Winthrop, Massachusetts

Winthrop: View from Deer Island trail

Winthrop: sunset facing northwest 2012

Winthrop: downtown

Winthrop: Winthrop Water Tower

- add

your

Submit your own pictures of this place and show them to the world

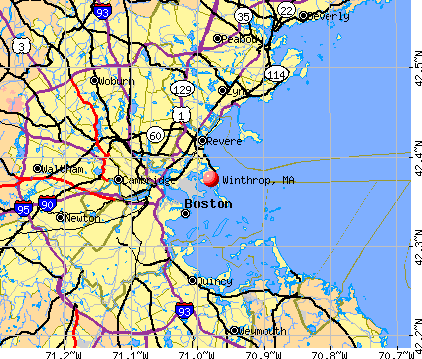

- OSM Map

- General Map

- Google Map

- MSN Map

| Males: 9,075 | |

| Females: 10,223 |

| Median resident age: | 39.9 years |

| Massachusetts median age: | 36.5 years |

Zip codes: 02152.

| Winthrop: | $115,218 |

| MA: | $94,488 |

Estimated per capita income in 2022: $66,527 (it was $27,374 in 2000)

Winthrop CDP income, earnings, and wages data

Estimated median house or condo value in 2022: $716,383 (it was $215,300 in 2000)

| Winthrop: | $716,383 |

| MA: | $534,700 |

Mean prices in 2022: all housing units: $852,380; detached houses: $688,497; townhouses or other attached units: over $1,000,000; in 2-unit structures: $773,785; in 3-to-4-unit structures: $827,903; in 5-or-more-unit structures: over $1,000,000; mobile homes: $239,132

Detailed information about poverty and poor residents in Winthrop, MA

- 17,02093.0%White alone

- 4932.7%Hispanic

- 2931.6%Black alone

- 2061.1%Asian alone

- 1821.0%Two or more races

- 730.4%Other race alone

- 290.2%American Indian alone

- 70.04%Native Hawaiian and Other

Pacific Islander alone

Races in Winthrop detailed stats: ancestries, foreign born residents, place of birth

According to our research of Massachusetts and other state lists, there were 2 registered sex offenders living in Winthrop, Massachusetts as of May 09, 2024.

The ratio of all residents to sex offenders in Winthrop is 9,649 to 1.

The ratio of registered sex offenders to all residents in this city is much lower than the state average.

Type |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Murders (per 100,000) | 0 (0.0) | 0 (0.0) | 1 (5.7) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 2 (10.7) | 0 (0.0) |

| Rapes (per 100,000) | 1 (4.7) | 3 (17.1) | 2 (11.4) | 2 (11.2) | 2 (11.0) | 6 (32.8) | 2 (10.8) | 1 (5.5) | 1 (5.5) | 6 (31.9) | 2 (10.7) | 0 (0.0) | 4 (21.4) | 1 (5.6) |

| Robberies (per 100,000) | 5 (23.7) | 16 (91.4) | 6 (34.1) | 6 (33.5) | 4 (22.1) | 2 (10.9) | 3 (16.2) | 3 (16.5) | 3 (16.4) | 2 (10.6) | 6 (32.1) | 1 (5.4) | 1 (5.3) | 2 (11.1) |

| Assaults (per 100,000) | 43 (204.1) | 64 (365.8) | 31 (176.1) | 32 (178.8) | 52 (286.8) | 51 (278.5) | 85 (457.7) | 71 (389.8) | 29 (158.3) | 20 (106.5) | 29 (155.1) | 27 (145.5) | 16 (85.6) | 19 (105.8) |

| Burglaries (per 100,000) | 107 (507.8) | 92 (525.8) | 78 (443.1) | 41 (229.1) | 82 (452.3) | 58 (316.7) | 53 (285.4) | 58 (318.4) | 26 (141.9) | 24 (127.8) | 10 (53.5) | 14 (75.4) | 13 (69.5) | 11 (61.3) |

| Thefts (per 100,000) | 124 (588.5) | 140 (800.1) | 134 (761.2) | 125 (698.5) | 117 (645.3) | 114 (622.5) | 106 (570.8) | 89 (488.6) | 78 (425.8) | 83 (441.9) | 102 (545.7) | 115 (619.6) | 96 (513.6) | 65 (362.0) |

| Auto thefts (per 100,000) | 22 (104.4) | 15 (85.7) | 11 (62.5) | 18 (100.6) | 12 (66.2) | 11 (60.1) | 20 (107.7) | 6 (32.9) | 8 (43.7) | 7 (37.3) | 16 (85.6) | 9 (48.5) | 11 (58.8) | 7 (39.0) |

| Arson (per 100,000) | 4 (19.0) | 1 (5.7) | 1 (5.7) | 2 (11.2) | 2 (11.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 1 (5.3) | 0 (0.0) | 1 (5.4) | 0 (0.0) | 1 (5.6) |

| City-Data.com crime index | 119.2 | 190.0 | 132.4 | 106.8 | 135.6 | 137.1 | 156.4 | 131.8 | 71.4 | 79.6 | 81.6 | 64.7 | 87.4 | 50.9 |

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

Crime rate in Winthrop detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 33 (32 officers - 28 male; 4 female).

| Officers per 1,000 residents here: | 1.71 |

| Massachusetts average: | 2.53 |

| Winthrop Gunman Who Killed 2 Made ‘Troubling White Supremacist Rhetoric,' DA Says (89 replies) |

| Winthrop Multi Family Investment (19 replies) |

| 2024 Real Estate Observations (861 replies) |

| So much for MA having great healthcare (168 replies) |

| MA to NC, are we crazy to even consider it (133 replies) |

| Big MA Ancestry Data Thread by Town (31 replies) |

Latest news from Winthrop, MA collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: Irish (33.4%), Italian (29.7%), English (10.8%), German (4.6%), United States (4.2%), French Canadian (3.3%).

Current Local Time: EST time zone

Incorporated in 1852

Elevation: 36 feet

Land area: 1.99 square miles.

Population density: 9,709 people per square mile (high).

1,585 residents are foreign born (3.6% Europe, 3.0% Latin America).

| This place: | 8.7% |

| Massachusetts: | 12.2% |

| Winthrop CDP: | 1.0% ($2,233) |

| Massachusetts: | 1.3% ($2,336) |

Nearest city with pop. 50,000+: Malden, MA (5.6 miles

, pop. 56,340).

Nearest city with pop. 200,000+: Boston, MA (6.7 miles

, pop. 589,141).

Nearest city with pop. 1,000,000+: Bronx, NY (183.2 miles

, pop. 1,332,650).

Nearest cities:

Latitude: 42.37 N, Longitude: 70.98 W

Daytime population change due to commuting: -6,183 (-33.8%)

Workers who live and work in this place: 1,683 (17.9%)

Area codes: 617, 857

Winthrop, Massachusetts accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 4 buildings, average cost: $298,700

- 2012: 4 buildings, average cost: $208,000

- 2008: 1 building, cost: $288,000

- 2006: 2 buildings, average cost: $196,500

- 2005: 7 buildings, average cost: $277,400

- 2004: 2 buildings, average cost: $275,400

- 2001: 5 buildings, average cost: $103,100

- 1998: 1 building, cost: $100,000

| Here: | 3.3% |

| Massachusetts: | 3.5% |

- Health care (9.7%)

- Educational services (9.2%)

- Professional, scientific, technical services (9.1%)

- Finance & insurance (8.7%)

- Public administration (6.7%)

- Air transportation (6.0%)

- Accommodation & food services (5.7%)

- Construction (8.8%)

- Professional, scientific, technical services (7.3%)

- Public administration (7.3%)

- Educational services (6.7%)

- Other transportation, support activities, couriers (6.0%)

- Finance & insurance (5.5%)

- Accommodation & food services (5.5%)

- Health care (14.3%)

- Finance & insurance (11.8%)

- Educational services (11.6%)

- Professional, scientific, technical services (10.8%)

- Air transportation (7.0%)

- Public administration (6.2%)

- Accommodation & food services (6.0%)

- Other office and administrative support workers, including supervisors (4.9%)

- Other management occupations, except farmers and farm managers (4.7%)

- Secretaries and administrative assistants (4.2%)

- Other sales and related occupations, including supervisors (3.7%)

- Information and record clerks, except customer service representatives (3.7%)

- Preschool, kindergarten, elementary, and middle school teachers (3.6%)

- Material recording, scheduling, dispatching, and distributing workers (3.0%)

- Other management occupations, except farmers and farm managers (5.5%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (5.3%)

- Other sales and related occupations, including supervisors (4.9%)

- Driver/sales workers and truck drivers (4.8%)

- Material recording, scheduling, dispatching, and distributing workers (4.0%)

- Computer specialists (3.8%)

- Law enforcement workers, including supervisors (2.9%)

- Secretaries and administrative assistants (7.8%)

- Other office and administrative support workers, including supervisors (7.2%)

- Information and record clerks, except customer service representatives (5.7%)

- Preschool, kindergarten, elementary, and middle school teachers (5.5%)

- Registered nurses (4.5%)

- Other management occupations, except farmers and farm managers (4.0%)

- Transportation, tourism, and lodging attendants (3.3%)

Average climate in Winthrop, Massachusetts

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

Air Quality Index (AQI) level in 2022 was 74.3. This is about average.

| City: | 74.3 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.274. This is about average. Closest monitor was 2.4 miles away from the city center.

| City: | 0.274 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 8.74. This is significantly worse than average. Closest monitor was 1.6 miles away from the city center.

| City: | 8.74 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.358. This is significantly better than average. Closest monitor was 1.6 miles away from the city center.

| City: | 0.358 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 29.8. This is about average. Closest monitor was 2.4 miles away from the city center.

| City: | 29.8 |

| U.S.: | 33.3 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 6.89. This is about average. Closest monitor was 2.5 miles away from the city center.

| City: | 6.89 |

| U.S.: | 8.11 |

Tornado activity:

Winthrop-area historical tornado activity is slightly below Massachusetts state average. It is 48% smaller than the overall U.S. average.

On 6/9/1953, a category F4 (max. wind speeds 207-260 mph) tornado 28.1 miles away from the Winthrop place center killed 90 people and injured 1228 people and caused between $50,000,000 and $500,000,000 in damages.

On 9/29/1974, a category F3 (max. wind speeds 158-206 mph) tornado 20.1 miles away from the place center injured one person and caused between $50,000 and $500,000 in damages.

Earthquake activity:

Winthrop-area historical earthquake activity is significantly above Massachusetts state average. It is 74% smaller than the overall U.S. average.On 4/20/2002 at 10:50:47, a magnitude 5.3 (5.3 ML, Depth: 3.0 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 201.2 miles away from Winthrop center

On 10/7/1983 at 10:18:46, a magnitude 5.3 (5.1 MB, 5.3 LG, 5.1 ML) earthquake occurred 201.7 miles away from Winthrop center

On 1/19/1982 at 00:14:42, a magnitude 4.7 (4.5 MB, 4.7 MD, 4.5 LG, Class: Light, Intensity: IV - V) earthquake occurred 83.9 miles away from the city center

On 10/16/2012 at 23:12:25, a magnitude 4.7 (4.7 ML, Depth: 10.0 mi) earthquake occurred 86.1 miles away from Winthrop center

On 4/20/2002 at 10:50:47, a magnitude 5.2 (5.2 MB, 4.2 MS, 5.2 MW, 5.0 MW) earthquake occurred 200.6 miles away from Winthrop center

On 8/22/1992 at 12:20:32, a magnitude 4.8 (4.8 MB, 3.8 MS, 4.7 LG, Depth: 6.2 mi) earthquake occurred 228.7 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), duration magnitude (MD), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Suffolk County (33) is a lot greater than the US average (15).Major Disasters (Presidential) Declared: 18

Emergencies Declared: 13

Causes of natural disasters: Floods: 11, Storms: 8, Hurricanes: 7, Snowstorms: 6, Winter Storms: 5, Blizzards: 3, Snows: 3, Explosion: 1, Fire: 1, Heavy Rain: 1, Snowfall: 1, Water Main Break: 1, Wind: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers in Winthrop:

- HOSPICE COMMUNITY CARE (495 PLEASANT STREET)

- WINTHROP COMMUNITY HOSPITAL (40 LINCOLN ST)

- COMMONWEALTH CLINICAL SERVICES INC (217 LINCOLN STREET)

- REW HOME HEALTH CARE AGENCY INC (217 LINCOLN STREET)

- CENTER FOR OPTIMUM CARE, BAY VIEW THE (26 STURGIS STREET)

- GOVERNOR WINTHROP NURSING HOME (142 PLEASANT STREET)

- RONCALLI HEALTH CARE CTR-WINTH (170 CLIFF AVENUE)

Amtrak stations near Winthrop:

- 5 miles: BOSTON (SO. STA) (BOSTON, ATLANTIC AVE. & SUMMER ST.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, full-service food facilities and snack bar, ATM, paid short-term parking, paid long-term parking, call for car rental service, taxi stand, intercity bus service, public transit connection.

- 5 miles: BOSTON, NORTH STATION (BOSTON, 126 CAUSEWAY ST.) . Services: ticket office, enclosed waiting area.

- 6 miles: BACK BAY (BOSTON, 145 DARTMOUTH ST.) . Services: ticket office, partially wheelchair accessible, enclosed waiting area, public restrooms, public payphones, vending machines, ATM, paid short-term parking, paid long-term parking, call for car rental service, taxi stand, public transit connection.

Colleges/universities with over 2000 students nearest to Winthrop:

- Suffolk University (about 5 miles; Boston, MA; Full-time enrollment: 6,982)

- Bunker Hill Community College (about 5 miles; Boston, MA; FT enrollment: 8,814)

- Emerson College (about 6 miles; Boston, MA; FT enrollment: 4,657)

- University of Massachusetts-Boston (about 6 miles; Boston, MA; FT enrollment: 12,625)

- Berklee College of Music (about 6 miles; Boston, MA; FT enrollment: 4,726)

- Massachusetts Institute of Technology (about 6 miles; Cambridge, MA; FT enrollment: 13,548)

- Northeastern University (about 7 miles; Boston, MA; FT enrollment: 27,758)

Public high school in Winthrop:

- WINTHROP SR HIGH (Students: 579, Location: 400 MAIN STREET, Grades: 8-12)

Public elementary/middle schools in Winthrop:

- WILLIAM P. GORMAN/FORT BANKS ELEMENTARY (Students: 481, Location: 101 KENNEDY DRIVE, Grades: PK-3)

- ARTHUR T. CUMMINGS ELEMENTARY SCHOOL (Students: 481, Location: 40 HERMON STREET, Grades: 4-7)

Points of interest:

Notable locations in Winthrop: Winthrop Light (A), Miller Field (B), Cottage Park Yacht Club (C), Winthrop Yacht Club (D), Shirley Gut (E), Winthrop Fire Department Station 2 Headquarters (F), Winthrop Townhall (G), Winthrop Fire Department Station 1 (H), Winthrop Public Library (I), Winthrop Public Library and Museum (J). Display/hide their locations on the map

Church in Winthrop: Saint Johns Episcopal Church (A). Display/hide its location on the map

Lake: Lewis Lake (A). Display/hide its location on the map

Streams, rivers, and creeks: Short Beach Creek (A), Belle Isle Inlet (B). Display/hide their locations on the map

Park in Winthrop: Ingleside Park (1). Display/hide its location on the map

Beach: Yirrell Beach (A). Display/hide its location on the map

Birthplace of: Benjamin Whorf - (1897-1941), linguist, Mark Bavaro - Football player., Ripley P. Bullen - Archaeologist, John Brendan McCormack - Catholic bishop, Rick DiPietro - NHL player (New York Islanders, born: Sep 19, 1981), Robert DeLeo (politician) - Speaker of the Massachusetts House of Representatives, Robert Ellis Orrall - Country singer, Dale Dunbar - Ice hockey player, Mike Eruzione - (born 1954), captain of the United States Olympic gold medal-winning ice hockey team, Pat Woodell - TV Actor.

Drinking water stations with addresses in Winthrop and their reported violations in the past:

CHRISTMAS TREE INN (Address: 37 CLIFF AVENUE , Serves VT, Population served: 32, Groundwater):Past health violations:Past monitoring violations:

- MCL, Acute (TCR) - In AUG-2013, Contaminant: Coliform. Follow-up actions: St Tech Assistance Visit (AUG-14-2013), St Formal NOV issued (AUG-14-2013), St Public Notif requested (AUG-14-2013), St Boil Water Order (AUG-14-2013), St Compliance achieved (NOV-08-2013)

- MCL, Monthly (TCR) - In SEP-2009, Contaminant: Coliform. Follow-up actions: St Boil Water Order (OCT-02-2009), St Formal NOV issued (OCT-02-2009), St Tech Assistance Visit (OCT-02-2009), St Public Notif requested (OCT-02-2009), St Compliance achieved (FEB-07-2011)

- MCL, Monthly (TCR) - In SEP-2007, Contaminant: Coliform. Follow-up actions: St Boil Water Order (OCT-02-2007), St Formal NOV issued (OCT-02-2007), St Tech Assistance Visit (OCT-02-2007), St Public Notif requested (OCT-02-2007), St Public Notif received (OCT-22-2007), St Compliance achieved (FEB-07-2011)

- Monitoring, Repeat Major (TCR) - Between JUL-2009 and SEP-2009, Contaminant: Coliform (TCR). Follow-up actions: St Formal NOV issued (NOV-02-2009), St Public Notif requested (NOV-02-2009), St Public Notif received (NOV-13-2009), St Compliance achieved (FEB-07-2011)

- 2 routine major monitoring violations

| This place: | 2.3 people |

| Massachusetts: | 2.5 people |

| This place: | 58.4% |

| Whole state: | 65.0% |

| This place: | 5.3% |

| Whole state: | 5.4% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.2% of all households

- Gay men: 0.6% of all households

| This place: | 5.5% |

| Whole state: | 9.3% |

| This place: | 3.0% |

| Whole state: | 4.4% |

People in group quarters in Winthrop in 2000:

- 189 people in nursing homes

- 43 people in homes for the mentally retarded

- 13 people in homes or halfway houses for drug/alcohol abuse

Banks with branches in Winthrop (2011 data):

- RBS Citizens, National Association: Winthrop Branch at 35 Putnam Street, branch established on 1978/07/24. Info updated 2007/09/19: Bank assets: $106,940.6 mil, Deposits: $75,690.2 mil, headquarters in Providence, RI, positive income, 1135 total offices, Holding Company: Uk Financial Investments Limited

- Bank of America, National Association: Bartlett Branch at 25 Bartlett Road, branch established on 1914/01/01. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- East Boston Savings Bank: Winthrop Branch at 15 Bartlett Road, branch established on 1993/08/18. Info updated 2011/06/07: Bank assets: $1,946.5 mil, Deposits: $1,609.3 mil, headquarters in Boston, MA, positive income, Commercial Lending Specialization, 24 total offices, Holding Company: Meridian Financial Services, Inc

For population 15 years and over in Winthrop:

- Never married: 31.6%

- Now married: 47.1%

- Separated: 2.0%

- Widowed: 8.8%

- Divorced: 10.5%

For population 25 years and over in Winthrop:

- High school or higher: 90.0%

- Bachelor's degree or higher: 29.0%

- Graduate or professional degree: 8.8%

- Unemployed: 4.1%

- Mean travel time to work (commute): 30.8 minutes

| Here: | 10.1 |

| Massachusetts average: | 13.1 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Winthrop, MA (based on Suffolk County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 332,744 | 56 |

| Evangelical Protestant | 48,562 | 180 |

| Other | 29,094 | 71 |

| Mainline Protestant | 20,380 | 103 |

| Orthodox | 7,693 | 17 |

| Black Protestant | 4,176 | 23 |

| None | 279,374 | - |

Food Environment Statistics:

| Suffolk County: | 2.47 / 10,000 pop. |

| Massachusetts: | 1.98 / 10,000 pop. |

| This county: | 3.29 / 10,000 pop. |

| Massachusetts: | 2.22 / 10,000 pop. |

| Suffolk County: | 0.74 / 10,000 pop. |

| Massachusetts: | 1.77 / 10,000 pop. |

| Here: | 10.53 / 10,000 pop. |

| State: | 8.76 / 10,000 pop. |

| Here: | 8.0% |

| Massachusetts: | 8.1% |

| Suffolk County: | 21.4% |

| Massachusetts: | 22.5% |

| This county: | 17.1% |

| Massachusetts: | 16.5% |

9.75% of this county's 2021 resident taxpayers lived in other counties in 2020 ($100,939 average adjusted gross income)

| Here: | 9.75% |

| Massachusetts average: | 6.35% |

0.01% of residents moved from foreign countries ($81 average AGI)

Suffolk County: 0.01% Massachusetts average: 0.01%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Middlesex County, MA | |

| from Norfolk County, MA | |

| from Essex County, MA |

13.75% of this county's 2020 resident taxpayers moved to other counties in 2021 ($123,761 average adjusted gross income)

| Here: | 13.75% |

| Massachusetts average: | 7.18% |

0.03% of residents moved to foreign countries ($317 average AGI)

Suffolk County: 0.03% Massachusetts average: 0.02%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Middlesex County, MA | |

| to Norfolk County, MA | |

| to Essex County, MA |

| Businesses in Winthrop, MA | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 7-Eleven | 1 | Suburban | 1 | |

| Ace Hardware | 1 | Subway | 1 | |

| CVS | 1 | True Value | 1 | |

| Dunkin Donuts | 2 | UPS | 1 | |

| MasterBrand Cabinets | 1 | |||

Strongest AM radio stations in Winthrop:

- WBZ (1030 AM; 50 kW; BOSTON, MA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WRKO (680 AM; 50 kW; BOSTON, MA; Owner: ENTERCOM BOSTON LICENSE, LLC)

- WROL (950 AM; 5 kW; BOSTON, MA; Owner: SCA LICENSE CORPORATION)

- WWZN (1510 AM; 50 kW; BOSTON, MA; Owner: ROSE CITY RADIO CORPORATION)

- WEZE (590 AM; 5 kW; BOSTON, MA; Owner: NEW ENGLAND CONTINENTAL MEDIA, INC.)

- WEEI (850 AM; 50 kW; BOSTON, MA; Owner: ENTERCOM BOSTON LICENSE, LLC)

- WILD (1090 AM; daytime; 5 kW; BOSTON, MA; Owner: RADIO ONE OF BOSTON LICENSES, LLC)

- WXKS (1430 AM; 5 kW; EVERETT, MA; Owner: AMFM RADIO LICENSES, L.L.C.)

- WRCA (1330 AM; 25 kW; WALTHAM, MA; Owner: WRCA LICENSE, LLC)

- WUNR (1600 AM; 20 kW; BROOKLINE, MA; Owner: CHAMPION BROADCASTING SYSTEMS, INC.)

- WKOX (1200 AM; 50 kW; FRAMINGHAM, MA; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WMKI (1260 AM; 5 kW; BOSTON, MA; Owner: ABC, INC.)

- WBIX (1060 AM; 40 kW; NATICK, MA; Owner: LANGER BROADCASTING CORPORATION)

Strongest FM radio stations in Winthrop:

- WXKS-FM (107.9 FM; MEDFORD, MA; Owner: AMFM RADIO LICENSES, L.L.C.)

- WMJX (106.7 FM; BOSTON, MA; Owner: GREATER BOSTON RADIO, INC.)

- WHRB (95.3 FM; CAMBRIDGE, MA; Owner: HARVARD RADIO BROADCASTING CO., INC.)

- W267AI (101.3 FM; BOSTON, MA; Owner: MCC BROADCASTING COMPANY, INC.)

- WBCN (104.1 FM; BOSTON, MA; Owner: HEMISPHERE BROADCASTING CORPORATION)

- WZLX (100.7 FM; BOSTON, MA; Owner: INFINITY BROADCASTING CORPORATION OF BOSTON)

- WERS (88.9 FM; BOSTON, MA; Owner: EMERSON COLLEGE)

- WBMX (98.5 FM; BOSTON, MA; Owner: INFINITY RADIO OPERATIONS INC.)

- WBOS (92.9 FM; BROOKLINE, MA; Owner: GREATER BOSTON RADIO, INC.)

- WJMN (94.5 FM; BOSTON, MA; Owner: AMFM RADIO LICENSES, L.L.C.)

- WCRB (102.5 FM; WALTHAM, MA; Owner: CHARLES RIVER BROADCASTING WCRB LICE)

- WTKK (96.9 FM; BOSTON, MA; Owner: GREATER BOSTON RADIO, INC.)

- WROR-FM (105.7 FM; FRAMINGHAM, MA; Owner: GREATER BOSTON RADIO, INC.)

- WFNX (101.7 FM; LYNN, MA; Owner: MCC BROADCASTING COMPANY, INC.)

- WGBH (89.7 FM; BOSTON, MA; Owner: WGBH EDUCATIONAL FOUNDATION)

- WBUR-FM (90.9 FM; BOSTON, MA; Owner: TRUSTEES OF BOSTON UNIVERSITY)

- WMBR (88.1 FM; CAMBRIDGE, MA; Owner: TECHNOLOGY BROADCASTING CORPORATION)

- WODS (103.3 FM; BOSTON, MA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WQSX (93.7 FM; LAWRENCE, MA; Owner: ENTERCOM BOSTON LICENSE, LLC)

- WUMB-FM (91.9 FM; BOSTON, MA; Owner: THE UNIVERSITY OF MASSACHUSETTS)

TV broadcast stations around Winthrop:

- WBPX (Channel 68; BOSTON, MA; Owner: PAXSON BOSTON-68 LICENSE, INC.)

- WTMU-LP (Channel 32; BOSTON, MA; Owner: ZGS BOSTON, INC.)

- WCEA-LP (Channel 58; BOSTON, MA; Owner: CHANNEL 19 TV CORPORATION)

- WCVB-TV (Channel 5; BOSTON, MA; Owner: WCVB HEARST-ARGYLE TV, INC.)

- WGBH-TV (Channel 2; BOSTON, MA; Owner: WGBH EDUCATIONAL FOUNDATION)

- WHDH-TV (Channel 7; BOSTON, MA; Owner: WHDH-TV)

- WMFP (Channel 62; LAWRENCE, MA; Owner: WSAH LICENSE, INC.)

- WSBK-TV (Channel 38; BOSTON, MA; Owner: VIACOM INC.)

- WLVI-TV (Channel 56; CAMBRIDGE, MA; Owner: WLVI, INC.)

- WBZ-TV (Channel 4; BOSTON, MA; Owner: VIACOM INC.)

- WGBX-TV (Channel 44; BOSTON, MA; Owner: WGBH EDUCATIONAL FOUNDATION)

- WFXT (Channel 25; BOSTON, MA; Owner: FOX TELEVISION STATIONS INC.)

- W40BO (Channel 40; BOSTON, MA; Owner: PAXSON COMMUNICATIONS LPTV, INC.)

- WUTF (Channel 66; MARLBOROUGH, MA; Owner: TELEFUTURA BOSTON LLC)

- WWDP (Channel 46; NORWELL, MA; Owner: NORWELL TELEVISION, LLC)

- WFXZ-CA (Channel 24; BOSTON, MA; Owner: BOSTON BROADCASTING CORP.)

- WUNI (Channel 27; WORCESTER, MA; Owner: ENTRAVISION HOLDINGS, LLC)

- WLNE-TV (Channel 6; NEW BEDFORD, MA; Owner: FREEDOM BROADCASTING OF SOUTHERN NEW ENGLAND, INC.)

- WPRI-TV (Channel 12; PROVIDENCE, RI; Owner: TVL BROADCASTING OF RHODE ISLAND, LLC)

- WNAC-TV (Channel 64; PROVIDENCE, RI; Owner: WNAC, LLC)

- WHDN-LP (Channel 26; BOSTON, MA; Owner: GUENTER MARKSTEINER)

- WJAR (Channel 10; PROVIDENCE, RI; Owner: OUTLET BROADCASTING, INC.)

- WSBE-TV (Channel 36; PROVIDENCE, RI; Owner: RHODE ISLAND PUBLIC TELECOM. AUTHORITY)

FCC Registered Antenna Towers:

9 (See the full list of FCC Registered Antenna Towers in Winthrop)FCC Registered Broadcast Land Mobile Towers:

6- Lat: 42.380250 Lon: -70.979611, Call Sign: WPXN613,

Assigned Frequencies: 452.200 MHz, 457.200 MHz, Grant Date: 05/12/2003, Expiration Date: 05/12/2013, Cancellation Date: 07/13/2013, Certifier: Scott Niven, Registrant: Cara Enterprises Inc, Salt Lake City, UT 84117-0503, Phone: (801) 278-9728, Fax: (801) 278-7239

- Lat: 42.384806 Lon: -70.980361, Call Sign: WQUV854,

Assigned Frequencies: 452.762 MHz, 457.762 MHz, Grant Date: 10/28/2014, Expiration Date: 10/28/2024, Certifier: Stephen Dion, Registrant: Cara Enterprises Inc, Las Vegas, NV 89140-0124, Phone: (702) 838-9728, Fax: (702) 363-4607, Email:

- Lat: 42.377917 Lon: -70.985528, Call Sign: WQUV856,

Assigned Frequencies: 451.487 MHz, 456.487 MHz, Grant Date: 10/28/2014, Expiration Date: 10/28/2024, Certifier: Stephen Dion, Registrant: Cara Enterprises Inc, Las Vegas, NV 89140-0124, Phone: (702) 838-9728, Fax: (702) 363-4607, Email:

- Lat: 42.375361 Lon: -70.988750, Call Sign: WQUY282,

Assigned Frequencies: 451.712 MHz, 456.712 MHz, Grant Date: 11/14/2014, Expiration Date: 11/14/2024, Certifier: Stephen Dion, Registrant: Cara Enterprises Inc, Las Vegas, NV 89140-0124, Phone: (702) 838-9728, Fax: (702) 363-4607, Email:

- Winthrop, Town of, Lat: 42.376778 Lon: -70.984222, Call Sign: WQZJ750,

Assigned Frequencies: 75.4800 MHz, Grant Date: 06/08/2017, Expiration Date: 06/08/2027, Certifier: Paul E Flanagan, Registrant: Signal Communications Corporation, 4 Wheeling Ave, Woburn, MA 01801, Phone: (781) 933-1587, Fax: (781) 933-5019, Email:

- Lat: 42.350500 Lon: -70.960056, Call Sign: WRYZ794,

Assigned Frequencies: 452.500 MHz, 457.500 MHz, 457.850 MHz, 464.812 MHz, 469.812 MHz, Grant Date: 10/07/2023, Expiration Date: 10/07/2033, Certifier: Juan Rodriguez, Registrant: Comtronics/Bearcom, 1230 Furnace Brook Pkwy., Quincy, MA 02169, Phone: (617) 770-0212, Fax: (617) 770-0429, Email:

FCC Registered Microwave Towers:

8 (See the full list of FCC Registered Microwave Towers in this town)FCC Registered Maritime Coast & Aviation Ground Towers:

2 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)FCC Registered Amateur Radio Licenses:

40 (See the full list of FCC Registered Amateur Radio Licenses in Winthrop)FAA Registered Aircraft:

4- Aircraft: CESSNA R172K (Category: Land, Seats: 4, Weight: Up to 12,499 Pounds, Speed: 76 mph), Engine: CONT MOTOR IO-360 SER (300 HP) (Reciprocating)

N-Number: 5351V, N5351V, N-5351V, Serial Number: R1722292, Year manufactured: 1977, Airworthiness Date: 02/03/1977, Certificate Issue Date: 01/19/1979

Registrant (Individual): Arthur F Housman, 84 Pleasant St, Winthrop, MA 02152 - Aircraft: PIPER PA-28R-200 (Category: Land, Seats: 4, Weight: Up to 12,499 Pounds, Speed: 107 mph), Engine: LYCOMING I0360 SER (180 HP) (Reciprocating)

N-Number: 6862J, N6862J, N-6862J, Serial Number: 28R-7635353, Year manufactured: 1976, Certificate Issue Date: 12/15/2006

Registrant (Co-Owned): Charles F Quigley, 160 Winthrop Shore Dr, Winthrop, MA 02152, Other Owners: Gregory F Quinn - Aircraft: KELLEY DERRICK/LEZA AIRCAM (Category: Land, Engines: 2, Seats: 2, Weight: Up to 12,499 Pounds), Engine: ROTAX 912ULS SERIES (100 HP) (4 Cycle)

N-Number: 959M, N959M, N-959M, Serial Number: AC0129, Year manufactured: 2007, Airworthiness Date: 04/11/2007, Certificate Issue Date: 10/02/2020

Registrant (Individual): Robert Lockyer, 550 Pleasant St Ste 104, Winthrop, MA 02152 - Aircraft: PIPER J3C-50S (Category: Land, Seats: 2, Weight: Up to 12,499 Pounds, Speed: 67 mph), Engine: LYCOMING 0-145B SERIES (65 HP) (Reciprocating)

N-Number: 21611, N21611, N-21611, Serial Number: 2456, Year manufactured: 1938

Registrant (Individual): Donald Distant, 69 Summit Ave, Winthrop, MA 02152

Deregistered: Cancel Date: 08/29/2019

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 5 full tracts) | ||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 42 | $297,548 | 109 | $218,119 | 408 | $242,360 | 19 | $174,053 | 3 | $5,325,000 | 19 | $211,474 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 2 | $274,000 | 11 | $222,364 | 29 | $278,828 | 1 | $30,000 | 0 | $0 | 5 | $214,000 |

| APPLICATIONS DENIED | 13 | $221,615 | 15 | $212,400 | 113 | $284,478 | 13 | $157,385 | 1 | $675,000 | 6 | $284,833 |

| APPLICATIONS WITHDRAWN | 12 | $270,000 | 15 | $249,467 | 88 | $276,102 | 3 | $269,000 | 0 | $0 | 4 | $199,750 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | $143,000 | 3 | $196,000 | 20 | $286,000 | 4 | $32,500 | 0 | $0 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 1801.00 , 1802.00, 1803.00, 1804.00, 1805.00

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 5 full tracts) | ||||

| A) Conventional Home Purchase Loans | B) Refinancings | |||

|---|---|---|---|---|

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 13 | $254,077 | 11 | $315,000 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 4 | $200,000 | 9 | $287,889 |

| APPLICATIONS DENIED | 10 | $336,400 | 2 | $426,500 |

| APPLICATIONS WITHDRAWN | 4 | $341,500 | 2 | $249,500 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 1801.00 , 1802.00, 1803.00, 1804.00, 1805.00

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Winthrop, MA

- 79560.0%Structure Fires

- 36627.6%Outside Fires

- 997.5%Other

- 665.0%Mobile Property/Vehicle Fires

Based on the data from the years 2002 - 2018 the average number of fire incidents per year is 78. The highest number of reported fire incidents - 108 took place in 2005, and the least - 43 in 2012. The data has a dropping trend.

Based on the data from the years 2002 - 2018 the average number of fire incidents per year is 78. The highest number of reported fire incidents - 108 took place in 2005, and the least - 43 in 2012. The data has a dropping trend. When looking into fire subcategories, the most reports belonged to: Structure Fires (60.0%), and Outside Fires (27.6%).

When looking into fire subcategories, the most reports belonged to: Structure Fires (60.0%), and Outside Fires (27.6%).

- 54.1%Utility gas

- 38.6%Fuel oil, kerosene, etc.

- 6.1%Electricity

- 0.9%Bottled, tank, or LP gas

- 0.1%Other fuel

- 0.1%No fuel used

- 45.7%Utility gas

- 31.6%Fuel oil, kerosene, etc.

- 19.4%Electricity

- 2.2%Bottled, tank, or LP gas

- 0.6%No fuel used

- 0.4%Other fuel

Winthrop compared to Massachusetts state average:

- Unemployed percentage significantly below state average.

- Black race population percentage significantly below state average.

- Hispanic race population percentage significantly below state average.

- Foreign-born population percentage below state average.

- Renting percentage significantly below state average.

- Length of stay since moving in significantly above state average.

- Number of rooms per house significantly below state average.

- House age significantly below state average.

- Institutionalized population percentage significantly above state average.

Winthrop on our top lists:

- #1 on the list of "Top 101 cities with largest percentage of females in occupations: transportation, tourism, and lodging attendants (population 5,000+)"

- #1 on the list of "Top 101 cities with largest percentage of females in industries: air transportation (population 5,000+)"

- #8 on the list of "Top 101 cities with largest percentage of males in industries: air transportation (population 5,000+)"

- #9 on the list of "Top 101 cities with the most people taking subway or elevated to work (population 5,000+)"

- #17 on the list of "Top 101 cities with largest percentage of males in industries: other transportation, and support activities, and couriers (population 5,000+)"

- #36 on the list of "Top 101 cities with largest percentage of males in occupations: customer service representatives (population 5,000+)"

- #36 on the list of "Top 101 cities with largest percentage of males in occupations: motor vehicle operators except bus and truck drivers (population 5,000+)"

- #36 on the list of "Top 101 cities with largest percentage of males in occupations: transportation, tourism, and lodging attendants (population 5,000+)"

- #40 on the list of "Top 101 cities with largest percentage of females in occupations: air transportation workers (population 5,000+)"

- #52 on the list of "Top 101 cities with largest percentage of females in occupations: pipelayers, plumbers, pipefitters, and steamfitters (population 5,000+)"

- #52 on the list of "Top 101 cities with largest percentage of females in industries: other transportation, and support activities, and couriers (population 5,000+)"

- #77 on the list of "Top 101 cities with largest percentage of males in industries: publishing, and motion picture and sound recording industries (population 5,000+)"

- #85 on the list of "Top 101 cities with largest percentage of females in industries: rail transportation (population 5,000+)"

- #87 on the list of "Top 101 cities with largest percentage of males in industries: health and personal care, except drug, stores (population 5,000+)"

- #42 (02152) on the list of "Top 101 zip codes with the largest percentage of Irish first ancestries (pop 5,000+)"

- #5 on the list of "Top 101 counties with the lowest percentage of residents that keep firearms around their homes"

- #9 on the list of "Top 101 counties with the largest decrease in the number of deaths per 1000 residents 2000-2006 to 2007-2013 (pop. 50,000+)"

- #19 on the list of "Top 101 counties with highest percentage of residents voting for Obama (Democrat) in the 2012 Presidential Election (pop. 50,000+)"

- #21 on the list of "Top 101 counties with the most Orthodox congregations"

- #31 on the list of "Top 101 counties with the most Catholic adherents"

|

|

Total of 102 patent applications in 2008-2024.