Lake Wales, Florida

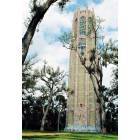

Lake Wales: Bok Tower Gardens

Lake Wales: Bok Tower in Lake Wales.

Lake Wales: Bok Tower

Lake Wales: Bok Tower Gardens

Lake Wales: Sand Cranes at Crocked Lake Park Lake Wales Florida

Lake Wales: Bok Tower, Lake Wales, FL

Lake Wales: Sun set over Tiger Lake in the chain of Lake Kissimmee

Lake Wales: Sun set over Tiger Lake in the chain of Lake Kissimmee

Lake Wales: Florida Snowbird Home

Lake Wales: Lake Wales Campground

- add

your

Submit your own pictures of this city and show them to the world

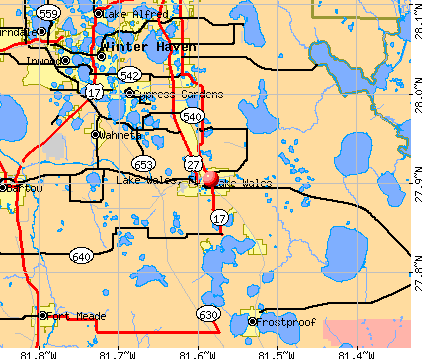

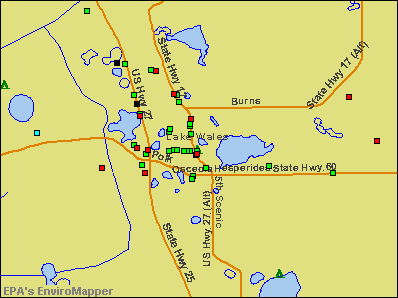

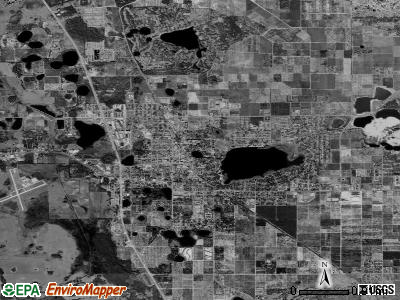

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +64.5%

| Males: 8,090 | |

| Females: 8,684 |

| Median resident age: | 42.8 years |

| Florida median age: | 42.7 years |

Zip codes: 33853.

| Lake Wales: | $56,887 |

| FL: | $69,303 |

Estimated per capita income in 2022: $26,263 (it was $16,106 in 2000)

Lake Wales city income, earnings, and wages data

Estimated median house or condo value in 2022: $258,571 (it was $68,300 in 2000)

| Lake Wales: | $258,571 |

| FL: | $354,100 |

Mean prices in 2022: all housing units: $259,062; detached houses: $278,855; townhouses or other attached units: $240,717; in 5-or-more-unit structures: $59,028; mobile homes: $63,154

Median gross rent in 2022: $1,011.

(12.1% for White Non-Hispanic residents, 39.9% for Black residents, 22.3% for Hispanic or Latino residents, 15.2% for other race residents, 13.0% for two or more races residents)

Detailed information about poverty and poor residents in Lake Wales, FL

- 8,20146.6%White alone

- 5,35330.4%Hispanic

- 3,40719.4%Black alone

- 5843.3%Two or more races

- 440.3%Other race alone

- 410.2%American Indian alone

- 140.08%Asian alone

- 40.02%Native Hawaiian and Other

Pacific Islander alone

Races in Lake Wales detailed stats: ancestries, foreign born residents, place of birth

According to our research of Florida and other state lists, there were 121 registered sex offenders living in Lake Wales, Florida as of April 26, 2024.

The ratio of all residents to sex offenders in Lake Wales is 131 to 1.

Type |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Murders (per 100,000) | 0 (0.0) | 0 (0.0) | 1 (6.9) | 2 (13.7) | 1 (6.7) | 0 (0.0) | 1 (6.5) | 1 (6.3) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) |

| Rapes (per 100,000) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 4 (27.4) | 3 (20.2) | 2 (13.3) | 1 (6.5) | 1 (6.3) | 4 (24.8) | 12 (73.4) | 1 (5.9) | 2 (11.7) | 9 (53.6) |

| Robberies (per 100,000) | 29 (195.0) | 15 (105.4) | 23 (159.5) | 10 (68.5) | 15 (101.0) | 20 (132.5) | 12 (78.0) | 18 (113.8) | 10 (61.9) | 7 (42.8) | 8 (47.3) | 5 (29.3) | 10 (59.5) |

| Assaults (per 100,000) | 39 (262.2) | 37 (260.1) | 18 (124.8) | 30 (205.5) | 29 (195.2) | 45 (298.2) | 25 (162.6) | 29 (183.3) | 39 (241.5) | 38 (232.4) | 46 (272.2) | 36 (210.8) | 82 (488.3) |

| Burglaries (per 100,000) | 189 (1,271) | 161 (1,132) | 193 (1,339) | 161 (1,103) | 186 (1,252) | 189 (1,252) | 132 (858.4) | 76 (480.4) | 59 (365.3) | 30 (183.5) | 54 (319.5) | 55 (322.1) | 74 (440.7) |

| Thefts (per 100,000) | 667 (4,484) | 684 (4,808) | 623 (4,321) | 288 (1,973) | 396 (2,666) | 453 (3,002) | 363 (2,361) | 412 (2,604) | 364 (2,254) | 315 (1,927) | 275 (1,627) | 170 (995.6) | 332 (1,977) |

| Auto thefts (per 100,000) | 16 (107.6) | 16 (112.5) | 20 (138.7) | 19 (130.2) | 21 (141.4) | 27 (178.9) | 27 (175.6) | 26 (164.4) | 29 (179.6) | 24 (146.8) | 29 (171.6) | 26 (152.3) | 27 (160.8) |

| Arson (per 100,000) | 1 (6.7) | 0 (0.0) | 1 (6.9) | 1 (6.9) | 1 (6.7) | 1 (6.6) | 1 (6.5) | 0 (0.0) | 1 (6.2) | 2 (12.2) | 1 (5.9) | 0 (0.0) | 0 (0.0) |

| City-Data.com crime index | 387.8 | 364.2 | 364.3 | 277.6 | 304.6 | 332.0 | 242.7 | 239.5 | 216.8 | 219.7 | 174.5 | 134.9 | 281.2 |

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

Crime rate in Lake Wales detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 54 (46 officers - 40 male; 6 female).

| Officers per 1,000 residents here: | 2.54 |

| Florida average: | 2.33 |

| Sarasota Rents Are Skyrocketing Again (375 replies) |

| 2020-2022 Census stats Fastest growing counties in Florida (36 replies) |

| Possible contract at MacDill AFB...gearing up to see where to live just in case (20 replies) |

| Hilly Towns In Florida (155 replies) |

| Florida is not Flat. (58 replies) |

| Is Lakeland a good area for a newly widowed women? (9 replies) |

Latest news from Lake Wales, FL collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: American (13.4%), German (7.1%), English (3.9%), Irish (2.7%), Jamaican (2.3%), Scotch-Irish (1.4%).

Current Local Time: EST time zone

Elevation: 147 feet

Land area: 13.3 square miles.

Population density: 1,257 people per square mile (low).

1,770 residents are foreign born (8.5% Latin America, 1.2% Europe).

| This city: | 10.1% |

| Florida: | 21.1% |

Median real estate property taxes paid for housing units with mortgages in 2022: $1,825 (0.7%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $2,038 (0.8%)

Nearest city with pop. 50,000+: Lakeland, FL (24.8 miles

, pop. 78,452).

Nearest city with pop. 200,000+: Tampa, FL (54.0 miles

, pop. 303,447).

Nearest city with pop. 1,000,000+: Houston, TX (845.4 miles

, pop. 1,953,631).

Nearest cities:

Latitude: 27.90 N, Longitude: 81.58 W

Daytime population change due to commuting: +2,893 (+16.4%)

Workers who live and work in this city: 2,261 (34.3%)

Area code: 863

Property values in Lake Wales, FL

Lake Wales, Florida accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 69 buildings, average cost: $330,900

- 2021: 34 buildings, average cost: $276,200

- 2020: 30 buildings, average cost: $276,200

- 2019: 86 buildings, average cost: $266,300

- 2018: 73 buildings, average cost: $262,900

- 2017: 137 buildings, average cost: $275,400

- 2016: 70 buildings, average cost: $275,000

- 2015: 46 buildings, average cost: $280,000

- 2014: 64 buildings, average cost: $283,800

- 2013: 43 buildings, average cost: $296,600

- 2012: 30 buildings, average cost: $257,100

- 2011: 24 buildings, average cost: $294,300

- 2010: 25 buildings, average cost: $252,600

- 2009: 24 buildings, average cost: $250,400

- 2008: 30 buildings, average cost: $247,300

- 2007: 54 buildings, average cost: $189,900

- 2006: 103 buildings, average cost: $143,000

- 2005: 408 buildings, average cost: $118,400

- 2004: 290 buildings, average cost: $119,400

- 2003: 214 buildings, average cost: $104,300

- 2002: 196 buildings, average cost: $88,500

- 2001: 70 buildings, average cost: $60,400

- 2000: 63 buildings, average cost: $65,100

- 1999: 54 buildings, average cost: $132,100

- 1998: 62 buildings, average cost: $52,700

- 1997: 32 buildings, average cost: $56,100

| Here: | 3.8% |

| Florida: | 2.9% |

- Educational services (8.5%)

- Agriculture, forestry, fishing & hunting (8.4%)

- Health care (8.3%)

- Accommodation & food services (7.4%)

- Construction (5.6%)

- Public administration (5.2%)

- Department & other general merchandise stores (4.4%)

- Agriculture, forestry, fishing & hunting (11.5%)

- Construction (10.4%)

- Public administration (6.5%)

- Educational services (5.1%)

- Accommodation & food services (5.0%)

- Food (4.8%)

- Department & other general merchandise stores (4.4%)

- Health care (13.2%)

- Educational services (12.1%)

- Accommodation & food services (10.0%)

- Food & beverage stores (5.2%)

- Agriculture, forestry, fishing & hunting (5.1%)

- Personal & laundry services (4.5%)

- Department & other general merchandise stores (4.4%)

- Agricultural workers, including supervisors (8.3%)

- Other production occupations, including supervisors (5.4%)

- Preschool, kindergarten, elementary, and middle school teachers (4.5%)

- Retail sales workers, except cashiers (4.0%)

- Building and grounds cleaning and maintenance occupations (3.9%)

- Other sales and related occupations, including supervisors (3.2%)

- Cashiers (2.8%)

- Agricultural workers, including supervisors (12.9%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (4.8%)

- Driver/sales workers and truck drivers (4.6%)

- Building and grounds cleaning and maintenance occupations (4.5%)

- Material recording, scheduling, dispatching, and distributing workers (4.1%)

- Retail sales workers, except cashiers (4.0%)

- Other production occupations, including supervisors (3.9%)

- Preschool, kindergarten, elementary, and middle school teachers (8.0%)

- Other production occupations, including supervisors (7.1%)

- Secretaries and administrative assistants (5.7%)

- Cashiers (5.5%)

- Registered nurses (4.3%)

- Other office and administrative support workers, including supervisors (4.2%)

- Retail sales workers, except cashiers (3.9%)

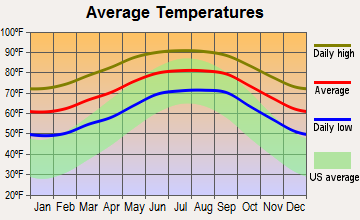

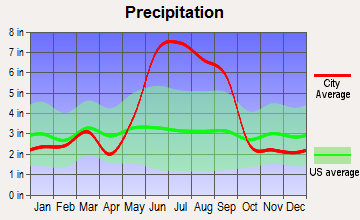

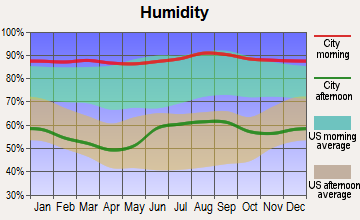

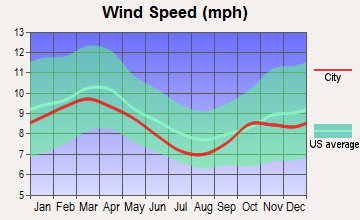

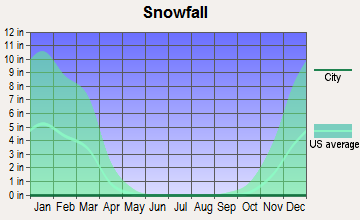

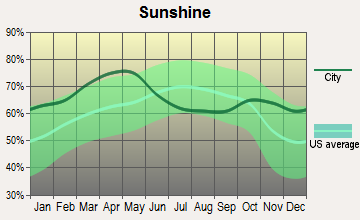

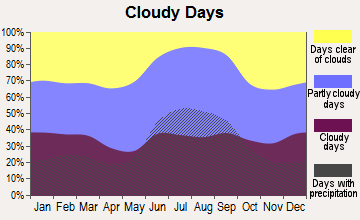

Average climate in Lake Wales, Florida

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

Air Quality Index (AQI) level in 2007 was 54.3. This is better than average.

| City: | 54.3 |

| U.S.: | 72.6 |

Particulate Matter (PM10) [µg/m3] level in 2006 was 20.5. This is about average. Closest monitor was 16.2 miles away from the city center.

| City: | 20.5 |

| U.S.: | 19.2 |

Tornado activity:

Lake Wales-area historical tornado activity is above Florida state average. It is 57% greater than the overall U.S. average.

On 2/22/1998, a category F3 (max. wind speeds 158-206 mph) tornado 23.4 miles away from the Lake Wales city center killed 25 people and injured 150 people and caused $55 million in damages.

On 2/19/1963, a category F2 (max. wind speeds 113-157 mph) tornado 0.4 miles away from the city center caused between $50,000 and $500,000 in damages.

Earthquake activity:

Lake Wales-area historical earthquake activity is significantly above Florida state average. It is 90% smaller than the overall U.S. average.On 9/10/2006 at 14:56:08, a magnitude 5.9 (5.9 MB, 5.5 MS, 5.8 MW, Class: Moderate, Intensity: VI - VII) earthquake occurred 331.1 miles away from Lake Wales center

On 6/23/2016 at 17:20:29, a magnitude 3.8 (3.8 ML, Class: Light, Intensity: II - III) earthquake occurred 193.9 miles away from Lake Wales center

On 9/4/2016 at 18:29:29, a magnitude 3.8 (3.8 ML) earthquake occurred 195.5 miles away from Lake Wales center

On 9/21/2016 at 16:30:52, a magnitude 3.8 (3.8 ML) earthquake occurred 195.8 miles away from the city center

On 11/22/1974 at 05:25:55, a magnitude 4.7 (4.7 MB, Class: Light, Intensity: IV - V) earthquake occurred 356.0 miles away from the city center

On 7/16/2016 at 20:00:10, a magnitude 3.7 (3.7 MB) earthquake occurred 183.1 miles away from Lake Wales center

Magnitude types: body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Polk County (23) is greater than the US average (15).Major Disasters (Presidential) Declared: 12

Emergencies Declared: 5

Causes of natural disasters: Hurricanes: 10, Fires: 6, Tropical Storms: 4, Tornadoes: 3, Floods: 2, Freeze: 1, Storm: 1, Wind: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers in Lake Wales:

- LAKE WALES MEDICAL CENTER (Proprietary, provides emergency services, 410 S 11TH ST)

- GRACE HEALTHCARE OF LAKE WALES (730 NORTH SCENIC HIGHWAY)

- GROVES CENTER (512 S 11TH ST)

- LAKE WALES CONVALESCENT CENTER (730 N SCENIC HIGHWAY)

- LAKE WALES MEDICAL EXT CARE (414 S 11TH ST)

- LAKE WALES DIALYSIS (1125 BRYN MAWR AVE)

- RAI CARE CENTERS - LAKE WALES (1348 STATE ROAD 60 E)

- AMEDISYS OF LAKE WALES (1120 CARLTON AVENUE)

Airports, heliports and other landing facilities located in Lake Wales:

- Lake Wales Municipal Airport (X07) (Runways: 2, Air Taxi Ops: 800, Itinerant Ops: 5,094, Local Ops: 13,986, Military Ops: 120)

- Chalet Suzanne Air Strip Airport (X25) (Runways: 1, Air Taxi Ops: 60, Itinerant Ops: 2,000, Local Ops: 400, Military Ops: 12)

- Bent Willies Airport (52FA) (Runways: 1)

- David Wine's Airstrip Airport (62FL) (Runways: 1)

- Lake Wales Heliport (FA45)

- Timmer Heliport (6FL7)

- Sage Seadrome Seaplane Base (9FD0)

College/University in Lake Wales:

Colleges/universities with over 2000 students nearest to Lake Wales:

- Polk State College (about 12 miles; Winter Haven, FL; Full-time enrollment: 7,935)

- Southeastern University (about 23 miles; Lakeland, FL; FT enrollment: 2,407)

- Florida Southern College (about 24 miles; Lakeland, FL; FT enrollment: 2,460)

- Universal Technical Institute-Auto Motorcycle & Marine Mechanics Institute Division-Orlando (about 38 miles; Orlando, FL; FT enrollment: 4,338)

- Everest University-South Orlando (about 38 miles; Orlando, FL; FT enrollment: 33,859)

- Valencia College (about 44 miles; Orlando, FL; FT enrollment: 30,467)

- Everest University-Brandon (about 48 miles; Tampa, FL; FT enrollment: 7,702)

Public high schools in Lake Wales:

- LAKE WALES SENIOR HIGH SCHOOL (Students: 601, Location: 1 HIGHLANDER WAY, Grades: PK-12, Charter school)

- ROOSEVELT ACADEMY (Students: 177, Location: 115 E ST, Grades: PK-12)

Private high schools in Lake Wales:

Public elementary/middle schools in Lake Wales:

- BOK ACADEMY (Students: 533, Location: 13895 HWY 27, Grades: 6-8, Charter school)

- HILLCREST ELEMENTARY SCHOOL (Students: 283, Location: 1051 STATE ROAD 60 E, Grades: PK-5, Charter school)

- SPOOK HILL ELEMENTARY SCHOOL (Students: 255, Location: 321 DR JA WILTSHIRE AVE E, Grades: PK-5)

- POLK AVENUE ELEMENTARY SCHOOL (Students: 241, Location: 110 POLK AVE E, Grades: PK-5, Charter school)

- JANIE HOWARD WILSON SCHOOL (Students: 238, Location: 306 FLORIDA AVE, Grades: PK-5, Charter school)

- OUR CHILDREN'S ACADEMY (Students: 14, Location: 555 BURNS AVE, Grades: PK-8, Charter school)

- MCLAUGHLIN MIDDLE SCHOOL AND FINE ARTS ACADEMY (Location: 800 4TH ST S, Grades: PK-8)

Points of interest:

Notable locations in Lake Wales: Anton Brees Carillon Library (A), Lake Wales Museum and Cultural Center (B), Lake Wales Public Library (C), City of Lake Wales Fire Department (D), Lake Wales Police Department (E). Display/hide their locations on the map

Church in Lake Wales: Church of God (A). Display/hide its location on the map

Cemetery: Garden Cemetery (1). Display/hide its location on the map

Lakes and swamps: Lake Alta (A), Lake Altamaha (B), Tater Patch Pond (C), Lake Warren (D), North Lake Wales (E), Twin Lakes (F), Lake Cooper (G), Crystal Lake (H). Display/hide their locations on the map

Tourist attractions: Lake Wales Museum & Cultural Center (Historical Places & Services; 325 South Scenic Highway) (1), My Image Art (Art Museums; 451 Eagle Ridge Dr) (2). Display/hide their approximate locations on the map

Hotels: Big Oak Motel (3618 North Scenic Highway) (1), Chalet Suzanne Restaurant & Country Inn - Canning Plant (3800 Chalet Suzanne Drive) (2), Arborgate Inn (705 West Central Avenue) (3), A Prince of Wales Motel (513 Scenic Hwy S) (4), Uncle Joe's Fish Camp (4535 Walk In Water Rd) (5). Display/hide their approximate locations on the map

Birthplace of: Alvin Harper - Football player, Amare Stoudemire - NBA player (Phoenix Suns, born: Nov 16, 1982), Buford Long - College football player, Dominique Jones - Basketball player, Justin Pope - Baseball player and coach, Lorenzo Hampton - College football player, Vin Baker - NBA player (Houston Rockets, born: Nov 23, 1971), Wade Davis (baseball) - Baseball player, Dave Braggins - Player of and football, Derrick Simmons - College basketball player (Fla Atlantic Owls).

Drinking water stations with addresses in Lake Wales and their reported violations in the past:

LAKE AURORA CHRISTIAN ASSEMBLY (Population served: 200, Groundwater):Past monitoring violations:WAYSIDE BAPTIST CHURCH (Population served: 125, Groundwater):

- One regular monitoring violation

Past monitoring violations:GRAPE HAMMOCK (Population served: 120, Groundwater):

- One minor monitoring violation

- One regular monitoring violation

Past health violations:JAY BEE'S RESTAURANT (Population served: 100, Groundwater):Past monitoring violations:

- MCL, Acute (TCR) - In OCT-2012, Contaminant: Coliform. Follow-up actions: St Public Notif requested (NOV-13-2012), St Violation/Reminder Notice (NOV-13-2012), St Public Notif received (NOV-13-2012), St Compliance achieved (DEC-17-2012)

- Monitoring and Reporting (DBP) - Between JAN-2012 and MAR-2012, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Tech Assistance Visit (FEB-24-2012), St Violation/Reminder Notice (SEP-26-2012), St Compliance achieved (JAN-27-2013)

- Monitoring and Reporting (DBP) - Between JAN-2012 and MAR-2012, Contaminant: TTHM. Follow-up actions: St Tech Assistance Visit (FEB-24-2012), St Violation/Reminder Notice (SEP-26-2012), St Compliance achieved (JAN-27-2013)

- Monitoring and Reporting (DBP) - Between OCT-2011 and DEC-2011, Contaminant: TTHM. Follow-up actions: St Violation/Reminder Notice (SEP-26-2012), St Compliance achieved (JAN-27-2013)

- Monitoring and Reporting (DBP) - Between OCT-2011 and DEC-2011, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Violation/Reminder Notice (SEP-26-2012), St Compliance achieved (JAN-27-2013)

- Monitoring and Reporting (DBP) - Between JUL-2011 and SEP-2011, Contaminant: TTHM. Follow-up actions: St Violation/Reminder Notice (SEP-26-2012), St Compliance achieved (JAN-27-2013)

- 2 minor monitoring violations

- One other older monitoring violation

Past monitoring violations:STOP ; SHOP CITGO (Population served: 75, Groundwater):

- One routine major monitoring violation

Past monitoring violations:TIOTIE BEACH ESTATES (Population served: 60, Groundwater):

- One routine major monitoring violation

Past monitoring violations:CAMP ROSALIE (Population served: 59, Groundwater):

- One routine major monitoring violation

- One minor monitoring violation

Past health violations:TRAVEL INN/MAMA'S TABLE CAFE' (Population served: 50, Groundwater):

- MCL, Monthly (TCR) - In MAR-2007, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (APR-26-2007), St Public Notif requested (APR-26-2007)

Past monitoring violations:

- 2 routine major monitoring violations

Drinking water stations with addresses in Lake Wales that have no violations reported:

- JIMMY'S FOOD ; DELI (Population served: 250, Primary Water Source Type: Groundwater)

- ENCHANTED GROVE MHP (Population served: 230, Primary Water Source Type: Groundwater)

- J K FOOD (Population served: 200, Primary Water Source Type: Groundwater)

- SUNOCO FOODMART (Population served: 150, Primary Water Source Type: Groundwater)

- LAKE WALES CAMPGROUND (Population served: 100, Primary Water Source Type: Groundwater)

- LIAR'S LAIR LOUNGE (Population served: 50, Primary Water Source Type: Groundwater)

- STARR LAKE VILLAGE INC (Population served: 30, Primary Water Source Type: Groundwater)

- SUNNY GEM ISLE (Population served: 26, Primary Water Source Type: Groundwater)

- HOLIDAY PARK (Population served: 25, Primary Water Source Type: Groundwater)

- LAKE WALES AIRPORT (Population served: 25, Primary Water Source Type: Groundwater)

| This city: | 2.4 people |

| Florida: | 2.5 people |

| This city: | 65.3% |

| Whole state: | 65.2% |

| This city: | 6.2% |

| Whole state: | 7.3% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.3% of all households

- Gay men: 0.2% of all households

People in group quarters in Lake Wales in 2010:

- 189 people in nursing facilities/skilled-nursing facilities

- 108 people in residential schools for people with disabilities

- 47 people in workers' group living quarters and job corps centers

- 8 people in group homes intended for adults

People in group quarters in Lake Wales in 2000:

- 290 people in nursing homes

- 20 people in other noninstitutional group quarters

- 10 people in unknown juvenile institutions

Banks with branches in Lake Wales (2011 data):

- Citizens Bank and Trust: Chalet Suzanne Branch, Messenger Service, Lake Wales Branch. Info updated 2007/08/06: Bank assets: $429.4 mil, Deposits: $378.5 mil, headquarters in Frostproof, FL, positive income, Commercial Lending Specialization, 13 total offices, Holding Company: Citizens Banking Corporation

- SunTrust Bank: East Lake Wales Branch at 2011 East State Road 60, branch established on 1988/10/31; Lake Wales Branch at 102 East Central Avenue, branch established on 1985/03/04. Info updated 2010/05/27: Bank assets: $171,291.7 mil, Deposits: $129,833.2 mil, headquarters in Atlanta, GA, positive income, Commercial Lending Specialization, 1716 total offices, Holding Company: Suntrust Banks, Inc.

- CenterState Bank of Florida, National Association: Lake Ashton Branch at 4144 Ashton Club Drive, branch established on 2002/12/20; Lake Wales Branch at 300 West Central Avenue, branch established on 2004/04/19. Info updated 2012/01/30: Bank assets: $2,082.6 mil, Deposits: $1,779.8 mil, headquarters in Winter Haven, FL, positive income, Commercial Lending Specialization, 65 total offices, Holding Company: Centerstate Banks, Inc.

- TD Bank, National Association: Lake Wales Branch at 1838 State Road 60, branch established on 2000/10/16. Info updated 2010/10/04: Bank assets: $188,912.6 mil, Deposits: $153,149.8 mil, headquarters in Wilmington, DE, positive income, 1314 total offices, Holding Company: Toronto-Dominion Bank, The

- Wells Fargo Bank, National Association: Lake Wales Branch at 149 East Stuart Avenue, branch established on 1915/10/28. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- Bank of America, National Association: East Lake Wales Branch at 1100 State Road 60 East, branch established on 1986/03/22. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- Urban Trust Bank: Lake Wales Branch at 2000 State Road 60 East, branch established on 2009/06/26. Info updated 2011/12/08: Bank assets: $597.3 mil, Deposits: $489.5 mil, headquarters in Lake Mary, FL, positive income, Mortgage Lending Specialization, 25 total offices

For population 15 years and over in Lake Wales:

- Never married: 28.7%

- Now married: 50.1%

- Separated: 2.1%

- Widowed: 5.9%

- Divorced: 13.3%

For population 25 years and over in Lake Wales:

- High school or higher: 86.0%

- Bachelor's degree or higher: 23.3%

- Graduate or professional degree: 7.8%

- Unemployed: 7.6%

- Mean travel time to work (commute): 25.5 minutes

| Here: | 12.2 |

| Florida average: | 12.2 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Lake Wales:

(Lake Wales, Florida Neighborhood Map)- 27 Corners neighborhood

- Alta Vista neighborhood

- Altadena neighborhood

- Beauty Lake Estates neighborhood

- Bel-Ombre neighborhood

- Blanchard Terrace neighborhood

- Blue Lake Heights neighborhood

- Blue Lake Terrace neighborhood

- Bohannon Estates neighborhood

- Brookshire neighborhood

- Bush Heights neighborhood

- Carlton Club neighborhood

- Chalet Estates on Lake Suzanne neighborhood

- Citrus Acres neighborhood

- Colonial Heights neighborhood

- Coral Acres neighborhood

- Country Club Estates neighborhood

- Country Club Village neighborhood

- Country Oaks Estates neighborhood

- Crooked Lake Park neighborhood

- Crown Pointe neighborhood

- Dinner Lake Shores neighborhood

- Druid Hills neighborhood

- East Gate neighborhood

- East Lake Park neighborhood

- East Park Heights neighborhood

- Easy Street neighborhood

- Emerald Heights neighborhood

- Estates at Lake Easy neighborhood

- Fair Oaks neighborhood

- Fairmont neighborhood

- Forest Hills neighborhood

- Gelnaw neighborhood

- Genesis Pointe Condominium neighborhood

- Genesis Pointe Estates neighborhood

- Golf View Park neighborhood

- Grant Estates neighborhood

- Grassy Lake neighborhood

- Greenbriar neighborhood

- Groveland Terrace neighborhood

- Heatherwood neighborhood

- Hibiscus Park neighborhood

- Highland Acres neighborhood

- Highland Crest neighborhood

- Highland Heights neighborhood

- Highland Park neighborhood

- Highland Park Manor neighborhood

- Highland Pointe neighborhood

- Hill Crest neighborhood

- Hillcrest neighborhood

- Hunters Glen neighborhood

- Indian Lake Estates neighborhood

- Key West Village neighborhood

- Lake Ashton neighborhood

- Lake Ashton Golf Club neighborhood

- Lake Ashton West neighborhood

- Lake Mabel Heights neighborhood

- Lake Parker Groves neighborhood

- Lake Pierce Heights neighborhood

- Lake Pierce Ranchettes neighborhood

- Lake View Hill neighborhood

- Lake View Manor neighborhood

- Lake Wales neighborhood

- Lake of the Hills neighborhood

- Lakeshore North neighborhood

- Landings at Lake Easy neighborhood

- Lincoln Park neighborhood

- Longleaf Business Park neighborhood

- Loretta Park neighborhood

- Mabel Loop Ridge neighborhood

- Magnolia Park neighborhood

- Majestic Oaks neighborhood

- Mallard Pointe neighborhood

- Mammoth Grove neighborhood

- Map of Avondale neighborhood

- Map of Fresco Park neighborhood

- Map of Lake Worth Estates neighborhood

- Mason Villa neighborhood

- Masterpiece Park Estates neighborhood

- Minne-Sota Heights neighborhood

- Morningside Park neighborhood

- Mountain Lake neighborhood

- Nature's Edge neighborhood

- North Grove neighborhood

- North Pointe neighborhood

- North Shore Highlands neighborhood

- North Shore Hills neighborhood

- Northside Heights neighborhood

- Oak Acres neighborhood

- Oak Tree Park neighborhood

- Oakland Park neighborhood

- Oakwood Golf Club neighborhood

- Oliver Park neighborhood

- Orange Center neighborhood

- Orange Heights neighborhood

- Orange Park neighborhood

- Palm Acres neighborhood

- Palm Park Terrace neighborhood

- Parker Lake neighborhood

- Pierce Hills Country Estates neighborhood

- Pine Ridge neighborhood

- Pinehurst neighborhood

- Plat of Stone's neighborhood

- Poinciana Heights neighborhood

- Poinciana Park neighborhood

- Resmondo Commercial Center neighborhood

- Rhodesbilt Newcenter neighborhood

- Ridge Manor neighborhood

- Rolling Oak Ridge neighborhood

- Roosevelt Manor neighborhood

- Scenic Heights neighborhood

- Seminole Heights neighborhood

- Shadow Lawn neighborhood

- Shoppes on the Ridge neighborhood

- South Lake Wales neighborhood

- South Star Hills neighborhood

- Spanish Heights neighborhood

- Starr Lake neighborhood

- Stokes Estates neighborhood

- Sun-Rise View neighborhood

- Sunset Pointe neighborhood

- Thousand Roses neighborhood

- Timberlake neighborhood

- Timberlane neighborhood

- Tindel Estates neighborhood

- Towergate Estates neighborhood

- Twin Lake Park neighborhood

- Twin Oak Park neighborhood

- Twin Oaks neighborhood

- View Pointe neighborhood

- Walden Vista neighborhood

- Walesdale neighborhood

- Walk in Water Road neighborhood

- Walk in the Water neighborhood

- Washington Park neighborhood

- Waverly neighborhood

- Waverly Manor neighborhood

- West Lake Wales neighborhood

- West Scenic Park neighborhood

- West Side neighborhood

- Westlake Condominium neighborhood

- Whispering Ridge neighborhood

- Wild Acres neighborhood

- Woodland Hills neighborhood

- Woodland Park neighborhood

- Woodlands neighborhood

- Yarnell Heights neighborhood

Religion statistics for Lake Wales, FL (based on Polk County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 148,424 | 504 |

| Catholic | 45,251 | 13 |

| Mainline Protestant | 31,347 | 74 |

| Black Protestant | 10,761 | 46 |

| Other | 8,630 | 36 |

| Orthodox | 307 | 3 |

| None | 357,375 | - |

Food Environment Statistics:

| Polk County: | 1.64 / 10,000 pop. |

| Florida: | 2.04 / 10,000 pop. |

| Polk County: | 0.10 / 10,000 pop. |

| State: | 0.11 / 10,000 pop. |

| Polk County: | 1.82 / 10,000 pop. |

| Florida: | 1.28 / 10,000 pop. |

| Here: | 3.75 / 10,000 pop. |

| Florida: | 3.04 / 10,000 pop. |

| This county: | 4.90 / 10,000 pop. |

| Florida: | 7.45 / 10,000 pop. |

| This county: | 9.8% |

| Florida: | 9.2% |

| This county: | 30.1% |

| Florida: | 23.7% |

| Polk County: | 15.0% |

| Florida: | 14.0% |

Health and Nutrition:

| Here: | 49.6% |

| State: | 51.4% |

| Lake Wales: | 46.0% |

| State: | 49.4% |

| This city: | 29.0 |

| Florida: | 28.6 |

| Lake Wales: | 19.9% |

| Florida: | 19.5% |

| Here: | 12.4% |

| State: | 10.7% |

| Lake Wales: | 6.8 |

| State: | 6.9 |

| This city: | 34.4% |

| State: | 34.7% |

| Lake Wales: | 54.2% |

| Florida: | 57.0% |

| Here: | 78.4% |

| Florida: | 79.2% |

More about Health and Nutrition of Lake Wales, FL Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 48 | $239,517 | $59,879 | 0 | $0 |

| Firefighters | 33 | $118,028 | $42,919 | 0 | $0 |

| Water Supply | 17 | $67,921 | $47,944 | 0 | $0 |

| Local Libraries | 16 | $53,413 | $40,060 | 4 | $3,523 |

| Parks and Recreation | 12 | $16,212 | $16,212 | 0 | $0 |

| Other Government Administration | 9 | $51,453 | $68,604 | 5 | $2,978 |

| Other and Unallocable | 9 | $38,473 | $51,297 | 0 | $0 |

| Sewerage | 9 | $34,851 | $46,468 | 0 | $0 |

| Streets and Highways | 7 | $22,229 | $38,107 | 0 | $0 |

| Police - Other | 6 | $13,137 | $26,274 | 0 | $0 |

| Housing and Community Development (Local) | 5 | $22,898 | $54,955 | 0 | $0 |

| Financial Administration | 4 | $21,806 | $65,418 | 0 | $0 |

| Airports | 3 | $10,932 | $43,728 | 0 | $0 |

| Totals for Government | 178 | $710,870 | $47,924 | 9 | $6,501 |

Lake Wales government finances - Expenditure in 2021 (per resident):

- Construction - Sewerage: $5,139,000 ($306.37)

- Current Operations - Police Protection: $5,085,000 ($303.15)

Local Fire Protection: $3,450,000 ($205.68)

Parks and Recreation: $2,557,000 ($152.44)

Sewerage: $2,406,000 ($143.44)

Water Utilities: $2,406,000 ($143.44)

Regular Highways: $1,437,000 ($85.67)

Libraries: $1,151,000 ($68.62)

Solid Waste Management: $1,106,000 ($65.94)

Central Staff Services: $1,006,000 ($59.97)

General - Other: $945,000 ($56.34)

Financial Administration: $733,000 ($43.70)

Natural Resources - Other: $582,000 ($34.70)

Air Transportation: $497,000 ($29.63)

Protective Inspection and Regulation - Other: $461,000 ($27.48)

Judicial and Legal Services: $60,000 ($3.58)

- General - Interest on Debt: $393,000 ($23.43)

- Other Capital Outlay - Air Transportation: $835,000 ($49.78)

Parks and Recreation: $47,000 ($2.80)

Police Protection: $6,000 ($0.36)

- Water Utilities - Interest on Debt: $226,000 ($13.47)

Lake Wales government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $5,039,000 ($300.41)

Solid Waste Management: $1,385,000 ($82.57)

Other: $1,181,000 ($70.41)

Natural Resources - Other: $516,000 ($30.76)

Air Transportation: $361,000 ($21.52)

Regular Highways: $150,000 ($8.94)

Miscellaneous Commercial Activities: $90,000 ($5.37)

- Federal Intergovernmental - Air Transportation: $551,000 ($32.85)

Sewerage: $357,000 ($21.28)

Other: $163,000 ($9.72)

- Local Intergovernmental - General Local Government Support: $1,356,000 ($80.84)

Other: $725,000 ($43.22)

Highways: $352,000 ($20.98)

- Miscellaneous - Special Assessments: $1,186,000 ($70.70)

General Revenue - Other: $359,000 ($21.40)

Fines and Forfeits: $166,000 ($9.90)

Donations From Private Sources: $96,000 ($5.72)

Interest Earnings: $40,000 ($2.38)

Sale of Property: $36,000 ($2.15)

Rents: $5,000 ($0.30)

- Revenue - Water Utilities: $5,039,000 ($300.41)

- State Intergovernmental - General Local Government Support: $1,507,000 ($89.84)

Other: $958,000 ($57.11)

Highways: $131,000 ($7.81)

- Tax - Property: $5,228,000 ($311.67)

Public Utilities Sales: $2,450,000 ($146.06)

Occupation and Business License - Other: $1,429,000 ($85.19)

Motor Fuels Sales: $739,000 ($44.06)

Other License: $534,000 ($31.83)

Insurance Premiums Sales: $273,000 ($16.28)

Lake Wales government finances - Debt in 2021 (per resident):

- Long Term Debt - Outstanding Unspecified Public Purpose: $23,438,000 ($1397.28)

Beginning Outstanding - Unspecified Public Purpose: $22,838,000 ($1361.51)

Retired Unspecified Public Purpose: $2,040,000 ($121.62)

Issue, Unspecified Public Purpose: $900,000 ($53.65)

Lake Wales government finances - Cash and Securities in 2021 (per resident):

- Other Funds - Cash and Securities: $19,817,000 ($1181.41)

10.64% of this county's 2021 resident taxpayers lived in other counties in 2020 ($52,063 average adjusted gross income)

| Here: | 10.64% |

| Florida average: | 8.80% |

0.06% of residents moved from foreign countries ($247 average AGI)

Polk County: 0.06% Florida average: 0.05%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Orange County, FL | |

| from Osceola County, FL | |

| from Hillsborough County, FL |

7.04% of this county's 2020 resident taxpayers moved to other counties in 2021 ($47,159 average adjusted gross income)

| Here: | 7.04% |

| Florida average: | 7.45% |

0.06% of residents moved to foreign countries ($256 average AGI)

Polk County: 0.06% Florida average: 0.04%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Orange County, FL | |

| to Osceola County, FL | |

| to Hillsborough County, FL |

| Businesses in Lake Wales, FL | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| AT&T | 1 | Kohl's | 1 | |

| Advance Auto Parts | 1 | Lowe's | 1 | |

| Aeropostale | 1 | MasterBrand Cabinets | 2 | |

| Arby's | 1 | McDonald's | 2 | |

| AutoZone | 1 | Nike | 4 | |

| Bath & Body Works | 1 | Pac Sun | 1 | |

| Blockbuster | 1 | Payless | 1 | |

| CVS | 1 | Pizza Hut | 1 | |

| Charlotte Russe | 1 | Publix Super Markets | 2 | |

| Chevrolet | 1 | RadioShack | 3 | |

| Curves | 1 | Sears | 2 | |

| Dairy Queen | 1 | Spencer Gifts | 1 | |

| Dennys | 1 | Sprint Nextel | 1 | |

| Domino's Pizza | 1 | Starbucks | 1 | |

| Dunkin Donuts | 1 | Super 8 | 1 | |

| FedEx | 3 | T-Mobile | 5 | |

| Foot Locker | 1 | Taco Bell | 1 | |

| Ford | 1 | Tire Kingdom | 1 | |

| GNC | 1 | Toys"R"Us | 1 | |

| GameStop | 1 | True Value | 1 | |

| H&R Block | 2 | U-Haul | 3 | |

| Hilton | 1 | UPS | 6 | |

| Holiday Inn | 1 | Vans | 1 | |

| Home Depot | 1 | Victoria's Secret | 1 | |

| IHOP | 1 | Walgreens | 2 | |

| JCPenney | 1 | Walmart | 1 | |

| Journeys | 1 | YMCA | 1 | |

| KFC | 1 | |||

Strongest AM radio stations in Lake Wales:

- WIPC (1280 AM; 1 kW; LAKE WALES, FL; Owner: SIBER MEDIA GROUP INC)

- WFLF (540 AM; 50 kW; PINE HILLS, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WQTM (740 AM; 50 kW; ORLANDO, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WHNR (1360 AM; 5 kW; CYPRESS GARDENS, FL; Owner: GB ENTERPRISES COMMUNICATIONS CORP.)

- WQYK (1010 AM; 50 kW; SEFFNER, FL; Owner: INFINITY BROADCASTING CORPORATION OF TAMPA)

- WHOO (1080 AM; daytime; 35 kW; KISSIMMEE, FL; Owner: GENESIS COMMUNICATIONS I, INC.)

- WDYZ (990 AM; 50 kW; ORLANDO, FL; Owner: ABC, INC.)

- WONQ (1030 AM; 45 kW; OVIEDO, FL; Owner: FLORIDA BROADCASTERS)

- WMGG (820 AM; 50 kW; LARGO, FL; Owner: MEGA COMMUNICATIONS OF ST. PETERSBURG LICENSEE)

- WIXC (1060 AM; 50 kW; TITUSVILLE, FL; Owner: GENESIS COMMUNICATIONS I, INC.)

- WWBF (1130 AM; 2 kW; BARTOW, FL; Owner: THOMAS N. THORNBURG, THORNBURG COMM.)

- WTWB (1570 AM; 5 kW; AUBURNDALE, FL; Owner: CARPENTER'S HOME CHURCH, INC.)

- WLCC (760 AM; 10 kW; BRANDON, FL; Owner: MEGA COMMUNICATIONS OF TAMPA LICENSEE)

Strongest FM radio stations in Lake Wales:

- WPCV (97.5 FM; WINTER HAVEN, FL; Owner: HALL COMMUNICATIONS, INC.)

- WSJT (94.1 FM; LAKELAND, FL; Owner: INFINITY RADIO OPERATIONS INC.)

- WWRM (94.9 FM; TAMPA, FL; Owner: COX RADIO, INC.)

- WWRZ (98.3 FM; FORT MEADE, FL; Owner: HALL COMMUNICATIONS INC)

- WPOI (101.5 FM; ST. PETERSBURG, FL; Owner: CXR HOLDINGS, INC.)

- WXXL (106.7 FM; TAVARES, FL; Owner: AMFM RADIO LICENSES, L.L.C.)

- WFLZ-FM (93.3 FM; TAMPA, FL; Owner: CITICASTERS LICENSES, L.P.)

- WMTX (100.7 FM; TAMPA, FL; Owner: CITICASTERS LICENSES, L.P.)

- WQYK-FM (99.5 FM; ST. PETERSBURG, FL; Owner: INFINITY BROADCASTING CORPORATION OF FLORIDA)

- WTBT (103.5 FM; BRADENTON, FL; Owner: CITICASTERS LICENSES, L.P.)

- WHPT (102.5 FM; SARASOTA, FL; Owner: CXR HOLDINGS, INC.)

- WJRR (101.1 FM; COCOA BEACH, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WSHE (100.3 FM; ORLANDO, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WTKS-FM (104.1 FM; COCOA BEACH, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WHTQ (96.5 FM; ORLANDO, FL; Owner: COX RADIO, INC.)

- WWOJ (99.1 FM; AVON PARK, FL; Owner: COHAN RADIO GROUP, INC.)

- WLAZ (89.1 FM; KISSIMMEE, FL; Owner: CAGUAS EDUCATIONAL TV, INC.)

- WBVM (90.5 FM; TAMPA, FL; Owner: BISHOP OF THE DIOCESE/ST. PETERSBURG)

- WLVF-FM (90.3 FM; HAINES CITY, FL; Owner: LANDMARK BAPTIST CHURCH, INC.)

- WUSF (89.7 FM; TAMPA, FL; Owner: UNIVERSITY OF S. FLORIDA)

TV broadcast stations around Lake Wales:

- WMOR-TV (Channel 32; LAKELAND, FL; Owner: WMOR-TV COMPANY)

- WLWA-LP (Channel 14; LAKELAND, FL; Owner: TRI-MEDIA GROUP, INC.)

- WOPX (Channel 56; MELBOURNE, FL; Owner: PAXSON ORLANDO LICENSE, INC.)

- WEDU (Channel 3; TAMPA, FL; Owner: FLORIDA WEST COAST PUBLIC BROADCASTING, INC.)

- WZXZ-CA (Channel 11; ORLANDO, ETC., FL; Owner: THE BOX WORLDWIDE LLC)

- WRDQ (Channel 27; ORLANDO, FL; Owner: WFTV-TV HOLDINGS, INC.)

- WXPX (Channel 66; BRADENTON, FL; Owner: PAXSON COMMUNICATION LICENSE COMPANY, LLC)

- WFLA-TV (Channel 8; TAMPA, FL; Owner: MEDIA GENERAL COMMUNICATIONS, INC.)

- WFTS-TV (Channel 28; TAMPA, FL; Owner: TAMPA BAY TELEVISION, INC.)

- WTOG (Channel 44; ST. PETERSBURG, FL; Owner: VIACOM INTERNATIONAL INC.)

- WUSF-TV (Channel 16; TAMPA, FL; Owner: UNIVERSITY OF SOUTH FLORIDA)

- WTVT (Channel 13; TAMPA, FL; Owner: TVT LICENSE, INC.)

- WTTA (Channel 38; ST. PETERSBURG, FL; Owner: BAY TELEVISION, INC.)

- WFTT (Channel 50; TAMPA, FL; Owner: TELEFUTURA TAMPA LLC)

- WFTV (Channel 9; ORLANDO, FL; Owner: WFTV-TV HOLDINGS, INC.)

- WCLF (Channel 22; CLEARWATER, FL; Owner: CHRISTIAN TELEVISION CORPORATION, INC.)

- WTGL-TV (Channel 52; COCOA, FL; Owner: GOOD LIFE BROADCASTING, INC.)

- WBCC (Channel 68; COCOA, FL; Owner: BREVARD COMMUNITY COLLEGE)

- WTAM-LP (Channel 6; TAMPA, FL; Owner: U.S. INTERACTIVE, L.L.C.)

- WACX (Channel 55; LEESBURG, FL; Owner: ASSOCIATED CHRISTIAN TELEVISION SYSTEM, INC.)

- WKCF (Channel 18; CLERMONT, FL; Owner: EMMIS TELEVISION LICENSE CORPORATION)

- WLCB-TV (Channel 45; LEESBURG, FL; Owner: GOOD LIFE BROADCASTING, INC.)

- WKMG-TV (Channel 6; ORLANDO, FL; Owner: POST-NEWSWEEK STATIONS ORLANDO, INC.)

- WRBW (Channel 65; ORLANDO, FL; Owner: FOX TELEVISION STATIONS, INC.)

- National Bridge Inventory (NBI) Statistics

- 11Number of bridges

- 85ft / 25.8mTotal length

- 190,303Total average daily traffic

- 26,218Total average daily truck traffic

- New bridges - historical statistics

- 11950-1959

- 71960-1969

- 11970-1979

- 12000-2009

- 12020-2022

FCC Registered Antenna Towers: 227 (See the full list of FCC Registered Antenna Towers)

FCC Registered Broadcast Land Mobile Towers: 36 (See the full list of FCC Registered Broadcast Land Mobile Towers in Lake Wales, FL)

FCC Registered Microwave Towers: 35 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 3 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 4 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 233 (See the full list of FCC Registered Amateur Radio Licenses in Lake Wales)

FAA Registered Aircraft Manufacturers and Dealers: 3 (See the full list of FAA Registered Manufacturers and Dealers in Lake Wales)

FAA Registered Aircraft: 50 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 4 partial tracts) | ||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 14 | $118,469 | 17 | $126,758 | 38 | $145,857 | 5 | $26,656 | 12 | $120,800 | 2 | $49,970 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 1 | $62,600 | 2 | $102,585 | 7 | $135,360 | 0 | $0 | 2 | $173,970 | 0 | $0 |

| APPLICATIONS DENIED | 3 | $149,573 | 8 | $73,905 | 42 | $125,461 | 11 | $26,549 | 11 | $74,790 | 4 | $23,488 |

| APPLICATIONS WITHDRAWN | 3 | $120,423 | 2 | $127,175 | 17 | $164,721 | 1 | $89,850 | 3 | $197,700 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | $82,570 | 0 | $0 | 3 | $148,433 | 0 | $0 | 1 | $94,000 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 0143.01 , 0143.02, 0144.00, 0155.00

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 2 partial tracts) | ||

| A) Conventional Home Purchase Loans | ||

|---|---|---|

| Number | Average Value | |

| LOANS ORIGINATED | 1 | $82,430 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | $0 |

| APPLICATIONS DENIED | 0 | $0 |

| APPLICATIONS WITHDRAWN | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 0143.01 , 0143.02, 0144.00, 0155.00

2004 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Lake Wales, FL

- 1,74555.5%Outside Fires

- 86127.4%Structure Fires

- 47015.0%Mobile Property/Vehicle Fires

- 662.1%Other

Based on the data from the years 2004 - 2018 the average number of fires per year is 209. The highest number of fires - 310 took place in 2006, and the least - 129 in 2005. The data has an increasing trend.

Based on the data from the years 2004 - 2018 the average number of fires per year is 209. The highest number of fires - 310 took place in 2006, and the least - 129 in 2005. The data has an increasing trend. When looking into fire subcategories, the most reports belonged to: Outside Fires (55.5%), and Structure Fires (27.4%).

When looking into fire subcategories, the most reports belonged to: Outside Fires (55.5%), and Structure Fires (27.4%).Fire-safe hotels and motels in Lake Wales, Florida:

- Tower View Motel, 1518 N Alt Hwy 27, Lake Wales, Florida 33853

- Royal Inn, 1747 N Hwy 27, Lake Wales, Florida 33853

- Holiday Motel, 18801 Hwy 27 S, Lake Wales, Florida 33853 , Phone: (863) 678-1700

- Lantern Motel, 3949 N Hwy 27, Lake Wales, Florida 33853

- Emerald Motel, 530 S Scenic Hwy, Lake Wales, Florida 33853 , Fax: (863) 676-0276

- Starr Lake Motel, 3901 N Alt 27, Lake Wales, Florida 33853

- Big Oak Motel, 3618 N Alt 27, Lake Wales, Florida 33853

- Econo Lodge, 501 S Hwy 27, Lake Wales, Florida 33853 , Fax: (863) 676-2569

- 4 other hotels and motels

| Most common first names in Lake Wales, FL among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| William | 268 | 74.4 years |

| John | 256 | 74.4 years |

| James | 248 | 71.1 years |

| Mary | 230 | 78.9 years |

| Robert | 205 | 73.6 years |

| Charles | 158 | 72.7 years |

| George | 139 | 76.5 years |

| Joseph | 102 | 75.8 years |

| Margaret | 92 | 77.1 years |

| Helen | 90 | 77.7 years |

| Most common last names in Lake Wales, FL among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 143 | 75.9 years |

| Jones | 112 | 74.7 years |

| Johnson | 100 | 71.0 years |

| Williams | 92 | 76.4 years |

| Brown | 77 | 74.5 years |

| Davis | 76 | 73.1 years |

| Miller | 49 | 76.3 years |

| Thomas | 45 | 75.4 years |

| White | 41 | 75.9 years |

| Allen | 36 | 71.2 years |

- 95.2%Electricity

- 2.3%No fuel used

- 1.0%Utility gas

- 1.0%Solar energy

- 0.5%Bottled, tank, or LP gas

- 92.1%Electricity

- 6.7%Utility gas

- 1.2%No fuel used

Lake Wales compared to Florida state average:

- Unemployed percentage below state average.

- Black race population percentage above state average.

- Hispanic race population percentage above state average.

- Length of stay since moving in above state average.

Lake Wales on our top lists:

- #71 on the list of "Top 101 cities with the largest city-data.com crime index decrease from 2002 to 2012 (population 5,000+)"

- #28 on the list of "Top 101 counties with the most Evangelical Protestant congregations"

- #32 on the list of "Top 101 counties with the highest ground withdrawal of fresh water for public supply"

- #39 on the list of "Top 101 counties with the lowest surface withdrawal of fresh water for public supply"

- #44 on the list of "Top 101 counties with the most Evangelical Protestant adherents"

- #45 on the list of "Top 101 counties with the highest number of infant deaths per 1000 residents 2007-2013 (pop. 50,000+)"

|

|

Total of 31 patent applications in 2008-2024.