Dallas, Texas

Dallas: White Rock Lake and Dallas Skyline from The Arboretum

Dallas: White Rock Lake Park

Dallas: Trinity River High

Dallas: Dallas Syline

Dallas: White Rock Lake Park

Dallas: Dallas Skyline

Dallas: Dallas Syline

Dallas: The Arboretum

Dallas: Dallas Syline

Dallas: Dallas Syline

Dallas: Reunion Tower (Fog)

- see

175

more - add

your

Submit your own pictures of this city and show them to the world

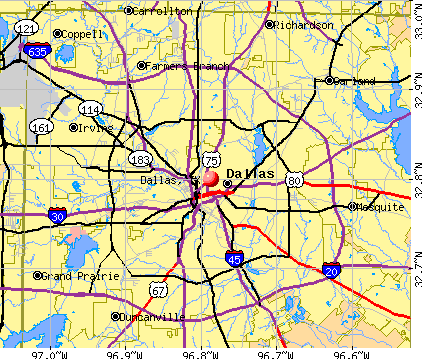

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +9.3%

| Males: 642,365 | |

| Females: 657,179 |

| Median resident age: | 33.1 years |

| Texas median age: | 35.6 years |

Zip codes: 75032, 75039, 75041, 75043, 75060, 75061, 75062, 75075, 75080, 75081, 75087, 75088, 75089, 75098, 75116, 75126, 75134, 75141, 75150, 75166, 75182, 75201, 75202, 75203, 75204, 75205, 75206, 75207, 75208, 75209, 75210, 75212, 75214, 75215, 75216, 75218, 75219, 75220, 75223, 75224, 75225, 75226, 75227, 75228, 75229, 75230, 75231, 75232, 75233, 75234, 75235, 75236, 75237, 75238, 75240, 75241, 75243, 75246, 75247, 75251, 75252, 75270, 75390.

Dallas Zip Code Map| Dallas: | $65,400 |

| TX: | $72,284 |

Estimated per capita income in 2022: $44,729 (it was $22,183 in 2000)

Dallas city income, earnings, and wages data

Estimated median house or condo value in 2022: $320,400 (it was $87,400 in 2000)

| Dallas: | $320,400 |

| TX: | $275,400 |

Mean prices in 2022: all housing units: $485,482; detached houses: $504,900; townhouses or other attached units: $442,341; in 2-unit structures: $344,076; in 3-to-4-unit structures: $258,595; in 5-or-more-unit structures: $436,290; mobile homes: $80,730; occupied boats, rvs, vans, etc.: $482,263

Median gross rent in 2022: $1,360.

(7.8% for White Non-Hispanic residents, 29.6% for Black residents, 18.0% for Hispanic or Latino residents, 10.1% for American Indian residents, 9.3% for Native Hawaiian and other Pacific Islander residents, 19.3% for other race residents, 14.8% for two or more races residents)

Detailed information about poverty and poor residents in Dallas, TX

- 564,45343.4%Hispanic

- 351,04427.0%White alone

- 296,83922.8%Black alone

- 50,0453.9%Asian alone

- 31,2222.4%Two or more races

- 3,3460.3%Other race alone

- 2,2020.2%American Indian alone

- 4020.03%Native Hawaiian and Other

Pacific Islander alone

Races in Dallas detailed stats: ancestries, foreign born residents, place of birth

According to our research of Texas and other state lists, there were 4,271 registered sex offenders living in Dallas, Texas as of April 25, 2024.

The ratio of all residents to sex offenders in Dallas is 309 to 1.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is about the same as the state average.- means the value is bigger than the state average.

- means the value is much bigger than the state average.

Crime rate in Dallas detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 3,761 (3,118 officers - 2,525 male; 593 female).

| Officers per 1,000 residents here: | 2.31 |

| Texas average: | 2.07 |

| Economics of Land Use in Dallas County (46 replies) |

| Dallas is the first city in Texas to have two downtowns (18 replies) |

| Moving to Downtown Dallas HELP! (26 replies) |

| Dallas’ Poverty Crisis (52 replies) |

| Downtown Dallas Bugs & Singles Scene? (22 replies) |

| Is Dallas green with trees? Are people friendly? (161 replies) |

Latest news from Dallas, TX collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: American (4.7%), English (2.7%), German (1.9%), Irish (1.7%), European (1.4%), African (1.1%).

Current Local Time: CST time zone

Elevation: 463 feet

Land area: 342.5 square miles.

Population density: 3,794 people per square mile (average).

320,358 residents are foreign born (17.9% Latin America, 2.8% Asia).

| This city: | 24.7% |

| Texas: | 17.1% |

Median real estate property taxes paid for housing units with mortgages in 2022: $6,418 (1.7%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $3,495 (1.4%)

Nearest cities:

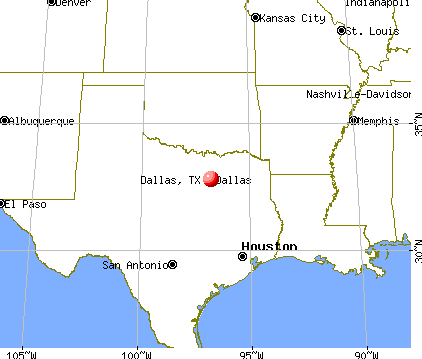

Latitude: 32.80 N, Longitude: 96.79 W

Daytime population change due to commuting: +261,864 (+20.2%)

Workers who live and work in this city: 459,258 (68.3%)

Area codes: 972, 214, 469

Property values in Dallas, TX

Detailed articles:

- Dallas: Introduction

- Dallas Basic Facts

- Dallas: Communications

- Dallas: Convention Facilities

- Dallas: Economy

- Dallas: Education and Research

- Dallas: Geography and Climate

- Dallas: Health Care

- Dallas: History

- Dallas: Municipal Government

- Dallas: Population Profile

- Dallas: Recreation

- Dallas: Transportation

Dallas tourist attractions:

- Adolphus Hotel in Dallas

- American Airlines Center, Dallas, Texas

- Bishop Arts District in Dallas

- Cedars Neighborhood in Dallas

- Cityplace Neighborhood in Dallas

- Cotton Bowl Stadium in Dallas

- Dallas Love Field

- Dallas/Fort Worth International Airport

- Dallas Alley Nightclubs

- Dallas Arboretum and Botanical Gardens

- Dallas Arts District

- Dallas Museum of Art

- Dallas Museum of Natural History

- Dallas World Aquarium

- Dallas Zoo

- Deep Ellum Neighborhood in Dallas

- Fountain Place in Dallas

- Frontiers of Flight Museum in Dallas

- Galleria Mall in Dallas

- Greenville Avenue in Dallas

- Harry Hines Boulevard in Dallas

- Highland Park Village in Dallas

- Hotel Lumen - Kimpton Hotel in Dallas

- Hotel Palomar Dallas - A Kimpton Hotel

- Hotel ZaZa in Dallas

- Knox-Henderson in Dallas

- Lakewood Area in Dallas

- Main Street District in Dallas

- McKinney Avenue in Dallas

- Medieval Times in Dallas

- Millermore Mansion in Dallas

- Morton H. Meyerson Symphony Center in Dallas

- Springhill Suites Dallas Downtown West End

- Rosewood Crescent Court

- The Westin Galleria Dallas

- Hyatt Regency DFW

- The Magnolia Hotel Dallas

- Renaissance Dallas Hotel

- Sheraton Dallas Hotel

- NorthPark Center Mall in Dallas

- Oak Lawn Neighborhood in Dallas

- Plaza of the Americas in Dallas

- Preston Hollow in Dallas

- Reunion Arena in Dallas

- Reunion District in Dallas

- Reunion Tower Lookout in Dallas

- Ritz-Carlton in Dallas

- Rosewood Crescent Court in Dallas

- Rosewood Mansion on Turtle Creek, Dallas

- Science Place in Dallas

- Swiss Avenue in Dallas

- The City Center District in Dallas

- The Joule Dallas Hotel

- The Sixth Floor Museum in Dallas

- The Stoneleigh Hotel and Spa in Dallas

- The Warwick Melrose Hotel in Dallas

- Uptown Neighborhood in Dallas

- Vickery Place in Dallas

- Victory Park in Dallas

- West End Historic District in Dallas

- West Village neighborhood in Dallas

- White Rock Lake Park in Dallas

- W Dallas Victory Hotel and Residences

- Zero Gravity Thrill Amusement Park

Dallas, Texas accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 2349 buildings, average cost: $251,300

- 2021: 2245 buildings, average cost: $237,400

- 2020: 1475 buildings, average cost: $234,900

- 2019: 2093 buildings, average cost: $237,200

- 2018: 2009 buildings, average cost: $235,200

- 2017: 2100 buildings, average cost: $230,300

- 2016: 1640 buildings, average cost: $226,500

- 2015: 1455 buildings, average cost: $222,200

- 2014: 1181 buildings, average cost: $213,900

- 2013: 1075 buildings, average cost: $202,400

- 2012: 936 buildings, average cost: $193,400

- 2011: 809 buildings, average cost: $273,900

- 2010: 865 buildings, average cost: $286,900

- 2009: 734 buildings, average cost: $284,900

- 2008: 1198 buildings, average cost: $295,700

- 2007: 2090 buildings, average cost: $284,700

- 2006: 3178 buildings, average cost: $235,900

- 2005: 3353 buildings, average cost: $164,300

- 2004: 3353 buildings, average cost: $165,000

- 2003: 2597 buildings, average cost: $163,600

- 2002: 2024 buildings, average cost: $178,200

- 2001: 1913 buildings, average cost: $178,400

- 2000: 1732 buildings, average cost: $206,400

- 1999: 1752 buildings, average cost: $110,000

- 1998: 1744 buildings, average cost: $134,300

- 1997: 1353 buildings, average cost: $153,000

| Here: | 3.4% |

| Texas: | 3.5% |

Population change in the 1990s: +177,536 (+17.6%).

- Professional, scientific, technical services (11.2%)

- Construction (10.3%)

- Health care (9.9%)

- Finance & insurance (7.1%)

- Accommodation & food services (6.9%)

- Educational services (6.3%)

- Administrative & support & waste management services (5.3%)

- Construction (17.4%)

- Professional, scientific, technical services (11.6%)

- Accommodation & food services (6.6%)

- Finance & insurance (6.1%)

- Health care (4.9%)

- Administrative & support & waste management services (4.8%)

- Educational services (3.9%)

- Health care (15.8%)

- Professional, scientific, technical services (10.6%)

- Educational services (9.1%)

- Finance & insurance (8.3%)

- Accommodation & food services (7.3%)

- Administrative & support & waste management services (5.8%)

- Real estate & rental & leasing (2.9%)

- Other management occupations, except farmers and farm managers (5.7%)

- Cooks and food preparation workers (5.3%)

- Building and grounds cleaning and maintenance occupations (4.7%)

- Laborers and material movers, hand (4.2%)

- Computer specialists (3.2%)

- Customer service representatives (3.1%)

- Driver/sales workers and truck drivers (2.3%)

- Other management occupations, except farmers and farm managers (5.9%)

- Laborers and material movers, hand (5.2%)

- Cooks and food preparation workers (4.9%)

- Computer specialists (4.4%)

- Building and grounds cleaning and maintenance occupations (4.1%)

- Construction laborers (4.1%)

- Driver/sales workers and truck drivers (3.8%)

- Cooks and food preparation workers (5.8%)

- Building and grounds cleaning and maintenance occupations (5.4%)

- Other management occupations, except farmers and farm managers (5.4%)

- Customer service representatives (5.2%)

- Registered nurses (3.1%)

- Other office and administrative support workers, including supervisors (3.0%)

- Laborers and material movers, hand (3.0%)

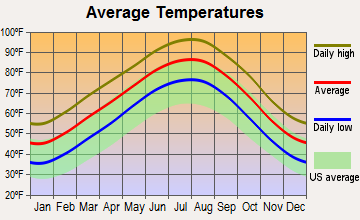

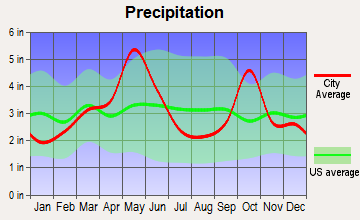

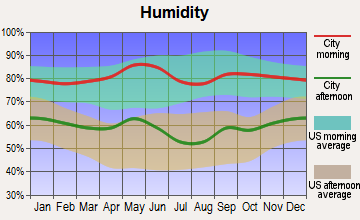

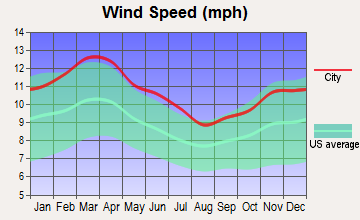

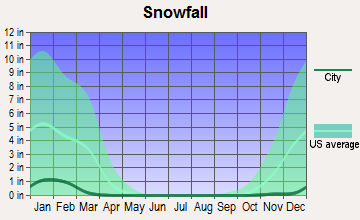

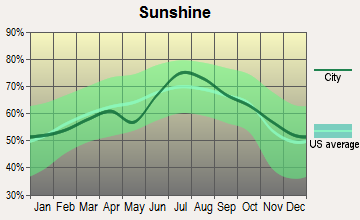

Average climate in Dallas, Texas

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

Air Quality Index (AQI) level in 2022 was 97.3. This is worse than average.

| City: | 97.3 |

| U.S.: | 72.6 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 6.50. This is worse than average. Closest monitor was 1.1 miles away from the city center.

| City: | 6.50 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.679. This is significantly better than average. Closest monitor was 3.4 miles away from the city center.

| City: | 0.679 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 30.4. This is about average. Closest monitor was 1.1 miles away from the city center.

| City: | 30.4 |

| U.S.: | 33.3 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 9.11. This is about average. Closest monitor was 1.9 miles away from the city center.

| City: | 9.11 |

| U.S.: | 8.11 |

Lead (Pb) [µg/m3] level in 2008 was 0.121. This is significantly worse than average. Closest monitor was 1.9 miles away from the city center.

| City: | 0.121 |

| U.S.: | 0.009 |

Tornado activity:

Dallas-area historical tornado activity is above Texas state average. It is 155% greater than the overall U.S. average.

On 4/25/1994, a category F4 (max. wind speeds 207-260 mph) tornado 11.3 miles away from the Dallas city center killed 3 people and injured 48 people and caused between $50,000,000 and $500,000,000 in damages.

On 4/2/1957, a category F3 (max. wind speeds 158-206 mph) tornado 4.3 miles away from the city center killed 10 people and injured 200 people and caused between $500,000 and $5,000,000 in damages.

Earthquake activity:

Dallas-area historical earthquake activity is significantly above Texas state average. It is 467% greater than the overall U.S. average.On 11/6/2011 at 03:53:10, a magnitude 5.7 (5.7 MW, Depth: 3.2 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 189.0 miles away from Dallas center

On 9/3/2016 at 12:02:44, a magnitude 5.8 (5.8 MW, Depth: 3.5 mi) earthquake occurred 250.9 miles away from the city center

On 6/16/1978 at 11:46:54, a magnitude 5.3 (4.4 MB, 4.6 UK, 5.3 ML) earthquake occurred 231.6 miles away from Dallas center

On 5/17/2012 at 08:12:00, a magnitude 4.8 (4.8 MW, Depth: 3.1 mi, Class: Light, Intensity: IV - V) earthquake occurred 153.7 miles away from the city center

On 11/7/2016 at 01:44:24, a magnitude 5.0 (5.0 MW, Depth: 2.8 mi) earthquake occurred 220.7 miles away from Dallas center

On 11/8/2011 at 02:46:57, a magnitude 4.8 (4.8 MW, Depth: 3.1 mi) earthquake occurred 188.9 miles away from the city center

Magnitude types: body-wave magnitude (MB), local magnitude (ML), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Dallas County (21) is greater than the US average (15).Major Disasters (Presidential) Declared: 9

Emergencies Declared: 10

Causes of natural disasters: Hurricanes: 7, Storms: 7, Floods: 5, Tornadoes: 5, Fires: 4, Winds: 2, Flash Flood: 1, Winter Storm: 1, Other: 2 (Note: some incidents may be assigned to more than one category).

Main business address for: HOLLY CORP (PETROLEUM REFINING), KRONOS INTERNATIONAL INC (INDUSTRIAL INORGANIC CHEMICALS), BRINKER INTERNATIONAL INC (RETAIL-EATING PLACES), GNC ENERGY CORP (CRUDE PETROLEUM & NATURAL GAS), FROZEN FOOD EXPRESS INDUSTRIES INC (TRUCKING (NO LOCAL)), TXU GAS CO (NATURAL GAS TRANSMISSION & DISTRIBUTION), ELKCORP (ASPHALT PAVING & ROOFING MATERIALS), DEAN HOLDING CO (DAIRY PRODUCTS) and 114 other public companies.

Hospitals in Dallas:

- 27 FERRIS CREEK (12327 FERRIS CREEK)

- BAYLOR HEART AND VASCULAR HOSPITAL (Proprietary, provides emergency services, 621 NORTH HALL STREET)

- COMMUNITY HOSPICE OF TEXAS (1341 W MOCKINGBIRD LANE # 210E)

- DALLAS VA MEDICAL CENTER - VA NORTH TEXAS (Government Federal, provides emergency services, 4500 S. LANCASTER ROAD)

- HEARTLAND HOME HEALTH CARE AND HOSPICE (8700 STEMMONS FREEWAY SUITE 144)

- LAKEWOOD HOSPITAL,THE (provides emergency services, 1600 ABRAMS RD)

- METHODIST CHARLTON MEDICAL CENTER (Voluntary non-profit - Private, provides emergency services, 3500 W WHEATLAND ROAD)

- PARKLAND HEALTH AND HOSPITAL SYSTEM (Government - Hospital District or Authority, 5201 HARRY HINES BLVD)

- SOUTHEASTERN METHODIST HOSPITAL (9202 ELAM ROAD)

- TRI CITY HEALTH CENTRE INC (7525 SCYENE RD)

Airports and heliports located in Dallas:

- Dallas Love Field Airport (DAL) (Runways: 3, Commercial Ops: 122,877, Air Taxi Ops: 28,158, Itinerant Ops: 57,350, Military Ops: 743)

- Mckinney National Airport (TKI) (Runways: 1, Air Taxi Ops: 2,042, Itinerant Ops: 35,623, Local Ops: 71,238, Military Ops: 55)

- Dallas Executive Airport (RBD) (Runways: 2, Air Taxi Ops: 97, Itinerant Ops: 25,855, Local Ops: 16,663, Military Ops: 325)

- Air Park-Dallas Airport (F69) (Runways: 1, Itinerant Ops: 6,000, Local Ops: 12,000)

- Airpark East Airport (1F7) (Runways: 1, Itinerant Ops: 6,000, Local Ops: 10,000)

- Lavon North Airport (46TS) (Runways: 2, Itinerant Ops: 30, Local Ops: 1,200)

- Heliports: 22

Biggest Colleges/Universities in Dallas:

- Richland College (Full-time enrollment: 11,617; Location: 12800 Abrams Rd.; Public; Website: www.richlandcollege.edu/)

- Southern Methodist University (Full-time enrollment: 9,150; Location: 6425 Boaz St; Private, not-for-profit; Website: www.smu.edu; Offers Doctor's degree)

- El Centro College (Full-time enrollment: 6,086; Location: 801 Main Street; Public; Website: www.elcentrocollege.edu/)

- Mountain View College (Full-time enrollment: 4,988; Location: 4849 West Illinois Ave.; Public; Website: www.dcccd.edu)

- Dallas Baptist University (Full-time enrollment: 4,280; Location: 3000 Mountain Creek Parkway; Private, not-for-profit; Website: www.dbu.edu; Offers Doctor's degree)

- South University-The Art Institute of Dallas (Full-time enrollment: 1,542; Location: 8080 Park Lane, Suite 100; Private, for-profit; Website: www.artinstitutes.edu/dallas/; Offers Master's degree)

- Le Cordon Bleu College of Culinary Arts-Dallas (Full-time enrollment: 1,467; Location: 11830 Webb Chapel Road; Private, for-profit; Website: www.chefs.edu/dallas)

- Dallas Theological Seminary (Full-time enrollment: 1,421; Location: 3909 Swiss Ave; Private, not-for-profit; Website: WWW.DTS.EDU; Offers Doctor's degree)

- Dallas Nursing Institute (Full-time enrollment: 1,397; Location: 12170 N. Abrams Road Suite 200; Private, for-profit; Website: www.dni.edu)

- Everest College-Dallas (Full-time enrollment: 1,374; Location: 6080 North Central Expressway; Private, for-profit; Website: www.everest.edu/campus/dallas)

- University of Texas Southwestern Medical Center (Full-time enrollment: 1,215; Location: 5323 Harry Hines Blvd; Public; Website: www.utsouthwestern.edu; Offers Doctor's degree)

- University of Phoenix-Dallas Campus (Full-time enrollment: 1,093; Location: 12400 Coit Rd; Private, for-profit; Website: www.phoenix.edu; Offers Master's degree)

- PCI Health Training Center (Full-time enrollment: 809; Location: 8101 John Carpenter Fwy; Private, for-profit; Website: www.pcihealth.com)

- Sanford-Brown College-Dallas (Full-time enrollment: 574; Location: 1250 Mockingbird Lane, Suite 150; Private, for-profit; Website: www.sanfordbrown.edu/Dallas)

- Kaplan College-Dallas (Full-time enrollment: 519; Location: 12005 Ford Road, Suite 100; Private, for-profit; Website: www.kaplancollege.com/dallas-tx/)

- Concorde Career Institute-Dallas (Full-time enrollment: 405; Location: 12606 Greenville Ave Ste 130; Private, for-profit; Website: www.concorde.edu)

- Wade College (Full-time enrollment: 334; Location: 1950 N. Stemmons Freeway, Suite 4080 Dallas INFOMART; Private, for-profit; Website: www.wadecollege.edu)

- Platt College-Dallas (Full-time enrollment: 296; Location: 2974 LBJ Freeway; Private, for-profit; Website: www.plattcolleges.edu)

- West Coast University-Dallas (Full-time enrollment: 271; Location: 8435 North Stemmons Freeway; Private, for-profit; Website: westcoastuniversity.edu/campuses/dallas.html)

- Dallas Christian College (Full-time enrollment: 259; Location: 2700 Christian Pkwy.; Private, not-for-profit; Website: www.dallas.edu)

Biggest public high schools in Dallas:

- SKYLINE H S (Students: 4,697, Location: 7777 FORNEY RD, Grades: 9-12)

- SUNSET H S (Students: 2,374, Location: 2120 W JEFFERSON BLVD, Grades: 9-12)

- W T WHITE H S (Students: 2,271, Location: 4505 RIDGESIDE DR, Grades: 9-12)

- W W SAMUELL H S (Students: 2,073, Location: 8928 PALISADE DR, Grades: 9-12)

- HIGHLAND PARK H S (Students: 1,904, Location: 4220 EMERSON AVE, Grades: 9-12)

- BRYAN ADAMS H S (Students: 1,853, Location: 2101 MILLMAR DR, Grades: 9-12)

- MOISES E MOLINA H S (Students: 1,704, Location: 2355 DUNCANVILLE RD, Grades: 9-12)

- NORTH DALLAS H S (Students: 1,587, Location: 3120 N HASKELL AVE, Grades: 9-12)

- WOODROW WILSON H S (Students: 1,425, Location: 100 S GLASGOW DR, Grades: 9-12)

- DAVID W CARTER H S (Students: 1,390, Location: 1819 W WHEATLAND RD, Grades: 9-12)

Biggest private high schools in Dallas:

- EPISCOPAL SCHOOL OF DALLAS PK-12 (Students: 1,168, Location: 4100 MERRELL RD, Grades: PK-12)

- THE PARISH EPISCOPAL SCHOOL PK-12 (Students: 1,104, Location: 4101 SIGMA RD, Grades: PK-12)

- BISHOP LYNCH HIGH SCHOOL (Students: 1,095, Location: 9750 FERGUSON RD, Grades: 9-12)

- JESUIT COLLEGE PREP SCHOOL (Students: 1,071, Location: 12345 INWOOD RD, Grades: 9-12, Boys only)

- THE HOCKADAY SCHOOL (Students: 1,068, Location: 11600 WELCH RD, Grades: PK-12, Girls only)

- SHELTON SCHOOL (Students: 868, Location: 15720 HILLCREST RD, Grades: PK-12)

- ST MARK'S SCHOOL OF TEXAS (Students: 852, Location: 10600 PRESTON RD, Grades: 1-12, Boys only)

- BISHOP DUNNE CATHOLIC SCHOOL (Students: 608, Location: 3900 RUGGED DR, Grades: 6-12)

- DALLAS INTERNATIONAL SCHOOL (Students: 599, Location: 6039 CHURCHILL WAY, Grades: PK-12)

- COVENANT SCHOOL (Students: 482, Location: 7300 VALLEY VIEW LN, Grades: KG-12)

Biggest public elementary/middle schools in Dallas:

- W E GREINER EXPLORATORY ARTS ACADEMY (Students: 1,689, Location: 501 S EDGEFIELD AVE, Grades: 6-8)

- LAKE HIGHLANDS J H (Students: 1,635, Location: 10301 WALNUT HILL LN, Grades: 7-8)

- JOHN B HOOD MIDDLE (Students: 1,381, Location: 7625 HUME DR, Grades: 6-8)

- HAROLD WENDELL LANG SR MIDDLE (Students: 1,367, Location: 1678 CHENAULT, Grades: 6-8)

- ANNE FRANK EL (Students: 1,250, Location: 5201 CELESTIAL RD, Grades: PK-5)

- THOMAS C MARSH MIDDLE (Students: 1,197, Location: 3838 CROWN SHORE DR, Grades: 6-8)

- FRED F FLORENCE MIDDLE (Students: 1,141, Location: 1625 N MASTERS DR, Grades: 6-8)

- FRANKFORD MIDDLE (Students: 1,130, Location: 7706 OSAGE PLAZA PKWY, Grades: 6-8)

- DAVID G BURNET EL (Students: 1,083, Location: 3200 KINKAID DR, Grades: PK-5)

- BENJAMIN FRANKLIN MIDDLE (Students: 1,078, Location: 6920 MEADOW RD, Grades: 6-8)

Biggest private elementary/middle schools in Dallas:

- ST THOMAS AQUINAS CATHOLIC SCHOOL (Students: 876, Location: 3741 ABRAMS RD, Grades: PK-8)

- ST MONICA SCHOOL (Students: 858, Location: 4140 WALNUT HILL LN, Grades: PK-8)

- ST RITA SCHOOL (Students: 670, Location: 12525 INWOOD RD, Grades: KG-8)

- GOOD SHEPHERD EPISCOPAL SCHOOL (Students: 582, Location: 11110 MIDWAY RD, Grades: PK-8)

- ST PATRICK SCHOOL (Students: 515, Location: 9635 FERNDALE RD, Grades: PK-8)

- ST ALCUIN MONTESSORI SCHOOL (Students: 472, Location: 6144 CHURCHILL WAY, Grades: PK-8)

- PROVIDENCE CHRISTIAN SCHOOL OF TEXAS (Students: 444, Location: 5002 W LOVERS LN, Grades: PK-8)

- THE LAMPLIGHTER SCHOOL (Students: 440, Location: 11611 INWOOD RD, Grades: PK-4)

- FELLOWSHIP CHRISTIAN ACADEMY (Students: 434, Location: 1821 W CAMP WISDOM RD, Grades: PK-8)

- WESLEY PREP (Students: 431, Location: 9200 INWOOD RD, Grades: PK-6)

Libraries in Dallas:

- DALLAS PUBLIC LIBRARY (Operating income: $32,895,470; Location: 1515 YOUNG ST; 4,626,800 books; 190,613 audio materials; 273,630 video materials; 32 local licensed databases; 52 state licensed databases; 4,533 print serial subscriptions)

- UNIVERSITY PARK PUBLIC LIBRARY (Operating income: $299,712; Location: 6517 HILLCREST AVE STE 110; 50,084 books; 3,012 audio materials; 3,637 video materials; 50 state licensed databases; 21 print serial subscriptions)

- COCKRELL HILL PUBLIC LIBRARY (Operating income: $29,668; Location: 4125 W CLARENDON DR; 13,660 books; 1,232 audio materials; 508 video materials; 50 state licensed databases; 18 print serial subscriptions)

User-submitted facts and corrections:

- Official government Web site: www.dallascityhall.org

- Ashlee Simpson was born in Dallas, Texas October 3, 1984. Muscian. Sister of Jessica Simpson. Luke Wilson was born in Dallas, Texas on September 21, 1971. U.S. Actor, brother of Owen Wilson. Ryan Cabrera was born in Dallas, Texas on July 18, 1982. Muscian and boyfriend of Ashlee Simpson. Stevie Ray Vaughan was born in Dallas, Texas on October 3,1954. Lengendary blues musician. Spud Webb was born in Dallas, Texas on July 13, 1963. NBA basketball player. Erykah Badu was born in Dallas, Texas on February 26, 1971. Musician.

- Churches in dallas: Preston road church of christ, preston crest church of crist, skillman church of christ, walnut hill church of christ, white rok church of christ, souther hills church of christ, highland oaks church of christ, saturn road church of christ, east dallas church of christ, lake highlands church, hillcrest church, guadelope cathredral, first united methodist church, Northway christian church.

Points of interest:

Notable locations in Dallas: Bachman Filtration Plant (A), Bachman Water Treatment Plant (B), City of Dallas Central Wastewater Treatment Plant (C), City of Garland Duck Creek Wastewater Treatment Plant (D), Cityof Dallas Southside Wastewater Treatment Plant (E), Ten Mile Creek Wastewater Treatment Plant (F), West End Marketplace Center (G), Brook Hollow Country Club (H), Cedar Crest Country Club (I), D A C Country Club (J), Dallas Country Club (K), Dallas Sewage Disposal (L), Glen Lakes Country Club (M), Lakewood Country Club (N), Mountain Creek Power Plant (O), Oak Cliff Country Club (P), Park Cities Filtration Plant (Q), Preston Hollow Country Club (R), River Lake Country Club (S), Spring Valley Athletic Club (T). Display/hide their locations on the map

Shopping Centers: College Station Shopping Center (1), Corner Shopping Center (2), EOP Sterling Plaza Shopping Center (3), Gannon Plaza Shopping Center (4), Henderson Plaza Shopping Center (5), Lancaster Kiest Shopping Center (6), Northtown Mall Shopping Center (7), Plaza Latina Shopping Center (8), Preston Forest Shopping Center (9). Display/hide their locations on the map

Main business address in Dallas include: HOLLY CORP (A), KRONOS INTERNATIONAL INC (B), BRINKER INTERNATIONAL INC (C), GNC ENERGY CORP (D), FROZEN FOOD EXPRESS INDUSTRIES INC (E), TXU GAS CO (F), DEAN HOLDING CO (G). Display/hide their locations on the map

Churches in Dallas include: Pleasant Haven Church (A), Pleasant Mound Church (B), Prairie Creek Church (C), Rowlett Church (D), Saint Andrews Church (E), Saint Bernard Church (F), Saint Francis Church (G), Saint John Church (H), Saint Luke Church (I). Display/hide their locations on the map

Cemeteries: Mount Calvary Cemetery (1), Calvary Hill Cemetery (2), Carver Cemetery (3), Grove Hill Memorial Park (4), Greenwood Cemetery (5), Cockrell Cemetery (6), Northaven Park (7). Display/hide their locations on the map

Lakes and reservoirs: White Rock Lake (A), Wahoo Lake (B), Elm Fork (C), Corder Lake (D), Thompson Slough (E), North Lake (F), Mountain Creek Lake (G), Little Lemmon Lake (H). Display/hide their locations on the map

Streams, rivers, and creeks: Yankee Creek (A), Woody Branch (B), Whites Branch (C), White Rock Creek (D), West Fork (E), Turtle Creek (F), Thompson Branch (G), Squabble Creek (H), South Fork Grapevine Creek (I). Display/hide their locations on the map

Parks in Dallas include: Apache Park (1), Arapahoe Park (2), Arcadia Heights Park (3), Arden Terrace Park (4), Lawnview Park (5), Lemmon Park (6), Lindsley Park (7), Harry Stone Park (8), Lake Highland Park (9). Display/hide their locations on the map

Tourist attractions: Biblical Arts Center (Museums; 7500 Park Lane) (1), Biblical Arts Center Rental (Museums; 7500 Park Lane) (2), Amigos Bibliographic Council (Cultural Attractions- Events- & Facilities; 14400 Midway Road) (3), Dallas Arboretum & Botanical Garden (Cultural Attractions- Events- & Facilities; 8617 Garland Road) (4), Dallas Zoo (Cultural Attractions- Events- & Facilities; 621 East Clarendon Drive) (5), Dallas Holocaust Memorial Center (Cultural Attractions- Events- & Facilities; 501 Elm Street Suite 380) (6), Dallas Museum of Natural History (Cultural Attractions- Events- & Facilities; 3535 Grand Avenue) (7), Dallas Fire Fighters Museum (Cultural Attractions- Events- & Facilities; 3801 Parry Avenue) (8), El Dragon (Botanical Gardens; 10788 Harry Hines Blvd) (9). Display/hide their approximate locations on the map

Hotels: Benjamin West Dallas LLC (17630 Davenport Road) (1), Bucks Bar (1241 West Mockingbird Lane) (2), Candlewood Suites Hotel (13939 Noel Road) (3), Beltline Motel-Sun (13415 Centre F Hawn Freeway) (4), Apex Motel (4036 North Westmoreland Road) (5), Century Inn (2126 West Northwest Highway) (6), Comfort Inn & Suites Market Center (7138 North Stemmons Freeway) (7), Comfort Inn (12670 East Northwest Highway) (8), Amerisuites - West End (1907 North Lamar Street) (9). Display/hide their approximate locations on the map

Courts: Housing Authority of the City of Dallas - Housing Developments- Turner C (6601 Bexar Street) (1), Farmers Branch City - Police Administration- Municipal Court (3723 Valley View Lane) (2), United States Government - Congress-United States- Frost Martin Congres (400 South Zang Boulevard Suite 506) (3), Sessions Pete Congressman (12750 Merit Drive Suite 1434) (4), Courts-Federal - District Court- Clerk Of Court Karen Mitchell (1100 Commerce Street Suite 1452) (5). Display/hide their approximate locations on the map

Birthplace of: Lacey Von Erich - Professional wrestler, Sly Stone - (born 1944), singer-songwriter, Allen R. Morris - Producer, Usher (entertainer) - Singer-songwriter, Acie Law - Professional basketball player, Clayton Kershaw - Baseball player, Tara Conner - Beauty queen, Samuel David Dealey - Navy Medal of Honor recipient, Harriet Miers - Judge, Stevie Ray Vaughan - (1954 - 1990), musician.

Drinking water stations with addresses in Dallas and their reported violations in the past:

USCOE ROCKY CREEK PARK 2 (Population served: 1,500, Purch groundwater):Past monitoring violations:LINDEN TRAILS (Address: 5910 N CENTRAL EXPY , Serves AZ, Population served: 883, Groundwater):

- 7 routine major monitoring violations

- One minor monitoring violation

- 2 regular monitoring violations

Past monitoring violations:TREVOR REES-JONES SCOUT CAMP (Population served: 600, Groundwater):

- Monitoring and Reporting (DBP) - Between JAN-2011 and DEC-2011, Contaminant: TTHM. Follow-up actions: State No Longer Subject to Rule (JUN-30-2012)

- Monitoring and Reporting (DBP) - Between JAN-2011 and DEC-2011, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: State No Longer Subject to Rule (JUN-30-2012)

- Monitoring and Reporting (DBP) - Between APR-2009 and JUN-2009, Contaminant: Chlorine. Follow-up actions: St Compliance achieved (OCT-20-2008), St Violation/Reminder Notice (JUL-31-2009), St Compliance achieved (AUG-14-2009)

- Monitoring and Reporting (DBP) - Between OCT-2008 and DEC-2008, Contaminant: Chlorine. Follow-up actions: St Compliance achieved (FEB-03-2009)

- Monitoring and Reporting (DBP) - Between JUL-2008 and SEP-2008, Contaminant: Chlorine. Follow-up actions: St Violation/Reminder Notice (OCT-20-2008)

- 3 routine major monitoring violations

- 20 regular monitoring violations

- 10 other older monitoring violations

Past health violations:BLUEBERRY HILLS WATERWORKS (Population served: 396, Purch surface water):Past monitoring violations:

- MCL, Monthly (TCR) - In JUN-2007, Contaminant: Coliform. Follow-up actions: St Compliance achieved (JUN-30-2007), St Public Notif requested (JUL-02-2007), St Violation/Reminder Notice (2 times from JUL-02-2007 to JAN-25-2011)

- 4 routine major monitoring violations

- 2 minor monitoring violations

Past health violations:SPEEDY STOP 81 (Population served: 300, Groundwater):Past monitoring violations:

- MCL, Average - Between JUL-2014 and SEP-2014, Contaminant: TTHM

- MCL, Single Sample - Between JUL-2013 and SEP-2013, Contaminant: Nitrite. Follow-up actions: St Public Notif requested (AUG-21-2013), St Violation/Reminder Notice (AUG-21-2013), St Public Notif received (AUG-27-2013), St Compliance achieved (SEP-02-2014)

- MCL, Average - Between OCT-2012 and DEC-2012, Contaminant: Arsenic

- MCL, Average - Between OCT-2012 and DEC-2012, Contaminant: Arsenic

- MCL, Average - Between OCT-2012 and DEC-2012, Contaminant: Arsenic

- MCL, Average - Between JUL-2012 and SEP-2012, Contaminant: Arsenic. Follow-up actions: St Public Notif requested (OCT-22-2012), St Violation/Reminder Notice (OCT-22-2012), St Public Notif received (DEC-06-2012)

- 45 other older health violations

- One routine major monitoring violation

- One minor monitoring violation

Past monitoring violations:SPEEDY STOP 46 (Population served: 300, Groundwater):

- 6 routine major monitoring violations

- One regular monitoring violation

Past monitoring violations:CHANNEL OAKS WATER SYSTEM (Population served: 159, Groundwater):

- 8 routine major monitoring violations

Past health violations:SOMERVELL TRAINING CENTER (Population served: 100, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - In JAN-2007, Contaminant: Coliform. Follow-up actions: St Compliance achieved (JAN-31-2007), St Violation/Reminder Notice (2 times from FEB-02-2007 to FEB-02-2007), St Public Notif requested (2 times from FEB-02-2007 to FEB-02-2007), St Public Notif received (2 times from MAR-04-2007 to MAR-04-2007)

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2013, Contaminant: Lead and Copper Rule

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2011, Contaminant: Lead and Copper Rule

- Monitoring, Source Water (GWR) - In JUL-01-2011, Contaminant: E. COLI. Follow-up actions: St Public Notif requested (AUG-25-2011), St Violation/Reminder Notice (AUG-25-2011), St Public Notif received (OCT-06-2011)

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2010, Contaminant: Lead and Copper Rule

- Monitoring and Reporting (DBP) - Between JAN-2009 and MAR-2009, Contaminant: Chlorine. Follow-up actions: St Public Notif requested (JUL-21-2009), St Violation/Reminder Notice (JUL-21-2009), St Other (JUL-30-2009), St Compliance achieved (JUL-17-2014)

- One minor monitoring violation

Past monitoring violations:

- One regular monitoring violation

Drinking water stations with addresses in Dallas that have no violations reported:

- TWIN COVES MARINA (Population served: 1,200, Primary Water Source Type: Groundwater)

- WEST BRANCH 7-11 (Address: Suite 1000 , Serves MI, Population served: 500, Primary Water Source Type: Groundwater)

- CHURCH OF THE KING (Population served: 300, Primary Water Source Type: Groundwater)

- WHISPERING CEDARS CAMP (Population served: 200, Primary Water Source Type: Groundwater)

- SQUAW CREEK OFFICE PARK (Population served: 150, Primary Water Source Type: Groundwater)

- COMANCHE PEAK TRAINING CENTER (Population served: 30, Primary Water Source Type: Groundwater)

- SQUAW CREEK PARK BOAT DOCK (Population served: 25, Primary Water Source Type: Groundwater)

- PLURIS ALABAMA LLC (Address: 2100 MCKINNEY AVENUE, SUITE 1550 , Serves AL, Population served: 0, Primary Water Source Type: Groundwater)

| This city: | 2.6 people |

| Texas: | 2.8 people |

| This city: | 58.0% |

| Whole state: | 69.9% |

| This city: | 7.3% |

| Whole state: | 6.0% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.5% of all households

- Gay men: 0.9% of all households

People in group quarters in Dallas in 2010:

- 6,363 people in local jails and other municipal confinement facilities

- 3,693 people in nursing facilities/skilled-nursing facilities

- 2,392 people in college/university student housing

- 2,214 people in state prisons

- 1,765 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 744 people in residential treatment centers for adults

- 512 people in other noninstitutional facilities

- 450 people in group homes intended for adults

- 327 people in correctional facilities intended for juveniles

- 123 people in workers' group living quarters and job corps centers

- 72 people in group homes for juveniles (non-correctional)

- 38 people in residential treatment centers for juveniles (non-correctional)

- 14 people in military disciplinary barracks and jails

- 11 people in mental (psychiatric) hospitals and psychiatric units in other hospitals

- 7 people in correctional residential facilities

People in group quarters in Dallas in 2000:

- 8,388 people in local jails and other confinement facilities (including police lockups)

- 5,399 people in nursing homes

- 2,265 people in other noninstitutional group quarters

- 1,225 people in college dormitories (includes college quarters off campus)

- 1,187 people in homes or halfway houses for drug/alcohol abuse

- 1,104 people in hospitals/wards and hospices for chronically ill

- 936 people in other hospitals or wards for chronically ill

- 285 people in other group homes

- 283 people in unknown juvenile institutions

- 195 people in mental (psychiatric) hospitals or wards

- 168 people in hospices or homes for chronically ill

- 148 people in homes for the mentally retarded

- 137 people in hospitals or wards for drug/alcohol abuse

- 131 people in schools, hospitals, or wards for the intellectually disabled

- 114 people in halfway houses

- 103 people in religious group quarters

- 57 people in other types of correctional institutions

- 48 people in wards in general hospitals for patients who have no usual home elsewhere

- 37 people in orthopedic wards and institutions for the physically handicapped

- 33 people in other nonhousehold living situations

- 13 people in homes for the mentally ill

- 6 people in institutions for the blind

- 6 people in homes for the physically handicapped

Banks with most branches in Dallas (2011 data):

- JPMorgan Chase Bank, National Association: 69 branches. Info updated 2011/11/10: Bank assets: $1,811,678.0 mil, Deposits: $1,190,738.0 mil, headquarters in Columbus, OH, positive income, International Specialization, 5577 total offices, Holding Company: Jpmorgan Chase & Co.

- Bank of America, National Association: 43 branches. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- Wells Fargo Bank, National Association: 42 branches. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- Comerica Bank: 26 branches. Info updated 2011/07/29: Bank assets: $60,970.5 mil, Deposits: $48,300.9 mil, local headquarters, positive income, Commercial Lending Specialization, 497 total offices, Holding Company: Comerica Incorporated

- Compass Bank: 21 branches. Info updated 2011/02/24: Bank assets: $63,107.0 mil, Deposits: $46,232.4 mil, headquarters in Birmingham, AL, negative income in the last year, Commercial Lending Specialization, 720 total offices, Holding Company: Banco Bilbao Vizcaya Argentaria, S.A.

- First National Bank Texas: 13 branches. Info updated 2006/11/03: Bank assets: $944.3 mil, Deposits: $815.9 mil, headquarters in Killeen, TX, positive income, Mortgage Lending Specialization, 250 total offices, Holding Company: First Community Bancshares, Inc.

- Capital One, National Association: 12 branches. Info updated 2011/07/01: Bank assets: $133,477.8 mil, Deposits: $97,063.7 mil, headquarters in Mclean, VA, positive income, 984 total offices, Holding Company: Capital One Financial Corporation

- Prosperity Bank: 11 branches. Info updated 2012/01/05: Bank assets: $9,816.2 mil, Deposits: $8,064.8 mil, headquarters in El Campo, TX, positive income, Mortgage Lending Specialization, 187 total offices, Holding Company: Prosperity Bancshares, Inc.

- BOKF, National Association: 10 branches. Info updated 2012/02/28: Bank assets: $25,360.0 mil, Deposits: $19,171.3 mil, headquarters in Tulsa, OK, positive income, Commercial Lending Specialization, 189 total offices, Holding Company: Bok Financial Corporation

- 71 other banks with 147 local branches

For population 15 years and over in Dallas:

- Never married: 42.8%

- Now married: 41.2%

- Separated: 2.5%

- Widowed: 4.0%

- Divorced: 9.6%

For population 25 years and over in Dallas:

- High school or higher: 81.0%

- Bachelor's degree or higher: 38.1%

- Graduate or professional degree: 15.3%

- Unemployed: 3.3%

- Mean travel time to work (commute): 21.0 minutes

| Here: | 16.9 |

| Texas average: | 14.0 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Dallas:

(Dallas, Texas Neighborhood Map)- Abrams neighborhood

- Alexander's Village neighborhood

- Arcadia Park neighborhood

- Arlington Park neighborhood

- Arts District neighborhood

- Beckley Club Estates neighborhood

- Belmont neighborhood

- Belmont Addition neighborhood

- Bent Tree neighborhood

- Beverly Hills neighborhood

- Bishop Arts District neighborhood

- Bluffview neighborhood

- Bonton neighborhood

- Branch Crossing neighborhood

- Briarwood neighborhood

- Bryan Place neighborhood

- Buckner Park Industrial District neighborhood

- Casa Linda neighborhood

- Casa Linda Estates neighborhood

- Casa View neighborhood

- Cedars neighborhood

- City Center District neighborhood

- Cityplace neighborhood

- Club Manor neighborhood

- Cochran Heights neighborhood

- Cockrell Hill neighborhood

- Convention Center District neighborhood

- Country Forest neighborhood

- Countryside Mobile Home Park neighborhood

- Dallas Land and Loan neighborhood

- Deep Ellum neighborhood

- Devonshire neighborhood

- Downtown neighborhood

- Downtown Farmers Branch (Downtown) neighborhood

- Eagle Ford neighborhood

- East Dallas neighborhood

- East Garrett Park neighborhood

- East Kessler Park neighborhood

- El Tivoli Place neighborhood

- Elkins Forrest neighborhood

- Elmwood neighborhood

- Exposition Park (Expo) neighborhood

- Fair Park neighborhood

- Far North Dallas neighborhood

- Farmers Market neighborhood

- Farmers Market District neighborhood

- First Company neighborhood

- Forest Hills neighborhood

- Freedman's Town neighborhood

- Glen Oaks neighborhood

- Glencoe Park neighborhood

- Government District neighborhood

- Greenland Hills (M-Streets) neighborhood

- Greenleaf Village neighborhood

- Greenway Parks neighborhood

- Gribble neighborhood

- Hamilton Park neighborhood

- Hampton Hills neighborhood

- Henderson neighborhood

- Highland Hills neighborhood

- Highland Meadows neighborhood

- Highland Park neighborhood

- Holiday Park neighborhood

- Hollywood Heights neighborhood

- Hollywood Santa Monica neighborhood

- International Center neighborhood

- Inwood neighborhood

- Junius Heights neighborhood

- Kessler neighborhood

- Kessler Highlands neighborhood

- Kessler Park neighborhood

- Kessler Plaza neighborhood

- Kessler Square neighborhood

- Kidd Springs neighborhood

- King's Highway neighborhood

- Kings Highway Conservation District neighborhood

- Knox Park neighborhood

- Knox/Henderson neighborhood

- Koreatown neighborhood

- L Streets neighborhood

- L.O. Daniel neighborhood

- LO Daniel neighborhood

- La Bajada neighborhood

- La L'aceate neighborhood

- La Loma neighborhood

- Lake Cliff neighborhood

- Lake Highlands neighborhood

- Lake Highlands Estates neighborhood

- Lake Highlands North neighborhood

- Lake Park Estates neighborhood

- Lake Ridge Estates neighborhood

- Lake West neighborhood

- Lakewood neighborhood

- Lakewood Heights neighborhood

- Ledbetter Gardens neighborhood

- Little Forest Hills neighborhood

- LoMac (Lo Mackinney Avenue) neighborhood

- Lochwood (Dixon Branch) neighborhood

- Lone Star Industrial Park neighborhood

- Los Altos neighborhood

- Love Field neighborhood

- Lower Greenville neighborhood

- M Streets (Greenland Hills) neighborhood

- Main Street District neighborhood

- Melshire Estates neighborhood

- Merriman Park North neighborhood

- Merriman Park/University Manor neighborhood

- Mesquite Springs Mobile Home Park neighborhood

- Mill Creek neighborhood

- Moss Farm neighborhood

- Moss Meadows neighborhood

- Muncie neighborhood

- Munger Place neighborhood

- Munger Place Historic District neighborhood

- North Cliff neighborhood

- North Dallas neighborhood

- North Park (Elm Thicket) neighborhood

- Northwest Dallas neighborhood

- Northwood Heights neighborhood

- Northwood Hills neighborhood

- Oak Cliff (The Cliff) neighborhood

- Oak Highlands neighborhood

- Oak Lawn neighborhood

- Oak Tree Village neighborhood

- Old East Dallas neighborhood

- Old Lake Highlands neighborhood

- Park Cities neighborhood

- Parkdale Heights neighborhood

- Perry Heights neighborhood

- Platinum Corridor neighborhood

- Pleasant Grove neighborhood

- Preston Center neighborhood

- Preston Highlands neighborhood

- Preston Hollow neighborhood

- Prestonwood North neighborhood

- Prestonwood on the Park neighborhood

- Ravinia Heights neighborhood

- Redbird neighborhood

- Reunion District (Reunion) neighborhood

- Ridgewood Park neighborhood

- Royal Highlands neighborhood

- Royal Lane Village neighborhood

- Santa Garza neighborhood

- Santa Monica (Little Forest Hill) neighborhood

- Scyene neighborhood

- Singleton Industrial Area neighborhood

- South Dallas neighborhood

- South Oak Cliff neighborhood

- Southwestern Bell neighborhood

- State Thomas neighborhood

- Stemmons Corridor (Lower Stemmons) neighborhood

- Stephens Park Village neighborhood

- Stevens Park neighborhood

- Stevens Park Estates neighborhood

- Sunset Hills neighborhood

- Swiss Avenue neighborhood

- Tanglewood neighborhood

- The Cedars neighborhood

- The Dells District neighborhood

- Timberglen neighborhood

- Town Creek neighborhood

- Turnpike Distribution Center neighborhood

- Turtle Creek neighborhood

- University Meadows neighborhood

- University Park neighborhood

- University Terrace neighborhood

- Uptown neighborhood

- Urban Park (Urbandale) neighborhood

- Urban Reserve neighborhood

- Vickery Meadows (Vickery Meadow) neighborhood

- Vickery Place neighborhood

- Victory Park neighborhood

- West Dallas neighborhood

- West End neighborhood

- West End Historic District neighborhood

- West Kessler neighborhood

- West Village neighborhood

- Western Heights neighborhood

- Westmoreland Heights neighborhood

- Wheatley Place neighborhood

- Whispering Oaks Mobile Home Park neighborhood

- White Rock Valley neighborhood

- Wilshire Heights neighborhood

- Winnetka Heights neighborhood

- Woodbridge neighborhood

- Woodlands on the Creek neighborhood

- Wynnewood neighborhood

- Wynnewood North neighborhood

Religion statistics for Dallas, TX (based on Dallas County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 615,849 | 1,672 |

| Catholic | 446,996 | 57 |

| Mainline Protestant | 166,224 | 240 |

| Other | 147,445 | 174 |

| Black Protestant | 69,831 | 174 |

| Orthodox | 8,813 | 19 |

| None | 912,981 | - |

Food Environment Statistics:

| Dallas County: | 1.64 / 10,000 pop. |

| Texas: | 1.47 / 10,000 pop. |

| Dallas County: | 0.10 / 10,000 pop. |

| Texas: | 0.14 / 10,000 pop. |

| This county: | 1.15 / 10,000 pop. |

| Texas: | 1.11 / 10,000 pop. |

| Dallas County: | 2.82 / 10,000 pop. |

| State: | 3.95 / 10,000 pop. |

| Dallas County: | 6.73 / 10,000 pop. |

| Texas: | 6.13 / 10,000 pop. |

| This county: | 8.8% |

| Texas: | 8.9% |

| This county: | 27.1% |

| Texas: | 26.6% |

| Dallas County: | 17.0% |

| Texas: | 15.7% |

Health and Nutrition:

| This city: | 47.4% |

| State: | 48.6% |

| This city: | 47.4% |

| Texas: | 47.4% |

| Here: | 28.4 |

| Texas: | 28.5 |

| Here: | 19.6% |

| State: | 20.6% |

| This city: | 9.9% |

| Texas: | 10.3% |

| This city: | 6.7 |

| Texas: | 6.8 |

| This city: | 31.5% |

| Texas: | 33.1% |

| This city: | 56.5% |

| State: | 56.2% |

| Dallas: | 82.0% |

| Texas: | 80.7% |

More about Health and Nutrition of Dallas, TX Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 3,138 | $27,161,418 | $103,868 | 0 | $0 |

| Airports | 2,163 | $14,438,118 | $80,101 | 0 | $0 |

| Firefighters | 2,012 | $17,914,187 | $106,844 | 0 | $0 |

| Water Supply | 1,344 | $7,491,898 | $66,892 | 0 | $0 |

| Parks and Recreation | 789 | $3,720,999 | $56,593 | 1 | $2,374 |

| Other and Unallocable | 749 | $4,523,571 | $72,474 | 11 | $15,030 |

| Streets and Highways | 601 | $2,891,228 | $57,728 | 2 | $9,581 |

| Health | 570 | $2,768,289 | $58,280 | 0 | $0 |

| Police - Other | 545 | $2,663,095 | $58,637 | 0 | $0 |

| Other Government Administration | 544 | $3,597,962 | $79,367 | 2 | $394 |

| Solid Waste Management | 519 | $2,582,459 | $59,710 | 1 | $1,063 |

| Judicial and Legal | 389 | $2,579,581 | $79,576 | 2 | $7,902 |

| Financial Administration | 345 | $2,810,110 | $97,743 | 0 | $0 |

| Local Libraries | 326 | $1,322,617 | $48,685 | 47 | $63,419 |

| Welfare | 252 | $1,117,001 | $53,191 | 0 | $0 |

| Housing and Community Development (Local) | 248 | $1,122,973 | $54,337 | 0 | $0 |

| Sewerage | 161 | $968,664 | $72,199 | 1 | $3,851 |

| Fire - Other | 102 | $556,375 | $65,456 | 0 | $0 |

| Totals for Government | 14,797 | $100,230,545 | $81,284 | 67 | $103,614 |

Dallas government finances - Expenditure in 2021 (per resident):

- Construction - Air Transportation: $394,540,000 ($303.60)

Water Utilities: $133,689,000 ($102.87)

Regular Highways: $109,053,000 ($83.92)

Sewerage: $102,335,000 ($78.75)

Parks and Recreation: $58,460,000 ($44.99)

General - Other: $48,404,000 ($37.25)

Natural Resources - Other: $48,183,000 ($37.08)

Libraries: $12,258,000 ($9.43)

General Public Buildings: $8,395,000 ($6.46)

Protective Inspection and Regulation - Other: $3,602,000 ($2.77)

Housing and Community Development: $2,049,000 ($1.58)

Local Fire Protection: $2,046,000 ($1.57)

Judicial and Legal Services: $1,953,000 ($1.50)

Financial Administration: $1,011,000 ($0.78)

Police Protection: $402,000 ($0.31)

Central Staff Services: $100,000 ($0.08)

Miscellaneous Commercial Activities - Other: $64,000 ($0.05)

- Current Operations - Air Transportation: $618,383,000 ($475.85)

Police Protection: $488,150,000 ($375.63)

Local Fire Protection: $289,139,000 ($222.49)

Water Utilities: $213,236,000 ($164.09)

Sewerage: $188,449,000 ($145.01)

Parks and Recreation: $172,372,000 ($132.64)

General - Other: $148,832,000 ($114.53)

Regular Highways: $109,289,000 ($84.10)

Solid Waste Management: $77,603,000 ($59.72)

Protective Inspection and Regulation - Other: $54,673,000 ($42.07)

Health - Other: $41,901,000 ($32.24)

Central Staff Services: $38,733,000 ($29.81)

Financial Administration: $38,529,000 ($29.65)

Libraries: $37,635,000 ($28.96)

Judicial and Legal Services: $36,471,000 ($28.06)

General Public Buildings: $28,178,000 ($21.68)

Public Welfare - Other: $21,440,000 ($16.50)

Housing and Community Development: $20,789,000 ($16.00)

Natural Resources - Other: $3,616,000 ($2.78)

Miscellaneous Commercial Activities - Other: $3,432,000 ($2.64)

Correctional Institutions: $3,322,000 ($2.56)

Parking Facilities: $231,000 ($0.18)

- General - Interest on Debt: $343,505,000 ($264.33)

- Intergovernmental to Local - Other - Correctional Institutions: $9,157,000 ($7.05)

Other - Financial Administration: $3,964,000 ($3.05)

Other - General - Other: $186,000 ($0.14)

Other - Transit Utilities: $129,000 ($0.10)

- Other Capital Outlay - Air Transportation: $39,153,000 ($30.13)

General - Other: $32,789,000 ($25.23)

Water Utilities: $24,794,000 ($19.08)

Sewerage: $17,878,000 ($13.76)

Solid Waste Management: $16,442,000 ($12.65)

Local Fire Protection: $12,367,000 ($9.52)

Regular Highways: $10,562,000 ($8.13)

Parks and Recreation: $6,025,000 ($4.64)

Financial Administration: $3,193,000 ($2.46)

Police Protection: $2,532,000 ($1.95)

Protective Inspection and Regulation - Other: $1,575,000 ($1.21)

General Public Building: $930,000 ($0.72)

Libraries: $658,000 ($0.51)

Health - Other: $276,000 ($0.21)

Public Welfare - Other: $121,000 ($0.09)

Central Staff Services: $89,000 ($0.07)

Judicial and Legal Services: $62,000 ($0.05)

Miscellaneous Commercial Activities - Other: $48,000 ($0.04)

Correctional Institutions: $9,000 ($0.01)

Natural Resources - Other: $6,000 ($0.00)

Housing and Community Development: $4,000 ($0.00)

- Total Salaries and Wages: $531,000 ($0.41)

- Water Utilities - Interest on Debt: $65,931,000 ($50.73)

Dallas government finances - Revenue in 2021 (per resident):

- Charges - Air Transportation: $1,042,733,000 ($802.38)

Sewerage: $304,946,000 ($234.66)

Solid Waste Management: $125,224,000 ($96.36)

Other: $63,161,000 ($48.60)

Parks and Recreation: $48,741,000 ($37.51)

Parking Facilities: $3,591,000 ($2.76)

Miscellaneous Commercial Activities: $1,524,000 ($1.17)

Regular Highways: $1,287,000 ($0.99)

Housing and Community Development: $48,000 ($0.04)

- Federal Intergovernmental - Health and Hospitals: $295,474,000 ($227.37)

Air Transportation: $43,639,000 ($33.58)

Housing and Community Development: $12,949,000 ($9.96)

Other: $10,799,000 ($8.31)

- Local Intergovernmental - Other: $9,495,000 ($7.31)

Highways: $9,350,000 ($7.19)

Public Welfare: $1,000,000 ($0.77)

- Miscellaneous - Interest Earnings: $52,278,000 ($40.23)

Special Assessments: $49,390,000 ($38.01)

General Revenue - Other: $39,920,000 ($30.72)

Fines and Forfeits: $23,250,000 ($17.89)

Sale of Property: $4,851,000 ($3.73)

Donations From Private Sources: $4,094,000 ($3.15)

Rents: $1,651,000 ($1.27)

- Revenue - Water Utilities: $392,387,000 ($301.94)

- State Intergovernmental - Other: $23,759,000 ($18.28)

Health and Hospitals: $20,058,000 ($15.43)

Housing and Community Development: $9,646,000 ($7.42)

Highways: $6,462,000 ($4.97)

Public Welfare: $2,989,000 ($2.30)

- Tax - Property: $1,162,950,000 ($894.89)

General Sales and Gross Receipts: $311,853,000 ($239.97)

Public Utilities Sales: $89,829,000 ($69.12)

Other Selective Sales: $43,769,000 ($33.68)

Other License: $29,836,000 ($22.96)

Occupation and Business License - Other: $12,857,000 ($9.89)

Alcoholic Beverage License: $689,000 ($0.53)

Amusements Sales: $253,000 ($0.19)

Amusements License: $91,000 ($0.07)

Dallas government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $11,126,834,000 ($8562.11)

Outstanding Unspecified Public Purpose: $11,059,245,000 ($8510.10)

Retired Unspecified Public Purpose: $2,870,004,000 ($2208.47)

Issue, Unspecified Public Purpose: $2,802,415,000 ($2156.46)

Beginning Outstanding - Public Debt for Private Purpose: $72,575,000 ($55.85)

Outstanding Nonguaranteed - Industrial Revenue: $71,170,000 ($54.77)

Retired Nonguaranteed - Public Debt for Private Purpose: $1,405,000 ($1.08)

- Short Term Debt Outstanding - End of Fiscal Year: $216,400,000 ($166.52)

Beginning: $168,000,000 ($129.28)

Dallas government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $1,071,598,000 ($824.60)

- Other Funds - Cash and Securities: $2,465,077,000 ($1896.88)

- Sinking Funds - Cash and Securities: $1,244,300,000 ($957.49)

7.50% of this county's 2021 resident taxpayers lived in other counties in 2020 ($78,710 average adjusted gross income)

| Here: | 7.50% |

| Texas average: | 8.12% |

0.01% of residents moved from foreign countries ($115 average AGI)

Dallas County: 0.01% Texas average: 0.04%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Tarrant County, TX | |

| from Collin County, TX | |

| from Denton County, TX |

8.56% of this county's 2020 resident taxpayers moved to other counties in 2021 ($74,660 average adjusted gross income)

| Here: | 8.56% |

| Texas average: | 7.40% |

0.02% of residents moved to foreign countries ($227 average AGI)

Dallas County: 0.02% Texas average: 0.03%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Tarrant County, TX | |

| to Collin County, TX | |

| to Denton County, TX |

| Businesses in Dallas, TX | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 24 Hour Fitness | 6 | Jimmy Jazz | 2 | |

| 7-Eleven | 58 | Jimmy John's | 6 | |

| 99 Cents Only Stores | 4 | JoS. A. Bank | 4 | |

| ALDI | 9 | Johnny Rockets | 1 | |

| ALDO | 3 | Jones New York | 16 | |

| AT&T | 19 | Journeys | 3 | |

| Abercrombie & Fitch | 2 | Juicy Couture | 2 | |

| Abercrombie Kids | 2 | Justice | 3 | |

| Academy Sports + Outdoors | 1 | KFC | 20 | |

| Ace Hardware | 3 | Kohl's | 2 | |

| Aeropostale | 2 | Kroger | 7 | |

| Albertsons | 8 | LA Fitness | 4 | |

| American Eagle Outfitters | 2 | La Quinta | 5 | |

| Ann Taylor | 5 | Lane Bryant | 3 | |

| Apple Store | 2 | Lane Furniture | 20 | |

| Applebee's | 3 | LensCrafters | 2 | |

| Arby's | 5 | Little Caesars Pizza | 14 | |

| Audi | 1 | Long John Silver's | 8 | |

| AutoZone | 32 | Lowe's | 6 | |

| Avenue | 3 | Macy's | 3 | |

| BMW | 1 | Marriott | 16 | |

| Bakers | 1 | Marshalls | 3 | |

| Bally Total Fitness | 3 | MasterBrand Cabinets | 17 | |

| Banana Republic | 3 | McDonald's | 60 | |

| Barnes & Noble | 3 | Men's Wearhouse | 4 | |

| Baskin-Robbins | 5 | Motel 6 | 6 | |

| Bath & Body Works | 5 | Motherhood Maternity | 5 | |

| Bebe | 2 | New Balance | 11 | |

| Bed Bath & Beyond | 2 | Nike | 65 | |

| Ben & Jerry's | 2 | Nissan | 1 | |

| Bentleymotors.Com | 1 | Nordstrom | 3 | |

| Best Western | 4 | Office Depot | 8 | |

| Blockbuster | 14 | OfficeMax | 3 | |

| Brooks Brothers | 2 | Old Navy | 2 | |

| Brookstone | 4 | Olive Garden | 2 | |

| Budget Car Rental | 5 | On The Border | 2 | |

| Burger King | 27 | Outback | 1 | |

| Burlington Coat Factory | 2 | Outback Steakhouse | 1 | |

| Buybuy BABY | 1 | Pac Sun | 2 | |

| CVS | 37 | Panda Express | 7 | |

| Cache | 2 | Panera Bread | 4 | |

| Carl\s Jr. | 3 | Papa John's Pizza | 6 | |

| Casual Male XL | 2 | Payless | 14 | |

| Catherines | 2 | Penske | 13 | |

| Charlotte Russe | 2 | PetSmart | 4 | |

| Chevrolet | 4 | Pier 1 Imports | 4 | |

| Chick-Fil-A | 11 | Pizza Hut | 21 | |

| Chico's | 5 | Plato's Closet | 1 | |

| Chipotle | 9 | Popeyes | 20 | |

| Chuck E. Cheese's | 2 | Pottery Barn | 2 | |

| Church's Chicken | 28 | Pottery Barn Kids | 1 | |

| Cinnabon | 2 | Qdoba Mexican Grill | 2 | |

| Circle K | 4 | Quality | 1 | |

| Clarks | 1 | Quiznos | 13 | |

| Cold Stone Creamery | 2 | RadioShack | 19 | |

| Coldwater Creek | 1 | Red Lobster | 2 | |

| ColorTyme | 1 | Rooms To Go | 1 | |

| Comfort Inn | 1 | Rue21 | 1 | |

| Comfort Suites | 1 | Ryder Rental & Truck Leasing | 1 | |

| Crate & Barrel | 2 | SAS Shoes | 1 | |

| Curves | 4 | SONIC Drive-In | 34 | |

| DHL | 17 | Safeway | 15 | |

| Dairy Queen | 1 | Saks Fifth Avenue | 1 | |

| Decora Cabinetry | 4 | Sam's Club | 4 | |

| Dennys | 11 | Sears | 7 | |

| Discount Tire | 10 | Sephora | 2 | |

| Domino's Pizza | 18 | Sheraton | 3 | |

| Dunkin Donuts | 6 | Skechers USA | 1 | |

| Econo Lodge | 1 | Soma Intimates | 1 | |

| Ethan Allen | 1 | Sprint Nextel | 12 | |

| Express | 2 | Staples | 3 | |

| Extended Stay America | 2 | Starbucks | 78 | |

| Extended Stay Deluxe | 1 | Steak 'n Shake | 1 | |

| Famous Footwear | 3 | Studio 6 | 3 | |

| FedEx | 228 | Subaru | 1 | |

| Finish Line | 2 | Suburban | 1 | |

| Firestone Complete Auto Care | 11 | Subway | 74 | |

| Foot Locker | 9 | Super 8 | 2 | |

| Ford | 2 | T-Mobile | 51 | |

| Forever 21 | 2 | T.G.I. Driday's | 8 | |

| GNC | 9 | T.J.Maxx | 1 | |

| GameStop | 19 | Taco Bell | 25 | |

| Gap | 7 | Talbots | 2 | |

| Gymboree | 1 | Target | 7 | |

| H&M | 1 | The Cheesecake Factory | 1 | |

| H&R Block | 45 | The Limited | 2 | |

| Havertys Furniture | 1 | The Room Place | 2 | |

| Haworth | 3 | Toyota | 4 | |

| Hilton | 17 | Toys"R"Us | 4 | |

| Hobby Lobby | 1 | U-Haul | 31 | |

| Holiday Inn | 18 | UPS | 224 | |

| Hollister Co. | 2 | Urban Outfitters | 2 | |

| Home Depot | 7 | Vans | 10 | |

| Homestead Studio Suites | 3 | Verizon Wireless | 4 | |

| Honda | 3 | Victoria's Secret | 3 | |

| Hot Topic | 1 | Volkswagen | 1 | |

| Houlihan's | 1 | Vons | 15 | |

| Hyatt | 13 | Waffle House | 1 | |

| IHOP | 5 | Walgreens | 27 | |

| InTown Suites | 2 | Walmart | 9 | |

| J. Jill | 1 | Wendy's | 26 | |

| J.Crew | 3 | Westin | 2 | |

| JCPenney | 1 | Whole Foods Market | 3 | |

| Jack In The Box | 37 | YMCA | 11 | |

| Jamba Juice | 6 | Z Gallerie | 2 | |

Strongest AM radio stations in Dallas:

- KSKY (660 AM; 20 kW; BALCH SPRINGS, TX; Owner: BISON MEDIA, INC.)

- KRLD (1080 AM; 50 kW; DALLAS, TX; Owner: TEXAS INFINITY BROADCASTING L.P.)

- KGGR (1040 AM; daytime; 5 kW; DALLAS, TX; Owner: MORTENSON BROADCASTING COMPANY)

- KBIS (1150 AM; 25 kW; HIGHLAND PARK, TX; Owner: DALLAS AM RADIO PARTNERS, L.P.)

- KZMP (1540 AM; 50 kW; UNIVERSITY PARK, TX; Owner: ENTRAVISION HOLDINGS, LLC)

- WBAP (820 AM; 50 kW; FORT WORTH, TX; Owner: WBAP-KSCS OPERATING, LTD.)

- KRVA (1600 AM; 5 kW; COCKRELL HILL, TX; Owner: ENTRAVISION HOLDINGS, LLC)

- KFXR (1190 AM; 50 kW; DALLAS, TX; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- KESS (1270 AM; 50 kW; FORT WORTH, TX; Owner: KESS-AM LICENSE CORP.)

- KTCK (1310 AM; 9 kW; DALLAS, TX; Owner: KRBE LICO, INC.)

- KLIF (570 AM; 5 kW; DALLAS, TX; Owner: KLIF LICO, INC.)

- KAAM (770 AM; 10 kW; GARLAND, TX; Owner: DONTRON, INC.)

- KAHZ (1360 AM; 50 kW; HURST, TX)

Strongest FM radio stations in Dallas:

- WRR (101.1 FM; DALLAS, TX; Owner: CITY OF DALLAS, TEXAS)

- KLUV-FM (98.7 FM; DALLAS, TX; Owner: INFINITY BROADCASTING CORPORATION OF DALLAS)

- KPLX (99.5 FM; FORT WORTH, TX; Owner: KPLX LICO, INC.)

- KLLI (105.3 FM; DALLAS, TX; Owner: INFINITY BROADCASTING CORPORATION OF DALLAS)

- KOAI (107.5 FM; FORT WORTH, TX; Owner: INFINITY KOAI-FM, INC.)

- KVIL-FM (103.7 FM; HIGHLAND PARK-DALLAS, TX; Owner: INFINITY BROADCASTING CORPORATION OF TEXAS)

- KEGL (97.1 FM; FORT WORTH, TX; Owner: CITICASTERS LICENSES, L.P.)

- KHKS (106.1 FM; DENTON, TX; Owner: AMFM TEXAS LICENSES LIMITED PARTNERSHIP)

- KZPS (92.5 FM; DALLAS, TX; Owner: AMFM TEXAS LICENSES LIMITED PARTNERSHIP)

- KKDA-FM (104.5 FM; DALLAS, TX; Owner: SERVICE BROADCASTING I, LTD.)

- KBFB (97.9 FM; DALLAS, TX; Owner: RADIO ONE LICENSES, LLC)

- KSCS (96.3 FM; FORT WORTH, TX; Owner: WBAP-KSCS OPERATING, LTD.)

- KLNO (94.1 FM; FORT WORTH, TX; Owner: HBC LICENSE CORPORATION)

- KRBV (100.3 FM; DALLAS, TX; Owner: INFINITY BROADCASTING CORP. OF FORT WORTH)

- KCBI (90.9 FM; DALLAS, TX; Owner: CRISWELL CENTER FOR BIBLICAL STUDIES)

- KDBN (93.3 FM; HALTOM CITY, TX; Owner: TEXAS STAR RADIO, INC.)

- KEOM (88.5 FM; MESQUITE, TX; Owner: MESQUITE INDEPENDENT SCHOOL DISTRICT)

- KDGE (102.1 FM; FORT WORTH-DALLAS, TX; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- KDMX (102.9 FM; DALLAS, TX; Owner: CITICASTERS LICENSES, L.P.)

- KERA (90.1 FM; DALLAS, TX; Owner: NORTH TEXAS PUBLIC BROADCASTING, INC.)

TV broadcast stations around Dallas:

- KLEG-LP (Channel 44; DALLAS, TX; Owner: DILIP VISWANATH)

- KLDT (Channel 55; LAKE DALLAS, TX; Owner: JOHNSON BROADCASTING OF DALLAS, INC.)

- KJJM-LP (Channel 46; DALLAS/MESQUITE, TX; Owner: JANE McGINNIS)

- KTVT (Channel 11; FORT WORTH, TX; Owner: CBS STATIONS GROUP OF TEXAS L.P.)

- KXAS-TV (Channel 5; FORT WORTH, TX; Owner: STATION VENTURE OPERATIONS, LP)

- KDTN (Channel 2; DENTON, TX; Owner: NORTH TEXAS PUBLIC BROADCASTING, INC.)

- KMPX (Channel 29; DECATUR, TX; Owner: WORD OF GOD FELLOWSHIP, INC.)

- KTXA (Channel 21; FORT WORTH, TX; Owner: VIACOM TELEVISION STATIONS GROUP OF DALLAS/FORT WORTH L.P.)

- KUVN (Channel 23; GARLAND, TX; Owner: KUVN LICENSE PARTNERSHIP, L.P.)

- KSTR-TV (Channel 49; IRVING, TX; Owner: TELEFUTURA DALLAS LLC)

- KPXD (Channel 68; ARLINGTON, TX; Owner: PAXSON DALLAS LICENSE, INC.)

- KERA-TV (Channel 13; DALLAS, TX; Owner: NORTH TEXAS PUBLIC BROADCASTING, INC.)

- WFAA-TV (Channel 8; DALLAS, TX; Owner: WFAA-TV, L.P.)

- KXTX-TV (Channel 39; DALLAS, TX; Owner: TELEMUNDO OF TEXAS PARTNERSHIP, LP)

- KDTX-TV (Channel 58; DALLAS, TX; Owner: TRINITY BROADCASTING OF TEXAS, INC.)

- KDFW (Channel 4; DALLAS, TX; Owner: KDFW LICENSE, INC.)

- KDAF (Channel 33; DALLAS, TX; Owner: TRIBUNE TELEVISION COMPANY)

- KDFI (Channel 27; DALLAS, TX; Owner: NEW DMIC, INC.)

- K26HF (Channel 26; BRITTON, TX; Owner: MAKO COMMUNICATIONS, LLC)

- KHPK-LP (Channel 28; DE SOTO, TX; Owner: MAKO COMMUNICATIONS, LLC)

- K25FW (Channel 25; CORSICANA, TX; Owner: VENTANA TELEVISION, INC.)

- KATA-LP (Channel 60; MESQUITE, TX; Owner: JANE McGINNIS)

- KVFW-LP (Channel 65; FORT WORTH, TX; Owner: GERALD BENAVIDES)

- KFWD (Channel 52; FORT WORTH, TX; Owner: HIC BROADCAST, INC.)

- KTAQ (Channel 47; GREENVILLE, TX; Owner: MIKE SIMONS)

Medal of Honor Recipients

Medal of Honor Recipients born in Dallas: Samuel David Dealey, Turney W. Leonard.

- National Bridge Inventory (NBI) Statistics

- 2,261Number of bridges

- 72,543ft / 22,111mTotal length

- $33,885,000Total costs

- 88,061,851Total average daily traffic

- 7,109,036Total average daily truck traffic

- New bridges - historical statistics

- 11900-1909

- 51910-1919

- 61920-1929

- 481930-1939

- 361940-1949

- 2151950-1959

- 5271960-1969

- 5041970-1979

- 2031980-1989

- 1981990-1999

- 1842000-2009

- 2852010-2019

- 492020-2022

FCC Registered Commercial Land Mobile Towers: 43 (See the full list of FCC Registered Commercial Land Mobile Towers in Dallas, TX)

FCC Registered Private Land Mobile Towers: 82 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 883 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 1,288 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 93 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 144 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 3,369 (See the full list of FCC Registered Amateur Radio Licenses in Dallas)

FAA Registered Aircraft Manufacturers and Dealers: 56 (See the full list of FAA Registered Manufacturers and Dealers in Dallas)

FAA Registered Aircraft: 2,056 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 249 full and 50 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 3,276 | $142,468 | 5,798 | $257,098 | 12,984 | $246,602 | 606 | $96,200 | 60 | $3,121,078 | 1,305 | $161,511 | 27 | $26,203 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 201 | $132,340 | 503 | $272,670 | 1,268 | $215,792 | 164 | $56,169 | 4 | $5,033,250 | 126 | $161,186 | 9 | $71,168 |

| APPLICATIONS DENIED | 615 | $114,385 | 1,121 | $221,462 | 4,747 | $206,576 | 1,338 | $39,760 | 13 | $11,284,923 | 600 | $136,972 | 84 | $38,099 |

| APPLICATIONS WITHDRAWN | 451 | $133,023 | 834 | $273,116 | 2,651 | $221,299 | 222 | $92,560 | 7 | $5,416,274 | 296 | $132,520 | 7 | $40,191 |

| FILES CLOSED FOR INCOMPLETENESS | 102 | $118,760 | 182 | $323,533 | 785 | $239,940 | 107 | $57,994 | 0 | $0 | 95 | $151,788 | 1 | $195,980 |

Detailed mortgage data for all 301 tracts in Dallas, TX

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 180 full and 47 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 821 | $216,084 | 343 | $226,695 | 5 | $99,328 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 249 | $210,612 | 136 | $213,314 | 26 | $146,013 |

| APPLICATIONS DENIED | 113 | $234,004 | 92 | $245,565 | 3 | $100,420 |

| APPLICATIONS WITHDRAWN | 38 | $242,133 | 36 | $209,104 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 36 | $212,368 | 8 | $199,446 | 8 | $137,958 |

2005 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Dallas, TX

- 14,44046.5%Outside Fires

- 9,44330.4%Structure Fires

- 6,08419.6%Mobile Property/Vehicle Fires

- 1,0713.5%Other

According to the data from the years 2005 - 2018 the average number of fires per year is 2209. The highest number of fires - 3,993 took place in 2012, and the least - 57 in 2008. The data has a rising trend.

According to the data from the years 2005 - 2018 the average number of fires per year is 2209. The highest number of fires - 3,993 took place in 2012, and the least - 57 in 2008. The data has a rising trend. When looking into fire subcategories, the most reports belonged to: Outside Fires (46.5%), and Structure Fires (30.4%).

When looking into fire subcategories, the most reports belonged to: Outside Fires (46.5%), and Structure Fires (30.4%).Fire-safe hotels and motels in Dallas, Texas:

- Omni Dallas Hotel At Park West, 1590 LBJ Fwy, Dallas, Texas 75234 , Phone: (972) 869-4300

- Wyndham Garden Dallas North, 2645 LBJ Fwy, Dallas, Texas 75234 , Phone: (972) 243-3363, Fax: (972) 243-6682

- Doubletree Hotel Compbell Centre, 8250 N Central Expy, Dallas, Texas 75206 , Phone: (214) 706-0104, Fax: (214) 706-0186

- Dallas Marriott City Center, 650 N Pearl St, Dallas, Texas 75201 , Phone: (214) 979-9000, Fax: (214) 855-1753

- Embassy Suites Hotel Dallas Love Field, 3880 W Northwest Hwy, Dallas, Texas 75220 , Phone: (214) 357-4500, Fax: (214) 357-0683

- Sheraton Dallas Hotel By The Galleria, 4801 Lyndon B Johnson Fwy, Dallas, Texas 75244 , Phone: (972) 661-3600, Fax: (972) 385-3156

- Hotel Indigo Dallas Downtown, 1933 Main St, Dallas, Texas 75201 , Phone: (214) 741-7700, Fax: (214) 760-9755

- Magnolia Hotel Dallas Park Cities, 6070 N Central Expy, Dallas, Texas 75206 , Phone: (214) 750-6060, Fax: (214) 750-5959

- 150 other hotels and motels

| Most common first names in Dallas, TX among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| Mary | 5,764 | 78.2 years |

| James | 5,419 | 70.2 years |

| John | 5,250 | 72.7 years |

| William | 4,838 | 73.7 years |

| Robert | 3,851 | 70.7 years |

| Charles | 2,770 | 70.8 years |

| Willie | 2,463 | 73.2 years |

| George | 2,456 | 74.3 years |

| Dorothy | 2,023 | 74.9 years |

| Helen | 1,690 | 78.2 years |

| Most common last names in Dallas, TX among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 3,375 | 73.8 years |

| Johnson | 2,843 | 71.5 years |

| Williams | 2,781 | 72.1 years |

| Jones | 2,337 | 73.4 years |

| Brown | 1,899 | 72.8 years |

| Davis | 1,732 | 72.6 years |

| Jackson | 1,372 | 71.5 years |

| Moore | 1,272 | 73.9 years |

| Taylor | 1,183 | 72.5 years |

| Wilson | 1,148 | 72.6 years |

- 57.4%Utility gas

- 41.2%Electricity

- 0.8%Bottled, tank, or LP gas

- 0.3%No fuel used

- 0.1%Solar energy

- 82.9%Electricity

- 15.1%Utility gas

- 1.0%No fuel used

- 0.7%Bottled, tank, or LP gas

- 0.1%Other fuel

- 0.1%Solar energy

Dallas compared to Texas state average:

- Unemployed percentage significantly below state average.

- Black race population percentage above state average.

- Foreign-born population percentage above state average.

- Renting percentage above state average.

- Number of rooms per house below state average.

- Percentage of population with a bachelor's degree or higher above state average.

Dallas, TX compared to other similar cities:

Dallas on our top lists:

- #3 on the list of "Top 101 cities with the largest house values disparities (population 50,000+)"

- #4 on the list of "Top 101 cities with the most mentions on city-data.com forum"

- #13 on the list of "Top 101 biggest cities in 2013"

- #13 on the list of "Top 100 biggest cities"

- #19 on the list of "Top 101 cities with the largest percentage of likely gay men couples (counted as self-reported male-male unmarried-partner households) (population 50,000+)"

- #26 on the list of "Top 101 cities with largest percentage of males in occupations: construction and extraction occupations (population 50,000+)"

- #27 on the list of "Top 100 cities with largest land areas (pop. 50,000+)"

- #34 on the list of "Top 101 cities with the hottest summers (population 50,000+)"

- #36 on the list of "Top 101 cities with the largest percentage of likely homosexual households (counted as self-reported same-sex unmarried-partner households) (population 50,000+)"

- #37 on the list of "Top 101 cities with the largest city-data.com crime index decrease from 2002 to 2012 (population 50,000+)"

- #43 on the list of "Top 101 cities with largest percentage of males in industries: construction (population 50,000+)"

- #48 on the list of "Top 101 cities with the smallest percentages of current college students (population 100,000+)"

- #50 on the list of "Top 101 cities with the largest percentage of people in institutions for the blind (population 1,000+)"

- #51 on the list of "Top 101 cities with the highest number of police officers per 1000 residents (population 50,000+)"

- #65 on the list of "Top 101 cities with the highest daily high temperatures (population 50,000+)"

- #66 on the list of "Top 101 cities with the highest number of arson incidents per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #66 on the list of "Top 101 cities with the highest average snowfall in a year (population 50,000+)"

- #68 on the list of "Top 101 cities with the highest number of robberies per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"