Houston, Texas

Houston: Houston at dusk

Houston: Downtown Houston viewed from the East

Houston: Houston skyline on a rainy cloudy night

Houston: Northwest Houston neighborhood off Tomball Pkwy (TX 249) and Cypresswood Dr

Houston: Building in Houston with reflection of clouds

Houston: A nice view of skyscrapers

Houston: Downtown Houston

Houston: Houston, Texas, downtown

Houston: houston freeway

Houston: Downtown Houston

Houston: Photo of Downtown Houston

- see

140

more - add

your

Submit your own pictures of this city and show them to the world

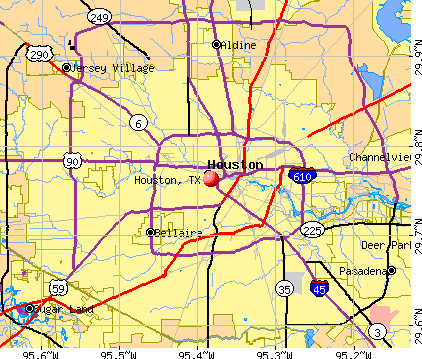

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +17.9%

| Males: 1,139,915 | |

| Females: 1,162,963 |

| Median resident age: | 34.6 years |

| Texas median age: | 35.6 years |

Zip codes: 77002, 77003, 77004, 77005, 77006, 77007, 77008, 77009, 77010, 77011, 77012, 77013, 77014, 77016, 77017, 77018, 77019, 77020, 77021, 77022, 77023, 77025, 77026, 77027, 77028, 77030, 77031, 77033, 77034, 77035, 77036, 77038, 77040, 77041, 77042, 77043, 77045, 77046, 77047, 77048, 77050, 77051, 77053, 77054, 77056, 77057, 77058, 77059, 77061, 77062, 77063, 77064, 77065, 77066, 77067, 77068, 77069, 77070, 77071, 77072, 77073, 77074, 77075, 77076, 77077, 77078, 77079, 77080, 77081, 77082, 77084, 77085, 77086, 77087, 77088, 77090, 77091, 77092, 77093, 77094, 77095, 77096, 77098, 77099, 77201, 77336, 77339, 77345, 77357, 77365, 77373, 77375, 77377, 77379, 77386, 77388, 77407, 77429, 77433, 77447, 77449, 77478, 77484, 77489, 77493, 77504, 77506, 77587.

Houston Zip Code Map| Houston: | $60,426 |

| TX: | $72,284 |

Estimated per capita income in 2022: $39,521 (it was $20,101 in 2000)

Houston city income, earnings, and wages data

Estimated median house or condo value in 2022: $267,000 (it was $77,500 in 2000)

| Houston: | $267,000 |

| TX: | $275,400 |

Mean prices in 2022: all housing units: $384,753; detached houses: $398,497; townhouses or other attached units: $331,802; in 2-unit structures: $404,196; in 3-to-4-unit structures: $227,661; in 5-or-more-unit structures: $320,273; mobile homes: $103,950; occupied boats, rvs, vans, etc.: $144,752

Median gross rent in 2022: $1,246.

(9.3% for White Non-Hispanic residents, 25.1% for Black residents, 25.1% for Hispanic or Latino residents, 22.3% for American Indian residents, 10.7% for Native Hawaiian and other Pacific Islander residents, 30.4% for other race residents, 19.9% for two or more races residents)

Detailed information about poverty and poor residents in Houston, TX

- 1,056,41445.8%Hispanic

- 529,43123.0%White alone

- 489,36821.2%Black alone

- 156,7396.8%Asian alone

- 57,8212.5%Two or more races

- 11,3620.5%Other race alone

- 2,2500.10%American Indian alone

- 1,0290.04%Native Hawaiian and Other

Pacific Islander alone

Races in Houston detailed stats: ancestries, foreign born residents, place of birth

According to our research of Texas and other state lists, there were 7,864 registered sex offenders living in Houston, Texas as of May 07, 2024.

The ratio of all residents to sex offenders in Houston is 293 to 1.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is about the same as the state average.- means the value is bigger than the state average.

- means the value is much bigger than the state average.

Crime rate in Houston detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 6,249 (5,250 officers - 4,345 male; 905 female).

| Officers per 1,000 residents here: | 2.24 |

| Texas average: | 2.07 |

| Houston CORE developments thread (728 replies) |

| Houston thoughts from someone who lives in DFW (63 replies) |

| Houston's economic diversity Thread .. (1244 replies) |

| Why I left Houston--why did YOU? (133 replies) |

| Why is Houston so ghetto? (339 replies) |

| Houston economy 101 for newcomers (38 replies) |

Latest news from Houston, TX collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: English (3.0%), American (2.7%), German (2.2%), Irish (1.4%), Nigerian (1.3%).

Current Local Time: CST time zone

Land area: 579.4 square miles.

Population density: 3,974 people per square mile (average).

676,712 residents are foreign born (20.7% Latin America, 5.5% Asia).

| This city: | 29.4% |

| Texas: | 17.2% |

Median real estate property taxes paid for housing units with mortgages in 2022: $5,335 (1.7%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $2,811 (1.3%)

Nearest cities:

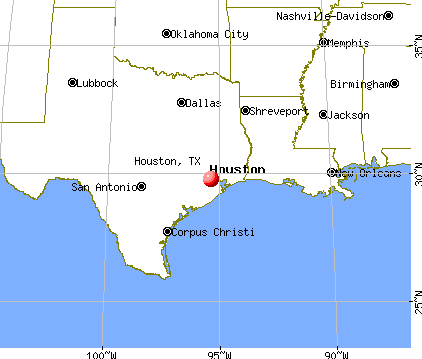

Latitude: 29.76 N, Longitude: 95.38 W

Daytime population change due to commuting: +741,597 (+32.2%)

Workers who live and work in this city: 925,566 (81.2%)

Area codes: 281, 832, 713

Property values in Houston, TX

Detailed articles:

- Houston: Introduction

- Houston Basic Facts

- Houston: Communications

- Houston: Convention Facilities

- Houston: Economy

- Houston: Education and Research

- Houston: Geography and Climate

- Houston: Health Care

- Houston: History

- Houston: Municipal Government

- Houston: Population Profile

- Houston: Recreation

- Houston: Transportation

Houston tourist attractions:

- The Alley Theatre in Houston

- Almeda Mall - Houston, TX

- Houston Museum District a Cultural Mecca for All Ages

- Bayou Place in Houston

- Children's Museum of Houston

- Cockrell Butterfly Center in Houston

- Downtown Aquarium in Houston

- George Bush Intercontinental Airport in Houston

- George R. Brown Convention Center in Houston

- Greenspoint Mall, Houston, TX

- Greenspoint Mall - Houston, TX - Large shopping mall

- Hermann Park in Houston

- Hobby Center for the Performing Arts in Houston

- Hotel Granduca in Houston

- Houston Aquarium in Houston, Texas

- Houston Arboretum and Nature Center

- Houston Museum of Natural Science

- Houston Zoo

- Johnson Space Center/Space Center Houston

- JPMorgan Chase Tower in Houston

- The Kingwood Neighborhood in Texas; Planned Community with Wide Open feel

- Market Square Historic District in Houston

- Memorial Park in Houston

- Midtown - Trendy and Pedestrian Friendly in Houston

- Minute Maid Park in Houston

- Museum of Fine Arts in Houston

- Museum of Health and Medical Science in Houston

- Sheraton Suites Houston Near The Galleria

- Hyatt Regency Houston

- Hilton Americas Houston

- Marriott Houston Airport at George Bush Intercontinental

- Four Seasons Hotel Houston

- Westin Galleria Houston

- JW Marriott on Westheimer by the Galleria

- Renaissance Houston Hotel Greenway Plaza

- Houston Marriott West Loop by the Galleria

- Hotel Derek

- Magnolia Hotel Houston

- Omni Houston Hotel

- Inn at the Ballpark

- Westin Oaks

- Crowne Plaza Houston Downtown

- Alden-Houston

- Doubletree Guest Suites Houston

- Hilton Houston Post Oak

- Memorial City Mall

- Omni Houston Hotel Westside

- Indigo Houston at the Galleria

- Doubletree Hotel Houston Downtown

- Sheraton North Houston at George Bush Intercontinental

- Reliant Stadium in Houston

- Rice University Art Gallery, Houston, TX

- River Oaks Neighborhood, Houston, One of the Best Little Places to Live in Texas

- St. Regis Hotel in Houston

- The Astrodome

- The Galleria Shopping Mall in Houston

- The Houstonian Hotel

- The Uptown District in Houston

- The Toyota Center: Basketball, Hockey and Concerts in Houston

- William P Hobby Airport - Houston TX - Houston Hobby Flights Airfield

Houston, Texas accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 6800 buildings, average cost: $294,300

- 2021: 7146 buildings, average cost: $235,000

- 2020: 5923 buildings, average cost: $219,600

- 2019: 5120 buildings, average cost: $237,000

- 2018: 5417 buildings, average cost: $235,200

- 2017: 5326 buildings, average cost: $230,300

- 2016: 4169 buildings, average cost: $233,700

- 2015: 5112 buildings, average cost: $224,500

- 2014: 5398 buildings, average cost: $213,300

- 2013: 5198 buildings, average cost: $203,600

- 2012: 3513 buildings, average cost: $194,900

- 2011: 2575 buildings, average cost: $181,500

- 2010: 2452 buildings, average cost: $175,600

- 2009: 2579 buildings, average cost: $179,300

- 2008: 3684 buildings, average cost: $173,500

- 2007: 6035 buildings, average cost: $164,800

- 2006: 7503 buildings, average cost: $155,300

- 2005: 7194 buildings, average cost: $144,300

- 2004: 6083 buildings, average cost: $135,200

- 2003: 5552 buildings, average cost: $129,500

- 2002: 4547 buildings, average cost: $125,800

- 2001: 4366 buildings, average cost: $137,500

- 2000: 4680 buildings, average cost: $158,800

- 1999: 4089 buildings, average cost: $161,400

- 1998: 3978 buildings, average cost: $155,400

- 1997: 3589 buildings, average cost: $142,400

| Here: | 4.2% |

| Texas: | 3.5% |

Population change in the 1990s: +246,383 (+14.4%).

- Construction (11.3%)

- Health care (9.5%)

- Professional, scientific, technical services (9.3%)

- Educational services (8.1%)

- Accommodation & food services (7.5%)

- Administrative & support & waste management services (6.5%)

- Finance & insurance (3.9%)

- Construction (19.1%)

- Professional, scientific, technical services (9.1%)

- Administrative & support & waste management services (5.9%)

- Accommodation & food services (5.8%)

- Educational services (4.8%)

- Health care (4.6%)

- Other transportation, support activities, couriers (4.0%)

- Health care (15.6%)

- Educational services (12.2%)

- Accommodation & food services (9.6%)

- Professional, scientific, technical services (9.6%)

- Administrative & support & waste management services (7.2%)

- Finance & insurance (4.6%)

- Public administration (3.0%)

- Other management occupations, except farmers and farm managers (5.7%)

- Cooks and food preparation workers (5.7%)

- Building and grounds cleaning and maintenance occupations (5.4%)

- Construction laborers (3.6%)

- Laborers and material movers, hand (3.5%)

- Computer specialists (2.7%)

- Driver/sales workers and truck drivers (2.6%)

- Construction laborers (6.2%)

- Other management occupations, except farmers and farm managers (6.0%)

- Driver/sales workers and truck drivers (4.4%)

- Building and grounds cleaning and maintenance occupations (4.2%)

- Laborers and material movers, hand (4.2%)

- Cooks and food preparation workers (4.1%)

- Computer specialists (3.9%)

- Cooks and food preparation workers (7.5%)

- Building and grounds cleaning and maintenance occupations (6.8%)

- Other management occupations, except farmers and farm managers (5.3%)

- Cashiers (3.8%)

- Nursing, psychiatric, and home health aides (3.6%)

- Laborers and material movers, hand (2.6%)

- Other office and administrative support workers, including supervisors (2.6%)

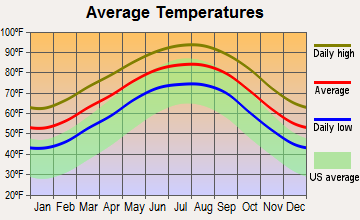

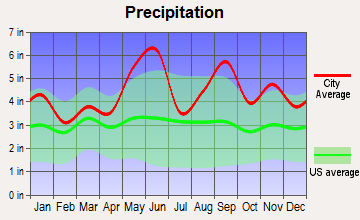

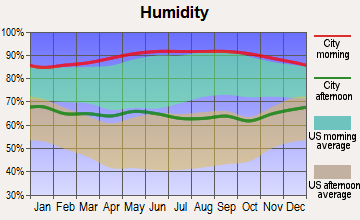

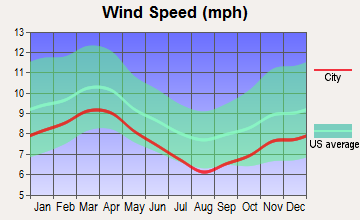

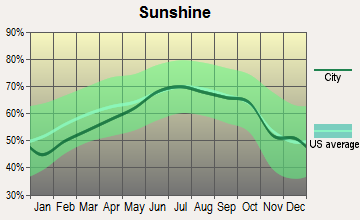

Average climate in Houston, Texas

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

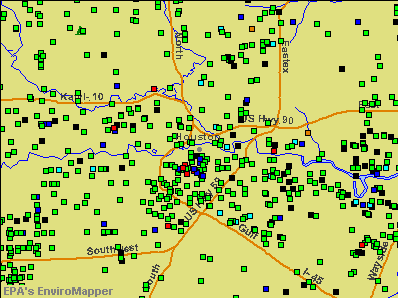

Air Quality Index (AQI) level in 2022 was 112. This is significantly worse than average.

| City: | 112 |

| U.S.: | 73 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.177. This is significantly better than average. Closest monitor was 1.7 miles away from the city center.

| City: | 0.177 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 9.74. This is significantly worse than average. Closest monitor was 0.8 miles away from the city center.

| City: | 9.74 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.242. This is significantly better than average. Closest monitor was 0.8 miles away from the city center.

| City: | 0.242 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 24.3. This is better than average. Closest monitor was 1.0 miles away from the city center.

| City: | 24.3 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 48.1. This is significantly worse than average. Closest monitor was 2.1 miles away from the city center.

| City: | 48.1 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 10.1. This is worse than average. Closest monitor was 1.5 miles away from the city center.

| City: | 10.1 |

| U.S.: | 8.1 |

Lead (Pb) [µg/m3] level in 2008 was 0.00590. This is significantly better than average. Closest monitor was 0.8 miles away from the city center.

| City: | 0.00590 |

| U.S.: | 0.00931 |

Tornado activity:

Houston-area historical tornado activity is slightly above Texas state average. It is 87% greater than the overall U.S. average.

On 11/21/1992, a category F4 (max. wind speeds 207-260 mph) tornado 6.6 miles away from the Houston city center injured 16 people and caused between $50,000,000 and $500,000,000 in damages.

On 12/13/1977, a category F3 (max. wind speeds 158-206 mph) tornado 6.3 miles away from the city center killed one person and injured 40 people and caused between $5,000,000 and $50,000,000 in damages.

Earthquake activity:

Houston-area historical earthquake activity is significantly above Texas state average. It is 36% smaller than the overall U.S. average.On 5/17/2012 at 08:12:00, a magnitude 4.8 (4.8 MW, Depth: 3.1 mi, Class: Light, Intensity: IV - V) earthquake occurred 161.3 miles away from the city center

On 10/20/2011 at 12:24:41, a magnitude 4.8 (4.8 MW, Depth: 3.1 mi) earthquake occurred 174.0 miles away from the city center

On 9/2/2013 at 23:51:15, a magnitude 4.3 (4.3 MW, Depth: 2.9 mi) earthquake occurred 158.9 miles away from Houston center

On 4/9/1993 at 12:29:19, a magnitude 4.3 (4.1 MB, 4.3 LG, Depth: 3.1 mi) earthquake occurred 178.0 miles away from the city center

On 9/2/2013 at 21:52:38, a magnitude 4.2 (4.2 MW, Depth: 3.0 mi) earthquake occurred 160.6 miles away from the city center

On 1/25/2013 at 07:01:19, a magnitude 4.1 (4.1 MB, Depth: 3.1 mi) earthquake occurred 157.7 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Harris County (32) is a lot greater than the US average (15).Major Disasters (Presidential) Declared: 22

Emergencies Declared: 6

Causes of natural disasters: Storms: 16, Floods: 15, Hurricanes: 9, Tornadoes: 7, Tropical Storms: 4, Fires: 2, Winds: 2, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: T-3 ENERGY SERVICES INC (BOLTS, NUTS, SCREWS, RIVETS & WASHERS), OYO GEOSPACE CORP (MEASURING & CONTROLLING DEVICES, NEC), FIRST INVESTORS FINANCIAL SERVICES GROUP INC (PERSONAL CREDIT INSTITUTIONS), BAKER HUGHES INC (OIL & GAS FILED MACHINERY & EQUIPMENT), COMSYS IT PARTNERS INC (SERVICES-HELP SUPPLY SERVICES), DIAMOND OFFSHORE DRILLING INC (DRILLING OIL & GAS WELLS), SYNAGRO TECHNOLOGIES INC (REFUSE SYSTEMS), WCA WASTE CORP (REFUSE SYSTEMS) and 189 other public companies.

Hospitals in Houston:

- 1801 BRANARD (1801 BRANARD ST)

- BETTYS HOME I I (7810 HUMMINGBIRD)

- CYPRESS FAIRBANKS MEDICAL CENTER (Proprietary, provides emergency services, 10655 STEEPLETOP DRIVE)

- FAITH HOSPICE CARE INC (9896 BISSONNET SUITE 360)

- HEARTHSTONE (7206 BENWICH CIRCLE)

- INSTUTUTE FOR REHAB AND RESEARCH,THE (1333 MOURSUND AVE)

- MEMORIAL HERMANN HOSPICE (16538 AIR CENTER BLVD SUITE 200)

- PARK PLAZA HOSPITAL (Proprietary, 1313 HERMANN DR)

- SPRING BRANCH MEDICAL CENTER (8850 LONG POINT ROAD)

- TWELVE OAKS HOSPITAL (4200 PORTSMOUTH)

- WOODEDGE (11914 GREEN CREEK CIRCLE)

Airports and heliports located in Houston:

- George Bush Intercontinental/Houston Airport (IAH) (Runways: 5, Commercial Ops: 311,864, Air Taxi Ops: 222,045, Itinerant Ops: 13,173, Military Ops: 327)

- William P Hobby Airport (HOU) (Runways: 4, Commercial Ops: 114,137, Air Taxi Ops: 33,075, Itinerant Ops: 56,313, Military Ops: 8,595)

- David Wayne Hooks Memorial Airport (DWH) (Runways: 3, Commercial Ops: 350, Air Taxi Ops: 5,703, Itinerant Ops: 87,930, Local Ops: 82,394, Military Ops: 3,194)

- West Houston Airport (IWS) (Runways: 1, Air Taxi Ops: 1,000, Itinerant Ops: 32,000, Local Ops: 70,000)

- Ellington Airport (EFD) (Runways: 3, Commercial Ops: 2,261, Air Taxi Ops: 9,638, Itinerant Ops: 37,939, Local Ops: 20,428, Military Ops: 26,848)

- Weiser Air Park Airport (EYQ) (Runways: 2, Itinerant Ops: 2,000, Local Ops: 36,000)

- Houston Executive Airport (TME) (Runways: 1, Itinerant Ops: 7,800, Local Ops: 9,000)

- North Houston Airport (9X1) (Runways: 1, Itinerant Ops: 4,000, Local Ops: 6,000)

- Dan Jones International Airport (T51) (Runways: 1, Itinerant Ops: 2,400, Local Ops: 5,400)

- Houston Fort Bend Airport (2H5) (Runways: 1, Itinerant Ops: 200)

- Flyin' B Airport (39R) (Runways: 1)

- Heliports: 83

Biggest Colleges/Universities in Houston:

- Houston Community College (Full-time enrollment: 38,303; Location: 3100 Main Street; Public; Website: www.hccs.edu)

- University of Houston (Full-time enrollment: 31,888; Location: 212 E. Cullen Building; Public; Website: www.uh.edu/students; Offers Doctor's degree)

- University of Houston-Downtown (Full-time enrollment: 10,122; Location: 1 Main Street; Public; Website: www.uhd.edu; Offers Master's degree)

- Texas Southern University (Full-time enrollment: 7,053; Location: 3100 Cleburne St; Public; Website: www.tsu.edu; Offers Doctor's degree)

- Rice University (Full-time enrollment: 6,713; Location: 6100 S Main; Private, not-for-profit; Website: www.rice.edu; Offers Doctor's degree)

- University of Houston-Clear Lake (Full-time enrollment: 5,833; Location: 2700 Bay Area Blvd; Public; Website: prtl.uhcl.edu/portal/page/portal/HOMEPAGE; Offers Doctor's degree)

- Universal Technical Institute of Texas Inc. (Full-time enrollment: 3,236; Location: 721 Lock Haven Dr.; Private, for-profit; Website: www.uti.edu)

- The University of Texas Health Science Center at Houston (Full-time enrollment: 3,023; Location: 7000 Fannin; Public; Website: www.uth.edu/; Offers Doctor's degree)

- University of St Thomas (Full-time enrollment: 2,747; Location: 3800 Montrose Blvd; Private, not-for-profit; Website: www.stthom.edu; Offers Doctor's degree)

- The Art Institute of Houston (Full-time enrollment: 2,429; Location: River Oaks Plaza, 4140 Southwest Freeway; Private, for-profit; Website: www.aih.aii.edu)

- Houston Baptist University (Full-time enrollment: 2,340; Location: 7502 Fondren Rd; Private, not-for-profit; Website: www.hbu.edu; Offers Master's degree)

- University of Phoenix-Houston Campus (Full-time enrollment: 1,610; Location: 11451 Katy Freeway; Private, for-profit; Website: www.phoenix.edu; Offers Master's degree)

- Everest Institute-Bissonnet (Full-time enrollment: 1,374; Location: 9700 Bissonnet St-Ste 1400; Private, for-profit; Website: www.everest.edu/campus/houston_bissonnet)

- College of Health Care Professions-Northwest (Full-time enrollment: 1,077; Location: 240 Northwest Mall; Private, for-profit; Website: www.chcp.edu)

- Pima Medical Institute-Houston (Full-time enrollment: 944; Location: 10201 Katy Freeway; Private, for-profit; Website: pmi.edu)

- Fortis College-Houston (Full-time enrollment: 866; Location: 6220 Westpark, Suite 180; Private, for-profit; Website: www.fortiscollege.edu)

- Remington College-North Houston Campus (Full-time enrollment: 817; Location: 11310 Greens Crossing Blvd, Ste 300; Private, not-for-profit; Website: www.remingtoncollege.edu/north-houston-texas-colleges)

- Texas School of Business-North Campus (Full-time enrollment: 788; Location: 711 East Airtex Dr; Private, for-profit; Website: www.tsb.edu/houston-tx/)

- Everest Institute-Hobby (Full-time enrollment: 781; Location: 7151 Office City Dr; Private, for-profit; Website: www.everest.edu/campus/houston_hobby)

- Baylor College of Medicine (Full-time enrollment: 778; Location: One Baylor Plaza; Private, not-for-profit; Website: www.bcm.edu; Offers Doctor's degree)

Biggest public high schools in Houston:

- NORTH SHORE SENIOR HIGH (Students: 4,469, Location: 353 N CASTLEGORY, Grades: 9-12)

- HASTINGS H S (Students: 4,233, Location: 4410 COOK RD, Grades: 9-12)

- ELSIK H S (Students: 4,166, Location: 12601 HIGH STAR, Grades: 9-12)

- KLEIN FOREST H S (Students: 3,474, Location: 11400 MISTY VLY, Grades: 9-12)

- DOBIE H S (Students: 3,452, Location: 10220 BLACKHAWK, Grades: 9-12)

- CLEAR LAKE H S (Students: 3,446, Location: 2929 BAY AREA BLVD, Grades: 9-12)

- CYPRESS FALLS H S (Students: 3,360, Location: 9811 HUFFMEISTER RD, Grades: 9-12)

- CYPRESS CREEK H S (Students: 3,293, Location: 9815 GRANT RD, Grades: 9-12)

- WESTFIELD H S (Students: 3,222, Location: 16713 ELLA BLVD, Grades: 9-12)

- LANGHAM CREEK H S (Students: 3,143, Location: 17610 FM 529, Grades: 9-12)

Biggest private high schools in Houston:

- THE KINKAID SCHOOL (Students: 1,379, Location: 201 KINKAID SCHOOL DR, Grades: PK-12)

- THE AWTY INTERNATIONAL SCHOOL (Students: 1,296, Location: 7455 AWTY SCHOOL LN, Grades: PK-12)

- ST JOHNS LOWER SCHOOL (Students: 1,258, Location: 2401 CLAREMONT LN, Grades: KG-12)

- THE VILLAGE SCHOOL (Students: 1,100, Location: 13077 WESTELLA DR, Grades: PK-12)

- STRAKE JESUIT COLLEGE PREP SCHOOL (Students: 903, Location: 8900 BELLAIRE BLVD, Grades: 9-12, Boys only)

- ST AGNES ACADEMY SCHOOL (Students: 871, Location: 9000 BELLAIRE BLVD, Grades: 9-12, Girls only)

- LUTHERAN SOUTH ACADEMY (Students: 761, Location: 12555 RYEWATER DR, Grades: PK-12)

- ST THOMAS HIGH SCHOOL (Students: 740, Location: 4500 MEMORIAL DR, Grades: 9-12, Boys only)

- ST PIUS X HIGH SCHOOL (Students: 660, Location: 811 W DONOVAN ST, Grades: 9-12)

- ST THOMAS EPISCOPAL SCHOOL (Students: 620, Location: 4900 JACKWOOD ST, Grades: KG-12)

Biggest public elementary/middle schools in Houston:

- PERSHING MIDDLE (Students: 1,748, Location: 3838 BLUE BONNET, Grades: 6-8)

- ARAGON MIDDLE (Students: 1,658, Location: 16823 W RD, Grades: 6-8)

- HARTMAN MIDDLE (Students: 1,597, Location: 7111 WESTOVER, Grades: 6-8)

- BLEYL MIDDLE (Students: 1,551, Location: 10800 MILLS RD, Grades: 6-8)

- LABAY MIDDLE (Students: 1,528, Location: 15435 WILLOW RIVER DR, Grades: 6-8)

- COOK MIDDLE (Students: 1,435, Location: 9111 WHEATLAND DR, Grades: 6-8)

- DOWLING MIDDLE (Students: 1,432, Location: 14000 STANCLIFF ST, Grades: 6-8)

- JOHNSTON MIDDLE (Students: 1,426, Location: 10410 MANHATTAN DR, Grades: 6-8)

- CAMPBELL MIDDLE (Students: 1,407, Location: 11415 BOBCAT DR, Grades: 6-8)

- WUNDERLICH INT (Students: 1,393, Location: 11800 MISTY VLY, Grades: 6-8)

Biggest private elementary/middle schools in Houston:

- RIVER OAKS BAPTIST SCHOOL (Students: 852, Location: 2300 WILLOWICK RD, Grades: PK-8)

- ST FRANCIS EPISCOPAL DAY SCHOOL (Students: 846, Location: 335 PINEY POINT RD, Grades: PK-8)

- JOHN PAUL II CATHOLIC SCHOOL (Students: 716, Location: 1400 PARKWAY PLAZA DR, Grades: PK-8)

- ANNUNCIATION ORTHODOX SCHOOL (Students: 715, Location: 3600 YOAKUM BLVD, Grades: PK-8)

- ST CECILIA CATHOLIC SCHOOL (Students: 599, Location: 11740 JOAN OF ARC DR, Grades: PK-8)

- ST ELIZABETH ANN SETON SCHOOL (Students: 551, Location: 6646 ADDICKS SATSUMA RD, Grades: PK-8)

- ST THOMAS MORE PARISH SCHOOL (Students: 543, Location: 5927 WIGTON DR, Grades: PK-8)

- PRESBYTERIAN SCHOOL (Students: 522, Location: 5300 MAIN ST, Grades: PK-8)

- ST VINCENT DE PAUL SCHOOL (Students: 513, Location: 6802 BUFFALO SPEEDWAY, Grades: PK-8)

- ST ANNE CATHOLIC SCHOOL (Students: 489, Location: 2120 WESTHEIMER RD, Grades: PK-8)

Libraries in Houston:

- HOUSTON PUBLIC LIBRARY (Operating income: $37,992,509; Location: 500 MCKINNEY ST; 2,515,779 books; 5,349 e-books; 134,493 audio materials; 99,054 video materials; 82 local licensed databases; 50 state licensed databases; 8,194 print serial subscriptions; 1,900 electronic serial subscriptions)

- HARRIS COUNTY PUBLIC LIBRARY (Operating income: $25,397,907; Location: 8080 EL RIO ST; 1,840,576 books; 62,475 e-books; 92,164 audio materials; 121,758 video materials; 19 local licensed databases; 50 state licensed databases; 57 other licensed databases; 3,443 print serial subscriptions)

User-submitted facts and corrections:

- Houston is also home to Mr Brent Spiner , of Star Trek fame.

Points of interest:

Notable locations in Houston: Eureka Yard (A), Atascocita Country Club (B), Blue Ridge State Prison Farm (C), Brae Burn Country Club (D), Champion Rod and Gun Club (E), Executive Golf Club (F), Glenbrook Park Golf Course (G), Golfcrest Country Club (H), Meyers Speedway (I), Sharpstown Country Club (J), South Main Golf Club (K), Westwood Country Club (L), Eldorado Golf Club (M), Camp Hudson (N), Chaney Yard (O), Englewood Yards (P), Fauna (Q), Grady Street Yard (R), Hardy Street Yard (S), Hester House (T). Display/hide their locations on the map

Shopping Centers: Jester Village Shopping Center (1), Katy Reed Shopping Center (2), Long Point Plaza Shopping Center (3), Memorial City Shopping Center (4), Northline Shopping Center (5), Northtown Plaza Shopping Center (6), Nottingham Shopping Center (7), River Oaks Shopping Center (8), Spring Valley Shopping Center (9). Display/hide their locations on the map

Main business address in Houston include: T-3 ENERGY SERVICES INC (A), OYO GEOSPACE CORP (B), FIRST INVESTORS FINANCIAL SERVICES GROUP INC (C), BAKER HUGHES INC (D), COMSYS IT PARTNERS INC (E), DIAMOND OFFSHORE DRILLING INC (F), SYNAGRO TECHNOLOGIES INC (G), WCA WASTE CORP (H). Display/hide their locations on the map

Churches in Houston include: Doverside Baptist Church (A), Dixie Drive Baptist Church (B), Deliverance Missionary Baptist Church (C), Cornerstone Missionary Baptist Church (D), Community Missionary Baptist Church (E), Community Baptist Church of Houston (F), Community Baptist Church (G), Colonial Street Missionary Baptist Church (H), College Park Baptist Church (I). Display/hide their locations on the map

Cemeteries: Beth El Cemetery (1), Alief Cemetery (2), Beth Jacob Cemetery (3), Saint Joseph Cemetery (4), Adath Yeshurun Cemetery (5), Adath Israel Cemetery (6), Adath Emeth Cemetery (7). Display/hide their locations on the map

Lakes, reservoirs, and swamps: Lake Rittenhouse (A), Browns Lake (B), Big Eddy (C), Bosman Lake (D), Barker Reservoir (E), Houston Heights Waterworks Reservoir (F), Addicks Reservoir (G), Nelson Reservoir (H). Display/hide their locations on the map

Streams, rivers, and creeks: Briar Branch (A), Willow Waterhole Bayou (B), White Oak Creek (C), Bear Creek (D), Spring Creek (E), Sims Bayou (F), Plum Creek (G), Mills Branch (H), Mason Creek (I). Display/hide their locations on the map

Parks in Houston include: Levy Park (1), LInkwood Park (2), Alexander Deussen Park (3), Hartman Park (4), Lafayette Park (5), Young Park (6), Yellowstone Park (7), Hager Park (8), John T Mason Park (9). Display/hide their locations on the map

Tourist attractions: APT Galerie d' Art (Museums; 5234 Elm) (1), Byzantine Fresco Chapel Museum (4011 Yupon Street) (2), A FS Training (Museums; 415 Barren Springs Drive) (3), Buffalo Soldier National Museum & Heritage Center (1834 Southmore Boulevard) (4), Bayou Bend Collection and Gardens (Museums; 1 Westcott Street) (5), Collectors Shop At The Houston Museum Of Natural Science (One Hermann Circle Drive) (6), Art Car Museum (140 Heights Boulevard) (7), Children's Museum of Houston (1500 Binz Street) (8), CY Twombly Gallery (Cultural Attractions- Events- & Facilities; 1515 Sul Ross Street) (9). Display/hide their approximate locations on the map

Hotels: Capital Inn (4601 Yellowstone Boulevard) (1), Bradford Homesuites - Houston Galleria (3440 Sage Rd) (2), Best Western Fountainview Inn and Suites (6229 Richmond Avenue) (3), Best Western Houston Htl Stes (7625 Katy Freeway) (4), Bradford Homesuites Houston Park 10 West (15405 Katy Freeway) (5), City Limit Motel (11922 Hempstead Road) (6), Best Western Westchase Mini (2950 West Sam Houston Parkway) (7), Camelot Inn and Suites (10807 Veterans Memorial Drive) (8), Four Seasons Hotel Houston (1300 Lamar Street) (9). Display/hide their approximate locations on the map

Courts: State Securities Board (1919 North Loop West Suite 660) (1), South Houston-City - Municipal Court (1019 Dallas Street) (2), Harris County - Courthouse Annex- Sheriff's Office- Clay Road Courthouse A (16715 Clay Road) (3), Bunker Hill Village - Municipal Court (11977 Memorial Drive) (4), Hedwig Village-City - City Hall And Municipal Court (955 Piney Point Road) (5), Augusta Court (1819 Augusta Drive) (6). Display/hide their approximate locations on the map

Birthplace of: David Koresh - Religious leader, Kaitlyn (wrestler) - Professional wrestler and model, Marcus Luttrell - Recipient of the Purple Heart medal, Barbara Mandrell - Singer, Juan Díaz (boxer) - Mexican professional boxer, Devendra Banhart - Folk singer, David Cook (singer) - Alternative rock musician, Leonard L. Northrup Jr. - Soilder, James Baker - (born 1930), politician, Isaiah Washington - Actor.

Drinking water stations with addresses in Houston and their reported violations in the past:

BRIDGESTONE MUD (Population served: 16,557, Groundwater):Past monitoring violations:CHELFORD CITY MUD (Population served: 8,478, Groundwater):

- Lead Consumer Notice - In DEC-30-2013, Contaminant: Lead and Copper Rule. Follow-up actions: St Compliance achieved (MAY-14-2014)

- 2 minor monitoring violations

Past monitoring violations:BIG OAKS MUD (Population served: 6,381, Purch surface water):

- 3 regular monitoring violations

Past monitoring violations:BARKER CYPRESS MUD (Population served: 6,153, Purch surface water):

- Lead Consumer Notice - In DEC-30-2013, Contaminant: Lead and Copper Rule. Follow-up actions: St Compliance achieved (AUG-14-2014)

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2013, Contaminant: Lead and Copper Rule. Follow-up actions: St Compliance achieved (AUG-08-2014)

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2011, Contaminant: Lead and Copper Rule. Follow-up actions: St Compliance achieved (AUG-08-2014)

Past monitoring violations:BILMA PUD (Population served: 4,839, Groundwater):

- Initial Tap Sampling for Pb and Cu - In JAN-01-2012, Contaminant: Lead and Copper Rule. Follow-up actions: St Compliance achieved (NOV-06-2013)

- Initial Tap Sampling for Pb and Cu - In JUL-01-2011, Contaminant: Lead and Copper Rule. Follow-up actions: St Compliance achieved (NOV-06-2013)

- Initial Tap Sampling for Pb and Cu - In JAN-01-2011, Contaminant: Lead and Copper Rule. Follow-up actions: St Compliance achieved (NOV-06-2013)

- Initial Tap Sampling for Pb and Cu - In JUL-01-2010, Contaminant: Lead and Copper Rule. Follow-up actions: St Compliance achieved (NOV-06-2013)

Past monitoring violations:CHELFORD ONE MUD (Population served: 4,701, Groundwater):

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2011, Contaminant: Lead and Copper Rule. Follow-up actions: St Compliance achieved (NOV-07-2013)

Past monitoring violations:BRAZORIA COUNTY MUD 3 (Population served: 4,476, Purch groundwater):

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2013, Contaminant: Lead and Copper Rule

Past monitoring violations:ADDICKS UTILITY DISTRICT (Population served: 3,831, Purch surface water):

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2011, Contaminant: Lead and Copper Rule. Follow-up actions: St Compliance achieved (NOV-06-2013)

Past monitoring violations:

- 4 minor monitoring violations

Drinking water stations with addresses in Houston that have no violations reported:

- BISSONNET MUD (Population served: 7,929, Primary Water Source Type: Groundwater)

- BLUE RIDGE WEST MUD (Population served: 7,482, Primary Water Source Type: Groundwater)

- BRAZORIA COUNTY MUD 6 (Population served: 7,407, Primary Water Source Type: Purch groundwater)

- CHARTERWOOD MUD (Population served: 5,526, Primary Water Source Type: Groundwater)

- BRAZORIA COUNTY MUD 21 (Population served: 4,488, Primary Water Source Type: Groundwater)

- CHAMBERS COUNTY MUD 1 (Population served: 2,718, Primary Water Source Type: Purch surface water)

- BAMMEL UTILITY DISTRICT (Population served: 2,571, Primary Water Source Type: Groundwater)

- CASTLEWOOD MUD (Population served: 1,980, Primary Water Source Type: Groundwater)

- BAMMEL FOREST UTILITY COMPANY (Population served: 1,035, Primary Water Source Type: Purch groundwater)

- BAKER ROAD MUD (Population served: 975, Primary Water Source Type: Purch groundwater)

| This city: | 2.6 people |

| Texas: | 2.8 people |

| This city: | 61.5% |

| Whole state: | 69.9% |

| This city: | 7.0% |

| Whole state: | 6.0% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.4% of all households

- Gay men: 0.6% of all households

People in group quarters in Houston in 2010:

- 10,104 people in college/university student housing

- 9,331 people in local jails and other municipal confinement facilities

- 4,778 people in nursing facilities/skilled-nursing facilities

- 3,802 people in other noninstitutional facilities

- 2,213 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 1,728 people in federal detention centers

- 1,223 people in state prisons

- 1,185 people in residential treatment centers for adults

- 1,001 people in group homes intended for adults

- 519 people in workers' group living quarters and job corps centers

- 514 people in correctional residential facilities

- 245 people in mental (psychiatric) hospitals and psychiatric units in other hospitals

- 181 people in correctional facilities intended for juveniles

- 103 people in group homes for juveniles (non-correctional)

- 73 people in residential treatment centers for juveniles (non-correctional)

- 40 people in hospitals with patients who have no usual home elsewhere

- 27 people in in-patient hospice facilities

- 4 people in maritime/merchant vessels

People in group quarters in Houston in 2000:

- 8,725 people in local jails and other confinement facilities (including police lockups)

- 5,774 people in nursing homes

- 4,305 people in college dormitories (includes college quarters off campus)

- 3,868 people in other noninstitutional group quarters

- 2,437 people in other group homes

- 1,266 people in homes or halfway houses for drug/alcohol abuse

- 1,146 people in federal prisons and detention centers

- 666 people in other nonhousehold living situations

- 660 people in religious group quarters

- 659 people in state prisons

- 524 people in halfway houses

- 413 people in schools, hospitals, or wards for the intellectually disabled

- 406 people in homes for the mentally ill

- 343 people in short-term care, detention or diagnostic centers for delinquent children

- 286 people in hospitals/wards and hospices for chronically ill

- 279 people in other workers' dormitories

- 258 people in other hospitals or wards for chronically ill

- 233 people in homes for the physically handicapped

- 200 people in wards in general hospitals for patients who have no usual home elsewhere

- 192 people in homes for the mentally retarded

- 169 people in orthopedic wards and institutions for the physically handicapped

- 144 people in mental (psychiatric) hospitals or wards

- 142 people in hospitals or wards for drug/alcohol abuse

- 134 people in homes for abused, dependent, and neglected children

- 106 people in unknown juvenile institutions

- 88 people in agriculture workers' dormitories on farms

- 49 people in residential treatment centers for emotionally disturbed children

- 37 people in crews of maritime vessels

- 28 people in hospices or homes for chronically ill

- 3 people in other types of correctional institutions

- 2 people in wards in military hospitals for patients who have no usual home elsewhere

Arenas or stadiums:

- Reliant Stadium. Capacity: 72,000. Houston Texans.

- Rice Stadium. Capacity: 70,000. Rice Owls.

- Minute Maid Park. Capacity: 40,950. Houston Astros.

- Toyota Center (Houston). Houston Rockets (NBA), Houston Comets (WNBA).

- Hofheinz Pavilion. University of Houston.

- Robertson Stadium. University of Houston.

Banks with most branches in Houston (2011 data):

- JPMorgan Chase Bank, National Association: 141 branches. Info updated 2011/11/10: Bank assets: $1,811,678.0 mil, Deposits: $1,190,738.0 mil, headquarters in Columbus, OH, positive income, International Specialization, 5577 total offices, Holding Company: Jpmorgan Chase & Co.

- Wells Fargo Bank, National Association: 101 branches. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- Bank of America, National Association: 66 branches. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- Comerica Bank: 39 branches. Info updated 2011/07/29: Bank assets: $60,970.5 mil, Deposits: $48,300.9 mil, headquarters in Dallas, TX, positive income, Commercial Lending Specialization, 497 total offices, Holding Company: Comerica Incorporated

- Compass Bank: 36 branches. Info updated 2011/02/24: Bank assets: $63,107.0 mil, Deposits: $46,232.4 mil, headquarters in Birmingham, AL, negative income in the last year, Commercial Lending Specialization, 720 total offices, Holding Company: Banco Bilbao Vizcaya Argentaria, S.A.

- Amegy Bank National Association: 32 branches. Info updated 2007/09/24: Bank assets: $12,197.6 mil, Deposits: $9,733.2 mil, local headquarters, positive income, Commercial Lending Specialization, 97 total offices, Holding Company: Zions Bancorporation

- First National Bank Texas: 30 branches. Info updated 2006/11/03: Bank assets: $944.3 mil, Deposits: $815.9 mil, headquarters in Killeen, TX, positive income, Mortgage Lending Specialization, 250 total offices, Holding Company: First Community Bancshares, Inc.

- Prosperity Bank: 27 branches. Info updated 2012/01/05: Bank assets: $9,816.2 mil, Deposits: $8,064.8 mil, headquarters in El Campo, TX, positive income, Mortgage Lending Specialization, 187 total offices, Holding Company: Prosperity Bancshares, Inc.

- Capital One, National Association: 26 branches. Info updated 2011/07/01: Bank assets: $133,477.8 mil, Deposits: $97,063.7 mil, headquarters in Mclean, VA, positive income, 984 total offices, Holding Company: Capital One Financial Corporation

- 72 other banks with 257 local branches

For population 15 years and over in Houston:

- Never married: 43.0%

- Now married: 40.9%

- Separated: 2.5%

- Widowed: 4.3%

- Divorced: 9.3%

For population 25 years and over in Houston:

- High school or higher: 79.7%

- Bachelor's degree or higher: 35.6%

- Graduate or professional degree: 14.9%

- Unemployed: 5.1%

- Mean travel time to work (commute): 23.9 minutes

| Here: | 18.6 |

| Texas average: | 14.0 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Houston:

(Houston, Texas Neighborhood Map)- Acres Homes neighborhood

- Alden Bridge (Village of Alden Bridge) neighborhood

- Alief neighborhood

- Allendale (Meadowbrook) neighborhood

- Astrodome neighborhood

- Belle Court neighborhood

- Binz neighborhood

- Braeburn (Braeburn Valley) neighborhood

- Braesview Terrace (Braesview Terrace/Braesmont Addition) neighborhood

- Braeswood Place neighborhood

- Briar Forest neighborhood

- Briar Meadow (Woodlake) neighborhood

- Central Southwest neighborhood

- Clear Lake neighborhood

- Clinton Park (Fidelity) neighborhood

- Cochran's Crossing' (Cochran's Crossing Village) neighborhood

- College Court Place neighborhood

- College Park (Village of College Park) neighborhood

- Colonial Terrace neighborhood

- Creekside Park (Village of Creekside Park) neighborhood

- Cunningham Terrace neighborhood

- Dorado (Oats Prairie) neighborhood

- Downtown neighborhood

- East End neighborhood

- East Houston neighborhood

- East Little York (Homestead) neighborhood

- Eastwood neighborhood

- Edgebrook neighborhood

- Eldridge (West Oaks) neighborhood

- Fairbanks (Northwest Crossing) neighborhood

- Fifth Ward neighborhood

- Fondren Gardens neighborhood

- Fondren Park neighborhood

- Fondren Southwest neighborhood

- Fonmeadow neighborhood

- Forth Ward (Freedman's Town) neighborhood

- Garden Oaks (Oak Forest) neighborhood

- George Bush International Airport (Airport) neighborhood

- Golfcrest (Reveille) neighborhood

- Greater Heights neighborhood

- Greater Hobby neighborhood

- Greater Inwood neighborhood

- Greenspoint neighborhood

- Grogan's Mill (Village of Grogan's Mill) neighborhood

- Gulfgate (Pine Valley) neighborhood

- Gulfton (Wesrmoreland Farms) neighborhood

- Harrisburg (Manchester) neighborhood

- Herman Park neighborhood

- Hidden Valley neighborhood

- Houston Heights (The Heights) neighborhood

- Huntwood neighborhood

- Independence Heights neighborhood

- Jensen neighborhood

- Kashmere Gardens neighborhood

- Langwood neighborhood

- Lazy Brook (Timbergrove) neighborhood

- Macgregor neighborhood

- Magnolia Park neighborhood

- Medical Center neighborhood

- Memorial neighborhood

- Memorial Park neighborhood

- Midtown neighborhood

- Minnetex neighborhood

- Monticello neighborhood

- Montrose neighborhood

- Museum District neighborhood

- Myerland neighborhood

- Neartown neighborhood

- North Shore neighborhood

- Northside (Northline) neighborhood

- Northside Village neighborhood

- Panther Creek (Village of Panther Creek) neighborhood

- Park Place neighborhood

- Park Ten (Addicks) neighborhood

- Pecan Park neighborhood

- Pemberton neighborhood

- Pleasantville neighborhood

- Port Houston (Denver Harbor) neighborhood

- Research Forest neighborhood

- Rice Court neighborhood

- Rice Village (Rice Court) neighborhood

- Richmond Plaza neighborhood

- River Oaks neighborhood

- Second Ward neighborhood

- Settegast neighborhood

- Sharpstown neighborhood

- South Acres (Crestmont Parl) neighborhood

- South Main neighborhood

- South Main Gardens neighborhood

- South Park neighborhood

- South Union (Old Spanish Trail) neighborhood

- Southbelt (Ellington) neighborhood

- Spring neighborhood

- Spring Branch neighborhood

- Spring Branch Central neighborhood

- Spring Branch East neighborhood

- Spring Branch West neighborhood

- Spring Shadows neighborhood

- Sterling Ridge (Village of Sterling Ridge) neighborhood

- Sunnyside neighborhood

- Sunset Terrace neighborhood

- The Villages neighborhood

- Third Ward neighborhood

- Trinity (Houston Gardens) neighborhood

- University Place (South Grove) neighborhood

- Upper Kirby (Greenway) neighborhood

- Uptown (Galleria) neighborhood

- Virginia Court neighborhood

- Washington Ave. neighborhood

- Wayside (Lawndale) neighborhood

- West University Place (West University) neighborhood

- Westbury neighborhood

- Westchase neighborhood

- Westwood neighborhood

- Willow Bend (Willow Meadows) neighborhood

Religion statistics for Houston, TX (based on Harris County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 1,077,287 | 2,102 |

| Catholic | 741,896 | 109 |

| Mainline Protestant | 278,855 | 288 |

| Other | 213,212 | 296 |

| Black Protestant | 65,641 | 211 |

| Orthodox | 12,884 | 25 |

| None | 1,702,684 | - |

Food Environment Statistics:

| Harris County: | 1.88 / 10,000 pop. |

| Texas: | 1.47 / 10,000 pop. |

| Here: | 0.10 / 10,000 pop. |

| Texas: | 0.14 / 10,000 pop. |

| Harris County: | 1.35 / 10,000 pop. |

| Texas: | 1.11 / 10,000 pop. |

| This county: | 3.38 / 10,000 pop. |

| State: | 3.95 / 10,000 pop. |

| Harris County: | 5.88 / 10,000 pop. |

| Texas: | 6.13 / 10,000 pop. |

| Harris County: | 8.9% |

| Texas: | 8.9% |

| Harris County: | 26.0% |

| State: | 26.6% |

| This county: | 17.1% |

| Texas: | 15.7% |

Health and Nutrition:

| Here: | 48.3% |

| Texas: | 48.6% |

| This city: | 48.3% |

| Texas: | 47.4% |

| This city: | 28.3 |

| State: | 28.5 |

| This city: | 19.3% |

| Texas: | 20.6% |

| Houston: | 10.3% |

| Texas: | 10.3% |

| This city: | 6.7 |

| Texas: | 6.8 |

| Houston: | 32.0% |

| Texas: | 33.1% |

| Houston: | 56.7% |

| State: | 56.2% |

| Here: | 82.3% |

| State: | 80.7% |

More about Health and Nutrition of Houston, TX Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 5,742 | $43,995,514 | $91,945 | 0 | $0 |

| Firefighters | 3,652 | $21,488,715 | $70,609 | 0 | $0 |

| Other and Unallocable | 2,722 | $14,187,219 | $62,545 | 61 | $124,214 |

| Health | 1,192 | $6,266,442 | $63,085 | 104 | $253,061 |

| Airports | 1,086 | $5,667,825 | $62,628 | 7 | $23,188 |

| Police - Other | 1,050 | $4,893,536 | $55,926 | 1 | $3,122 |

| Financial Administration | 734 | $4,528,489 | $74,035 | 0 | $0 |

| Streets and Highways | 734 | $2,939,529 | $48,058 | 2 | $5,786 |

| Water Supply | 650 | $3,014,808 | $55,658 | 0 | $0 |

| Sewerage | 569 | $2,727,894 | $57,530 | 0 | $0 |

| Parks and Recreation | 561 | $2,201,937 | $47,100 | 97 | $119,096 |

| Other Government Administration | 543 | $3,347,697 | $73,982 | 17 | $38,605 |

| Judicial and Legal | 421 | $2,699,757 | $76,953 | 45 | $187,150 |

| Local Libraries | 415 | $1,719,424 | $49,718 | 27 | $74,218 |

| Solid Waste Management | 381 | $1,600,579 | $50,412 | 7 | $13,936 |

| Housing and Community Development (Local) | 266 | $1,642,506 | $74,098 | 0 | $0 |

| Fire - Other | 190 | $818,666 | $51,705 | 17 | $31,422 |

| Totals for Government | 20,908 | $123,740,534 | $71,020 | 385 | $873,799 |

Houston government finances - Expenditure in 2021 (per resident):

- Construction - Sewerage: $508,475,000 ($220.80)

Air Transportation: $279,252,000 ($121.26)

Water Utilities: $271,821,000 ($118.04)

General - Other: $110,242,000 ($47.87)

Regular Highways: $83,448,000 ($36.24)

Parks and Recreation: $32,233,000 ($14.00)

Libraries: $13,426,000 ($5.83)

Health - Other: $9,431,000 ($4.10)

Police Protection: $5,694,000 ($2.47)

Local Fire Protection: $2,592,000 ($1.13)

General Public Buildings: $1,898,000 ($0.82)

Central Staff Services: $669,000 ($0.29)

Parking Facilities: $241,000 ($0.10)

Solid Waste Management: $177,000 ($0.08)

Protective Inspection and Regulation - Other: $98,000 ($0.04)

Housing and Community Development: $86,000 ($0.04)

Judicial and Legal Services: $12,000 ($0.01)

Financial Administration: $8,000 ($0.00)

- Current Operations - Police Protection: $794,470,000 ($344.99)

Central Staff Services: $407,711,000 ($177.04)

Local Fire Protection: $403,256,000 ($175.11)

Sewerage: $258,160,000 ($112.10)

Air Transportation: $251,372,000 ($109.16)

General - Other: $250,571,000 ($108.81)

Health - Other: $243,631,000 ($105.79)

Water Utilities: $215,064,000 ($93.39)

Housing and Community Development: $200,636,000 ($87.12)

Regular Highways: $128,819,000 ($55.94)

Solid Waste Management: $85,117,000 ($36.96)

Protective Inspection and Regulation - Other: $68,305,000 ($29.66)

Financial Administration: $66,124,000 ($28.71)

Parks and Recreation: $65,788,000 ($28.57)

Judicial and Legal Services: $49,174,000 ($21.35)

General Public Buildings: $47,020,000 ($20.42)

Libraries: $37,544,000 ($16.30)

Parking Facilities: $8,325,000 ($3.62)

- General - Interest on Debt: $574,026,000 ($249.26)

- Intergovernmental to Local - Other - General - Other: $33,442,000 ($14.52)

Other - Sewerage: $174,000 ($0.08)

- Intergovernmental to State - Sewerage: $2,955,000 ($1.28)

Water Utilities: $1,267,000 ($0.55)

General - Other: $10,000 ($0.00)

- Other Capital Outlay - Sewerage: $24,851,000 ($10.79)

Police Protection: $24,632,000 ($10.70)

Air Transportation: $18,985,000 ($8.24)

General - Other: $17,476,000 ($7.59)

Local Fire Protection: $11,666,000 ($5.07)

Regular Highways: $9,976,000 ($4.33)

Water Utilities: $8,879,000 ($3.86)

Central Staff Services: $7,291,000 ($3.17)

Health - Other: $2,683,000 ($1.17)

Protective Inspection and Regulation - Other: $2,540,000 ($1.10)

Parks and Recreation: $885,000 ($0.38)

Solid Waste Management: $662,000 ($0.29)

Libraries: $634,000 ($0.28)

Financial Administration: $470,000 ($0.20)

Judicial and Legal Services: $168,000 ($0.07)

General Public Building: $155,000 ($0.07)

- Total Salaries and Wages: $4,316,000 ($1.87)

- Water Utilities - Interest on Debt: $83,673,000 ($36.33)

Houston government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $537,239,000 ($233.29)

Air Transportation: $391,368,000 ($169.95)

Other: $136,799,000 ($59.40)

Parks and Recreation: $24,639,000 ($10.70)

Solid Waste Management: $7,159,000 ($3.11)

Parking Facilities: $6,361,000 ($2.76)

Housing and Community Development: $2,240,000 ($0.97)

- Federal Intergovernmental - Housing and Community Development: $252,317,000 ($109.57)

Air Transportation: $212,087,000 ($92.10)

Health and Hospitals: $70,800,000 ($30.74)

Other: $48,763,000 ($21.17)

- Local Intergovernmental - Other: $77,907,000 ($33.83)

Health and Hospitals: $37,842,000 ($16.43)

- Miscellaneous - Special Assessments: $180,889,000 ($78.55)

Interest Earnings: $174,069,000 ($75.59)

General Revenue - Other: $49,230,000 ($21.38)

Fines and Forfeits: $24,448,000 ($10.62)

Sale of Property: $7,513,000 ($3.26)

Donations From Private Sources: $1,041,000 ($0.45)

Rents: $293,000 ($0.13)

Royalties: $32,000 ($0.01)

- Revenue - Water Utilities: $565,857,000 ($245.72)

- State Intergovernmental - Other: $251,443,000 ($109.19)

Health and Hospitals: $221,410,000 ($96.14)

Housing and Community Development: $107,897,000 ($46.85)

General Local Government Support: $14,630,000 ($6.35)

- Tax - Property: $1,626,367,000 ($706.23)

General Sales and Gross Receipts: $720,937,000 ($313.06)

Public Utilities Sales: $155,776,000 ($67.64)

Other License: $128,648,000 ($55.86)

Other Selective Sales: $47,449,000 ($20.60)

Occupation and Business License - Other: $30,929,000 ($13.43)

Alcoholic Beverage License: $1,322,000 ($0.57)

Amusements Sales: $261,000 ($0.11)

Houston government finances - Debt in 2021 (per resident):

- Long Term Debt - Outstanding Unspecified Public Purpose: $13,022,753,000 ($5654.99)

Beginning Outstanding - Unspecified Public Purpose: $12,426,929,000 ($5396.26)

Issue, Unspecified Public Purpose: $2,284,590,000 ($992.06)

Beginning Outstanding - Public Debt for Private Purpose: $1,994,661,000 ($866.16)

Outstanding Nonguaranteed - Industrial Revenue: $1,902,754,000 ($826.25)

Retired Unspecified Public Purpose: $1,688,766,000 ($733.33)

Retired Nonguaranteed - Public Debt for Private Purpose: $117,808,000 ($51.16)

Issue, Nonguaranteed - Public Debt for Private Purpose: $25,900,000 ($11.25)

- Short Term Debt Outstanding - Beginning: $539,873,000 ($234.43)

End of Fiscal Year: $264,600,000 ($114.90)

Houston government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $964,032,000 ($418.62)

- Other Funds - Cash and Securities: $3,872,465,000 ($1681.58)

- Sinking Funds - Cash and Securities: $2,551,801,000 ($1108.09)

5.26% of this county's 2021 resident taxpayers lived in other counties in 2020 ($67,872 average adjusted gross income)

| Here: | 5.26% |

| Texas average: | 8.12% |

0.02% of residents moved from foreign countries ($158 average AGI)

Harris County: 0.02% Texas average: 0.04%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Fort Bend County, TX | |

| from Montgomery County, TX | |

| from Galveston County, TX |

5.91% of this county's 2020 resident taxpayers moved to other counties in 2021 ($76,622 average adjusted gross income)

| Here: | 5.91% |

| Texas average: | 7.40% |

0.01% of residents moved to foreign countries ($155 average AGI)

Harris County: 0.01% Texas average: 0.03%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Fort Bend County, TX | |

| to Montgomery County, TX | |

| to Brazoria County, TX |

| Businesses in Houston, TX | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 24 Hour Fitness | 20 | Juicy Couture | 1 | |

| 99 Cents Only Stores | 17 | Justice | 6 | |

| ALDO | 4 | KFC | 41 | |

| AMF Bowling | 4 | Kincaid | 4 | |

| AT&T | 41 | Knights Inn | 2 | |

| Abercrombie & Fitch | 3 | Kohl's | 4 | |

| Abercrombie Kids | 3 | Kroger | 43 | |

| Academy Sports + Outdoors | 11 | LA Fitness | 9 | |

| Ace Hardware | 12 | La Quinta | 18 | |

| Advance Auto Parts | 35 | La-Z-Boy | 7 | |

| Aeropostale | 5 | Lane Bryant | 5 | |

| Alco Stores | 1 | Lane Furniture | 36 | |

| American Eagle Outfitters | 4 | LensCrafters | 5 | |

| Ann Taylor | 12 | Little Caesars Pizza | 35 | |

| Apple Store | 3 | Long John Silver's | 12 | |

| Applebee's | 5 | Lowe's | 9 | |

| Arby's | 13 | Macy's | 8 | |

| Ashley Furniture | 3 | MainStay | 1 | |

| Audi | 3 | Marriott | 37 | |

| AutoZone | 59 | Marshalls | 6 | |

| Avenue | 9 | MasterBrand Cabinets | 39 | |

| BMW | 4 | Mazda | 5 | |

| Bakers | 5 | McDonald's | 135 | |

| Bally Total Fitness | 7 | Men's Wearhouse | 8 | |

| Banana Republic | 5 | Microtel | 1 | |

| Barnes & Noble | 7 | Motel 6 | 6 | |

| Baskin-Robbins | 20 | Motherhood Maternity | 16 | |

| Bath & Body Works | 14 | New Balance | 16 | |

| Baymont Inn | 1 | New York & Co | 6 | |

| Bebe | 2 | Nike | 135 | |

| Bed Bath & Beyond | 6 | Nissan | 5 | |

| Ben & Jerry's | 2 | Nordstrom | 2 | |

| Bentleymotors.Com | 1 | Office Depot | 23 | |

| Best Western | 9 | OfficeMax | 10 | |

| Blockbuster | 33 | Old Navy | 7 | |

| Brooks Brothers | 3 | Olive Garden | 8 | |

| Brookstone | 4 | Outback | 6 | |

| Budget Car Rental | 12 | Outback Steakhouse | 6 | |

| Burger King | 58 | Pac Sun | 2 | |

| Burlington Coat Factory | 7 | Panda Express | 19 | |

| CVS | 71 | Panera Bread | 9 | |

| Cache | 3 | Papa John's Pizza | 18 | |

| CarMax | 2 | Payless | 50 | |

| Carl\s Jr. | 1 | Penske | 14 | |

| Casual Male XL | 5 | PetSmart | 14 | |

| Catherines | 6 | Pier 1 Imports | 10 | |

| Charlotte Russe | 2 | Pizza Hut | 43 | |

| Chevrolet | 8 | Plato's Closet | 2 | |

| Chick-Fil-A | 24 | Popeyes | 48 | |

| Chico's | 8 | Pottery Barn | 2 | |

| Chipotle | 16 | Pottery Barn Kids | 1 | |

| Chuck E. Cheese's | 6 | Quality | 3 | |

| Church's Chicken | 69 | Quiznos | 46 | |

| Cinnabon | 4 | RadioShack | 46 | |

| Clarks | 2 | Ramada | 1 | |

| Coldwater Creek | 3 | Red Lobster | 3 | |

| Comfort Inn | 3 | Red Robin | 3 | |

| Comfort Suites | 8 | Red Roof Inn | 3 | |

| Costco | 3 | Rodeway Inn | 2 | |

| Cracker Barrel | 1 | Rooms To Go | 5 | |

| Crate & Barrel | 1 | Rue21 | 3 | |

| Cricket Wireless | 262 | Ryan's Grill | 1 | |

| Crossland Economy Studios | 2 | Ryder Rental & Truck Leasing | 4 | |

| Curves | 13 | SAS Shoes | 4 | |

| DHL | 70 | SONIC Drive-In | 59 | |

| Dairy Queen | 20 | Safeway | 15 | |

| Days Inn | 4 | Saks Fifth Avenue | 1 | |

| Decora Cabinetry | 7 | Sam's Club | 6 | |

| Dennys | 25 | Sears | 23 | |

| Discount Tire | 34 | Sephora | 7 | |

| Domino's Pizza | 52 | Sheraton | 4 | |

| DressBarn | 6 | Shoe Carnival | 6 | |

| Dressbarn | 6 | Skechers USA | 4 | |

| Dunkin Donuts | 2 | Soma Intimates | 4 | |

| Econo Lodge | 4 | Spencer Gifts | 1 | |

| Eddie Bauer | 1 | Sprint Nextel | 35 | |

| Ethan Allen | 3 | Staples | 8 | |

| Express | 6 | Starbucks | 127 | |

| Extended Stay America | 6 | Steak 'n Shake | 1 | |

| Extended Stay Deluxe | 4 | Studio 6 | 5 | |

| Famous Footwear | 9 | Studio Plus Deluxe Studios | 2 | |

| FedEx | 415 | Subaru | 3 | |

| Finish Line | 6 | Subway | 130 | |

| Firestone Complete Auto Care | 25 | Super 8 | 11 | |

| Foot Locker | 10 | T-Mobile | 140 | |

| Forever 21 | 3 | T.G.I. Driday's | 3 | |

| Fredericks Of Hollywood | 1 | T.J.Maxx | 6 | |

| GNC | 35 | Taco Bell | 56 | |

| GameStop | 35 | Talbots | 6 | |

| Gap | 8 | Target | 15 | |

| Goodwill | 1 | The Athlete's Foot | 3 | |

| Gymboree | 5 | The Cheesecake Factory | 1 | |

| H&R Block | 83 | The Limited | 3 | |

| Haworth | 3 | The Room Place | 4 | |

| Hilton | 40 | Torrid | 3 | |

| Hobby Lobby | 5 | Toyota | 6 | |

| Holiday Inn | 45 | Toys"R"Us | 8 | |

| Hollister Co. | 3 | True Value | 4 | |

| Home Depot | 19 | U-Haul | 103 | |

| Homestead Studio Suites | 3 | UPS | 406 | |

| Honda | 6 | Urban Outfitters | 3 | |

| Hot Topic | 3 | Vans | 24 | |

| Howard Johnson | 3 | Verizon Wireless | 21 | |

| Hyatt | 4 | Victoria's Secret | 7 | |

| IHOP | 19 | Volkswagen | 5 | |

| InTown Suites | 9 | Vons | 16 | |

| J. Jill | 2 | Waffle House | 7 | |

| J.Crew | 1 | Walgreens | 85 | |

| JCPenney | 4 | Walmart | 22 | |

| Jack In The Box | 103 | Wendy's | 44 | |

| Jamba Juice | 9 | Westin | 3 | |

| Jimmy Jazz | 1 | Wet Seal | 2 | |

| Jimmy John's | 12 | Whole Foods Market | 4 | |

| JoS. A. Bank | 8 | Wingate | 1 | |

| Jones New York | 28 | YMCA | 19 | |

| Journeys | 8 | Z Gallerie | 1 | |

Strongest AM radio stations in Houston:

- KPRC (950 AM; 5 kW; HOUSTON, TX; Owner: CCB TEXAS LICENSES, L.P.)

- KCOH (1430 AM; 5 kW; HOUSTON, TX; Owner: KCOH, INC.)

- KLAT (1010 AM; 10 kW; HOUSTON, TX; Owner: TICHENOR LICENSE CORPORATION ("TLC"))

- KTRH (740 AM; 50 kW; HOUSTON, TX; Owner: AMFM TEXAS LICENSES LIMITED PARTNERSHIP)

- KMIC (1590 AM; 5 kW; HOUSTON, TX; Owner: ABC, INC)

- KILT (610 AM; 5 kW; HOUSTON, TX; Owner: TEXAS INFINITY BROADCASTING L.P.)

- KGOL (1180 AM; 50 kW; HUMBLE, TX; Owner: ENTRAVISION HOLDINGS, LLC)

- KBME (790 AM; 5 kW; HOUSTON, TX; Owner: AMFM TEXAS LICENSES LTD. PARTNERSHIP)

- KKHT (1070 AM; 10 kW; HOUSTON, TX; Owner: SOUTH TEXAS BROADCASTING, INC.)

- KILE (1560 AM; 50 kW; BELLAIRE, TX; Owner: THE RAFTT CORPORATION)

- KEYH (850 AM; 10 kW; HOUSTON, TX; Owner: LIBERMAN BROADCASTING OF HOUSTON LICENSE CORP.)

- KXYZ (1320 AM; 5 kW; HOUSTON, TX; Owner: BLAYA INC.)

- KSEV (700 AM; 15 kW; TOMBALL, TX; Owner: LIBERMAN BROADCASTING OF HOUSTON LICENSE CORP.)

Strongest FM radio stations in Houston:

- KLTN (102.9 FM; HOUSTON, TX; Owner: HBC HOUSTON LICENSE CORPORATION)

- KMJQ (102.1 FM; HOUSTON, TX; Owner: RADIO ONE LICENSES, LLC)

- KTSU (90.9 FM; HOUSTON, TX; Owner: TEXAS SOUTHERN UNIVERSITY)

- KBXX (97.9 FM; HOUSTON, TX; Owner: RADIO ONE LICENSES, LLC)

- KHJZ-FM (95.7 FM; HOUSTON, TX; Owner: TEXAS INFINITY BROADCASTING L.P.)

- KHMX (96.5 FM; HOUSTON, TX; Owner: CITICASTERS LICENSES, L.P.)

- KILT-FM (100.3 FM; HOUSTON, TX; Owner: TEXAS INFINITY BROADCASTING L.P.)

- KKBQ-FM (92.9 FM; PASADENA, TX; Owner: CXR HOLDINGS, INC.)

- KLOL (101.1 FM; HOUSTON, TX; Owner: AMFM TEXAS LICENSES LIMITED PARTNERSHIP)

- KODA (99.1 FM; HOUSTON, TX; Owner: AMFM TEXAS LICENSES LIMITED PARTNERSHIP)

- KTBZ-FM (94.5 FM; HOUSTON, TX; Owner: AMFM TEXAS LICENSES LIMITED PARTNERSHIP)

- KRBE (104.1 FM; HOUSTON, TX; Owner: KRBE LICO, INC.)

- KUHF (88.7 FM; HOUSTON, TX; Owner: UNIVERSITY OF HOUSTON SYSTEM)

- KKRW (93.7 FM; HOUSTON, TX; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- KHCB-FM (105.7 FM; HOUSTON, TX; Owner: HOUSTON CHRISTIAN BROADCASTERS, INC.)

- KPFT (90.1 FM; HOUSTON, TX; Owner: PACIFICA FOUNDATION, INC.)

- KPTY (104.9 FM; MISSOURI CITY, TX; Owner: TICHENOR LICENSE CORPORATION ("TLC"))

- KLDE (107.5 FM; LAKE JACKSON, TX; Owner: CXR HOLDINGS, INC.)

- K259AB (99.7 FM; SUGAR LAND, TX; Owner: THE KSBJ EDUCATIONAL FOUNDATION)

- KHPT (106.9 FM; CONROE, TX; Owner: CXR HOLDINGS, INC.)

TV broadcast stations around Houston:

- KVVV-LP (Channel 53; HOUSTON, TX; Owner: KAZH LICENSE, LLC)

- K30CV (Channel 30; HOUSTON, TX; Owner: BROADCASTING SYSTEMS, INC.)

- KPRC-TV (Channel 2; HOUSTON, TX; Owner: POST-NEWSWEEK STATIONS, HOUSTON, LP)

- KHOU-TV (Channel 11; HOUSTON, TX; Owner: KHOU-TV, L.P.)

- KRIV (Channel 26; HOUSTON, TX; Owner: FOX TELEVISION STATIONS, INC.)

- KTRK-TV (Channel 13; HOUSTON, TX; Owner: KTRK TELEVISION, INC.)

- KHWB (Channel 39; HOUSTON, TX; Owner: KHWB, INC.)

- KUHT (Channel 8; HOUSTON, TX; Owner: UNIVERSITY OF HOUSTON SYSTEM)

- KPXB (Channel 49; CONROE, TX; Owner: PAXSON HOUSTON LICENSE, INC.)

- KFTH (Channel 67; ALVIN, TX; Owner: TELEFUTURA HOUSTON LLC)

- KNWS-TV (Channel 51; KATY, TX; Owner: JOHNSON BROADCASTING, INC.)

- KTBU (Channel 55; CONROE, TX; Owner: HUMANITY INTERESTED MEDIA, INC.)

- KTXH (Channel 20; HOUSTON, TX; Owner: FOX TELEVISION STATIONS, INC.)

- KXLN-TV (Channel 45; ROSENBERG, TX; Owner: KXLN LICENSE PARTNERSHIP, L.P.)

- KZJL (Channel 61; HOUSTON, TX; Owner: KZJL LICENSE CORP.)

- KETH (Channel 14; HOUSTON, TX; Owner: COMMUNITY EDUCATIONAL TV, INC.)

- KVDO-LP (Channel 69; CLEAR LAKE, TX; Owner: FAR EASTERN TELECASTERS)

- KBPX-LP (Channel 33; HOUSTON, TX; Owner: PAXSON COMMUNICATIONS LPTV, INC.)

- KVQT-LP (Channel 24; HOUSTON, TX; Owner: C. DOWEN JOHNSON)

- KJIB-LP (Channel 5; CLEAR LAKE CITY, TX; Owner: FAR EASTERN TELECASTERS)

- KHMV-LP (Channel 28; HOUSTON, TX; Owner: PAPPAS TELECASTING OF THE GULF COAST, A CALIFORNIA LP)

- KTMD (Channel 48; GALVESTON, TX; Owner: TELEMUNDO OF TEXAS PARTNERSHIP, LP)

- KVIT-LP (Channel 28; VICTORIA, TX; Owner: CLUB COMMUNICATIONS)

- KHLM-LP (Channel 43; HOUSTON, TX; Owner: U.S. INTERACTIVE, L.L.C.)

- KLTJ (Channel 22; GALVESTON, TX; Owner: WORD OF GOD FELLOWSHIP, INC.)

- National Bridge Inventory (NBI) Statistics

- 4,433Number of bridges

- 145,748ft / 44,424mTotal length

- $113,750,000Total costs

- 148,292,432Total average daily traffic

- 8,915,561Total average daily truck traffic

- New bridges - historical statistics

- 31910-1919

- 91920-1929

- 131930-1939

- 371940-1949

- 1401950-1959

- 5831960-1969

- 5371970-1979

- 7781980-1989

- 9001990-1999

- 7342000-2009

- 6482010-2019

- 512020-2022

FCC Registered Antenna Towers: 6,861 (See the full list of FCC Registered Antenna Towers)

FCC Registered Commercial Land Mobile Towers: 59 (See the full list of FCC Registered Commercial Land Mobile Towers in Houston, TX)

FCC Registered Private Land Mobile Towers: 154 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 1,547 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 8,253 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 191 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 178 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 7,118 (See the full list of FCC Registered Amateur Radio Licenses in Houston)

FAA Registered Aircraft Manufacturers and Dealers: 44 (See the full list of FAA Registered Manufacturers and Dealers in Houston)

FAA Registered Aircraft: 1,721 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 397 full and 70 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 6,378 | $141,787 | 10,768 | $243,599 | 18,108 | $227,706 | 1,086 | $77,176 | 69 | $4,735,358 | 1,783 | $154,097 | 31 | $108,517 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 402 | $130,193 | 1,020 | $242,038 | 2,002 | $189,232 | 241 | $50,901 | 3 | $2,619,667 | 202 | $146,855 | 27 | $59,411 |

| APPLICATIONS DENIED | 1,369 | $121,665 | 2,279 | $189,727 | 8,237 | $169,687 | 2,760 | $36,238 | 28 | $4,097,107 | 1,004 | $114,003 | 75 | $51,930 |

| APPLICATIONS WITHDRAWN | 970 | $132,519 | 1,712 | $236,252 | 4,599 | $191,303 | 499 | $77,113 | 12 | $3,953,500 | 427 | $130,466 | 10 | $62,262 |

| FILES CLOSED FOR INCOMPLETENESS | 252 | $118,567 | 374 | $262,588 | 1,368 | $202,265 | 221 | $50,551 | 2 | $2,751,500 | 136 | $131,638 | 4 | $69,435 |

Detailed mortgage data for all 473 tracts in Houston, TX

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 320 full and 65 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 2,100 | $208,840 | 587 | $203,350 | 14 | $168,058 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 629 | $200,064 | 242 | $200,205 | 47 | $151,146 |

| APPLICATIONS DENIED | 297 | $192,580 | 133 | $189,880 | 14 | $186,104 |

| APPLICATIONS WITHDRAWN | 150 | $201,940 | 65 | $199,510 | 4 | $225,250 |

| FILES CLOSED FOR INCOMPLETENESS | 83 | $171,704 | 19 | $152,585 | 12 | $121,697 |

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Houston, TX

- 44,41838.1%Outside Fires

- 40,05534.4%Structure Fires

- 25,93822.2%Mobile Property/Vehicle Fires

- 6,1665.3%Other

Based on the data from the years 2002 - 2018 the average number of fire incidents per year is 6857. The highest number of fires - 10,311 took place in 2011, and the least - 1,108 in 2002. The data has a rising trend.

Based on the data from the years 2002 - 2018 the average number of fire incidents per year is 6857. The highest number of fires - 10,311 took place in 2011, and the least - 1,108 in 2002. The data has a rising trend. When looking into fire subcategories, the most incidents belonged to: Outside Fires (38.1%), and Structure Fires (34.4%).

When looking into fire subcategories, the most incidents belonged to: Outside Fires (38.1%), and Structure Fires (34.4%).Fire-safe hotels and motels in Houston, Texas:

- Hyatt North Houston, 425 N Sam Houston Parkway E, Houston, Texas 77060 , Phone: (281) 445-9000, Fax: (281) 445-9826

- Days Inn Greenspoint, 12500 N Fwy, Houston, Texas 77060 , Phone: (281) 876-3888, Fax: (281) 876-1524

- Red Lion Hotel Houston Intercontinental Airport, 500 N Sam Houston Pkwy E, Houston, Texas 77060 , Phone: (281) 931-0101, Fax: (281) 931-4924

- La Quinta Inn #4693 Houston, 10552 SW Fwy, Houston, Texas 77074 , Phone: (713) 270-9559, Fax: (713) 270-0219

- Houston Airport Marriott At George Bush Intercontinental, 18700 John F Kennedy Blvd, Houston, Texas 77032 , Phone: (281) 443-2310, Fax: (281) 443-5294

- Sheraton North Houston Hotel, 15700 John F Kennedy Blvd, Houston, Texas 77032 , Phone: (281) 442-5100, Fax: (281) 969-1245

- Royal Sonesta Houston, 2222 W Loop St, Houston, Texas 77027 , Phone: (713) 627-7600, Fax: (713) 961-5575

- Days Inn Cavalcade, 100 W Cavalcade, Houston, Texas 77009 , Phone: (713) 869-7121, Fax: (713) 868-5167

- 346 other hotels and motels

| Most common first names in Houston, TX among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| Mary | 8,269 | 77.3 years |

| John | 8,045 | 71.6 years |

| James | 7,498 | 69.0 years |

| William | 6,803 | 72.3 years |

| Robert | 5,969 | 68.4 years |

| Charles | 4,218 | 69.6 years |

| George | 3,667 | 72.8 years |

| Willie | 3,577 | 72.6 years |

| Joseph | 2,792 | 71.2 years |

| Dorothy | 2,792 | 74.7 years |

| Most common last names in Houston, TX among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 4,494 | 72.1 years |

| Williams | 4,285 | 71.7 years |

| Johnson | 3,966 | 70.7 years |

| Jones | 3,309 | 71.2 years |

| Brown | 2,619 | 71.0 years |

| Davis | 2,512 | 71.2 years |

| Jackson | 2,107 | 71.0 years |

| Thomas | 1,789 | 70.6 years |

| Wilson | 1,624 | 72.4 years |

| Taylor | 1,599 | 71.5 years |

- 59.5%Utility gas

- 38.9%Electricity

- 0.9%Bottled, tank, or LP gas

- 0.5%No fuel used

- 80.8%Electricity

- 16.5%Utility gas

- 1.8%No fuel used

- 0.7%Bottled, tank, or LP gas

Houston compared to Texas state average:

- Unemployed percentage significantly below state average.

- Black race population percentage above state average.

- Foreign-born population percentage above state average.

- Renting percentage above state average.

- Number of rooms per house below state average.

- Percentage of population with a bachelor's degree or higher above state average.

Houston, TX compared to other similar cities:

Houston on our top lists:

- #1 on the list of "Top 101 cities with largest percentage of females in industries: broadcasting, internet publishing, and telecommunications services (population 50,000+)"

- #1 on the list of "Top 101 cities with largest percentage of males in industries: broadcasting, internet publishing, and telecommunications services (population 50,000+)"

- #1 on the list of "Top 101 cities with the most mentions on city-data.com forum"

- #1 on the list of "Top 101 cities with largest percentage of males in industries: wholesale electronic markets and agents and brokers (population 50,000+)"

- #1 on the list of "Top 101 cities with largest percentage of females in industries: wholesale electronic markets and agents and brokers (population 50,000+)"

- #5 on the list of "Top 101 cities with the largest house values disparities (population 50,000+)"

- #6 on the list of "Top 101 biggest cities in 2013"

- #6 on the list of "Top 100 biggest cities"

- #12 on the list of "Top 100 cities with largest land areas (pop. 50,000+)"

- #14 on the list of "Top 101 cities with largest percentage of females in industries: mining, quarrying, and oil and gas extraction (population 50,000+)"

- #29 on the list of "Top 101 cities with largest percentage of males in occupations: construction and extraction occupations (population 50,000+)"

- #30 on the list of "Top 101 cities with the highest average humidity (population 50,000+)"

- #36 on the list of "Top 101 cities with the highest number of robberies per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #36 on the list of "Top 101 cities with largest percentage of males in industries: construction (population 50,000+)"

- #37 on the list of "Top 101 cities with largest percentage of males in industries: mining, quarrying, and oil and gas extraction (population 50,000+)"

- #61 on the list of "Top 101 cities with the largest percentage of people in crews of maritime vessels (population 1,000+)"

- #70 on the list of "Top 101 cities with largest percentage of females in occupations: building and grounds cleaning and maintenance occupations (population 50,000+)"

- #71 on the list of "Top 101 cities with the highest city-data.com crime index, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #71 on the list of "Top 100 least-safe cities (highest city-data.com crime index) (pop. 50,000+)"

- #73 on the list of "Top 101 cities with the hottest summers (population 50,000+)"

- #1 (77012) on the list of "Top 101 zip codes with the smallest percentage of taxpayers reporting net capital gain/loss in 2012 (pop 5,000+)"

- #3 (77030) on the list of "Top 101 zip codes with the most offices of physicians in 2005"

- #5 (77078) on the list of "Top 101 zip codes with the largest percentage of English first ancestries (pop 5,000+)"

- #5 (77002) on the list of "Top 101 zip codes with the highest 2012 average net capital gain/loss (pop 5,000+)"

- #5 (77002) on the list of "Top 101 zip codes with the most offices of lawyers in 2005"

- #13 (77002) on the list of "Top 101 zip codes with the most medium-big companies in 2005 (at least 100 employees)"

- #15 (77048) on the list of "Top 101 zip codes with the largest percentage of Scottish first ancestries (pop 5,000+)"

- #17 (77005) on the list of "Top 101 zip codes with the highest average reported salary/wage in 2012 (pop 5,000+)"

- #22 (77033) on the list of "Top 101 zip codes with the largest percentage of Subsaharan African first ancestries"

- #23 (77056) on the list of "Top 101 zip codes with the most finance and insurance companies in 2005"

- #25 (77006) on the list of "Top 101 zip codes with the most alcohol drinking places in 2005"

- #25 (77026) on the list of "Top 101 zip codes with the smallest percentage of taxpayers reporting taxable interest in 2012 (pop 5,000+)"

- #27 (77002) on the list of "Top 101 zip codes with the highest 2012 average taxable interest for individuals (pop 5,000+)"

- #28 (77030) on the list of "Top 101 zip codes with the most big companies in 2005 (at least 1000 employees)"

- #29 (77082) on the list of "Top 101 zip codes with the largest percentage of Arab first ancestries (pop 5,000+)"

- #29 (77019) on the list of "Top 101 zip codes with the highest 2012 average Adjusted Gross Income (AGI) for individuals (pop 5,000+)"

- #46 (77005) on the list of "Top 101 zip codes with the highest 2012 average reported profit/loss from business (pop 5,000+)"

- #51 (77002) on the list of "Top 101 zip codes with the largest charity contributions deductions as a percentage of AGI in 2012 (pop 5,000+)"

- #52 (77005) on the list of "Top 101 zip codes with the largest percentage of taxpayers reporting net capital gain/loss in 2012 (pop 5,000+)"

- #54 (77011) on the list of "Top 101 zip codes with the largest percentage of Greek first ancestries (pop 5,000+)"

- #1 on the list of "Top 101 counties with the most Mainline Protestant adherents"

- #1 on the list of "Top 101 counties with the most Evangelical Protestant adherents"

- #2 on the list of "Top 101 counties with the most Evangelical Protestant congregations"