Jacksonville, Florida

Jacksonville: Northbank, Downtown, 2008

Jacksonville: Downtown Fountains

Jacksonville: Downtown Jacksonville

Jacksonville: The Main St. Bridge at night from Friendship Fountain

Jacksonville: Bridge and South Bank

Jacksonville: View of he north bank.

Jacksonville: Night Scene

Jacksonville: Downtown Bridges

Jacksonville: Saturday Before the Superbowl

Jacksonville: Next to the Bridge.

Jacksonville: Jacksonville skyline at dusk

- see

163

more - add

your

Submit your own pictures of this city and show them to the world

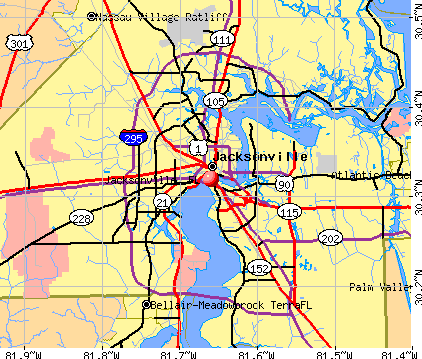

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +32.0%

| Males: 471,995 | |

| Females: 499,324 |

| Median resident age: | 36.5 years |

| Florida median age: | 42.7 years |

Zip codes: 32202, 32204, 32205, 32206, 32207, 32208, 32209, 32210, 32211, 32212, 32216, 32217, 32218, 32219, 32221, 32222, 32223, 32224, 32225, 32226, 32227, 32228, 32244, 32246, 32250, 32254, 32256, 32257, 32258, 32277.

Jacksonville Zip Code Map| Jacksonville: | $69,309 |

| FL: | $69,303 |

Estimated per capita income in 2022: $36,958 (it was $20,337 in 2000)

Jacksonville city income, earnings, and wages data

Estimated median house or condo value in 2022: $301,000 (it was $84,100 in 2000)

| Jacksonville: | $301,000 |

| FL: | $354,100 |

Mean prices in 2022: all housing units: $354,633; detached houses: $375,142; townhouses or other attached units: $297,179; in 2-unit structures: $147,153; in 3-to-4-unit structures: $228,812; in 5-or-more-unit structures: $261,135; mobile homes: $116,651; occupied boats, rvs, vans, etc.: over $1,000,000

Median gross rent in 2022: $1,406.

(9.5% for White Non-Hispanic residents, 23.0% for Black residents, 12.7% for Hispanic or Latino residents, 21.1% for American Indian residents, 16.0% for Native Hawaiian and other Pacific Islander residents, 16.3% for other race residents, 13.8% for two or more races residents)

Detailed information about poverty and poor residents in Jacksonville, FL

- 462,40647.6%White alone

- 284,12729.3%Black alone

- 116,21812.0%Hispanic

- 50,0865.2%Asian alone

- 49,1505.1%Two or more races

- 8,2520.8%Other race alone

- 7290.08%American Indian alone

- 3470.04%Native Hawaiian and Other

Pacific Islander alone

Races in Jacksonville detailed stats: ancestries, foreign born residents, place of birth

According to our research of Florida and other state lists, there were 2,411 registered sex offenders living in Jacksonville, Florida as of April 26, 2024.

The ratio of all residents to sex offenders in Jacksonville is 365 to 1.

Latest news from Jacksonville, FL collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: American (8.7%), English (5.0%), European (4.5%), Irish (4.3%), German (3.9%), Italian (2.3%).

Current Local Time: EST time zone

Elevation: 12 feet

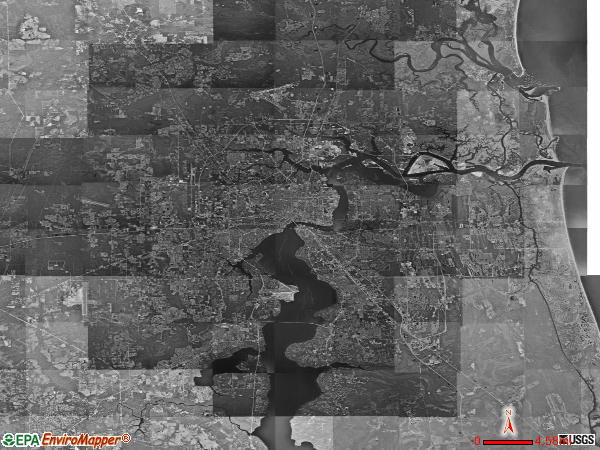

Land area: 757.7 square miles.

Population density: 1,282 people per square mile (low).

120,517 residents are foreign born (5.3% Latin America, 4.2% Asia, 1.8% Europe).

| This city: | 12.4% |

| Florida: | 21.1% |

Median real estate property taxes paid for housing units with mortgages in 2022: $2,164 (0.7%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $1,579 (0.7%)

Nearest city with pop. 1,000,000+: Philadelphia, PA (763.6 miles

, pop. 1,517,550).

Nearest cities:

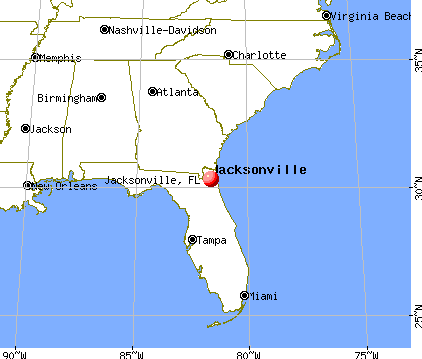

Latitude: 30.32 N, Longitude: 81.66 W

Daytime population change due to commuting: +66,522 (+6.8%)

Workers who live and work in this city: 437,419 (89.6%)

Area code: 904

Property values in Jacksonville, FL

Detailed articles:

- Jacksonville: Introduction

- Jacksonville Basic Facts

- Jacksonville: Communications

- Jacksonville: Convention Facilities

- Jacksonville: Economy

- Jacksonville: Education and Research

- Jacksonville: Geography and Climate

- Jacksonville: Health Care

- Jacksonville: History

- Jacksonville: Municipal Government

- Jacksonville: Population Profile

- Jacksonville: Recreation

- Jacksonville: Transportation

Jacksonville tourist attractions:

- Gateway Mall, Jacksonville, Florida

- Jacksonville International Airport

- Jacksonville Stadium - Jacksonville, Florida - home of the Jacksonville Jaguars NFL football team

- Jacksonville Zoological Gardens in Jacksonville, Florida

- Alexander Brest Planetarium

- Alltel Stadium

- Atlantic Beach

- B.E.A.K.S

- Bethesda Park

- Fort Caroline National Memorial

- Friendship Park

- Gate River Run

- Great Florida Birding Trail

- Guana Pine State Park and Wildlife Management Area

- Huguenot Memorial Park

- Islands Initiative Preserve

- Jacksonville Historical Center

- Jacksonville Landing

- Jacksonville Municipal Stadiums

- Jacksonville Museum of Modern Art

- Jacksonville Symphony Orchestra

- Jacksonville Zoo and Gardens

- Jacksonville- Baldwin Rail Trail

- Kathryn Abbey Hanna Park

- Kingsley Plantation

- Little Talbot Island State Park

- Mandarin Museum

- Mandarin Park

- Metropolitan Park

- Morocco Shrine Auditorium

- Museum of Science and History

- Museum of Southern History

- Old Jacksonville Run

- Prime F. Osborn Convention Center

- Ribault Monument

- Ritz Theatre and LaVilla Museum

- Ringhaver Park/Ortega River Nature Preserve

- River City Brewing Company

- River City Playhouse

- Sally Corporation

- Timucuan Ecological and Historical Preserve

- Tree Hill Nature Center

- Talbot Island State Parks

- University of North Florida National Recreational Trails

- Veterans Memorial Wall

- Theatre Jacksonville

- Westside Regional Park

- Theodore Roosevelt Area

- Windsor Parke Golf Club

- Yellow Bluff Fort

- Big Talbot Island State Park

- Centennial Hall

- Cummer Museum of Art and Gardens

- Diamond D Horse Stables

- Edward Waters College

Jacksonville, Florida accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2012: 1310 buildings, average cost: $192,500

- 2011: 957 buildings, average cost: $181,500

- 2010: 1397 buildings, average cost: $175,800

- 2009: 1467 buildings, average cost: $179,500

- 2008: 2592 buildings, average cost: $173,500

- 2007: 3449 buildings, average cost: $159,100

- 2006: 6291 buildings, average cost: $157,400

- 2005: 8175 buildings, average cost: $152,600

- 2004: 6067 buildings, average cost: $138,800

- 2003: 5766 buildings, average cost: $126,700

- 2002: 5397 buildings, average cost: $122,700

- 2001: 4832 buildings, average cost: $120,300

- 2000: 3497 buildings, average cost: $114,700

- 1999: 3878 buildings, average cost: $119,800

- 1998: 3796 buildings, average cost: $110,500

- 1997: 3483 buildings, average cost: $111,100

| Here: | 3.1% |

| Florida: | 2.9% |

- Health care (12.0%)

- Finance & insurance (9.2%)

- Professional, scientific, technical services (8.8%)

- Accommodation & food services (7.6%)

- Construction (7.1%)

- Educational services (6.3%)

- Administrative & support & waste management services (5.4%)

- Construction (12.1%)

- Professional, scientific, technical services (10.6%)

- Finance & insurance (7.4%)

- Accommodation & food services (6.4%)

- Health care (6.2%)

- Administrative & support & waste management services (6.0%)

- Truck transportation (3.6%)

- Health care (17.9%)

- Finance & insurance (11.1%)

- Educational services (9.6%)

- Accommodation & food services (8.8%)

- Professional, scientific, technical services (7.0%)

- Administrative & support & waste management services (4.8%)

- Personal & laundry services (3.2%)

- Cooks and food preparation workers (6.4%)

- Other management occupations, except farmers and farm managers (6.4%)

- Laborers and material movers, hand (4.0%)

- Computer specialists (3.9%)

- Customer service representatives (3.3%)

- Building and grounds cleaning and maintenance occupations (2.9%)

- Driver/sales workers and truck drivers (2.7%)

- Other management occupations, except farmers and farm managers (7.3%)

- Computer specialists (6.1%)

- Laborers and material movers, hand (5.8%)

- Cooks and food preparation workers (5.4%)

- Driver/sales workers and truck drivers (4.9%)

- Building and grounds cleaning and maintenance occupations (3.7%)

- Retail sales workers, except cashiers (3.3%)

- Cooks and food preparation workers (7.4%)

- Customer service representatives (5.6%)

- Other management occupations, except farmers and farm managers (5.4%)

- Health technologists and technicians (4.9%)

- Registered nurses (4.3%)

- Information and record clerks, except customer service representatives (3.0%)

- Other office and administrative support workers, including supervisors (2.8%)

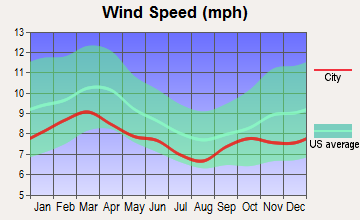

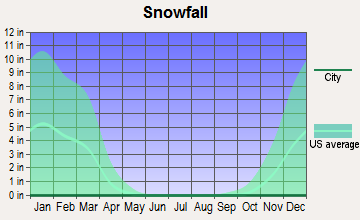

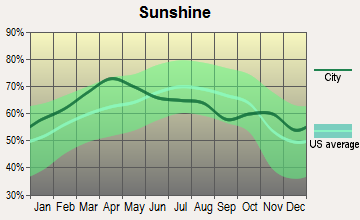

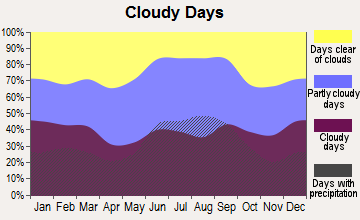

Average climate in Jacksonville, Florida

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

Air Quality Index (AQI) level in 2022 was 71.7. This is about average.

| City: | 71.7 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2016 was 0.501. This is significantly worse than average. Closest monitor was 0.6 miles away from the city center.

| City: | 0.501 |

| U.S.: | 0.251 |

Sulfur Dioxide (SO2) [ppb] level in 2017 was 0.672. This is significantly better than average. Closest monitor was 0.6 miles away from the city center.

| City: | 0.672 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 24.9. This is better than average. Closest monitor was 0.8 miles away from the city center.

| City: | 24.9 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 17.5. This is about average. Closest monitor was 1.4 miles away from the city center.

| City: | 17.5 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 8.94. This is about average. Closest monitor was 2.9 miles away from the city center.

| City: | 8.94 |

| U.S.: | 8.11 |

Lead (Pb) [µg/m3] level in 2002 was 0.00332. This is significantly better than average. Closest monitor was 0.8 miles away from the city center.

| City: | 0.00332 |

| U.S.: | 0.00931 |

Tornado activity:

Jacksonville-area historical tornado activity is slightly below Florida state average. It is 25% smaller than the overall U.S. average.

On 2/7/1971, a category F3 (max. wind speeds 158-206 mph) tornado 29.7 miles away from the Jacksonville city center caused between $50,000 and $500,000 in damages.

On 2/2/1996, a category F2 (max. wind speeds 113-157 mph) tornado 3.6 miles away from the city center caused $3 million in damages.

Earthquake activity:

Jacksonville-area historical earthquake activity is significantly above Florida state average. It is 82% smaller than the overall U.S. average.On 9/10/2006 at 14:56:08, a magnitude 5.9 (5.9 MB, 5.5 MS, 5.8 MW, Class: Moderate, Intensity: VI - VII) earthquake occurred 413.3 miles away from Jacksonville center

On 11/22/1974 at 05:25:55, a magnitude 4.7 (4.7 MB, Class: Light, Intensity: IV - V) earthquake occurred 199.6 miles away from Jacksonville center

On 8/2/1974 at 08:52:09, a magnitude 4.9 (4.3 MB, 4.9 LG) earthquake occurred 250.5 miles away from Jacksonville center

On 8/21/1992 at 16:31:55, a magnitude 4.4 (4.1 MB, 4.1 LG, 4.4 LG, Depth: 6.2 mi) earthquake occurred 209.6 miles away from Jacksonville center

On 9/4/2016 at 18:29:29, a magnitude 3.8 (3.8 ML, Class: Light, Intensity: II - III) earthquake occurred 127.6 miles away from Jacksonville center

On 9/21/2016 at 16:30:52, a magnitude 3.8 (3.8 ML) earthquake occurred 130.0 miles away from Jacksonville center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Duval County (24) is greater than the US average (15).Major Disasters (Presidential) Declared: 14

Emergencies Declared: 5

Causes of natural disasters: Hurricanes: 12, Fires: 4, Tropical Storms: 4, Floods: 3, Tornadoes: 3, Storms: 2, Freeze: 1, Wind: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: ARMOR HOLDINGS INC (ORTHOPEDIC, PROSTHETIC & SURGICAL APPLIANCES & SUPPLIES), TRAILER BRIDGE INC (TRUCKING (NO LOCAL)), REGENCY CENTERS LP (REAL ESTATE), RAYONIER INC (REAL ESTATE INVESTMENT TRUSTS), PARKERVISION INC (RADIO & TV BROADCASTING & COMMUNICATIONS EQUIPMENT), INTERLINE BRANDS, INC./DE (WHOLESALE-HARDWARE & PLUMBING & HEATING EQUIPMENT & SUPPLIES), CSX TRANSPORTATION INC (RAILROADS, LINE-HAUL OPERATING), MPS GROUP INC (SERVICES-HELP SUPPLY SERVICES) and 15 other public companies.

Hospitals in Jacksonville:

- BAPTIST MEDICAL CENTER (Voluntary non-profit - Private, provides emergency services, 800 PRUDENTIAL DR)

- BROOKS REHABILITATION HOSPITAL (provides emergency services, 3599 UNIVERSITY BLVD SOUTH)

- CORF AMERICA INC (1443 SAN MARCO BLVD 2ND FLOOR)

- FLORIDA MENTOR (5808 KINKAID ROAD)

- HIGH DESERT COURT GROUP HOME (11818 HIGH DESERT COURT)

- MEMORIAL HOSPITAL JACKSONVILLE (Proprietary, 3625 UNIVERSITY BLVD S)

- RIVERSIDE CORF (3947 SALISBURY ROAD)

- SHANDS JACKSONVILLE MEDICAL CENTER (Voluntary non-profit - Private, 655 W 8TH ST)

- ST VINCENT'S MEDICAL CENTER (Voluntary non-profit - Church, 1 SHIRCLIFF WAY)

- TEN BROECK HOSPITAL (6300 BEACH BLVD)

Airports, heliports and other landing facilities located in Jacksonville:

- Jacksonville Executive At Craig Airport (CRG) (Runways: 2, Air Taxi Ops: 7,601, Itinerant Ops: 79,920, Local Ops: 56,209, Military Ops: 15,039)

- Cecil Airport (VQQ) (Runways: 6, Commercial Ops: 744, Air Taxi Ops: 346, Itinerant Ops: 16,805, Local Ops: 32,567, Military Ops: 53,899)

- Jacksonville International Airport (JAX) (Runways: 2, Commercial Ops: 53,707, Air Taxi Ops: 19,125, Itinerant Ops: 10,276, Local Ops: 3,512, Military Ops: 5,770)

- Herlong Recreational Airport (HEG) (Runways: 2, Itinerant Ops: 35,000, Local Ops: 43,000, Military Ops: 2,700)

- Deep Forest Airport (FD48) (Runways: 1)

- Jacksonville Nas (Towers Fld) Airport (NIP) (Runways: 2)

- Whitehouse Nolf Airport (NEN) (Runways: 1)

- Heliports: 12

- Gary Gale Seaplane Base (0FL8)

Biggest Colleges/Universities in Jacksonville:

- Florida State College at Jacksonville (Full-time enrollment: 21,810; Location: 501 W State St; Public; Website: www.fscj.edu)

- University of North Florida (Full-time enrollment: 13,870; Location: 1 UNF Drive; Public; Website: www.unf.edu; Offers Doctor's degree)

- Jacksonville University (Full-time enrollment: 3,335; Location: 2800 University Blvd N; Private, not-for-profit; Website: www.jacksonville.edu; Offers Doctor's degree)

- University of Phoenix-North Florida Campus (Full-time enrollment: 978; Location: 4500 Salisbury Road; Private, for-profit; Website: www.phoenix.edu; Offers Master's degree)

- Edward Waters College (Full-time enrollment: 897; Location: 1658 Kings Rd; Private, not-for-profit; Website: www.ewc.edu)

- Everest University-Jacksonville (Full-time enrollment: 849; Location: 8226 Phillips Hwy; Private, for-profit; Website: www.everest.edu/campus/jacksonville; Offers Master's degree)

- ITT Technical Institute-Jacksonville (Full-time enrollment: 707; Location: 7011 A.C. Skinner Pkwy, Suite 140; Private, for-profit; Website: www.itt-tech.edu)

- Concorde Career Institute-Jacksonville (Full-time enrollment: 671; Location: 7259 Salisbury Road; Private, for-profit; Website: www.concorde.edu)

- Sanford-Brown Institute-Jacksonville (Full-time enrollment: 616; Location: 10255 Fortune Parkway, Suite 501; Private, for-profit; Website: www.sbjacksonville.com)

- Tulsa Welding School-Jacksonville (Full-time enrollment: 614; Location: 3500 Southside Blvd; Private, for-profit; Website: www.weldingschool.com)

- Chamberlain College of Nursing-Florida (Full-time enrollment: 581; Location: 5200 Belfort Rd; Private, for-profit; Website: www.chamberlain.edu)

- CDA Technical Institute (Full-time enrollment: 553; Location: 91 Trout River Drive; Private, for-profit; Website: commercialdivingacademy.com)

- Kaplan College-Jacksonville (Full-time enrollment: 478; Location: 7450 Beach Blvd; Private, for-profit; Website: www.kaplancollege.com/jacksonville-fl/)

- Fortis Institute-Jacksonville (Full-time enrollment: 460; Location: 5995-2 University Blvd West; Private, for-profit; Website: fortis.edu)

- Virginia College-Jacksonville (Full-time enrollment: 444; Location: 5940 Beach Boulevard; Private, for-profit; Website: www.vc.edu/college/jacksonville-colleges.cfm)

- Heritage Institute-Jacksonville (Full-time enrollment: 393; Location: 4130 Salibury Road North, Suite 1100; Private, for-profit; Website: www.heritage-education.com)

- Jones College-Jacksonville (Full-time enrollment: 345; Location: 5353 Arlington Expy; Private, not-for-profit; Website: www.jones.edu)

- Stenotype Institute of Jacksonville Inc-Jacksonville (Full-time enrollment: 325; Location: 3563 Phillips Highway Building E Suite 501; Private, for-profit; Website: www.stenotype.edu)

- Southeastern College-Jacksonville (Full-time enrollment: 256; Location: 6700 Southpoint Parkway, Suite 400; Private, for-profit; Website: www.sec.edu/)

- Trinity Baptist College (Full-time enrollment: 235; Location: 800 Hammond Blvd; Private, not-for-profit; Website: www.tbc.edu; Offers Master's degree)

Other colleges/universities with over 2000 students near Jacksonville:

- Flagler College-St Augustine (about 36 miles; Saint Augustine, FL; Full-time enrollment: 2,644)

- Saint Johns River State College (about 47 miles; Palatka, FL; FT enrollment: 4,698)

- Florida Gateway College (about 56 miles; Lake City, FL; FT enrollment: 2,179)

- College of Coastal Georgia (about 58 miles; Brunswick, GA; FT enrollment: 2,447)

- University of Florida (about 64 miles; Gainesville, FL; FT enrollment: 43,357)

- Santa Fe College (about 65 miles; Gainesville, FL; FT enrollment: 11,819)

- Wyotech-Daytona (about 75 miles; Ormond Beach, FL; FT enrollment: 2,295)

Biggest public high schools in Jacksonville:

- DUVAL REGIONAL JUVENILE DETENTION CENTER (Students: 1,509, Location: 1214 E 8TH ST, Grades: 6-12)

- FLORIDA VIRTUAL ACADEMY AT DUVAL COUNTY (Students: 1,463, Location: 2370-1 SOUTH 3RD ST, Grades: KG-12, Charter school)

- IMPACT HALFWAY HOUSE (Students: 1,193, Location: 4501 LANNIE RD, Grades: 6-12)

- PAXON SCHOOL/ADVANCED STUDIES (Students: 1,079, Location: 3239 NORMAN E THAGARD BLVD, Grades: 9-12)

- A. PHILIP RANDOLPH ACADEMIES (Students: 1,063, Location: 1157 GOLFAIR BLVD, Grades: PK-12)

- PRETRIAL DETENTION FACILITY (Students: 1,042, Location: 500 E ADAMS ST, Grades: 5-12)

- ENGLEWOOD HIGH SCHOOL (Students: 1,012, Location: 4412 BARNES RD, Grades: 9-12)

- EDWARD H. WHITE HIGH SCHOOL (Students: 948, Location: 1700 OLD MIDDLEBURG RD N, Grades: 9-12)

- GATEWAY COMMUNITY SERVICES (Students: 749, Location: 2671 HUFFMAN BLVD, Grades: 6-12)

- FIRST COAST HIGH SCHOOL (Students: 712, Location: 590 DUVAL STATION RD, Grades: 9-12)

Biggest private high schools in Jacksonville:

- THE BOLLES SCHOOL (Students: 1,643, Location: 7400 SAN JOSE BLVD, Grades: PK-12)

- TRINITY CHRISTIAN ACADEMY (Students: 1,466, Location: 800 HAMMOND BLVD, Grades: PK-12)

- PROVIDENCE SCHOOL (Students: 1,443, Location: 2701 HODGES BLVD, Grades: PK-12)

- BISHOP KENNY HIGH SCHOOL (Students: 1,236, Location: 1055 KINGMAN AVE, Grades: 9-12)

- EPISCOPAL SCHOOL OF JACKSONVILLE (Students: 869, Location: 4455 ATLANTIC BLVD, Grades: 6-12)

- FIRST COAST CHRISTIAN SCHOOL (Students: 569, Location: 7587 BLANDING BLVD, Grades: PK-12)

- UNIVERSITY CHRISTIAN SCHOOL (Students: 532, Location: 5520 UNIVERSITY BLVD W, Grades: PK-12)

- BISHOP JOHN J SNYDER HIGH SCHOOL (Students: 466, Location: 5001 SAMARITAN WAY, Grades: 9-12)

- CHRIST'S CHURCH ACADEMY (Students: 444, Location: 10850 OLD SAINT AUGUSTINE RD, Grades: KG-12)

- EAGLE'S VIEW ACADEMY (Students: 398, Location: 7788 RAMONA BLVD W, Grades: KG-12)

Biggest public elementary/middle schools in Jacksonville:

- ABESS PARK ELEMENTARY SCHOOL (Students: 1,471, Location: 12731 ABESS BLVD, Grades: PK-5)

- TWIN LAKES ACADEMY ELEMENTARY SCHOOL (Students: 1,351, Location: 8000 POINT MEADOWS DR, Grades: PK-5)

- SPRING PARK ELEMENTARY SCHOOL (Students: 1,333, Location: 2250 SPRING PARK RD, Grades: PK-5)

- ANDREW A. ROBINSON ELEMENTARY SCHOOL (Students: 1,291, Location: 101 W 12TH ST, Grades: PK-5)

- PINEDALE ELEMENTARY SCHOOL (Students: 1,218, Location: 4229 EDISON AVE, Grades: PK-5)

- CLAY HILL ELEMENTARY SCHOOL (Students: 1,214, Location: 6345 COUNTY ROAD 218, Grades: PK-6)

- OCEANWAY ELEMENTARY SCHOOL (Students: 1,170, Location: 12555 GILLESPIE AVE, Grades: PK-5)

- CRYSTAL SPRINGS ELEMENTARY SCHOOL (Students: 1,169, Location: 1200 HAMMOND BLVD, Grades: PK-5)

- CHIMNEY LAKES ELEMENTARY SCHOOL (Students: 1,168, Location: 9353 STAPLES MILL DR, Grades: PK-5)

- HENDRICKS AVENUE ELEMENTARY SCHOOL (Students: 1,167, Location: 3400 HENDRICKS AVE, Grades: KG-5)

Biggest private elementary/middle schools in Jacksonville:

- ASSUMPTION CATHOLIC SCHOOL (Students: 567, Location: 2431 ATLANTIC BLVD, Grades: PK-8)

- ST JOSEPH CATHOLIC SCHOOL (Students: 536, Location: 11600 OLD SAINT AUGUSTINE RD, Grades: PK-8)

- RIVERSIDE PRESBYTERIAN DAY SCHOOL (Students: 510, Location: 830 OAK ST, Grades: PK-6)

- JACKSONVILLE COUNTRY DAY SCHOOL (Students: 496, Location: 10063 BAYMEADOWS RD, Grades: PK-6)

- SAN JOSE CATHOLIC GRADE SCHOOL (Students: 448, Location: 3619 TOLEDO RD, Grades: PK-8)

- HOLY FAMILY CATHOLIC SCHOOL (Students: 444, Location: 9800-3 BAYMEADOWS RD, Grades: PK-8)

- SACRED HEART SCHOOL (Students: 435, Location: 5752 BLANDING BLVD, Grades: PK-8)

- ST MARKS EPISCOPAL DAY SCHOOL (Students: 415, Location: 4114 OXFORD AVE, Grades: PK-6)

- CHRIST THE KING CATHOLIC SCHOOL (Students: 297, Location: 6822 LARKIN RD, Grades: PK-8)

- HENDRICKS DAY SCHOOL OF JACKSONVILLE (Students: 292, Location: 1824 DEAN RD, Grades: PK-8)

Library in Jacksonville:

User-submitted facts and corrections:

- To add to "Strongest A.M. stations in Jacksonville" listings, please: WAYR (550 AM; 5 kW; ORANGE PARK, FL; Owner: GOOD TIDINGS TRUST, INC)

Points of interest:

Notable locations in Jacksonville: Pavilion Plaza (A), Oaks Plaza (B), Camp Wil-le-ma (C), High Point Country Club (D), Hidden Lakes Golf Course (E), Hidden Hills Golf Course (F), Hibiscus Golf Club (G), Herons Glen Championship Golf and Country Club (H), Heritage Ridge Golf Club (I), Hawks Nest Golf Club (J), Hawks Landing Golf Course (K), Harbor City Municipal Golf Course (L), Hamlet Golf Course (M), Haile Plantation Golf and Country Club (N), Grey Oaks Golf and Country Club (O), Grenelefe Golf and Tennis Resort (P), Greenview Cove Golf Course (Q), Great Outdoors Recreational Vehicle and Golf Resort (R), House of Reptiles (S), Murray Hill Art Center (T). Display/hide their locations on the map

Shopping Centers: Windsor Commons Shopping Center (1), University Mall (2), The Avenues Mall (3), Venetia Village Shopping Center (4), Mandarin South Shopping Center (5), Mandarin Corners Shopping Center (6), Mandarin Landing Shopping Center (7), Mandarin Pointe Shopping Center (8), Crossroads Shopping Center (9). Display/hide their locations on the map

Main business address in Jacksonville include: TRAILER BRIDGE INC (A), REGENCY CENTERS LP (B), RAYONIER INC (C), PARKERVISION INC (D), INTERLINE BRANDS, INC./DE (E), CSX TRANSPORTATION INC (F), MPS GROUP INC (G). Display/hide their locations on the map

Churches in Jacksonville include: Anniston Road Church (A), Arlington Alliance Church (B), Atonement Church (C), Church of the Redeemer (D), Barford Church (E), Bethel Church (F), New Beginning Ministries of Jacksonville (G), New Berlin Road Baptist Church (H), New Bethel African Methodist Episcopal Church (I). Display/hide their locations on the map

Cemeteries: Whitker Cemetery (1), Manning Cemetery (2), Deese Cemetery (3), Potters Field (4), Dunn Creek Cemetery (5), Rain Cemetery (6), Westview Cemetery (7). Display/hide their locations on the map

Lakes, reservoirs, and swamps: Lake Tresca (A), Southern Pond (B), Turner Pond (C), Lake Narcissus (D), Casa Linda Lake (E), Pleasant Point Lake (F), Round Pond (G), Lake Effie (H). Display/hide their locations on the map

Streams, rivers, and creeks: Oldfield Creek (A), Saint Johns River (B), Pablo Creek (C), Little Fishweir Creek (D), Mink Creek (E), Julington Creek (F), Durbin Creek (G), Clapboard Creek (H), Christopher Creek (I). Display/hide their locations on the map

Parks in Jacksonville include: Arques Park (1), Lackawanna Park (2), Kooker Park (3), Jennings Park (4), James Park (5), Jacksonville Heights Park (6), Hollybrook Park (7), Highlands Park (8), Hemming Park (9). Display/hide their locations on the map

Tourist attractions: Brown Museum of Art (335 West 8th Street) (1), Cummer Museum of Art & Gardens (829 Riverside Avenue) (2), Nature's Botanica Boutique (Botanical Gardens; 5853 University Boulevard West) (3), Crosby J Ellis Jr LBR (Cultural Attractions- Events- & Facilities; 6196 Lake Gray Boulevard) (4), Jacksonville Maritime Museum Society Inc (Cultural Attractions- Events- & Facilities; 1015 Museum Circle) (5), Fish Mania (Cultural Attractions- Events- & Facilities; 11757 Beach Boulevard Suite 1) (6), Museum of Science and History (Planetariums; 1025 Museum Circle) (7), Mike S Aquatics (Aquariums; 5277 Royce Avenue) (8), Hands On Childrens Museum (Cultural Attractions- Events- & Facilities; 8580 Beach Boulevard) (9). Display/hide their approximate locations on the map

Hotels: Civista Inn (1055 Golfair Boulevard) (1), Best Western Baldwin Inn (1088 US Highway 301 South) (2), City Center Motel (2414 Phillips Highway) (3), Best Western Hotel JTB South (4660 Salisbury Road) (4), Budget Inn (6545 Ramona Boulevard) (5), Classic Inn (4903 West Highway 98) (6), Adam's Mark Hotel (225 E Coastline Dr) (7), CANDLEWOOD SUITES (4990 Belfort Road) (8), Airport Motor Inn (1500 Airport Road) (9). Display/hide their approximate locations on the map

Courts: U S Government - United States Tax Court- United States Courthouse- Court Off (300 North Hogan Street) (1), U S Government - United States Courts- United States Bankruptcy Court- Office Of The C (300 North Hogan Street) (2), Brown Corrine Congress Mbr (101 Union Street East) (3), U S Government - National Labor Relations Board (500 Water Street) (4), U S Government - United States Courts- District Court- Office Of The Clerk- Perso (300 North Hogan) (5), U S Government - United States Courts- Circuit Court of Appeals Eleventh Cir (300 North Hogan Street) (6), U S Government - United States Courts- District Court- Office Of The C (300 North Hogan Street) (7). Display/hide their approximate locations on the map

Birthplace of: Bob Hayes - (1942-2002), athlete, Jack Youngblood - College football player, Travis Tomko - Professional wrestler, Stetson Kennedy - Author, Sable (wrestler) - Professional wrestler, Mike Miranda (BMX rider) - Bicycle motocross rider, Angela Corey - Lawyer, Derek Trucks - Blues musician, Elijah Burke - Professional wrestler, Elizabeth Edwards - Deceased wife of John Edwards.

Drinking water stations with addresses in Jacksonville and their reported violations in the past:

KINGSLEY PLANTATION (Population served: 200, Groundwater):Past health violations:BAYSIDE ESTATES (Population served: 180, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - In APR-2008, Contaminant: Coliform. Follow-up actions: St Public Notif requested (JUN-05-2008)

- MCL, Monthly (TCR) - In OCT-2005, Contaminant: Coliform

- Monitoring, Repeat Major (TCR) - In JUN-2008, Contaminant: Coliform (TCR)

Past health violations:TEMPLE BAPTIST CHURCH (Population served: 166, Groundwater):

- MCL, Monthly (TCR) - In APR-2006, Contaminant: Coliform. Follow-up actions: St Public Notif requested (MAY-30-2006), St Violation/Reminder Notice (MAY-30-2006), St Public Notif received (MAY-31-2006)

Past monitoring violations:MONCRIEF LIQUORS ; LOUNGE (Population served: 135, Groundwater):

- Failure to Conduct Assessment Monitoring - Between JUL-2012 and SEP-2012, Contaminant: E. COLI. Follow-up actions: St Public Notif requested (OCT-31-2012), St Intentional no-action (JUN-24-2014)

- Monitoring, Repeat Major (TCR) - In JUL-2010, Contaminant: Coliform (TCR). Follow-up actions: St Compliance achieved (APR-28-2011)

- 2 routine major monitoring violations

- 2 minor monitoring violations

- One regular monitoring violation

Past monitoring violations:LIQUOR MART (Population served: 100, Groundwater):

- 3 routine major monitoring violations

- One regular monitoring violation

Past monitoring violations:LIVE OAK GOLF ; COUNTRY CLUB (Population served: 100, Groundwater):

- One routine major monitoring violation

Past monitoring violations:BAILEY'S MHP (NORTH) (Population served: 75, Groundwater):

- Failure to Conduct Assessment Monitoring - Between APR-2014 and JUN-2014, Contaminant: E. COLI

- One routine major monitoring violation

Past monitoring violations:JULINGTON CREEK MARINA (Population served: 75, Groundwater):

- Monitoring and Reporting (DBP) - Between JUL-2010 and SEP-2010, Contaminant: Total Haloacetic Acids (HAA5)

- Monitoring and Reporting (DBP) - Between JUL-2010 and SEP-2010, Contaminant: TTHM

- Monitoring and Reporting (DBP) - Between JUL-2007 and SEP-2007, Contaminant: TTHM. Follow-up actions: St Violation/Reminder Notice (MAR-27-2008), St Compliance achieved (MAY-09-2008)

- Monitoring and Reporting (DBP) - Between JUL-2007 and SEP-2007, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Violation/Reminder Notice (MAR-27-2008), St Compliance achieved (MAY-09-2008)

- 2 minor monitoring violations

Past monitoring violations:

- One routine major monitoring violation

Drinking water stations with addresses in Jacksonville that have no violations reported:

- ROLLING HILLS BAPTIST CHURCH (Population served: 350, Primary Water Source Type: Groundwater)

- KINGDOM HALL OF JEHOVAH'S WITNESS (Population served: 250, Primary Water Source Type: Groundwater)

- DANIEL MEMORIAL (Population served: 100, Primary Water Source Type: Groundwater)

- HECKSCHER DRIVE BAPTIST CHURCH (Population served: 75, Primary Water Source Type: Groundwater)

- BARCELONA APARTMENTS (Population served: 56, Primary Water Source Type: Groundwater)

- RUDDER CLUB (Population served: 50, Primary Water Source Type: Groundwater)

- STAR FOOD MART #336 (Population served: 27, Primary Water Source Type: Groundwater)

- JOE CARLUCCI SISTERS CREEK BOAT RAMP (Population served: 25, Primary Water Source Type: Groundwater)

- MAXVILLE FOOD MART (Population served: 25, Primary Water Source Type: Groundwater)

- THOMAS MARSHALL PARK (Population served: 25, Primary Water Source Type: Groundwater)

| This city: | 2.5 people |

| Florida: | 2.5 people |

| This city: | 64.3% |

| Whole state: | 65.2% |

| This city: | 7.3% |

| Whole state: | 7.3% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.4% of all households

- Gay men: 0.4% of all households

People in group quarters in Jacksonville in 2010:

- 4,332 people in local jails and other municipal confinement facilities

- 4,101 people in college/university student housing

- 3,155 people in nursing facilities/skilled-nursing facilities

- 2,554 people in military ships

- 2,108 people in military barracks and dormitories (nondisciplinary)

- 1,077 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 602 people in other noninstitutional facilities

- 515 people in group homes intended for adults

- 374 people in residential treatment centers for adults

- 258 people in workers' group living quarters and job corps centers

- 163 people in correctional residential facilities

- 149 people in correctional facilities intended for juveniles

- 134 people in state prisons

- 78 people in mental (psychiatric) hospitals and psychiatric units in other hospitals

- 75 people in group homes for juveniles (non-correctional)

- 58 people in residential treatment centers for juveniles (non-correctional)

- 7 people in hospitals with patients who have no usual home elsewhere

- 7 people in in-patient hospice facilities

People in group quarters in Jacksonville in 2000:

- 3,401 people in nursing homes

- 2,634 people in military ships

- 2,343 people in college dormitories (includes college quarters off campus)

- 2,024 people in state prisons

- 1,400 people in military barracks, etc.

- 1,318 people in other noninstitutional group quarters

- 590 people in local jails and other confinement facilities (including police lockups)

- 335 people in homes or halfway houses for drug/alcohol abuse

- 272 people in other group homes

- 268 people in other types of correctional institutions

- 171 people in homes for the mentally ill

- 106 people in hospitals/wards and hospices for chronically ill

- 106 people in hospices or homes for chronically ill

- 105 people in other nonhousehold living situations

- 67 people in homes for the mentally retarded

- 51 people in unknown juvenile institutions

- 49 people in mental (psychiatric) hospitals or wards

- 45 people in crews of maritime vessels

- 40 people in hospitals or wards for drug/alcohol abuse

- 26 people in halfway houses

- 24 people in short-term care, detention or diagnostic centers for delinquent children

- 23 people in homes for the physically handicapped

- 18 people in religious group quarters

- 5 people in other workers' dormitories

- 2 people in military transient quarters for temporary residents

Banks with most branches in Jacksonville (2011 data):

- Wells Fargo Bank, National Association: 38 branches. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- Bank of America, National Association: 23 branches. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- SunTrust Bank: 19 branches. Info updated 2010/05/27: Bank assets: $171,291.7 mil, Deposits: $129,833.2 mil, headquarters in Atlanta, GA, positive income, Commercial Lending Specialization, 1716 total offices, Holding Company: Suntrust Banks, Inc.

- Regions Bank: 18 branches. Info updated 2011/02/24: Bank assets: $123,368.2 mil, Deposits: $98,301.3 mil, headquarters in Birmingham, AL, positive income, Commercial Lending Specialization, 1778 total offices, Holding Company: Regions Financial Corporation

- Compass Bank: 14 branches. Info updated 2011/02/24: Bank assets: $63,107.0 mil, Deposits: $46,232.4 mil, headquarters in Birmingham, AL, negative income in the last year, Commercial Lending Specialization, 720 total offices, Holding Company: Banco Bilbao Vizcaya Argentaria, S.A.

- Branch Banking and Trust Company: 8 branches. Info updated 2010/03/29: Bank assets: $168,867.6 mil, Deposits: $127,549.5 mil, headquarters in Winston Salem, NC, positive income, Commercial Lending Specialization, 1793 total offices, Holding Company: Bb&T Corporation

- CenterState Bank of Florida, National Association: 8 branches. Info updated 2012/01/30: Bank assets: $2,082.6 mil, Deposits: $1,779.8 mil, headquarters in Winter Haven, FL, positive income, Commercial Lending Specialization, 65 total offices, Holding Company: Centerstate Banks, Inc.

- The Jacksonville Bank: 7 branches. Info updated 2010/11/30: Bank assets: $580.7 mil, Deposits: $474.7 mil, local headquarters, positive income, Commercial Lending Specialization, 9 total offices, Holding Company: Capgen Capital Group Iv Lp

- Fifth Third Bank: 7 branches. Info updated 2009/10/05: Bank assets: $114,540.4 mil, Deposits: $89,689.1 mil, headquarters in Cincinnati, OH, positive income, Commercial Lending Specialization, 1378 total offices, Holding Company: Fifth Third Bancorp

- 22 other banks with 49 local branches

For population 15 years and over in Jacksonville:

- Never married: 34.9%

- Now married: 46.1%

- Separated: 2.4%

- Widowed: 4.7%

- Divorced: 11.9%

For population 25 years and over in Jacksonville:

- High school or higher: 91.2%

- Bachelor's degree or higher: 33.0%

- Graduate or professional degree: 11.0%

- Unemployed: 3.3%

- Mean travel time to work (commute): 19.7 minutes

| Here: | 11.0 |

| Florida average: | 12.2 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Jacksonville:

(Jacksonville, Florida Neighborhood Map)- Arlington neighborhood

- Avondale neighborhood

- Barnette Office Park neighborhood

- Belfort Station neighborhood

- Brooklyn neighborhood

- Cecil Field Naval Air Station neighborhood

- Central Civic Core District neighborhood

- Church District neighborhood

- Downtown neighborhood

- East Jacksonville neighborhood

- Empire Point (Keystone Bluff) neighborhood

- First Coast Center neighborhood

- Institutional District neighborhood

- La Valla District neighborhood

- Mandarin (Bayard) neighborhood

- North Jacksonville neighborhood

- Oakland neighborhood

- Ortega neighborhood

- River Park neighborhood

- Riverside neighborhood

- San Marco (San Jose) neighborhood

- Sherwood Forest neighborhood

- South Bank Dist neighborhood

- South Jacksonville neighborhood

- South Side neighborhood

- Springfield neighborhood

- Springfield Historical District neighborhood

- St. John Quarter Historic District neighborhood

- Stadium District neighborhood

- Waterleaf neighborhood

- West Jacksonville (Westside) neighborhood

Religion statistics for Jacksonville, FL (based on Duval County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 266,356 | 587 |

| Catholic | 78,167 | 25 |

| Black Protestant | 53,508 | 86 |

| Mainline Protestant | 52,038 | 111 |

| Other | 26,972 | 64 |

| Orthodox | 3,414 | 12 |

| None | 383,808 | - |

Food Environment Statistics:

| Duval County: | 2.66 / 10,000 pop. |

| Florida: | 2.04 / 10,000 pop. |

| Duval County: | 0.12 / 10,000 pop. |

| Florida: | 0.11 / 10,000 pop. |

| This county: | 1.53 / 10,000 pop. |

| Florida: | 1.28 / 10,000 pop. |

| Duval County: | 3.32 / 10,000 pop. |

| State: | 3.04 / 10,000 pop. |

| Duval County: | 7.25 / 10,000 pop. |

| State: | 7.45 / 10,000 pop. |

| Duval County: | 10.4% |

| State: | 9.2% |

| Duval County: | 27.5% |

| Florida: | 23.7% |

| Duval County: | 10.9% |

| State: | 14.0% |

Health and Nutrition:

| Jacksonville: | 50.4% |

| State: | 51.4% |

| Jacksonville: | 48.8% |

| Florida: | 49.4% |

| Here: | 28.8 |

| Florida: | 28.6 |

| Jacksonville: | 19.8% |

| Florida: | 19.5% |

| Here: | 10.8% |

| State: | 10.7% |

| Jacksonville: | 6.8 |

| Florida: | 6.9 |

| Jacksonville: | 34.0% |

| Florida: | 34.7% |

| Here: | 57.5% |

| Florida: | 57.0% |

| Jacksonville: | 81.3% |

| State: | 79.2% |

More about Health and Nutrition of Jacksonville, FL Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 1,759 | $10,681,433 | $72,869 | 0 | $0 |

| Firefighters | 1,583 | $9,452,126 | $71,652 | 1 | $830 |

| Correction | 969 | $4,567,600 | $56,565 | 1 | $1,621 |

| Other and Unallocable | 826 | $6,493,278 | $94,333 | 1 | $1,097 |

| Financial Administration | 676 | $3,288,770 | $58,381 | 60 | $124,619 |

| Police - Other | 672 | $3,226,730 | $57,620 | 314 | $395,686 |

| Electric Power | 626 | $5,733,636 | $109,910 | 0 | $0 |

| Other Government Administration | 592 | $2,658,026 | $53,879 | 33 | $48,584 |

| Sewerage | 386 | $2,968,133 | $92,274 | 0 | $0 |

| Judicial and Legal | 308 | $2,468,743 | $96,185 | 2 | $3,937 |

| Airports | 256 | $1,724,286 | $80,826 | 0 | $0 |

| Parks and Recreation | 222 | $745,581 | $40,302 | 0 | $0 |

| Water Supply | 153 | $1,266,166 | $99,307 | 0 | $0 |

| Welfare | 144 | $518,271 | $43,189 | 0 | $0 |

| Water Transport and Terminals | 140 | $1,060,399 | $90,891 | 3 | $2,725 |

| Health | 123 | $407,528 | $39,759 | 0 | $0 |

| Fire - Other | 108 | $528,519 | $58,724 | 3 | $5,875 |

| Housing and Community Development (Local) | 30 | $94,368 | $37,747 | 0 | $0 |

| Gas Supply | 6 | $54,343 | $108,686 | 0 | $0 |

| Natural Resources | 4 | $13,906 | $41,718 | 0 | $0 |

| Totals for Government | 9,583 | $57,951,843 | $72,568 | 418 | $584,974 |

Jacksonville government finances - Expenditure in 2021 (per resident):

- Construction - Electric Utilities: $228,651,000 ($235.40)

Water Utilities: $180,488,000 ($185.82)

General - Other: $89,751,000 ($92.40)

Air Transportation: $24,860,000 ($25.59)

Parks and Recreation: $21,623,000 ($22.26)

Regular Highways: $12,691,000 ($13.07)

Natural Resources - Other: $509,000 ($0.52)

Sea and Inland Port Facilities: $440,000 ($0.45)

- Current Operations - Electric Utilities: $906,383,000 ($933.15)

Police Protection: $484,219,000 ($498.52)

General - Other: $314,307,000 ($323.59)

Financial Administration: $249,413,000 ($256.78)

Local Fire Protection: $188,065,000 ($193.62)

Transit Utilities: $179,669,000 ($184.97)

Sewerage: $118,626,000 ($122.13)

Parks and Recreation: $116,570,000 ($120.01)

Health - Other: $106,948,000 ($110.11)

Natural Resources - Other: $85,813,000 ($88.35)

Solid Waste Management: $85,609,000 ($88.14)

Air Transportation: $61,699,000 ($63.52)

Water Utilities: $54,421,000 ($56.03)

Judicial and Legal Services: $45,059,000 ($46.39)

Sea and Inland Port Facilities: $36,900,000 ($37.99)

Libraries: $31,121,000 ($32.04)

Regular Highways: $31,010,000 ($31.93)

Central Staff Services: $28,776,000 ($29.63)

Housing and Community Development: $21,567,000 ($22.20)

Protective Inspection and Regulation - Other: $18,968,000 ($19.53)

Public Welfare, Vendor Payments for Other Purposes: $7,800,000 ($8.03)

Public Welfare - Other: $7,727,000 ($7.96)

Parking Facilities: $3,704,000 ($3.81)

Correctional Institutions: $188,000 ($0.19)

- Electric Utilities - Interest on Debt: $90,605,000 ($93.28)

- General - Interest on Debt: $86,916,000 ($89.48)

- Other Capital Outlay - Local Fire Protection: $9,412,000 ($9.69)

Police Protection: $4,420,000 ($4.55)

Libraries: $4,114,000 ($4.24)

Financial Administration: $2,050,000 ($2.11)

Judicial and Legal Services: $873,000 ($0.90)

Health - Other: $334,000 ($0.34)

Central Staff Services: $175,000 ($0.18)

Sea and Inland Port Facilities: $70,000 ($0.07)

- Total Salaries and Wages: $31,816,000 ($32.76)

- Water Utilities - Interest on Debt: $50,607,000 ($52.10)

Jacksonville government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $261,575,000 ($269.30)

Other: $84,350,000 ($86.84)

Solid Waste Management: $73,073,000 ($75.23)

Air Transportation: $72,233,000 ($74.37)

Sea and Inland Port Facilities: $63,997,000 ($65.89)

Natural Resources - Other: $35,034,000 ($36.07)

Parks and Recreation: $9,304,000 ($9.58)

Parking Facilities: $3,932,000 ($4.05)

- Federal Intergovernmental - Other: $319,905,000 ($329.35)

Public Welfare: $15,895,000 ($16.36)

Air Transportation: $11,878,000 ($12.23)

Transit Utilities: $9,532,000 ($9.81)

Housing and Community Development: $4,999,000 ($5.15)

Highways: $2,683,000 ($2.76)

General Local Government Support: $23,000 ($0.02)

- Local Intergovernmental - General Local Government Support: $208,548,000 ($214.71)

- Miscellaneous - Interest Earnings: $64,781,000 ($66.69)

General Revenue - Other: $32,831,000 ($33.80)

Rents: $10,448,000 ($10.76)

Special Assessments: $9,410,000 ($9.69)

Donations From Private Sources: $8,332,000 ($8.58)

Fines and Forfeits: $5,162,000 ($5.31)

Sale of Property: $3,316,000 ($3.41)

- Revenue - Electric Utilities: $1,203,688,000 ($1239.23)

Water Utilities: $182,357,000 ($187.74)

Transit Utilities: $20,519,000 ($21.12)

- State Intergovernmental - General Local Government Support: $162,253,000 ($167.04)

Other: $23,895,000 ($24.60)

Highways: $22,887,000 ($23.56)

Transit Utilities: $5,751,000 ($5.92)

Public Welfare: $1,900,000 ($1.96)

Housing and Community Development: $1,599,000 ($1.65)

- Tax - Property: $728,048,000 ($749.55)

General Sales and Gross Receipts: $188,580,000 ($194.15)

Public Utilities Sales: $124,789,000 ($128.47)

Occupation and Business License - Other: $57,991,000 ($59.70)

Public Utility License: $41,007,000 ($42.22)

Motor Fuels Sales: $30,953,000 ($31.87)

Other Selective Sales: $18,472,000 ($19.02)

Other License: $11,739,000 ($12.09)

Jacksonville government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $6,137,024,000 ($6318.24)

Outstanding Unspecified Public Purpose: $5,822,634,000 ($5994.56)

Retired Unspecified Public Purpose: $1,119,892,000 ($1152.96)

Beginning Outstanding - Public Debt for Private Purpose: $937,032,000 ($964.70)

Issue, Unspecified Public Purpose: $805,502,000 ($829.29)

Outstanding Nonguaranteed - Industrial Revenue: $711,136,000 ($732.13)

Retired Nonguaranteed - Public Debt for Private Purpose: $225,896,000 ($232.57)

Jacksonville government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $354,958,000 ($365.44)

- Other Funds - Cash and Securities: $1,347,165,000 ($1386.94)

- Sinking Funds - Cash and Securities: $711,036,000 ($732.03)

8.15% of this county's 2021 resident taxpayers lived in other counties in 2020 ($65,269 average adjusted gross income)

| Here: | 8.15% |

| Florida average: | 8.80% |

0.10% of residents moved from foreign countries ($679 average AGI)

Duval County: 0.10% Florida average: 0.05%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Clay County, FL | |

| from St. Johns County, FL | |

| from Nassau County, FL |

7.44% of this county's 2020 resident taxpayers moved to other counties in 2021 ($65,097 average adjusted gross income)

| Here: | 7.44% |

| Florida average: | 7.45% |

0.08% of residents moved to foreign countries ($572 average AGI)

Duval County: 0.08% Florida average: 0.04%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to St. Johns County, FL | |

| to Clay County, FL | |

| to Nassau County, FL |

| Businesses in Jacksonville, FL | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| ALDO | 2 | Kincaid | 2 | |

| AT&T | 19 | Kmart | 4 | |

| Abercrombie & Fitch | 1 | Knights Inn | 1 | |

| Abercrombie Kids | 1 | Kohl's | 3 | |

| Academy Sports + Outdoors | 2 | Kroger | 1 | |

| Ace Hardware | 7 | La Quinta | 5 | |

| Advance Auto Parts | 23 | La-Z-Boy | 2 | |

| Aeropostale | 3 | Lane Bryant | 3 | |

| Aerosoles | 1 | Lane Furniture | 4 | |

| American Eagle Outfitters | 4 | LensCrafters | 5 | |

| Ann Taylor | 2 | Little Caesars Pizza | 10 | |

| Apple Store | 1 | Lowe's | 6 | |

| Applebee's | 7 | Marriott | 14 | |

| Arby's | 15 | Marshalls | 1 | |

| Ashley Furniture | 2 | MasterBrand Cabinets | 47 | |

| Audi | 1 | Maurices | 2 | |

| AutoZone | 13 | Mazda | 3 | |

| Avenue | 2 | McDonald's | 48 | |

| BMW | 2 | Men's Wearhouse | 5 | |

| Bakers | 2 | Microtel | 2 | |

| Banana Republic | 2 | Motel 6 | 3 | |

| Barnes & Noble | 2 | Motherhood Maternity | 1 | |

| Baskin-Robbins | 4 | New Balance | 11 | |

| Bath & Body Works | 5 | New York & Co | 2 | |

| Bebe | 1 | Nike | 47 | |

| Bed Bath & Beyond | 4 | Nissan | 4 | |

| Best Western | 3 | Office Depot | 7 | |

| Blockbuster | 16 | OfficeMax | 4 | |

| Brooks Brothers | 2 | Old Navy | 2 | |

| Brookstone | 1 | Olive Garden | 4 | |

| Budget Car Rental | 3 | Outback | 4 | |

| Buffalo Wild Wings | 2 | Outback Steakhouse | 4 | |

| Burger King | 23 | Pac Sun | 1 | |

| Burlington Coat Factory | 3 | Panda Express | 7 | |

| CVS | 25 | Panera Bread | 11 | |

| Cache | 2 | Papa John's Pizza | 11 | |

| CarMax | 1 | Payless | 15 | |

| Casual Male XL | 1 | Penske | 6 | |

| Catherines | 2 | PetSmart | 6 | |

| Charlotte Russe | 1 | Pier 1 Imports | 3 | |

| Chevrolet | 1 | Pizza Hut | 20 | |

| Chick-Fil-A | 13 | Plato's Closet | 3 | |

| Chico's | 2 | Popeyes | 20 | |

| Chipotle | 3 | Pottery Barn | 2 | |

| Chuck E. Cheese's | 2 | Pottery Barn Kids | 1 | |

| Church's Chicken | 4 | Publix Super Markets | 26 | |

| Cinnabon | 2 | Qdoba Mexican Grill | 1 | |

| Clarks | 1 | Quality | 2 | |

| Cold Stone Creamery | 2 | Quiznos | 13 | |

| Coldwater Creek | 1 | RadioShack | 17 | |

| ColorTyme | 1 | Ramada | 2 | |

| Comfort Suites | 2 | Red Lobster | 3 | |

| Costco | 1 | Red Roof Inn | 3 | |

| Cracker Barrel | 4 | Rooms To Go | 4 | |

| Curves | 8 | Ruby Tuesday | 4 | |

| DHL | 4 | Rue21 | 3 | |

| Dairy Queen | 7 | Ryder Rental & Truck Leasing | 2 | |

| Days Inn | 2 | SAS Shoes | 3 | |

| Decora Cabinetry | 4 | SONIC Drive-In | 7 | |

| Dennys | 5 | Sam's Club | 3 | |

| Discount Tire | 5 | Sears | 10 | |

| Domino's Pizza | 18 | Sephora | 3 | |

| DressBarn | 2 | Sheraton | 1 | |

| Dressbarn | 2 | Shoe Carnival | 1 | |

| Dunkin Donuts | 27 | Skechers USA | 1 | |

| Express | 3 | Sleep Inn | 1 | |

| Extended Stay America | 2 | Soma Intimates | 1 | |

| Extended Stay Deluxe | 2 | Spencer Gifts | 2 | |

| Famous Footwear | 5 | Sprint Nextel | 13 | |

| Fashion Bug | 1 | Staples | 3 | |

| FedEx | 125 | Starbucks | 32 | |

| Finish Line | 3 | Steak 'n Shake | 3 | |

| Firestone Complete Auto Care | 6 | Studio 6 | 1 | |

| Foot Locker | 5 | Subaru | 2 | |

| Ford | 4 | Suburban | 1 | |

| Forever 21 | 3 | Subway | 49 | |

| GNC | 15 | Super 8 | 4 | |

| GameStop | 17 | T-Mobile | 35 | |

| Gap | 3 | T.G.I. Driday's | 2 | |

| Goodwill | 1 | T.J.Maxx | 3 | |

| Gymboree | 2 | Taco Bell | 18 | |

| H&R Block | 36 | Talbots | 2 | |

| Hardee's | 12 | Target | 7 | |

| Havertys Furniture | 3 | The Athlete's Foot | 3 | |

| Haworth | 1 | The Cheesecake Factory | 1 | |

| Hilton | 12 | The Limited | 1 | |

| Hobby Lobby | 3 | The Room Place | 3 | |

| Holiday Inn | 16 | Tire Kingdom | 12 | |

| Hollister Co. | 2 | Torrid | 1 | |

| Home Depot | 6 | Toys"R"Us | 4 | |

| Homestead Studio Suites | 3 | Travelodge | 1 | |

| Honda | 4 | U-Haul | 52 | |

| Howard Johnson | 1 | UPS | 124 | |

| Hyatt | 2 | Urban Outfitters | 1 | |

| Hyundai | 3 | Value City Furniture | 1 | |

| IHOP | 3 | Vans | 6 | |

| InTown Suites | 3 | Verizon Wireless | 8 | |

| J. Jill | 1 | Victoria's Secret | 3 | |

| J.Crew | 1 | Village Inn | 1 | |

| JCPenney | 3 | Volkswagen | 3 | |

| Jimmy Jazz | 1 | Waffle House | 5 | |

| Jimmy John's | 3 | Walgreens | 34 | |

| JoS. A. Bank | 1 | Walmart | 11 | |

| Jones New York | 9 | Wet Seal | 2 | |

| Journeys | 2 | Whole Foods Market | 1 | |

| Juicy Couture | 1 | Wingate | 2 | |

| Justice | 4 | World Gym | 2 | |

| KFC | 15 | YMCA | 13 | |

Strongest AM radio stations in Jacksonville:

- WOBS (1530 AM; daytime; 50 kW; JACKSONVILLE, FL; Owner: WORD BROADCASTING NETWORK, INC.)

- WCGL (1360 AM; 5 kW; JACKSONVILLE, FL; Owner: JBD COMMUNICATIONS, INC.)

- WSVE (1280 AM; 5 kW; JACKSONVILLE, FL; Owner: WILLIS & SONS, INC.)

- WOKV (690 AM; 50 kW; JACKSONVILLE, FL; Owner: COX RADIO, INC.)

- WIOJ (1010 AM; 10 kW; JACKSONVILLE BEACH, FL)

- WGSR (1570 AM; 50 kW; FERNANDINA BEACH, FL; Owner: RJM COMMUNICATIONS, INC)

- WBWL (600 AM; 5 kW; JACKSONVILLE, FL)

- WROS (1050 AM; 5 kW; JACKSONVILLE, FL; Owner: THE ROSE OF JACKSONVILLE)

- WFXJ (930 AM; 5 kW; JACKSONVILLE, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WZAZ (1400 AM; 1 kW; JACKSONVILLE, FL; Owner: CARON BROADCASTING, INC.)

- WJGR (1320 AM; 5 kW; JACKSONVILLE, FL; Owner: CARON BROADCASTING, INC.)

- WZNZ (1460 AM; 5 kW; JACKSONVILLE, FL; Owner: CARON BROADCASTING, INC.)

- WEWC (1160 AM; 5 kW; CALLAHAN, FL; Owner: CIRCLE BROADCASTING OF AMERICA, INC.)

Strongest FM radio stations in Jacksonville:

- W232AY (94.3 FM; JACKSONVILLE, FL; Owner: NEW COVENANT EDUCATIONAL MINISTRIES, INC.)

- WEJZ (96.1 FM; JACKSONVILLE, FL; Owner: RENDA BROADCASTING CORP. OF NEVADA)

- WKQL (96.9 FM; JACKSONVILLE, FL; Owner: COX RADIO, INC.)

- WJFR (88.7 FM; JACKSONVILLE, FL; Owner: FAMILY STATIONS, INC.)

- WAPE-FM (95.1 FM; JACKSONVILLE, FL; Owner: COX RADIO, INC.)

- WQIK-FM (99.1 FM; JACKSONVILLE, FL; Owner: CITICASTERS LICENSES, L.P.)

- WFKS (97.9 FM; NEPTUNE BEACH, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WROO (107.3 FM; JACKSONVILLE, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WFYV-FM (104.5 FM; ATLANTIC BEACH, FL; Owner: COX RADIO, INC.)

- WMXQ (102.9 FM; JACKSONVILLE, FL; Owner: COX RADIO, INC.)

- WJCT-FM (89.9 FM; JACKSONVILLE, FL; Owner: WJCT, INC.)

- WNCM-FM (88.1 FM; JACKSONVILLE, FL; Owner: NEW COVENANT EDUCATIONAL MINISTRIES)

- WKTZ-FM (90.9 FM; JACKSONVILLE, FL; Owner: JONES COLLEGE)

- WBGB (106.5 FM; PONTE VEDRA BEACH, FL; Owner: CARON BROADCASTING, INC.)

- W288BC (105.5 FM; ARLINGTON, FL; Owner: DEAN HARRIS)

- WJSJ (105.3 FM; FERNANDINA BEACH, FL; Owner: TAMA BROADCASTING, INC.)

- WWRR (100.7 FM; BRUNSWICK, GA; Owner: RENDA BROADCASTING CORP. OF NEVADA)

- WSOL-FM (101.5 FM; BRUNSWICK, GA; Owner: CITICASTERS LICENSES, L.P.)

- W270AK (101.9 FM; CAMBON, FL; Owner: CALVARY CHAPEL OF TWIN FALLS, INC.)

- WJBT (92.7 FM; GREEN COVE SPRINGS, FL; Owner: CITICASTERS LICENSES, L.P.)

TV broadcast stations around Jacksonville:

- WPXJ-LP (Channel 41; JACKSONVILLE, FL; Owner: PAXSON COMMUNICATIONS LICENSE COMPANY, LLC)

- WWRJ-LP (Channel 27; JACKSONVILLE, FL; Owner: U.S. INTERACTIVE, L.L.C.)

- W50CO (Channel 50; JACKSONVILLE, FL; Owner: THREE ANGELS BROADCASTING NETWORK)

- W54CS (Channel 54; JACKSONVILLE, FL; Owner: VENTANA TELEVISION, INC.)

- WJWB (Channel 17; JACKSONVILLE, FL; Owner: MEDIA GENERAL COMMUNICATIONS, INC.)

- WJCT (Channel 7; JACKSONVILLE, FL; Owner: WJCT, INC.)

- W09CF (Channel 9; JACKSONVILLE, FL; Owner: BENJAMIN PEREZ)

- WAWS (Channel 30; JACKSONVILLE, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WTEV-TV (Channel 47; JACKSONVILLE, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WJEB-TV (Channel 59; JACKSONVILLE, FL; Owner: JACKSONVILLE EDUCATORS BROADCASTING, INC.)

- WTLV (Channel 12; JACKSONVILLE, FL; Owner: MULTIMEDIA HOLDINGS CORPORATION)

- WJXX (Channel 25; ORANGE PARK, FL; Owner: GANNETT RIVER STATES PUBLISHING CORPORATION)

- WJXT (Channel 4; JACKSONVILLE, FL; Owner: POST-NEWSWEEK STATIONS, FLORIDA, INC.)

- WBXJ-CA (Channel 10; JACKSONVILLE, ETC., FL; Owner: THE BOX WORLDWIDE LLC)

- W45BZ (Channel 45; JACKSONVILLE, FL; Owner: DEEPAK VISWANATH)

- WUBF-LP (Channel 69; JACKSONVILLE, FL; Owner: UMMAT BROADCASTING CORPORATION INC.)

- WPXC-TV (Channel 21; BRUNSWICK, GA; Owner: PAXSON JAX LICENSE, INC.)

Medal of Honor Recipients

Medal of Honor Recipient born in Jacksonville: Thomas R. Norris.

- National Bridge Inventory (NBI) Statistics

- 1,327Number of bridges

- 32,392ft / 9,873mTotal length

- $64,626,000Total costs

- 35,101,922Total average daily traffic

- 3,229,365Total average daily truck traffic

- New bridges - historical statistics

- 11900-1909

- 101920-1929

- 141930-1939

- 121940-1949

- 1171950-1959

- 3171960-1969

- 1831970-1979

- 771980-1989

- 1401990-1999

- 2332000-2009

- 2102010-2019

- 132020-2022

FCC Registered Antenna Towers: 2,760 (See the full list of FCC Registered Antenna Towers)

FCC Registered Commercial Land Mobile Towers: 62 (See the full list of FCC Registered Commercial Land Mobile Towers in Jacksonville, FL)

FCC Registered Private Land Mobile Towers: 30 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 465 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 626 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 52 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 134 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 3,074 (See the full list of FCC Registered Amateur Radio Licenses in Jacksonville)

FAA Registered Aircraft Manufacturers and Dealers: 34 (See the full list of FAA Registered Manufacturers and Dealers in Jacksonville)

FAA Registered Aircraft: 566 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 145 full and 1 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 4,824 | $155,646 | 2,254 | $161,276 | 9,381 | $171,116 | 634 | $68,038 | 11 | $2,519,420 | 662 | $122,367 | 148 | $78,946 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 288 | $153,518 | 238 | $156,410 | 1,033 | $173,718 | 74 | $54,294 | 0 | $0 | 92 | $135,730 | 59 | $72,322 |

| APPLICATIONS DENIED | 1,196 | $142,209 | 676 | $133,777 | 5,577 | $164,854 | 695 | $47,280 | 4 | $1,765,620 | 579 | $117,349 | 250 | $66,202 |

| APPLICATIONS WITHDRAWN | 665 | $152,547 | 433 | $169,186 | 3,489 | $167,244 | 142 | $94,228 | 1 | $5,200,000 | 252 | $117,539 | 62 | $99,177 |

| FILES CLOSED FOR INCOMPLETENESS | 201 | $150,418 | 142 | $193,349 | 1,025 | $168,914 | 63 | $89,118 | 0 | $0 | 71 | $110,197 | 26 | $74,962 |

Detailed mortgage data for all 144 tracts in Jacksonville, FL

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 104 full and 1 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 236 | $201,735 | 110 | $195,601 | 2 | $310,000 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 109 | $211,963 | 94 | $212,649 | 6 | $140,667 |

| APPLICATIONS DENIED | 41 | $206,855 | 46 | $196,326 | 4 | $136,500 |

| APPLICATIONS WITHDRAWN | 27 | $210,704 | 19 | $195,755 | 1 | $143,000 |

| FILES CLOSED FOR INCOMPLETENESS | 18 | $179,056 | 9 | $150,000 | 4 | $172,500 |

2003 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Jacksonville, FL

- 10,65145.8%Outside Fires

- 6,57628.3%Structure Fires

- 4,36018.7%Mobile Property/Vehicle Fires

- 1,6757.2%Other

According to the data from the years 2003 - 2018 the average number of fires per year is 1452. The highest number of reported fires - 4,093 took place in 2007, and the least - 5 in 2016. The data has an increasing trend.

According to the data from the years 2003 - 2018 the average number of fires per year is 1452. The highest number of reported fires - 4,093 took place in 2007, and the least - 5 in 2016. The data has an increasing trend. When looking into fire subcategories, the most incidents belonged to: Outside Fires (45.8%), and Structure Fires (28.3%).

When looking into fire subcategories, the most incidents belonged to: Outside Fires (45.8%), and Structure Fires (28.3%).Fire-safe hotels and motels in Jacksonville, Florida:

- Jacksonville Mayo Clinic Courtyard, 14390 Mayo Blvd, Jacksonville, Florida 32224 , Phone: (904) 223-1700, Fax: (904) 223-1026

- Best Western Premier, 4700 Salisbury Rd, Jacksonville, Florida 32256 , Phone: (904) 281-9700, Fax: (904) 281-1957

- Crowne Plaza Jacksonville, 14670 Duval Rd At I-95 & Airport Rd, Jacksonville, Florida 32218 , Phone: (904) 741-4404, Fax: (904) 741-5045

- Emerson Inn, 3558 Phillips Hwy, Jacksonville, Florida 32256 , Phone: (904) 398-6961, Fax: (904) 398-6961

- Howard Johnson Lodge, 1055 Golfair Blvd, Jacksonville, Florida 32209

- Plaza Motor Lodge, 3333 Phillips Hwy, Jacksonville, Florida 32207

- Florida Motel, 10462 New Kings Rd, Jacksonville, Florida 32219

- Ambassador Hotel & Apt, 420 Julia St, Jacksonville, Florida 32202

- 113 other hotels and motels

| Most common first names in Jacksonville, FL among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| James | 4,291 | 70.6 years |

| John | 3,936 | 72.0 years |

| Mary | 3,861 | 77.4 years |

| William | 3,709 | 72.1 years |

| Robert | 2,815 | 69.5 years |

| Charles | 2,012 | 71.5 years |

| George | 1,987 | 73.7 years |

| Willie | 1,746 | 71.9 years |

| Joseph | 1,508 | 72.4 years |

| Dorothy | 1,358 | 75.5 years |

| Most common last names in Jacksonville, FL among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Williams | 2,252 | 71.3 years |

| Smith | 2,175 | 73.0 years |

| Johnson | 1,816 | 71.8 years |

| Jones | 1,583 | 72.3 years |

| Brown | 1,552 | 71.4 years |

| Davis | 1,224 | 73.0 years |

| Thomas | 908 | 71.7 years |

| Jackson | 874 | 71.1 years |

| Taylor | 751 | 72.9 years |

| Wilson | 746 | 72.9 years |

- 94.1%Electricity

- 3.5%Utility gas

- 1.0%No fuel used

- 0.9%Bottled, tank, or LP gas

- 0.2%Solar energy

- 0.2%Fuel oil, kerosene, etc.

- 93.3%Electricity

- 4.0%Utility gas

- 1.8%No fuel used

- 0.5%Bottled, tank, or LP gas

- 0.2%Other fuel

Jacksonville compared to Florida state average:

- Unemployed percentage significantly below state average.

- Black race population percentage above state average.

- Hispanic race population percentage below state average.

- Median age below state average.

Jacksonville, FL compared to other similar cities:

Jacksonville on our top lists:

- #10 on the list of "Top 100 cities with largest land areas (pop. 50,000+)"

- #17 on the list of "Top 100 biggest cities"

- #18 on the list of "Top 101 biggest cities in 2013"

- #22 on the list of "Top 101 cities with largest percentage of females in industries: finance and insurance (population 50,000+)"

- #25 on the list of "Top 101 cities with the largest percentage of people in military ships (population 1,000+)"

- #52 on the list of "Top 101 cities with the highest maximum monthly morning or afternoon humidity (population 50,000+)"

- #53 on the list of "Top 101 cities with the largest percentage of people in crews of maritime vessels (population 1,000+)"

- #57 on the list of "Top 101 cities with the most mentions on city-data.com forum"

- #80 on the list of "Top 101 cities with the highest ratio of murders to rapes between 2002 and 2012 (population 50,000+)"

- #81 on the list of "Top 101 cities with largest percentage of females in occupations: office and administrative support occupations (population 50,000+)"

- #81 on the list of "Top 101 cities with largest percentage of males in industries: finance and insurance (population 50,000+)"

- #85 on the list of "Top 101 cities with largest percentage of males in industries: transportation and warehousing (population 50,000+)"

- #88 on the list of "Top 101 cities with largest percentage of males in industries: administrative and support and waste management services (population 50,000+)"

- #90 on the list of "Top 101 cities with the highest number of murders per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #101 on the list of "Top 101 cities with the largest house values disparities (population 50,000+)"

- #7 (32212) on the list of "Top 101 zip codes with the largest percentage of returns reporting salary or wage in 2012 (pop 1,000+)"

- #17 (32227) on the list of "Top 101 zip codes with the lowest 2012 average taxable interest for individuals (pop 5,000+)"

- #26 (32202) on the list of "Top 101 zip codes with the highest 2012 average net capital gain/loss (pop 5,000+)"

- #26 (32256) on the list of "Top 101 zip codes with the most medium-big companies in 2005 (at least 100 employees)"

- #28 (32227) on the list of "Top 101 zip codes with the lowest charity contributions deductions as a percentage of AGI in 2012 (pop 5,000+)"

- #40 (32256) on the list of "Top 101 zip codes with the most finance and insurance companies in 2005"

- #47 (32256) on the list of "Top 101 zip codes with the most big companies in 2005 (at least 1000 employees)"

- #63 (32202) on the list of "Top 101 zip codes with the most offices of lawyers in 2005"

- #65 (32227) on the list of "Top 101 zip codes with the smallest percentage of taxpayers using charity contributions deductions in 2012 (pop 5,000+)"

- #70 (32216) on the list of "Top 101 zip codes with the most offices of physicians in 2005"

- #81 (32209) on the list of "Top 101 zip codes with the lowest average reported salary/wage in 2012 (pop 5,000+)"

- #91 (32209) on the list of "Top 101 zip codes with the lowest 2012 average Adjusted Gross Income (AGI) for individuals (pop 5,000+)"

- #95 (32227) on the list of "Top 101 zip codes with the smallest percentage of taxpayers using paid preparers for 2012 taxes (pop 5,000+)"

- #11 on the list of "Top 101 counties with the most Black Protestant adherents"

- #13 on the list of "Top 101 counties with the most Evangelical Protestant adherents"

- #18 on the list of "Top 101 counties with the highest carbon monoxide air pollution readings in 2012 (ppm)"

- #18 on the list of "Top 101 counties with the most Evangelical Protestant congregations"

- #20 on the list of "Top 101 counties with the highest ground withdrawal of fresh water for public supply"

State forum archive:

- Florida Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81

- Brevard County Pages: 2 3 4 5 6 7 8 9 10

- Fort Lauderdale area Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31

- Fort Myers - Cape Coral area Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

- Jacksonville Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56

- Miami Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52

- Naples Pages: 2 3 4 5 6 7 8 9 10 11

- Ocala Pages: 2 3 4 5 6 7

- Orlando Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72

- Pensacola Pages: 2 3 4 5 6

- Port St. Lucie - Sebastian - Vero Beach Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18

- Punta Gorda - Port Charlotte Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18

- Sarasota - Bradenton - Venice area Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56

- Tallahassee Pages: 2 3 4

- Tampa Bay Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97

- West Palm Beach - Boca Raton - Boynton Beach Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29

|

|

Total of 2024 patent applications in 2008-2024.