-TV (Channel 6; ORLANDO, FL; Owner: POST-NEWSWEEK STATIONS ORLANDO, INC.)

- WACX (Channel 55; LEESBURG, FL; Owner: ASSOCIATED CHRISTIAN TELEVISION SYSTEM, INC.)

- WKCF (Channel 18; CLERMONT, FL; Owner: EMMIS TELEVISION LICENSE CORPORATION)

- WLCB-TV (Channel 45; LEESBURG, FL; Owner: GOOD LIFE BROADCASTING, INC.)

- WOFL (Channel 35; ORLANDO, FL; Owner: FOX TELEVISION STATIONS, INC.)

- WMFE-TV (Channel 24; ORLANDO, FL; Owner: COMMUNITY COMMUNICATIONS, INC.)

- National Bridge Inventory (NBI) Statistics

- 86Number of bridges

- 2,119ft / 646mTotal length

- $17,201,000Total costs

- 1,986,881Total average daily traffic

- 264,547Total average daily truck traffic

- New bridges - historical statistics

- 31940-1949

- 11950-1959

- 51960-1969

- 31970-1979

- 41980-1989

- 111990-1999

- 52000-2009

- 532010-2019

- 12020-2022

FCC Registered Antenna Towers: 413 (See the full list of FCC Registered Antenna Towers)

FCC Registered Commercial Land Mobile Towers: 4 (See the full list of FCC Registered Commercial Land Mobile Towers in Daytona Beach, FL)

FCC Registered Private Land Mobile Towers: 8 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 92 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 90 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 26 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 47 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 467 (See the full list of FCC Registered Amateur Radio Licenses in Daytona Beach)

FAA Registered Aircraft Manufacturers and Dealers: 29 (See the full list of FAA Registered Manufacturers and Dealers in Daytona Beach)

FAA Registered Aircraft: 312 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 13 full and 5 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 105 | $122,638 | 177 | $157,760 | 236 | $146,059 | 10 | $53,113 | 2 | $1,376,000 | 142 | $170,889 | 4 | $60,528 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 10 | $137,751 | 23 | $135,947 | 44 | $145,968 | 2 | $26,965 | 0 | $0 | 24 | $150,923 | 3 | $34,920 |

| APPLICATIONS DENIED | 26 | $121,112 | 59 | $125,189 | 297 | $142,101 | 52 | $42,978 | 0 | $0 | 81 | $144,231 | 10 | $42,764 |

| APPLICATIONS WITHDRAWN | 11 | $111,358 | 32 | $196,194 | 97 | $148,376 | 7 | $104,316 | 0 | $0 | 37 | $138,662 | 1 | $130,210 |

| FILES CLOSED FOR INCOMPLETENESS | 12 | $104,909 | 10 | $173,883 | 42 | $141,470 | 4 | $63,400 | 0 | $0 | 14 | $128,891 | 0 | $0 |

Detailed mortgage data for all 19 tracts in Daytona Beach, FL

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 6 full and 4 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 7 | $108,307 | 2 | $216,820 | 0 | $0 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 4 | $188,892 | 1 | $168,000 | 3 | $171,857 |

| APPLICATIONS DENIED | 2 | $134,510 | 3 | $111,673 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 0 | $0 | 2 | $160,335 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | $115,880 | 0 | $0 | 0 | $0 |

2003 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Daytona Beach, FL

- 2,76546.5%Outside Fires

- 1,85331.2%Structure Fires

- 1,15119.4%Mobile Property/Vehicle Fires

- 1732.9%Other

Based on the data from the years 2003 - 2018 the average number of fire incidents per year is 371. The highest number of reported fires - 512 took place in 2011, and the least - 32 in 2003. The data has a growing trend.

Based on the data from the years 2003 - 2018 the average number of fire incidents per year is 371. The highest number of reported fires - 512 took place in 2011, and the least - 32 in 2003. The data has a growing trend. When looking into fire subcategories, the most reports belonged to: Outside Fires (46.5%), and Structure Fires (31.2%).

When looking into fire subcategories, the most reports belonged to: Outside Fires (46.5%), and Structure Fires (31.2%).Fire-safe hotels and motels in Daytona Beach, Florida:

- Daytona Beach Hilton Resort, 2637 S Atlantic Ave, Daytona Beach, Florida 32118 , Phone: (386) 767-7350, Fax: (386) 767-0222

- Holidays Sands Motel, 200 N Atlantic Ave, Daytona Beach, Florida 32118

- Days Inn Daytona Speedway, 2900 International Speedway Blvd, Daytona Beach, Florida 32124 , Phone: (386) 255-0541, Fax: (386) 253-1468

- Ramada Speedway, 1798 W International Speedway Blvd, Daytona Beach, Florida 32114 , Phone: (386) 255-2422, Fax: (386) 253-1749

- Daytona Beach Motel, 2071 S Atlantic Ave, Daytona Beach, Florida 32018

- Thunderbird Beach Motel, 500 N Atlantic Ave, Daytona Beach, Florida 32118 , Phone: (386) 253-2562, Fax: (386) 238-3676

- Beachcomer Inn, 2000 N Atlantic Ave, Daytona Beach, Florida 32018

- Beachside Budget Inn, 1717 N Atlantic Ave, Daytona Beach, Florida 32018

- 60 other hotels and motels

| Most common first names in Daytona Beach, FL among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| John | 933 | 76.0 years |

| Robert | 743 | 72.8 years |

| Mary | 719 | 80.5 years |

| William | 714 | 76.1 years |

| James | 638 | 72.9 years |

| Charles | 456 | 75.9 years |

| Joseph | 437 | 77.0 years |

| Dorothy | 374 | 81.3 years |

| Helen | 362 | 83.1 years |

| George | 361 | 77.0 years |

| Most common last names in Daytona Beach, FL among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 341 | 75.8 years |

| Williams | 194 | 73.6 years |

| Brown | 192 | 77.2 years |

| Johnson | 192 | 75.5 years |

| Jones | 155 | 72.4 years |

| Miller | 139 | 76.7 years |

| Davis | 131 | 75.9 years |

| Thomas | 103 | 75.4 years |

| Taylor | 97 | 75.4 years |

| Wilson | 97 | 74.1 years |

- 91.7%Electricity

- 6.3%Utility gas

- 0.7%Fuel oil, kerosene, etc.

- 0.6%Solar energy

- 0.4%No fuel used

- 0.3%Bottled, tank, or LP gas

- 94.0%Electricity

- 4.2%Utility gas

- 1.2%No fuel used

- 0.5%Fuel oil, kerosene, etc.

Daytona Beach compared to Florida state average:

- Black race population percentage above state average.

- Hispanic race population percentage below state average.

- Foreign-born population percentage below state average.

- Renting percentage above state average.

- Number of college students above state average.

Daytona Beach on our top lists:

- #8 on the list of "Top 101 cities with largest percentage of females in industries: retail trade (population 50,000+)"

- #11 on the list of "Top 101 cities with largest percentage of males in occupations: healthcare support occupations (population 50,000+)"

- #13 on the list of "Top 101 cities with largest percentage of females in occupations: health technologists and technicians (population 50,000+)"

- #14 on the list of "Top 101 cities with largest percentage of females in occupations: sales and related occupations (population 50,000+)"

- #16 on the list of "Top 101 cities with the most users submitting photos to our site per 10,000 residents (population 50,000+)"

- #16 on the list of "Top 101 cities with the highest number of police officers per 1000 residents (population 50,000+)"

- #18 on the list of "Top 100 cities with strongest arts, entertainment, recreation, accommodation and food services industries (pop. 50,000+)"

- #20 on the list of "Top 101 cities with the highest percentage of single-parent households, population 50,000+"

- #20 on the list of "Top 100 least-safe cities (highest city-data.com crime index) (pop. 50,000+)"

- #21 on the list of "Top 101 cities with the highest number of assaults per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #22 on the list of "Top 101 cities with largest percentage of females in industries: real estate and rental and leasing (population 50,000+)"

- #23 on the list of "Top 101 cities with the highest number of thefts per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #24 on the list of "Top 101 cities with largest percentage of males in industries: retail trade (population 50,000+)"

- #48 on the list of "Top 101 cities with the largest household incomes disparities (population 50,000+)"

- #50 on the list of "Top 100 cities with highest percentage of college students (pop. 50,000+)"

- #53 on the list of "Top 101 cities with the largest city-data.com crime index decrease from 2011 to 2012 (population 50,000+)"

- #55 on the list of "Top 101 cities with the smallest racial income disparities between White and Black householders (with at least 2,000 householders)"

- #55 on the list of "Top 101 cities with largest percentage of males in industries: accommodation and food services (population 50,000+)"

- #59 on the list of "Top 101 cities with the largest percentage population decrease from 2000 (population 50,000+)"

- #67 on the list of "Top 100 cities with smallest houses (pop. 50,000+)"

- #5 (32118) on the list of "Top 101 zip codes with the most hotels or motels in 2005"

- #40 on the list of "Top 101 counties with the lowest number of births per 1000 residents 2007-2013"

- #40 on the list of "Top 101 counties with the highest ground withdrawal of fresh water for public supply"

- #50 on the list of "Top 101 counties with the highest number of deaths per 1000 residents 2007-2013 (pop. 50,000+)"

- #69 on the list of "Top 101 counties with the lowest Particulate Matter (PM2.5) Annual air pollution readings in 2012 (µg/m3)"

- #75 on the list of "Top 101 counties with the lowest Ozone (1-hour) air pollution readings in 2012 (ppm)"

|

|

Total of 102 patent applications in 2008-2024.