Miami Beach, Florida

Miami Beach: Loew's Miami Beach Hotel

Miami Beach: South Miami Beach

Miami Beach: Colony Hotel

Miami Beach: Victor Hotel

Miami Beach

Miami Beach

Miami Beach: Holocaust Memorial, Miami Beach (Not Miami)

Miami Beach: Comodore Hotel

Miami Beach: Hoffman's Cafeteria

Miami Beach: Comodore Hotel

Miami Beach: White Condos of Miami Beach

- see

47

more - add

your

Submit your own pictures of this city and show them to the world

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: -9.0%

| Males: 43,000 | |

| Females: 37,017 |

| Median resident age: | 42.5 years |

| Florida median age: | 42.7 years |

| Miami Beach: | $69,258 |

| FL: | $69,303 |

Estimated per capita income in 2022: $75,450 (it was $27,853 in 2000)

Miami Beach city income, earnings, and wages data

Estimated median house or condo value in 2022: $712,200 (it was $138,700 in 2000)

| Miami Beach: | $712,200 |

| FL: | $354,100 |

Mean prices in 2022: all housing units: over $1,000,000; detached houses: over $1,000,000; townhouses or other attached units: over $1,000,000; in 2-unit structures: over $1,000,000; in 3-to-4-unit structures: $824,010; in 5-or-more-unit structures: $924,265; mobile homes: $242,619

Median gross rent in 2022: $1,684.

(9.8% for White Non-Hispanic residents, 12.3% for Black residents, 16.1% for Hispanic or Latino residents, 17.2% for other race residents, 14.5% for two or more races residents)

Detailed information about poverty and poor residents in Miami Beach, FL

- 36,99446.2%Hispanic

- 33,60342.0%White alone

- 2,9943.7%Two or more races

- 2,9053.6%Black alone

- 2,0962.6%Other race alone

- 1,3651.7%Asian alone

- 700.09%Native Hawaiian and Other

Pacific Islander alone

Races in Miami Beach detailed stats: ancestries, foreign born residents, place of birth

According to our research of Florida and other state lists, there were 16 registered sex offenders living in Miami Beach, Florida as of May 07, 2024.

The ratio of all residents to sex offenders in Miami Beach is 5,744 to 1.

The ratio of registered sex offenders to all residents in this city is much lower than the state average.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is bigger than the state average.- means the value is much bigger than the state average.

Crime rate in Miami Beach detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 504 (414 officers - 345 male; 69 female).

| Officers per 1,000 residents here: | 4.72 |

| Florida average: | 2.33 |

| Man randomly shot dead in Miami Beach was ‘best dad ever’ (48 replies) |

| Miami Beach parking lot is out of control. Someone needs to do something about it (10 replies) |

| Miami Beach in the 50s? (4 replies) |

| Iconic NYC eatery Rao’s is expanding to Miami Beach (6 replies) |

| Miami beach Crime Not What It Seems? (8 replies) |

| Sea level rise accelerates (251 replies) |

Latest news from Miami Beach, FL collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: Italian (7.6%), American (5.1%), Russian (2.1%), European (2.0%), German (1.6%), Irish (1.4%).

Current Local Time: EST time zone

Elevation: 4 feet

Land area: 7.03 square miles.

Population density: 11,377 people per square mile (high).

45,409 residents are foreign born (42.3% Latin America, 8.6% Europe).

| This city: | 55.4% |

| Florida: | 21.1% |

Median real estate property taxes paid for housing units with mortgages in 2022: $6,096 (0.7%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $5,534 (0.9%)

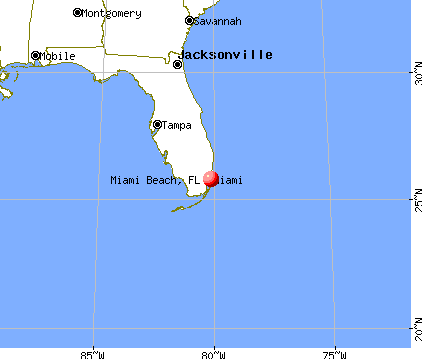

Nearest city with pop. 200,000+: Miami, FL (5.9 miles

, pop. 362,470).

Nearest city with pop. 1,000,000+: Houston, TX (971.4 miles

, pop. 1,953,631).

Nearest cities:

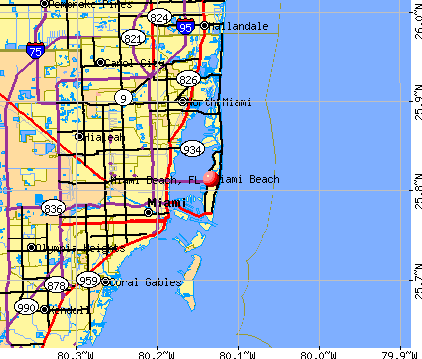

Latitude: 25.81 N, Longitude: 80.13 W

Daytime population change due to commuting: +20,664 (+25.8%)

Workers who live and work in this city: 27,153 (57.9%)

Property values in Miami Beach, FL

Miami Beach tourist attractions:

- Crowne Plaza Hotel South Beach - Z Ocean Hotel

- Holiday Inn Miami Beach

- Fontainebleau Miami Beach

- Hotel St. Augustine

- Bel Aire South Beach

- Chesterfield Hotel

- The Park Central

- Hotel Victor

- Best Western Atlantic Beach Resort

- Cadet Hotel

- Marriott South Beach

- The Shore Club

- Metropole Apartments

- Hilton Grand Vacations Club at South Beach

- The Standard Miami

- The Angler's Boutique Resort

- Eden Roc

- Mondrian Miami

- Royal Palm Resort

- Century Hotel

- The Bentley Hotel & Beach Club

- Cardozo Hotel

- The Strand Ocean Drive

- The National Hotel

- Beach House Bal Harbour

- Gansevoort South

- Loews Miami Beach Hotel

- The Betsy Hotel

- The Raleigh Hotel

- The Palms Hotel & Spa

- Four Points by Sheraton Miami Beach

- Clevelander Hotel

- Sense South Beach Hotel

- Courtyard by Marriott Miami Beach South Beach

- The Alexander All-Suite Oceanfront Resort

- The Hotel

- Pelican Hotel

- Beacon Hotel

- Courtyard Miami Beach Oceanfront

- Room Mate Waldorf

- South Seas Hotel

- Sherbrooke Hotel

- Grand Beach Hotel

- Canyon Ranch Hotel and Spa Miami Beach

- Delano Hotel

- Haddon Hall Hotel

- Marlin Hotel

- Adams Key

- Elliott Key

- Hotel Astor

- Sixty Sixty Resort Residences

- The Setai

- Doubletree Ocean Point Resort & Spa

- The Tides South Beach

- W South Beach

- Winterhaven South Beach

- Lords South Beach (Hotel Nash)

- Miami City Ballet

- Miami Beach Convention Center

- Hilton Bentley

- New World Symphony

- Nikki Beach

- Ritz-Carlton South Beach

- Catalina Hotel & Beach Club

- Collins Avenue

- Colony Theater

- Haulover Inlet

- Haulover Beach Park

- Fisher Island

- Blue Moon Hotel

- Avalon Hotel

- Jackie Gleason Theater of the Performing Arts

- Jazid

- K 17 Beach Club

- Mac's Club Deuce

- Mango's Tropical Cafe

- Brownes & Co

- Clevelander

- The Savoy Hotel

- Nassau Suite Hotel

- Sanford L. Ziff Jewish Museum

- South Pointe Park

- Spa 101

- The New Clinton Hotel & Spa Miami

- Sagamore

- Sunset Cinema's Movies on the Beach

- The Ancient Spanish Monastery

- The Wolfsonian-Florida International University

- World Erotic Art Museum (WEAM)

- Essex House

- Townhouse Hotel

- Casanova Suites on the Beach

Miami Beach, Florida accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 73 buildings, average cost: $1,829,900

- 2021: 50 buildings, average cost: $1,036,000

- 2020: 33 buildings, average cost: $969,400

- 2019: 38 buildings, average cost: $1,023,200

- 2018: 31 buildings, average cost: $999,300

- 2017: 46 buildings, average cost: $1,037,200

- 2016: 62 buildings, average cost: $925,200

- 2015: 75 buildings, average cost: $1,348,700

- 2014: 63 buildings, average cost: $1,464,600

- 2013: 36 buildings, average cost: $1,664,900

- 2012: 14 buildings, average cost: $2,197,500

- 2011: 7 buildings, average cost: $1,980,300

- 2010: 7 buildings, average cost: $2,931,600

- 2009: 21 buildings, average cost: $1,057,600

- 2008: 8 buildings, average cost: $709,100

- 2007: 13 buildings, average cost: $707,100

- 2006: 23 buildings, average cost: $712,300

- 2005: 26 buildings, average cost: $689,800

- 2004: 23 buildings, average cost: $776,100

- 2003: 28 buildings, average cost: $446,800

- 2002: 18 buildings, average cost: $482,300

- 2001: 10 buildings, average cost: $361,900

- 2000: 16 buildings, average cost: $717,200

- 1999: 8 buildings, average cost: $221,600

| Here: | 1.3% |

| Florida: | 2.9% |

- Accommodation & food services (16.2%)

- Professional, scientific, technical services (9.2%)

- Health care (8.5%)

- Educational services (5.3%)

- Real estate & rental & leasing (5.1%)

- Administrative & support & waste management services (5.0%)

- Finance & insurance (4.4%)

- Accommodation & food services (17.9%)

- Professional, scientific, technical services (9.8%)

- Health care (6.3%)

- Construction (5.9%)

- Real estate & rental & leasing (5.1%)

- Finance & insurance (4.7%)

- Administrative & support & waste management services (4.6%)

- Accommodation & food services (13.8%)

- Health care (11.6%)

- Professional, scientific, technical services (8.2%)

- Educational services (6.8%)

- Administrative & support & waste management services (5.5%)

- Real estate & rental & leasing (5.1%)

- Finance & insurance (3.9%)

- Other management occupations, except farmers and farm managers (6.5%)

- Building and grounds cleaning and maintenance occupations (5.4%)

- Other sales and related occupations, including supervisors (5.2%)

- Retail sales workers, except cashiers (3.9%)

- Other office and administrative support workers, including supervisors (3.8%)

- Waiters and waitresses (3.5%)

- Sales representatives, services, wholesale and manufacturing (3.4%)

- Other management occupations, except farmers and farm managers (6.8%)

- Other sales and related occupations, including supervisors (5.3%)

- Building and grounds cleaning and maintenance occupations (4.5%)

- Sales representatives, services, wholesale and manufacturing (3.8%)

- Top executives (3.7%)

- Waiters and waitresses (3.7%)

- Other food preparation and serving workers, including supervisors (3.5%)

- Building and grounds cleaning and maintenance occupations (6.8%)

- Other management occupations, except farmers and farm managers (6.0%)

- Retail sales workers, except cashiers (5.2%)

- Other office and administrative support workers, including supervisors (5.2%)

- Other sales and related occupations, including supervisors (5.1%)

- Secretaries and administrative assistants (4.9%)

- Information and record clerks, except customer service representatives (3.7%)

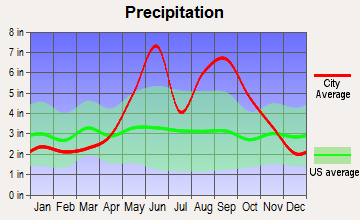

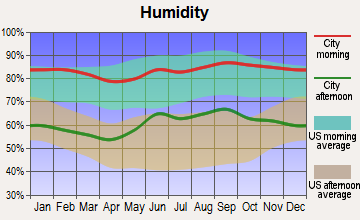

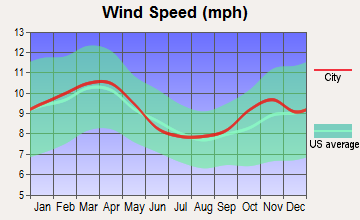

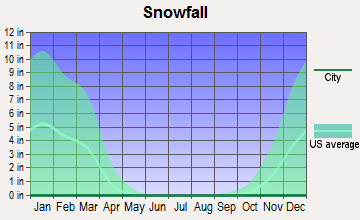

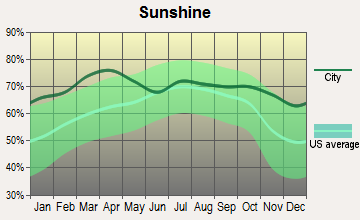

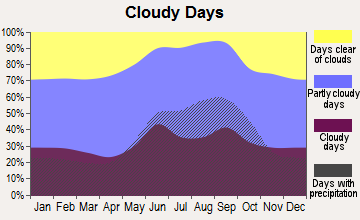

Average climate in Miami Beach, Florida

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

Air Quality Index (AQI) level in 2022 was 78.1. This is about average.

| City: | 78.1 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.263. This is about average. Closest monitor was 4.5 miles away from the city center.

| City: | 0.263 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 4.69. This is about average. Closest monitor was 1.1 miles away from the city center.

| City: | 4.69 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.387. This is significantly better than average. Closest monitor was 1.1 miles away from the city center.

| City: | 0.387 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 29.8. This is about average. Closest monitor was 4.7 miles away from the city center.

| City: | 29.8 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 16.7. This is about average. Closest monitor was 6.9 miles away from the city center.

| City: | 16.7 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 7.83. This is about average. Closest monitor was 5.2 miles away from the city center.

| City: | 7.83 |

| U.S.: | 8.11 |

Tornado activity:

Miami Beach-area historical tornado activity is below Florida state average. It is 38% smaller than the overall U.S. average.

On 6/17/1959, a category F3 (max. wind speeds 158-206 mph) tornado 5.1 miles away from the Miami Beach city center injured 77 people and caused between $500,000 and $5,000,000 in damages.

On 4/10/1956, a category F3 tornado 14.2 miles away from the city center injured 20 people and caused between $500,000 and $5,000,000 in damages.

Earthquake activity:

Miami Beach-area historical earthquake activity is significantly below Florida state average. It is 99% smaller than the overall U.S. average.On 9/10/2006 at 14:56:08, a magnitude 5.9 (5.9 MB, 5.5 MS, 5.8 MW, Class: Moderate, Intensity: VI - VII) earthquake occurred 404.8 miles away from the city center

On 2/22/1992 at 04:21:34, a magnitude 3.2 (3.2 MB, Depth: 6.2 mi, Class: Light, Intensity: II - III) earthquake occurred 86.0 miles away from the city center

On 6/23/2016 at 17:20:29, a magnitude 3.8 (3.8 ML) earthquake occurred 292.3 miles away from the city center

On 7/16/2016 at 20:00:10, a magnitude 3.7 (3.7 MB) earthquake occurred 276.7 miles away from Miami Beach center

On 9/21/2016 at 16:30:52, a magnitude 3.8 (3.8 ML) earthquake occurred 297.3 miles away from the city center

On 9/4/2016 at 18:29:29, a magnitude 3.8 (3.8 ML) earthquake occurred 298.4 miles away from Miami Beach center

Magnitude types: body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Miami-Dade County (10) is smaller than the US average (15).Major Disasters (Presidential) Declared: 5

Emergencies Declared: 3

Causes of natural disasters: Hurricanes: 7, Tropical Storms: 2, Tornado: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: LNR PROPERTY CORP (OPERATORS OF APARTMENT BUILDINGS).

Hospitals and medical centers in Miami Beach:

- MIAMI BEACH COMMUNITY HOSPITAL (250 W 63 ST)

- MOUNT SINAI MEDICAL CENTER (Proprietary, 4300 ALTON RD)

- MT SINAI MED CTR AND MIAMI HEART INSTITU (4701 MERIDAN AVENUE)

- CENTURY HOME CARE INC (300 71ST STREET STE 440)

- HOME MED SOLUTIONS LLC (1860 WEST AVENUE)

- HEBREW HOME OF SOUTH BEACH (320 COLLINS AVENUE)

- OCEANSIDE EXTENDED CARE CENTER (550 9TH STREET)

- SOUTH POINTE PLAZA REHABILITATION AND NURSING CENT (42 COLLINS AVENUE)

- SOUTH SHORE HOSPITAL SNU (630 ALTON ROAD)

Heliports located in Miami Beach:

See details about Heliports located in Miami Beach, FLAmtrak stations near Miami Beach:

- 9 miles: MIAMI (8303 N.W. 37TH AVE.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, vending machines, free short-term parking, call for car rental service, taxi stand, public transit connection.

- 10 miles: MIAMI INT'L AIRPORT (MIAMI, TRANSIT BUS LOADING AREA) - Bus Station

- 14 miles: HOLLYWOOD (3001 HOLLYWOOD BLVD.) . Services: ticket office, partially wheelchair accessible, enclosed waiting area, public restrooms, public payphones, vending machines, free short-term parking, free long-term parking, taxi stand, public transit connection.

Colleges/Universities in Miami Beach:

- Beauty Schools of America (Full-time enrollment: 286; Location: 1011 5th Street; Private, for-profit; Website: www.bsa.edu)

- Miami Ad School-Miami Beach (Full-time enrollment: 191; Location: 955 Alton Rd; Private, for-profit; Website: www.miamiadschool.com)

- Hollywood Institute of Beauty Careers (Full-time enrollment: 164; Location: 1440 79th St Causeway Ste 100; Private, for-profit; Website: www.hi.edu)

- Talmudic College of Florida (Full-time enrollment: 51; Location: 4000 Alton Rd; Private, not-for-profit; Website: www.talmudicu.edu; Offers Master's degree)

- Yeshivah Gedolah Rabbinical College (Full-time enrollment: 31; Location: 1140 Alton Rd; Private, not-for-profit; Website: www.lecfl.com)

Colleges/universities with over 2000 students nearest to Miami Beach:

- AI Miami International University of Art and Design (about 4 miles; Miami, FL; Full-time enrollment: 3,578)

- Miami Dade College (about 5 miles; Miami, FL; FT enrollment: 53,787)

- Johnson & Wales University-North Miami (about 6 miles; North Miami, FL; FT enrollment: 2,051)

- Barry University (about 6 miles; Miami, FL; FT enrollment: 7,181)

- St Thomas University (about 11 miles; Miami Gardens, FL; FT enrollment: 2,096)

- University of Miami (about 11 miles; Coral Gables, FL; FT enrollment: 13,674)

- Florida National University-Main Campus (about 13 miles; Hialeah, FL; FT enrollment: 4,106)

Public high school in Miami Beach:

Private high schools in Miami Beach:

Public elementary/middle schools in Miami Beach:

- NORTH BEACH ELEMENTARY SCHOOL (Students: 1,364, Location: 4100 PRAIRIE AVE, Grades: PK-5)

- NAUTILUS MIDDLE SCHOOL (Students: 1,128, Location: 4301 N MICHIGAN AVE, Grades: 6-8)

- BISCAYNE ELEMENTARY SCHOOL (Students: 975, Location: 800 77TH ST, Grades: PK-5)

- SOUTH POINTE ELEMENTARY SCHOOL (Students: 263, Location: 1050 4TH ST, Grades: PK-5)

- FIENBERG/FISHER K-8 CENTER (Location: 1420 WASHINGTON AVE, Grades: PK-8)

- MATER ACADEMY AT MOUNT SINAI (Location: 4300 ALTON RD, Grades: KG-5, Charter school)

Private elementary/middle schools in Miami Beach:

Points of interest:

Notable locations in Miami Beach: Reeves Plaza (A), United States Coast Guard Integrated Support Command Miami Beach Wharves (B), Florida Power and Light Company Miami Beach Wharf (C), City of Miami Beach Causeway Island Wharf (D), La Gorce Country Club (E), 21st Street Recreation Center (F), South Shore Community Center (G), Abel Holtz Stadium (H), Miami Beach Marina (I), Miami Municipal Golf Course (J), Holocaust Memorial (K), Normandy Shores Golf Course (L), Art Deco District (M), Bayshore Golf Course (N), Wolfsonian Gallery (O), Young President's Club Day Care Center (P), South Pointe Tower (Q), South Shore Library (R), Sunbridge Care and Rehabilitation for South Miami (S), Scott Rakow Youth Center (T). Display/hide their locations on the map

Shopping Centers: Tamiami Shopping Center (1), Lincoln Road Mall (2), Lincoln Mall (3). Display/hide their locations on the map

Main business address in Miami Beach: LNR PROPERTY CORP (A). Display/hide its location on the map

Churches in Miami Beach include: Saint Francis de Sales Church (A), Temple Beth Shalom (B), Saint Patricks Church (C), Beth El Congregation (D), Miami Beach First Baptist Church (E). Display/hide their locations on the map

Lakes: Lake Pancoast (A), Sunset Lake (B), Surprise Lake (C). Display/hide their locations on the map

Parks in Miami Beach include: South Beach Park (1), Collins Park (2), Fisher Park (3), Flagler Memorial Monument (4), Flamingo Park (5), Miami Beach Botanical Garden (6), Crespi Park (7), Tatum Park (8), Brittany Bay Park (9). Display/hide their locations on the map

Tourist attractions: Bass Museum of Art - Main Office (2121 Park Avenue) (1), Bass Museum School of Art (2100 Washington Avenue) (2), Holocaust Memorial of Miami Beach (Cultural Attractions- Events- & Facilities; 1933 Meridian Avenue) (3), AMG - Advanced Media Group (1655 Washington Avenue) (4), Miami Beach 411 (Recreational Trips & Guides; 901 Collins Ave #302) (5). Display/hide their approximate locations on the map

Hotels: Capital Hotel & Restaurant Supplies (1860 West Avenue) (1), Casa Grande Beach Suites (834 Ocean Drive) (2), Collins Plaza Hotel (318 20th Street) (3), Cavalier Hotel (1320 Ocean Dr) (4), Berkeley Shore Hotel (1610 Collins Avenue) (5), Astor Hotel (956 Washington Avenue) (6), Beachcomber Bistro (1340 Collins Avenue) (7), Beekman Hotel - Suites On The Ocean (9499 Collins Ave) (8), Cadet Hotel (1701 James Ave) (9). Display/hide their approximate locations on the map

Birthplace of: Charles Karel Bouley - Music journalist and radio show host, Laila Ali - Boxer, Sherman Bergman - Film actor, Steve Spurrier - College football player, Brett Ratner - Film director, Cheryl Hines - Actress, Fernando Perdomo - Guitarist and singer/songwriter, Jorge Arauz - Magazine editor, Gina Philips - Actor, Irene Marie - Fashion businesspeople.

| This city: | 1.8 people |

| Florida: | 2.5 people |

| This city: | 38.9% |

| Whole state: | 65.2% |

| This city: | 7.9% |

| Whole state: | 7.3% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.4% of all households

- Gay men: 1.5% of all households

People in group quarters in Miami Beach in 2010:

- 473 people in nursing facilities/skilled-nursing facilities

- 311 people in college/university student housing

- 69 people in workers' group living quarters and job corps centers

- 52 people in mental (psychiatric) hospitals and psychiatric units in other hospitals

- 37 people in military ships

- 35 people in other noninstitutional facilities

- 22 people in military barracks and dormitories (nondisciplinary)

- 12 people in group homes intended for adults

- 9 people in group homes for juveniles (non-correctional)

- 6 people in residential treatment centers for adults

People in group quarters in Miami Beach in 2000:

- 671 people in nursing homes

- 232 people in other noninstitutional group quarters

- 157 people in other group homes

- 125 people in wards in general hospitals for patients who have no usual home elsewhere

- 55 people in college dormitories (includes college quarters off campus)

- 46 people in military ships

- 30 people in homes for the mentally ill

- 8 people in military transient quarters for temporary residents

- 7 people in military barracks, etc.

- 3 people in religious group quarters

- 2 people in homes or halfway houses for drug/alcohol abuse

Banks with most branches in Miami Beach (2011 data):

- Bank of America, National Association: Lincoln Road Mall Branch, Washington Avenue Branch, North Beach Branch, Arthur Godfrey Branch, Alton Road Branch. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- Wells Fargo Bank, National Association: Alton Road Branch, Lincoln Road Branch, South Beach Branch, Arthur Godfrey Branch. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- Regions Bank: South Beach Branch, Fisher Island Branch, Normandy Isle Branch, Miami Beach Branch. Info updated 2011/02/24: Bank assets: $123,368.2 mil, Deposits: $98,301.3 mil, headquarters in Birmingham, AL, positive income, Commercial Lending Specialization, 1778 total offices, Holding Company: Regions Financial Corporation

- City National Bank of Florida: South Beach Branch, 41st Street Branch, Miami Beach Branch. Info updated 2006/11/03: Bank assets: $3,973.8 mil, Deposits: $2,922.0 mil, headquarters in Miami, FL, positive income, Commercial Lending Specialization, 27 total offices, Holding Company: Caja De Ahorros De Valencia, Castellon Y Alicante, Bancaja

- TD Bank, National Association: South Beach 5th And Collins Branch at 500 Collins Avenue, branch established on 2007/03/31; South Beach Branch at 500 South Pointe Drive, branch established on 2002/12/31. Info updated 2010/10/04: Bank assets: $188,912.6 mil, Deposits: $153,149.8 mil, headquarters in Wilmington, DE, positive income, 1314 total offices, Holding Company: Toronto-Dominion Bank, The

- Branch Banking and Trust Company: Miami Beach Branch at 901 Arthur Godfrey Road, branch established on 1964/03/16; South Beach Branch at 1691 Michigan Ave Ste 100, branch established on 2003/07/14. Info updated 2010/03/29: Bank assets: $168,867.6 mil, Deposits: $127,549.5 mil, headquarters in Winston Salem, NC, positive income, Commercial Lending Specialization, 1793 total offices, Holding Company: Bb&T Corporation

- JPMorgan Chase Bank, National Association: 1801 Alton Road Branch at 1801 Alton Road, branch established on 1934/07/01; 71st Street at 1025 71st Street, branch established on 1933/12/01. Info updated 2011/11/10: Bank assets: $1,811,678.0 mil, Deposits: $1,190,738.0 mil, headquarters in Columbus, OH, positive income, International Specialization, 5577 total offices, Holding Company: Jpmorgan Chase & Co.

- SunTrust Bank: Miami Beach Branch at 1665 Alton Rd, branch established on 1964/10/26. Info updated 2010/05/27: Bank assets: $171,291.7 mil, Deposits: $129,833.2 mil, headquarters in Atlanta, GA, positive income, Commercial Lending Specialization, 1716 total offices, Holding Company: Suntrust Banks, Inc.

- Gibraltar Private Bank & Trust Co.: Miami Beach Branch at 400 Arthur Godfrey Road, Suite 506, branch established on 2010/05/03. Info updated 2011/07/21: Bank assets: $1,629.0 mil, Deposits: $1,332.7 mil, headquarters in Coral Gables, FL, negative income in the last year, Commercial Lending Specialization, 8 total offices

- 11 other banks with 11 local branches

For population 15 years and over in Miami Beach:

- Never married: 37.2%

- Now married: 39.3%

- Separated: 3.4%

- Widowed: 4.2%

- Divorced: 15.9%

For population 25 years and over in Miami Beach:

- High school or higher: 90.8%

- Bachelor's degree or higher: 55.3%

- Graduate or professional degree: 21.0%

- Unemployed: 7.4%

- Mean travel time to work (commute): 20.4 minutes

| Here: | 12.1 |

| Florida average: | 12.2 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Miami Beach:

(Miami Beach, Florida Neighborhood Map)Religion statistics for Miami Beach, FL (based on Miami-Dade County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 544,449 | 65 |

| Evangelical Protestant | 271,814 | 922 |

| Other | 71,458 | 200 |

| Black Protestant | 60,074 | 94 |

| Mainline Protestant | 40,287 | 146 |

| Orthodox | 4,440 | 10 |

| None | 1,503,913 | - |

Food Environment Statistics:

| Miami-Dade County: | 2.51 / 10,000 pop. |

| State: | 2.04 / 10,000 pop. |

| Here: | 0.06 / 10,000 pop. |

| Florida: | 0.11 / 10,000 pop. |

| Here: | 1.20 / 10,000 pop. |

| Florida: | 1.28 / 10,000 pop. |

| Miami-Dade County: | 1.98 / 10,000 pop. |

| State: | 3.04 / 10,000 pop. |

| This county: | 6.76 / 10,000 pop. |

| Florida: | 7.45 / 10,000 pop. |

| Here: | 7.9% |

| Florida: | 9.2% |

| Miami-Dade County: | 20.5% |

| State: | 23.7% |

| This county: | 15.8% |

| Florida: | 14.0% |

Health and Nutrition:

| Miami Beach: | 51.5% |

| State: | 51.4% |

| Miami Beach: | 52.2% |

| Florida: | 49.4% |

| This city: | 28.3 |

| Florida: | 28.6 |

| Miami Beach: | 17.4% |

| State: | 19.5% |

| Here: | 9.6% |

| Florida: | 10.7% |

| This city: | 6.9 |

| Florida: | 6.9 |

| Here: | 33.9% |

| State: | 34.7% |

| Miami Beach: | 58.3% |

| Florida: | 57.0% |

| Miami Beach: | 81.3% |

| State: | 79.2% |

More about Health and Nutrition of Miami Beach, FL Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 451 | $2,823,975 | $75,139 | 4 | $11,548 |

| Other and Unallocable | 212 | $1,523,486 | $86,235 | 14 | $36,120 |

| Firefighters | 208 | $2,814,629 | $162,382 | 0 | $0 |

| Parks and Recreation | 179 | $1,080,133 | $72,411 | 97 | $231,655 |

| Financial Administration | 165 | $1,301,480 | $94,653 | 0 | $0 |

| Police - Other | 140 | $1,205,510 | $103,329 | 12 | $33,490 |

| Other Government Administration | 129 | $1,028,759 | $95,699 | 1 | $1,368 |

| Fire - Other | 124 | $880,544 | $85,214 | 40 | $69,441 |

| Solid Waste Management | 120 | $650,116 | $65,012 | 0 | $0 |

| Streets and Highways | 96 | $789,477 | $98,685 | 0 | $0 |

| Water Supply | 45 | $250,773 | $66,873 | 0 | $0 |

| Sewerage | 42 | $254,850 | $72,814 | 0 | $0 |

| Housing and Community Development (Local) | 33 | $191,680 | $69,702 | 8 | $14,952 |

| Judicial and Legal | 22 | $302,484 | $164,991 | 0 | $0 |

| Totals for Government | 1,966 | $15,097,895 | $92,154 | 176 | $398,573 |

Miami Beach government finances - Expenditure in 2021 (per resident):

- Construction - Parks and Recreation: $30,495,000 ($381.11)

General - Other: $9,642,000 ($120.50)

Regular Highways: $6,700,000 ($83.73)

- Current Operations - Police Protection: $123,541,000 ($1543.93)

Parks and Recreation: $82,211,000 ($1027.42)

General - Other: $44,149,000 ($551.75)

Financial Administration: $43,872,000 ($548.28)

Local Fire Protection: $39,540,000 ($494.14)

Parking Facilities: $38,708,000 ($483.75)

Sewerage: $37,710,000 ($471.27)

Water Utilities: $29,216,000 ($365.12)

Health - Other: $28,348,000 ($354.27)

Central Staff Services: $23,260,000 ($290.69)

Natural Resources - Other: $22,620,000 ($282.69)

Protective Inspection and Regulation - Other: $21,906,000 ($273.77)

Solid Waste Management: $17,836,000 ($222.90)

Judicial and Legal Services: $5,361,000 ($67.00)

Regular Highways: $4,968,000 ($62.09)

Housing and Community Development: $4,529,000 ($56.60)

Public Welfare - Other: $1,471,000 ($18.38)

Transit Utilities: $1,224,000 ($15.30)

- General - Interest on Debt: $47,008,000 ($587.48)

- Other Capital Outlay - Parking Facilities: $9,023,000 ($112.76)

Natural Resources - Other: $5,913,000 ($73.90)

Police Protection: $1,601,000 ($20.01)

Local Fire Protection: $422,000 ($5.27)

Sewerage: $222,000 ($2.77)

Solid Waste Management: $218,000 ($2.72)

Housing and Community Development: $155,000 ($1.94)

Health - Other: $31,000 ($0.39)

Financial Administration: $11,000 ($0.14)

- Water Utilities - Interest on Debt: $6,813,000 ($85.14)

Miami Beach government finances - Revenue in 2021 (per resident):

- Charges - Parking Facilities: $31,293,000 ($391.08)

Sewerage: $30,861,000 ($385.68)

Other: $27,261,000 ($340.69)

Parks and Recreation: $24,116,000 ($301.39)

Solid Waste Management: $10,506,000 ($131.30)

Regular Highways: $16,000 ($0.20)

- Federal Intergovernmental - Other: $4,099,000 ($51.23)

Highways: $1,066,000 ($13.32)

Housing and Community Development: $810,000 ($10.12)

Public Welfare: $98,000 ($1.22)

- Local Intergovernmental - Other: $5,989,000 ($74.85)

General Local Government Support: $2,662,000 ($33.27)

Public Welfare: $1,700,000 ($21.25)

Highways: $195,000 ($2.44)

- Miscellaneous - Interest Earnings: $25,454,000 ($318.11)

Rents: $6,880,000 ($85.98)

General Revenue - Other: $1,914,000 ($23.92)

Fines and Forfeits: $1,584,000 ($19.80)

Special Assessments: $1,341,000 ($16.76)

Donations From Private Sources: $269,000 ($3.36)

Sale of Property: $42,000 ($0.52)

- Revenue - Water Utilities: $80,721,000 ($1008.80)

- State Intergovernmental - Highways: $11,804,000 ($147.52)

General Local Government Support: $9,377,000 ($117.19)

Other: $2,868,000 ($35.84)

Transit Utilities: $1,146,000 ($14.32)

Housing and Community Development: $501,000 ($6.26)

Public Welfare: $248,000 ($3.10)

- Tax - Property: $199,851,000 ($2497.61)

Public Utilities Sales: $148,087,000 ($1850.69)

Other License: $24,614,000 ($307.61)

Occupation and Business License - Other: $17,551,000 ($219.34)

General Sales and Gross Receipts: $3,530,000 ($44.12)

Insurance Premiums Sales: $2,279,000 ($28.48)

Other Selective Sales: $927,000 ($11.59)

Miami Beach government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $1,259,562,000 ($15741.18)

Outstanding Unspecified Public Purpose: $1,224,832,000 ($15307.15)

Retired Unspecified Public Purpose: $34,730,000 ($434.03)

Miami Beach government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $291,419,000 ($3641.96)

- Other Funds - Cash and Securities: $890,489,000 ($11128.75)

- Sinking Funds - Cash and Securities: $1,207,000 ($15.08)

4.04% of this county's 2021 resident taxpayers lived in other counties in 2020 ($229,296 average adjusted gross income)

| Here: | 4.04% |

| Florida average: | 8.80% |

0.03% of residents moved from foreign countries ($357 average AGI)

Miami-Dade County: 0.03% Florida average: 0.05%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Broward County, FL | |

| from New York County, NY | |

| from Palm Beach County, FL |

5.24% of this county's 2020 resident taxpayers moved to other counties in 2021 ($66,399 average adjusted gross income)

| Here: | 5.24% |

| Florida average: | 7.45% |

0.03% of residents moved to foreign countries ($505 average AGI)

Miami-Dade County: 0.03% Florida average: 0.04%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Broward County, FL | |

| to Palm Beach County, FL | |

| to Lee County, FL |

| Businesses in Miami Beach, FL | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 7-Eleven | 2 | Jones New York | 1 | |

| ALDO | 1 | Journeys | 1 | |

| AT&T | 3 | Juicy Couture | 1 | |

| Ace Hardware | 2 | KFC | 1 | |

| Advance Auto Parts | 2 | Macy's | 1 | |

| Apple Store | 1 | Marriott | 5 | |

| Banana Republic | 2 | McDonald's | 3 | |

| Baskin-Robbins | 1 | Motherhood Maternity | 1 | |

| Bebe | 1 | Nike | 13 | |

| Best Western | 1 | Office Depot | 1 | |

| Blockbuster | 2 | Papa John's Pizza | 1 | |

| Budget Car Rental | 2 | Payless | 2 | |

| Burger King | 1 | Pier 1 Imports | 1 | |

| CVS | 4 | Pizza Hut | 2 | |

| Cache | 1 | Pottery Barn | 1 | |

| Charlotte Russe | 1 | Publix Super Markets | 4 | |

| Cold Stone Creamery | 1 | RadioShack | 2 | |

| DHL | 4 | Sprint Nextel | 1 | |

| Days Inn | 2 | Staples | 1 | |

| Domino's Pizza | 3 | Starbucks | 8 | |

| Dunkin Donuts | 2 | Subway | 7 | |

| Express | 1 | T-Mobile | 3 | |

| FedEx | 22 | T.G.I. Driday's | 1 | |

| Firestone Complete Auto Care | 1 | T.J.Maxx | 1 | |

| Foot Locker | 1 | The Athlete's Foot | 2 | |

| Gap | 2 | U-Haul | 2 | |

| H&R Block | 2 | UPS | 10 | |

| Haagen-Dazs | 3 | Urban Outfitters | 1 | |

| Hilton | 2 | Vans | 3 | |

| Holiday Inn | 2 | Victoria's Secret | 1 | |

| Howard Johnson | 1 | Walgreens | 9 | |

| IHOP | 1 | Whole Foods Market | 1 | |

| J.Crew | 1 | |||

Strongest AM radio stations in Miami Beach:

- WIOD (610 AM; 5 kW; MIAMI, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WQAM (560 AM; 5 kW; MIAMI, FL; Owner: WQAM LICENSE LIMITED PARTNERSHIP)

- WRFX (940 AM; 50 kW; MIAMI, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WAQI (710 AM; 50 kW; MIAMI, FL; Owner: LICENSE CORPORATION #1)

- WNMA (1210 AM; 49 kW; MIAMI SPRINGS, FL; Owner: RADIO UNICA OF MIAMI LICENSE CORP.)

- WKAT (1360 AM; 5 kW; NORTH MIAMI, FL; Owner: SPANISH MEDIA BROADCASTING, L.L.C.)

- WWFE (670 AM; 50 kW; MIAMI, FL; Owner: FENIX BROADCASTING CORP.)

- WSUA (1260 AM; 50 kW; MIAMI, FL; Owner: WSUA BROADCASTING CORPORATION)

- WQBA (1140 AM; 50 kW; MIAMI, FL; Owner: WQBA-AM LICENSE CORP.)

- WMBM (1490 AM; 1 kW; MIAMI BEACH, FL; Owner: NEW BIRTH BROADCASTING CORP. INC.)

- WVCG (1080 AM; 50 kW; CORAL GABLES, FL; Owner: RADIO ONE LICENSES, LLC)

- WRHC (1550 AM; 45 kW; CORAL GABLES, FL; Owner: WRHC BROADCASTING CORP.)

- WWNN (1470 AM; 50 kW; POMPANO BEACH, FL; Owner: WWNN LICENSE, LLC)

Strongest FM radio stations in Miami Beach:

- WXDJ (95.7 FM; NORTH MIAMI BEACH, FL; Owner: WXDJ LICENSING, INC.)

- WCMQ-FM (92.3 FM; HIALEAH, FL; Owner: WCMQ LICENSING, INC.)

- WAMR-FM (107.5 FM; MIAMI, FL; Owner: WQBA-FM LICENSE CORP.)

- WHQT (105.1 FM; CORAL GABLES, FL; Owner: COX RADIO, INC.)

- WLVE (93.9 FM; MIAMI BEACH, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WMIB (103.5 FM; FORT LAUDERDALE, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WMXJ (102.7 FM; POMPANO BEACH, FL; Owner: JEFFERSON-PILOT COMMUNICATIONS CO. OF FLORIDA)

- WPOW (96.5 FM; MIAMI, FL; Owner: WPOW LICENSE LIMITED PARTNERSHIP)

- WZTA (94.9 FM; MIAMI BEACH, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WFLC (97.3 FM; MIAMI, FL; Owner: COX RADIO, INC.)

- WPYM (93.1 FM; MIAMI, FL; Owner: COX RADIO-MIAMI, LLC)

- WBGG-FM (105.9 FM; FORT LAUDERDALE, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WHYI-FM (100.7 FM; FORT LAUDERDALE, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WLRN-FM (91.3 FM; MIAMI, FL; Owner: THE SCHOOL BOARD OF MIAMI - DADE COUNTY, FL)

- WKIS (99.9 FM; BOCA RATON, FL; Owner: WKIS LICENSE LIMITED PARTNERSHIP)

- WRMA (106.7 FM; FORT LAUDERDALE, FL; Owner: WRMA LICENSING, INC.)

- WDNA (88.9 FM; MIAMI, FL; Owner: BASCOMB MEMORIAL BROADCASTING FOUNDATION)

- WLYF (101.5 FM; MIAMI, FL; Owner: JEFFERSON-PILOT COMMUNICATIONS CO. OF FLORIDA)

- WRTO (98.3 FM; GOULDS, FL; Owner: LICENSE CORPORATION #2)

- WMCU (89.7 FM; MIAMI, FL; Owner: TRINITY INTERNATIONAL FOUNDATION, INC.)

TV broadcast stations around Miami Beach:

- WPBT (Channel 2; MIAMI, FL; Owner: COMMUNITY TV FOUNDATION OF S. FLORIDA, INC.)

- WSVN (Channel 7; MIAMI, FL; Owner: SUNBEAM TELEVISION CORP.)

- WPLG (Channel 10; MIAMI, FL; Owner: POST-NEWSWEEK STATIONS, FLORIDA, INC.)

- WLRN-TV (Channel 17; MIAMI, FL; Owner: THE SCHOOL BOARD OF MIAMI - DADE COUNTY, FL)

- WBFS-TV (Channel 33; MIAMI, FL; Owner: VIACOM STATIONS GROUP OF MIAMI INC.)

- WLTV (Channel 23; MIAMI, FL; Owner: WLTV LICENSE PARTNERSHIP, G.P.)

- WPXM (Channel 35; MIAMI, FL; Owner: PAXSON COMMUNICATIONS LICENSE COMPANY, LLC)

- WAMI-TV (Channel 69; HOLLYWOOD, FL; Owner: TELEFUTURA MIAMI LLC)

- WPPB-TV (Channel 63; BOCA RATON, FL; Owner: THE SCHOOL BOARD OF BROWARD COUNTY, FLORIDA)

- WSCV (Channel 51; FORT LAUDERDALE, FL; Owner: TELEMUNDO OF FLORIDA LICENSE CORP.)

- W58BU (Channel 58; HALLANDALE, FL; Owner: NBC STATIONS MANAGEMENT,INC.)

- WHFT-TV (Channel 45; MIAMI, FL; Owner: TRINITY BROADCASTING OF FLORIDA, INC.)

- W24CA (Channel 24; MARATHON, FL; Owner: KEY COMMUNICATIONS OF TEXAS)

- WBZL (Channel 39; MIAMI, FL; Owner: CHANNEL 39, INC.)

- WLMF-LP (Channel 53; MIAMI, FL; Owner: PAGING SYSTEMS, INC.)

- WIMP-CA (Channel 25; MIAMI, FL; Owner: SUNSHINE BROADCASTING COMPANY, INC.)

- WTVJ (Channel 6; MIAMI, FL; Owner: NBC STATIONS MANAGEMENT, INC.)

- WFUN-CA (Channel 48; MIAMI, ETC., FL; Owner: LOCALONE TEXAS, LTD.)

- WGEN-LP (Channel 55; MIAMI, FL; Owner: WDLP BROADCASTING COMPANY, LLC)

- WJAN-CA (Channel 41; MIAMI, FL; Owner: SHERJAN BROADCASTING COMPANY, INC.)

- WVEB-CA (Channel 21; MIAMI, ETC., FL; Owner: HISPANIC KEYS BROADCASTING CORPORATION)

- WHDT-LP (Channel 44; MIAMI, FL; Owner: GUENTER MARKSTEINER)

- WPMF-LP (Channel 31; MIAMI, FL; Owner: JAMES J. CHLADEK)

- WFLX (Channel 29; WEST PALM BEACH, FL; Owner: RAYCOM NATIONAL, INC.)

- W54BB (Channel 54; ROCK HARBOR, FL; Owner: WDLP BROADCASTING COMPANY, LLC)

- National Bridge Inventory (NBI) Statistics

- 57Number of bridges

- 1,804ft / 550mTotal length

- $1,127,000Total costs

- 897,050Total average daily traffic

- 42,715Total average daily truck traffic

- New bridges - historical statistics

- 141920-1929

- 11930-1939

- 201950-1959

- 31970-1979

- 61980-1989

- 91990-1999

- 32000-2009

- 12010-2019

FCC Registered Broadcast Land Mobile Towers: 90 (See the full list of FCC Registered Broadcast Land Mobile Towers in Miami Beach, FL)

FCC Registered Microwave Towers: 106 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Maritime Coast & Aviation Ground Towers: 9 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 181 (See the full list of FCC Registered Amateur Radio Licenses in Miami Beach)

FAA Registered Aircraft Manufacturers and Dealers: 10 (See the full list of FAA Registered Manufacturers and Dealers in Miami Beach)

FAA Registered Aircraft: 83 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 9 full and 5 partial tracts) | ||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 11 | $238,237 | 413 | $401,817 | 521 | $332,419 | 19 | $537,976 | 15 | $7,833,993 | 341 | $335,507 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 1 | $223,000 | 117 | $363,387 | 104 | $374,406 | 11 | $150,608 | 7 | $28,904,030 | 85 | $345,550 |

| APPLICATIONS DENIED | 21 | $194,328 | 330 | $392,940 | 681 | $350,693 | 41 | $181,763 | 9 | $334,129 | 421 | $304,340 |

| APPLICATIONS WITHDRAWN | 10 | $213,289 | 132 | $430,988 | 242 | $363,705 | 10 | $152,828 | 10 | $761,752 | 130 | $317,280 |

| FILES CLOSED FOR INCOMPLETENESS | 2 | $156,500 | 40 | $403,075 | 83 | $327,656 | 3 | $200,227 | 1 | $500,000 | 52 | $339,667 |

Detailed mortgage data for all 14 tracts in Miami Beach, FL

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 7 full and 4 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 2 | $362,535 | 0 | $0 | 0 | $0 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 9 | $239,567 | 4 | $236,865 | 1 | $84,230 |

| APPLICATIONS DENIED | 4 | $319,250 | 0 | $0 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 2 | $333,000 | 0 | $0 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 6 | $336,653 | 0 | $0 | 2 | $227,500 |

2009 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Miami Beach, FL

- 8439.3%Outside Fires

- 6932.2%Structure Fires

- 4219.6%Mobile Property/Vehicle Fires

- 198.9%Other

According to the data from the years 2009 - 2018 the average number of fires per year is 21. The highest number of fires - 166 took place in 2018, and the least - 1 in 2012. The data has a growing trend.

According to the data from the years 2009 - 2018 the average number of fires per year is 21. The highest number of fires - 166 took place in 2018, and the least - 1 in 2012. The data has a growing trend. When looking into fire subcategories, the most reports belonged to: Outside Fires (39.3%), and Structure Fires (32.2%).

When looking into fire subcategories, the most reports belonged to: Outside Fires (39.3%), and Structure Fires (32.2%).Fire-safe hotels and motels in Miami Beach, Florida:

- Colonial Inn Motel, 18101 Collins Ave, Miami Beach, Florida 33160

- Aqua Hotel & Suites, 1530 Collins Ave, Miami Beach, Florida 33139 , Phone: (305) 538-4361, Fax: (305) 673-8109

- Comfort Inn & Suites, 1238 Collins Ave, Miami Beach, Florida 33139 , Phone: (305) 531-3406, Fax: (305) 538-0850

- Matanzas Hotel, 506 Espanola Way, Miami Beach, Florida 33139

- Plaza Hotel, 426 Meridian Ave, Miami Beach, Florida 33139

- Crest Hotel Suites, 1670 James Ave, Miami Beach, Florida 33139 , Phone: (305) 531-0321, Fax: (305) 531-0726

- The Angler's Boutique Resort, 634 Washington Ave, Miami Beach, Florida 33139 , Phone: (305) 571-5007, Fax: (305) 573-7654

- Days Inn Broadmoor, 7450 Ocean Ter, Miami Beach, Florida 33141 , Phone: (305) 868-4617, Fax: (305) 868-4617

- 95 other hotels and motels

| Most common first names in Miami Beach, FL among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| Harry | 1,390 | 80.4 years |

| Joseph | 1,341 | 79.4 years |

| Rose | 1,319 | 82.9 years |

| Samuel | 1,297 | 81.3 years |

| Louis | 1,154 | 81.1 years |

| Morris | 1,026 | 81.2 years |

| Max | 986 | 81.5 years |

| David | 855 | 79.1 years |

| Anna | 836 | 83.7 years |

| William | 805 | 77.7 years |

| Most common last names in Miami Beach, FL among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Cohen | 705 | 81.1 years |

| Schwartz | 401 | 81.5 years |

| Miller | 304 | 78.7 years |

| Goldstein | 301 | 80.6 years |

| Friedman | 289 | 82.3 years |

| Rodriguez | 288 | 76.6 years |

| Goldberg | 271 | 80.7 years |

| Levine | 270 | 80.5 years |

| Gonzalez | 251 | 78.0 years |

| Levy | 237 | 80.7 years |

- 86.7%Electricity

- 8.4%No fuel used

- 4.4%Utility gas

- 0.2%Fuel oil, kerosene, etc.

- 0.2%Solar energy

- 85.9%Electricity

- 7.8%No fuel used

- 6.0%Utility gas

- 0.2%Bottled, tank, or LP gas

Miami Beach compared to Florida state average:

- Median house value above state average.

- Unemployed percentage below state average.

- Black race population percentage significantly below state average.

- Foreign-born population percentage significantly above state average.

- Renting percentage above state average.

- Number of rooms per house significantly below state average.

- House age above state average.

- Percentage of population with a bachelor's degree or higher above state average.

Miami Beach, FL compared to other similar cities:

Miami Beach on our top lists:

- #1 on the list of "Top 100 cities with smallest houses (pop. 50,000+)"

- #1 on the list of "Top 101 cities with the highest cost per building permit(population 50,000+)"

- #1 on the list of "Top 101 cities with the most local government spending on current operations of parking facilities per resident (population 10,000+)"

- #1 on the list of "Top 101 cities with the smallest differences between daily high and daily low temperatures (population 50,000+)"

- #2 on the list of "Top 101 cities with the highest number of thefts per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #3 on the list of "Top 101 cities with the largest household incomes disparities (population 50,000+)"

- #3 on the list of "Top 101 cities with largest percentage of males in industries: accommodation and food services (population 50,000+)"

- #3 on the list of "Top 101 larger cities with the highest increase in house/condo value from 2000 (population 50,000+)"

- #4 on the list of "Top 101 cities with the largest percentage of likely gay men couples (counted as self-reported male-male unmarried-partner households) (population 50,000+)"

- #4 on the list of "Top 101 cities with largest percentage of females in occupations: arts, design, entertainment, sports, and media occupations (population 50,000+)"

- #5 on the list of "Top 101 cities with the most local government spending on current operations of parks and recreation per resident (population 10,000+)"

- #6 on the list of "Top 101 cities with largest percentage of females in occupations: food preparation and serving related occupations (population 50,000+)"

- #8 on the list of "Top 101 cities with largest percentage of males in occupations: food preparation and serving related occupations (population 50,000+)"

- #8 on the list of "Top 100 cities with the largest percentage of males (pop. 50,000+)"

- #8 on the list of "Top 101 cities with the highest number of police officers per 1000 residents (population 50,000+)"

- #11 on the list of "Top 101 cities with the largest percentage of likely homosexual households (counted as self-reported same-sex unmarried-partner households) (population 50,000+)"

- #11 on the list of "Top 101 cities with the smallest percentage of one, detached housing units in structures (20,000+ housing units)"

- #11 on the list of "Top 101 cities with largest percentage of females in industries: real estate and rental and leasing (population 50,000+)"

- #11 on the list of "Top 101 larger cities with the highest increase in household income from 2000 (population 50,000+)"

- #11 on the list of "Top 101 cities with the most residents born in Argentina (population 500+)"

- #24 (33140) on the list of "Top 101 zip codes with the highest 2012 average net capital gain/loss (pop 5,000+)"

- #36 (33140) on the list of "Top 101 zip codes with the highest 2012 average taxable interest for individuals (pop 5,000+)"

- #61 (33140) on the list of "Top 101 zip codes with the largest percentage of Russian first ancestries (pop 5,000+)"

- #69 (33141) on the list of "Top 101 zip codes with the largest percentage of taxpayers reporting profit/loss from business in 2012 (pop 5,000+)"

- #81 (33140) on the list of "Top 101 zip codes with the most offices of physicians in 2005"

- #2 on the list of "Top 101 counties with the highest ground withdrawal of fresh water for public supply"

- #8 on the list of "Top 101 counties with the most Evangelical Protestant congregations"

- #9 on the list of "Top 101 counties with the most Black Protestant adherents"

- #11 on the list of "Top 101 counties with the highest total withdrawal of fresh water for public supply (pop. 50,000+)"

- #12 on the list of "Top 101 counties with the most Evangelical Protestant adherents (pop. 50,000+)"

State forum archive:

- Florida Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81

- Brevard County Pages: 2 3 4 5 6 7 8 9 10

- Fort Lauderdale area Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31

- Fort Myers - Cape Coral area Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

- Jacksonville Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56

- Miami Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52

- Naples Pages: 2 3 4 5 6 7 8 9 10 11

- Ocala Pages: 2 3 4 5 6 7

- Orlando Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72

- Pensacola Pages: 2 3 4 5 6

- Port St. Lucie - Sebastian - Vero Beach Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18

- Punta Gorda - Port Charlotte Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18

- Sarasota - Bradenton - Venice area Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56

- Tallahassee Pages: 2 3 4

- Tampa Bay Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97

- West Palm Beach - Boca Raton - Boynton Beach Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29

|

|

Total of 876 patent applications in 2008-2024.